| From | American Energy Alliance <[email protected]> |

| Subject | Powering the world is a big job |

| Date | November 15, 2022 4:40 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Your Daily Energy News

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 11/15/2022

Subscribe Now ([link removed])

** Let the greens live without diesel for a week and see how that goes.

------------------------------------------------------------

Bloomberg ([link removed]) (11/14/22) reports: "Next month, Tesla Inc. plans to deliver the first of its electric Semi trucks—able to haul a full 40 ton-load some 500 miles on a single charge. These massive batteries-on-wheels may accelerate the transition to electrified transport, but those responsible for delivering the power are starting to ask: Are we ready for this? Probably not, according to a sweeping new study of highway charging requirements conducted by utility company National Grid Plc. Researchers found that by 2030, electrifying a typical highway gas station will require as much power as a professional sports stadium—and that’s mostly just for electrified passenger vehicles. As more electric trucks hit the road, the projected power needs for a big truck stop by 2035 will equal that of a small town. Even the authors who planned the study

were caught off guard by how quickly highway power demands will change. A connection to the grid that can handle more than 5 megawatts takes up to eight years to build, at a cost tens of millions of dollars. If power upgrades don’t start soon, the transition to electric vehicles—let alone electric trucks—will quickly be constrained by a grid unprepared for the demand, warned Bart Franey, vice president of clean energy development at National Grid.."

[link removed]

** "Believe what you see, and what is actually happening in the marketplace, not what you hear. Germany and California show that 'alternative' energy is really just 'supplemental' energy."

------------------------------------------------------------

– Jude Clemente, RealClearEnergy ([link removed])

============================================================

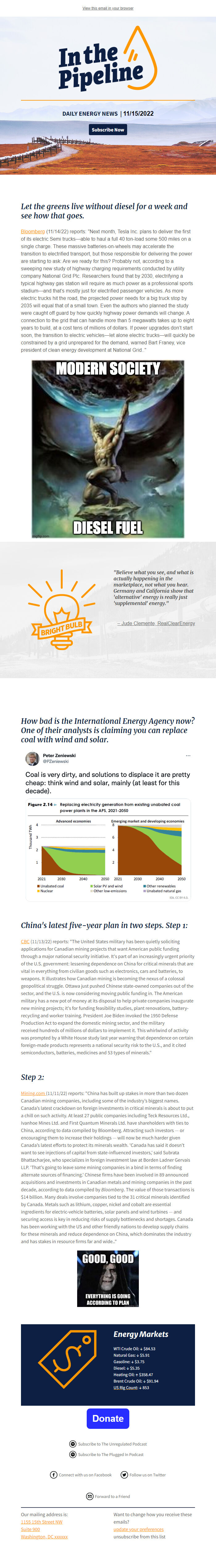

How bad is the International Energy Agency now? One of their analysts is claiming you can replace coal with wind and solar.

** ([link removed])

China's latest five-year plan in two steps. Step 1:

** CBC ([link removed])

(11/13/22) reports: "The United States military has been quietly soliciting applications for Canadian mining projects that want American public funding through a major national security initiative. It's part of an increasingly urgent priority of the U.S. government: lessening dependence on China for critical minerals that are vital in everything from civilian goods such as electronics, cars and batteries, to weapons. It illustrates how Canadian mining is becoming the nexus of a colossal geopolitical struggle. Ottawa just pushed Chinese state-owned companies out of the sector, and the U.S. is now considering moving public funding in. The American military has a new pot of money at its disposal to help private companies inaugurate new mining projects; it's for funding feasibility studies, plant renovations, battery-recycling and worker training. President Joe Biden invoked the 1950 Defense Production Act to expand the domestic mining sector, and the military received hundreds of millions of

dollars to implement it. This whirlwind of activity was prompted by a White House study last year warning that dependence on certain foreign-made products represents a national security risk to the U.S., and it cited semiconductors, batteries, medicines and 53 types of minerals."

Step 2:

** Mining.com ([link removed])

(11/11/22) reports: "China has built up stakes in more than two dozen Canadian mining companies, including some of the industry’s biggest names. Canada’s latest crackdown on foreign investments in critical minerals is about to put a chill on such activity. At least 27 public companies including Teck Resources Ltd., Ivanhoe Mines Ltd. and First Quantum Minerals Ltd. have shareholders with ties to China, according to data compiled by Bloomberg. Attracting such investors — or encouraging them to increase their holdings — will now be much harder given Canada’s latest efforts to protect its minerals wealth. 'Canada has said it doesn’t want to see injections of capital from state-influenced investors,' said Subrata Bhattacharjee, who specializes in foreign investment law at Borden Ladner Gervais LLP. 'That’s going to leave some mining companies in a bind in terms of finding alternate sources of financing.' Chinese firms have been involved in 89 announced acquisitions and investments in Canadian

metals and mining companies in the past decade, according to data compiled by Bloomberg. The value of those transactions is $14 billion. Many deals involve companies tied to the 31 critical minerals identified by Canada. Metals such as lithium, copper, nickel and cobalt are essential ingredients for electric-vehicle batteries, solar panels and wind turbines — and securing access is key in reducing risks of supply bottlenecks and shortages. Canada has been working with the US and other friendly nations to develop supply chains for these minerals and reduce dependence on China, which dominates the industry and has stakes in resource firms far and wide.."

Energy Markets

WTI Crude Oil: ↓ $84.53

Natural Gas: ↓ $5.91

Gasoline: ↓ $3.75

Diesel: ↓ $5.35

Heating Oil: ↑ $358.47

Brent Crude Oil: ↓ $91.94

** US Rig Count ([link removed])

: ↓ 853

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 11/15/2022

Subscribe Now ([link removed])

** Let the greens live without diesel for a week and see how that goes.

------------------------------------------------------------

Bloomberg ([link removed]) (11/14/22) reports: "Next month, Tesla Inc. plans to deliver the first of its electric Semi trucks—able to haul a full 40 ton-load some 500 miles on a single charge. These massive batteries-on-wheels may accelerate the transition to electrified transport, but those responsible for delivering the power are starting to ask: Are we ready for this? Probably not, according to a sweeping new study of highway charging requirements conducted by utility company National Grid Plc. Researchers found that by 2030, electrifying a typical highway gas station will require as much power as a professional sports stadium—and that’s mostly just for electrified passenger vehicles. As more electric trucks hit the road, the projected power needs for a big truck stop by 2035 will equal that of a small town. Even the authors who planned the study

were caught off guard by how quickly highway power demands will change. A connection to the grid that can handle more than 5 megawatts takes up to eight years to build, at a cost tens of millions of dollars. If power upgrades don’t start soon, the transition to electric vehicles—let alone electric trucks—will quickly be constrained by a grid unprepared for the demand, warned Bart Franey, vice president of clean energy development at National Grid.."

[link removed]

** "Believe what you see, and what is actually happening in the marketplace, not what you hear. Germany and California show that 'alternative' energy is really just 'supplemental' energy."

------------------------------------------------------------

– Jude Clemente, RealClearEnergy ([link removed])

============================================================

How bad is the International Energy Agency now? One of their analysts is claiming you can replace coal with wind and solar.

** ([link removed])

China's latest five-year plan in two steps. Step 1:

** CBC ([link removed])

(11/13/22) reports: "The United States military has been quietly soliciting applications for Canadian mining projects that want American public funding through a major national security initiative. It's part of an increasingly urgent priority of the U.S. government: lessening dependence on China for critical minerals that are vital in everything from civilian goods such as electronics, cars and batteries, to weapons. It illustrates how Canadian mining is becoming the nexus of a colossal geopolitical struggle. Ottawa just pushed Chinese state-owned companies out of the sector, and the U.S. is now considering moving public funding in. The American military has a new pot of money at its disposal to help private companies inaugurate new mining projects; it's for funding feasibility studies, plant renovations, battery-recycling and worker training. President Joe Biden invoked the 1950 Defense Production Act to expand the domestic mining sector, and the military received hundreds of millions of

dollars to implement it. This whirlwind of activity was prompted by a White House study last year warning that dependence on certain foreign-made products represents a national security risk to the U.S., and it cited semiconductors, batteries, medicines and 53 types of minerals."

Step 2:

** Mining.com ([link removed])

(11/11/22) reports: "China has built up stakes in more than two dozen Canadian mining companies, including some of the industry’s biggest names. Canada’s latest crackdown on foreign investments in critical minerals is about to put a chill on such activity. At least 27 public companies including Teck Resources Ltd., Ivanhoe Mines Ltd. and First Quantum Minerals Ltd. have shareholders with ties to China, according to data compiled by Bloomberg. Attracting such investors — or encouraging them to increase their holdings — will now be much harder given Canada’s latest efforts to protect its minerals wealth. 'Canada has said it doesn’t want to see injections of capital from state-influenced investors,' said Subrata Bhattacharjee, who specializes in foreign investment law at Borden Ladner Gervais LLP. 'That’s going to leave some mining companies in a bind in terms of finding alternate sources of financing.' Chinese firms have been involved in 89 announced acquisitions and investments in Canadian

metals and mining companies in the past decade, according to data compiled by Bloomberg. The value of those transactions is $14 billion. Many deals involve companies tied to the 31 critical minerals identified by Canada. Metals such as lithium, copper, nickel and cobalt are essential ingredients for electric-vehicle batteries, solar panels and wind turbines — and securing access is key in reducing risks of supply bottlenecks and shortages. Canada has been working with the US and other friendly nations to develop supply chains for these minerals and reduce dependence on China, which dominates the industry and has stakes in resource firms far and wide.."

Energy Markets

WTI Crude Oil: ↓ $84.53

Natural Gas: ↓ $5.91

Gasoline: ↓ $3.75

Diesel: ↓ $5.35

Heating Oil: ↑ $358.47

Brent Crude Oil: ↓ $91.94

** US Rig Count ([link removed])

: ↓ 853

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp