| From | American Energy Alliance <[email protected]> |

| Subject | Unicorns and fairy dust would be just as good. |

| Date | January 12, 2022 4:37 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Your Daily Energy News

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 01/12/2022

Subscribe Now ([link removed])

** Why are prices spiking in New England? Why are they burning oil in New York? Isn't the sun shining in Massachusetts? Am I being lied to about the Green New Deal?

------------------------------------------------------------

Inside Sources ([link removed]) (1/11/22) reports: "Energy sector officials have been warning for years about the risks posed to New England’s grid by plunging temperatures, risks exacerbated by anti-energy-infrastructure policies across the region. Now with New England facing its coldest temperatures since the 'polar vortex' of 2019 and wind chills of -45 degrees below zero across the U.S. northern tier states, the grid is under stress once again. 'Well-documented natural gas pipeline constraints, coupled with global supply chain issues related to deliveries of oil and liquefied natural gas (LNG), are placing New England’s power system at heightened risk heading into the winter season,' ISO New England Inc, operator of the region’s power grid said in a December 6 statement...Dan Kish of the Washington, D.C.-based Institute for Energy Research (IER) says these warnings were not sexy at the time,

but people are paying attention now. 'What they pointed to was a growing gap between demand for energy and the supply that people are making available either through pipelines or electrical lines or anything else and because New England is an area of the country that does not have a lot of energy production,' says Kish. 'I would be concerned based upon what the people who oversee the grid have said about it.'"

[link removed]

**

"The voters’ message must be unambiguous: Stop trying to fundamentally transform America. We never asked for it, we don’t want it, and we never gave you permission."

------------------------------------------------------------

– Charles Lipson, University of Chicago ([link removed])

============================================================

Big Green, Inc. wants travel to be an elite enterprise once again.

** Bloomberg ([link removed])

(1/10/22) reports: "Air France-KLM will apply a surcharge to its tickets prices to help fund the extra cost of using sustainable aviation fuel, going beyond voluntary measures that have so far prevailed in the industry. The move will add between 1 and 12 euros ($1.1-$13.6) to the cost of a flight depending on the distance traveled and the class, according to a statement Monday, the first day the extra charges will apply. 'In the absence of industrial production, the cost of using sustainable aviation fuels is four to eight times higher than that of fossil fuels,' Air France-KLM said, adding that the fee will apply to flights at both its French and Dutch arms. Airlines are turning to SAF to shrink their carbon footprints in the decade or more before hybrid, electric and hydrogen-powered jetliners become widely available. At the same time the fuel, which requires feedstocks such as algae and cooking oil or synthetic processing methods, remains in short supply. Air France-KLM faces an

additional challenge after making commitments to government shareholders on lowering emissions after being propped up by a series of pandemic-related bailouts."

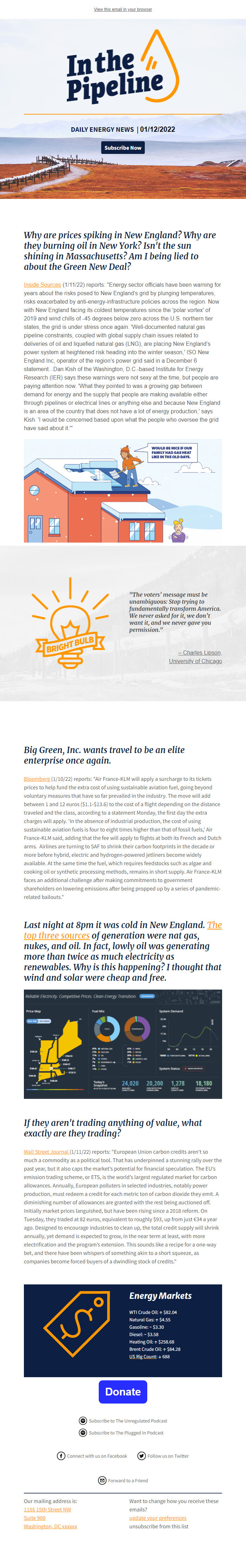

Last night at 8pm it was cold in New England. ** The top three sources ([link removed])

of generation were nat gas, nukes, and oil. In fact, lowly oil was generating more than twice as much electricity as renewables. Why is this happening? I thought that wind and solar were cheap and free.

If they aren't trading anything of value, what exactly are they trading?

** Wall Street Journal ([link removed])

(1/11/22) reports: "European Union carbon credits aren’t so much a commodity as a political tool. That has underpinned a stunning rally over the past year, but it also caps the market’s potential for financial speculation. The EU’s emission trading scheme, or ETS, is the world’s largest regulated market for carbon allowances. Annually, European polluters in selected industries, notably power production, must redeem a credit for each metric ton of carbon dioxide they emit. A diminishing number of allowances are granted with the rest being auctioned off. Initially market prices languished, but have been rising since a 2018 reform. On Tuesday, they traded at 82 euros, equivalent to roughly $93, up from just €34 a year ago. Designed to encourage industries to clean up, the total credit supply will shrink annually, yet demand is expected to grow, in the near term at least, with more electrification and the program’s extension. This sounds like a recipe for a one-way bet, and there have been

whispers of something akin to a short squeeze, as companies become forced buyers of a dwindling stock of credits."

Energy Markets

WTI Crude Oil: ↑ $82.04

Natural Gas: ↑ $4.55

Gasoline: ~ $3.30

Diesel: ~ $3.58

Heating Oil: ↑ $258.68

Brent Crude Oil: ↑ $84.28

** US Rig Count ([link removed])

: ↓ 688

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 01/12/2022

Subscribe Now ([link removed])

** Why are prices spiking in New England? Why are they burning oil in New York? Isn't the sun shining in Massachusetts? Am I being lied to about the Green New Deal?

------------------------------------------------------------

Inside Sources ([link removed]) (1/11/22) reports: "Energy sector officials have been warning for years about the risks posed to New England’s grid by plunging temperatures, risks exacerbated by anti-energy-infrastructure policies across the region. Now with New England facing its coldest temperatures since the 'polar vortex' of 2019 and wind chills of -45 degrees below zero across the U.S. northern tier states, the grid is under stress once again. 'Well-documented natural gas pipeline constraints, coupled with global supply chain issues related to deliveries of oil and liquefied natural gas (LNG), are placing New England’s power system at heightened risk heading into the winter season,' ISO New England Inc, operator of the region’s power grid said in a December 6 statement...Dan Kish of the Washington, D.C.-based Institute for Energy Research (IER) says these warnings were not sexy at the time,

but people are paying attention now. 'What they pointed to was a growing gap between demand for energy and the supply that people are making available either through pipelines or electrical lines or anything else and because New England is an area of the country that does not have a lot of energy production,' says Kish. 'I would be concerned based upon what the people who oversee the grid have said about it.'"

[link removed]

**

"The voters’ message must be unambiguous: Stop trying to fundamentally transform America. We never asked for it, we don’t want it, and we never gave you permission."

------------------------------------------------------------

– Charles Lipson, University of Chicago ([link removed])

============================================================

Big Green, Inc. wants travel to be an elite enterprise once again.

** Bloomberg ([link removed])

(1/10/22) reports: "Air France-KLM will apply a surcharge to its tickets prices to help fund the extra cost of using sustainable aviation fuel, going beyond voluntary measures that have so far prevailed in the industry. The move will add between 1 and 12 euros ($1.1-$13.6) to the cost of a flight depending on the distance traveled and the class, according to a statement Monday, the first day the extra charges will apply. 'In the absence of industrial production, the cost of using sustainable aviation fuels is four to eight times higher than that of fossil fuels,' Air France-KLM said, adding that the fee will apply to flights at both its French and Dutch arms. Airlines are turning to SAF to shrink their carbon footprints in the decade or more before hybrid, electric and hydrogen-powered jetliners become widely available. At the same time the fuel, which requires feedstocks such as algae and cooking oil or synthetic processing methods, remains in short supply. Air France-KLM faces an

additional challenge after making commitments to government shareholders on lowering emissions after being propped up by a series of pandemic-related bailouts."

Last night at 8pm it was cold in New England. ** The top three sources ([link removed])

of generation were nat gas, nukes, and oil. In fact, lowly oil was generating more than twice as much electricity as renewables. Why is this happening? I thought that wind and solar were cheap and free.

If they aren't trading anything of value, what exactly are they trading?

** Wall Street Journal ([link removed])

(1/11/22) reports: "European Union carbon credits aren’t so much a commodity as a political tool. That has underpinned a stunning rally over the past year, but it also caps the market’s potential for financial speculation. The EU’s emission trading scheme, or ETS, is the world’s largest regulated market for carbon allowances. Annually, European polluters in selected industries, notably power production, must redeem a credit for each metric ton of carbon dioxide they emit. A diminishing number of allowances are granted with the rest being auctioned off. Initially market prices languished, but have been rising since a 2018 reform. On Tuesday, they traded at 82 euros, equivalent to roughly $93, up from just €34 a year ago. Designed to encourage industries to clean up, the total credit supply will shrink annually, yet demand is expected to grow, in the near term at least, with more electrification and the program’s extension. This sounds like a recipe for a one-way bet, and there have been

whispers of something akin to a short squeeze, as companies become forced buyers of a dwindling stock of credits."

Energy Markets

WTI Crude Oil: ↑ $82.04

Natural Gas: ↑ $4.55

Gasoline: ~ $3.30

Diesel: ~ $3.58

Heating Oil: ↑ $258.68

Brent Crude Oil: ↑ $84.28

** US Rig Count ([link removed])

: ↓ 688

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp