| From | Children's Hospital Los Angeles <[email protected]> |

| Subject | From transplanted to transformed |

| Date | December 14, 2019 12:57 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

#

Children's Hospital Los Angeles eNews

#

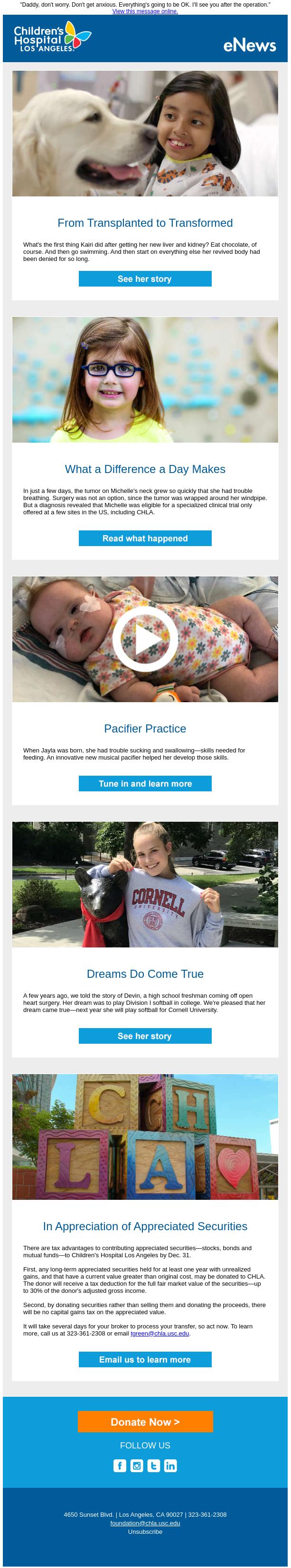

From Transplanted to Transformed

What's the first thing Kairi did after getting her new liver and

kidney? Eat chocolate, of course. And then go swimming. And then start

on everything else her revived body had been denied for so long.

See her story:

[link removed]

#

What a Difference a Day Makes

In just a few days, the tumor on Michelle's neck grew so quickly that

she had trouble breathing. Surgery was not an option, since the tumor

was wrapped around her windpipe. But a diagnosis revealed that

Michelle was eligible for a specialized clinical trial only offered at

a few sites in the US, including CHLA.

Read what happened:

[link removed]

#

Pacifier Practice

When Jayla was born, she had trouble sucking and

swallowing-skills needed for feeding. An innovative new musical

pacifier helped her develop those skills.

Tune in and learn more:

[link removed]

#

Dreams Do Come True

A few years ago, we told the story of Devin, a high school freshman

coming off open heart surgery. Her dream was to play Division I

softball in college. We're pleased that her dream came true-next

year she will play softball for Cornell University.

See her story:

[link removed]

#

In Appreciation of Appreciated Securities

There are tax advantages to contributing appreciated securities--stocks, bonds and mutual funds--to Children's Hospital Los Angeles by Dec. 31.

First, any long-term appreciated securities held for at least one year with unrealized gains, and that have a current value greater than original cost, may be donated to CHLA. The donor will receive a tax deduction for the full fair market value of the securities--up to 30% of the donor's adjusted gross income. Second, by donating securities rather than selling them and donating the proceeds, there will be no capital gains tax on the appreciated value.

It will take several days for your broker to process your transfer, so act now. To learn more, call us at 323-361-2308 or email [email protected].

#

DONATE NOW

[link removed]

4650 Sunset Blvd. | Los Angeles, CA 90027 | 323-361-2308

[email protected]

Unsubscribe

[link removed]

Children's Hospital Los Angeles eNews

#

From Transplanted to Transformed

What's the first thing Kairi did after getting her new liver and

kidney? Eat chocolate, of course. And then go swimming. And then start

on everything else her revived body had been denied for so long.

See her story:

[link removed]

#

What a Difference a Day Makes

In just a few days, the tumor on Michelle's neck grew so quickly that

she had trouble breathing. Surgery was not an option, since the tumor

was wrapped around her windpipe. But a diagnosis revealed that

Michelle was eligible for a specialized clinical trial only offered at

a few sites in the US, including CHLA.

Read what happened:

[link removed]

#

Pacifier Practice

When Jayla was born, she had trouble sucking and

swallowing-skills needed for feeding. An innovative new musical

pacifier helped her develop those skills.

Tune in and learn more:

[link removed]

#

Dreams Do Come True

A few years ago, we told the story of Devin, a high school freshman

coming off open heart surgery. Her dream was to play Division I

softball in college. We're pleased that her dream came true-next

year she will play softball for Cornell University.

See her story:

[link removed]

#

In Appreciation of Appreciated Securities

There are tax advantages to contributing appreciated securities--stocks, bonds and mutual funds--to Children's Hospital Los Angeles by Dec. 31.

First, any long-term appreciated securities held for at least one year with unrealized gains, and that have a current value greater than original cost, may be donated to CHLA. The donor will receive a tax deduction for the full fair market value of the securities--up to 30% of the donor's adjusted gross income. Second, by donating securities rather than selling them and donating the proceeds, there will be no capital gains tax on the appreciated value.

It will take several days for your broker to process your transfer, so act now. To learn more, call us at 323-361-2308 or email [email protected].

#

DONATE NOW

[link removed]

4650 Sunset Blvd. | Los Angeles, CA 90027 | 323-361-2308

[email protected]

Unsubscribe

[link removed]

Message Analysis

- Sender: Children's Hospital Los Angeles

- Political Party: n/a

- Country: United States

- State/Locality: California Los Angeles, California

- Office: n/a

-

Email Providers:

- Convio