Email

How Will Gold & Silver Perform in Second Half of 2025?

| From | Money Metals Exchange <[email protected]> |

| Subject | How Will Gold & Silver Perform in Second Half of 2025? |

| Date | July 14, 2025 2:58 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Breaking News from America's #1 Precious Metals Dealer

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

July 14, 2025 Gold prices rose last week while silver exploded higher -- gaining $1.39/oz (3.7%) on Friday alone and another 40 cents this morning.

The Trump administration announced plans for a 50% tariff on imported copper, leading to an immediate 10% up move in copper prices that shook the silver market too.

Exchange of Futures for Physical (EFP) premiums on silver are also back in the news. Traders who need physical COMEX bars now are once again paying a hefty premium to get them.

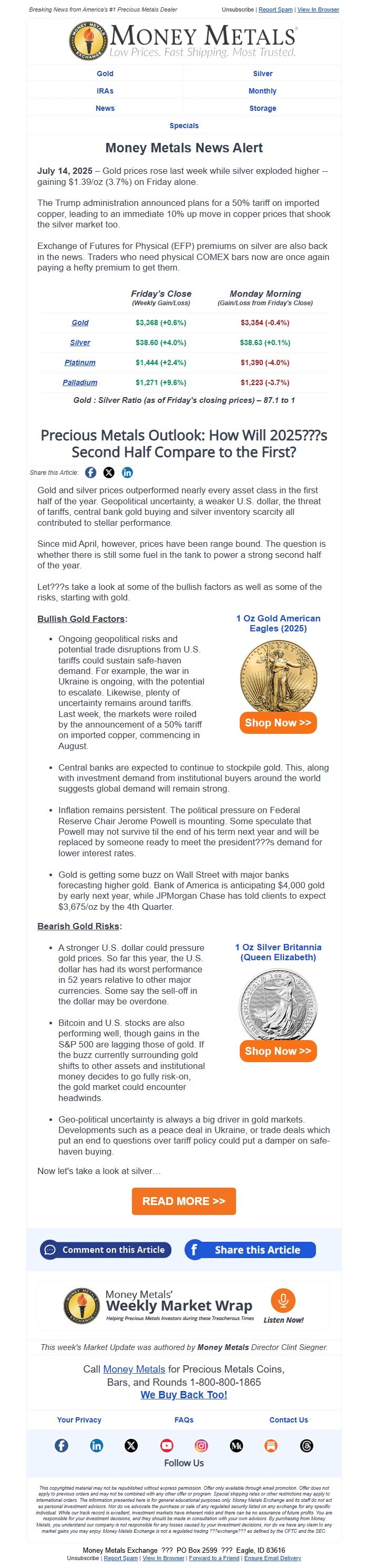

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$3,368 (+0.6%) [link removed]

$3,370 (+0.1%) [link removed]

Silver [link removed]

$38.60 (+4.0%) [link removed]

$39.00 (+1.0%) [link removed]

Platinum [link removed]

$1,444 (+2.4%) [link removed]

$1,390 (-4.0%) [link removed]

Palladium [link removed]

$1,271 (+9.6%) [link removed]

$1,,237 (-2.7%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 87.1 to 1

Precious Metals Outlook: How Will 2025???s Second Half Compare to the First?

Share this Article: [link removed] [link removed] [link removed]

Gold and silver prices outperformed nearly every asset class in the first half of the year. Geopolitical uncertainty, a weaker U.S. dollar, the threat of tariffs, central bank gold buying and silver inventory scarcity all contributed to stellar performance.

Since mid April, however, prices have been range bound. The question is whether there is still some fuel in the tank to power a strong second half of the year.

Let???s take a look at some of the bullish factors as well as some of the risks, starting with gold.

Bullish Gold Factors:

Ongoing geopolitical risks and potential trade disruptions from U.S. tariffs could sustain safe-haven demand. For example, the war in Ukraine is ongoing, with the potential to escalate. Likewise, plenty of uncertainty remains around tariffs. Last week, the markets were roiled by the announcement of a 50% tariff on imported copper, commencing in August.

1 Oz Gold American Eagles (2025) [link removed] [link removed]

Shop Now >> [link removed]

Central banks are expected to continue to stockpile gold. This, along with investment demand from institutional buyers around the world suggests global demand will remain strong.

Inflation remains persistent. The political pressure on Federal Reserve Chair Jerome Powell is mounting. Some speculate that Powell may not survive til the end of his term next year and will be replaced by someone ready to meet the president???s demand for lower interest rates.

Gold is getting some buzz on Wall Street with major banks forecasting higher gold. Bank of America is anticipating $4,000 gold by early next year, while JPMorgan Chase has told clients to expect $3,675/oz by the 4th Quarter. Bearish Gold Risks:

A stronger U.S. dollar could pressure gold prices. So far this year, the U.S. dollar has had its worst performance in 52 years relative to other major currencies. Some say the sell-off in the dollar may be overdone.

Bitcoin and U.S. stocks are also performing well, though gains in the S&P 500 are lagging those of gold. If the buzz currently surrounding gold shifts to other assets and institutional money decides to go fully risk-on, the gold market could encounter headwinds.

1 Oz Silver Britannia (Queen Elizabeth) [link removed] [link removed]

Shop Now >> [link removed]

Geo-political uncertainty is always a big driver in gold markets. Developments such as a peace deal in Ukraine, or trade deals which put an end to questions over tariff policy could put a damper on safe-haven buying. Now let's take a look at silver

READ MORE >> [link removed]

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Director Clint Siegner.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

July 14, 2025 Gold prices rose last week while silver exploded higher -- gaining $1.39/oz (3.7%) on Friday alone and another 40 cents this morning.

The Trump administration announced plans for a 50% tariff on imported copper, leading to an immediate 10% up move in copper prices that shook the silver market too.

Exchange of Futures for Physical (EFP) premiums on silver are also back in the news. Traders who need physical COMEX bars now are once again paying a hefty premium to get them.

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$3,368 (+0.6%) [link removed]

$3,370 (+0.1%) [link removed]

Silver [link removed]

$38.60 (+4.0%) [link removed]

$39.00 (+1.0%) [link removed]

Platinum [link removed]

$1,444 (+2.4%) [link removed]

$1,390 (-4.0%) [link removed]

Palladium [link removed]

$1,271 (+9.6%) [link removed]

$1,,237 (-2.7%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 87.1 to 1

Precious Metals Outlook: How Will 2025???s Second Half Compare to the First?

Share this Article: [link removed] [link removed] [link removed]

Gold and silver prices outperformed nearly every asset class in the first half of the year. Geopolitical uncertainty, a weaker U.S. dollar, the threat of tariffs, central bank gold buying and silver inventory scarcity all contributed to stellar performance.

Since mid April, however, prices have been range bound. The question is whether there is still some fuel in the tank to power a strong second half of the year.

Let???s take a look at some of the bullish factors as well as some of the risks, starting with gold.

Bullish Gold Factors:

Ongoing geopolitical risks and potential trade disruptions from U.S. tariffs could sustain safe-haven demand. For example, the war in Ukraine is ongoing, with the potential to escalate. Likewise, plenty of uncertainty remains around tariffs. Last week, the markets were roiled by the announcement of a 50% tariff on imported copper, commencing in August.

1 Oz Gold American Eagles (2025) [link removed] [link removed]

Shop Now >> [link removed]

Central banks are expected to continue to stockpile gold. This, along with investment demand from institutional buyers around the world suggests global demand will remain strong.

Inflation remains persistent. The political pressure on Federal Reserve Chair Jerome Powell is mounting. Some speculate that Powell may not survive til the end of his term next year and will be replaced by someone ready to meet the president???s demand for lower interest rates.

Gold is getting some buzz on Wall Street with major banks forecasting higher gold. Bank of America is anticipating $4,000 gold by early next year, while JPMorgan Chase has told clients to expect $3,675/oz by the 4th Quarter. Bearish Gold Risks:

A stronger U.S. dollar could pressure gold prices. So far this year, the U.S. dollar has had its worst performance in 52 years relative to other major currencies. Some say the sell-off in the dollar may be overdone.

Bitcoin and U.S. stocks are also performing well, though gains in the S&P 500 are lagging those of gold. If the buzz currently surrounding gold shifts to other assets and institutional money decides to go fully risk-on, the gold market could encounter headwinds.

1 Oz Silver Britannia (Queen Elizabeth) [link removed] [link removed]

Shop Now >> [link removed]

Geo-political uncertainty is always a big driver in gold markets. Developments such as a peace deal in Ukraine, or trade deals which put an end to questions over tariff policy could put a damper on safe-haven buying. Now let's take a look at silver

READ MORE >> [link removed]

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Director Clint Siegner.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a