Email

Big Beautiful Hypocrisy

| From | Ben Samuels <[email protected]> |

| Subject | Big Beautiful Hypocrisy |

| Date | July 2, 2025 12:32 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

Congress is poised to pass Trump’s signature legislation—the One Big Beautiful Bill Act [ [link removed] ]—at some point soon.

I won’t get into the nuance, because these sorts of budget bills are endlessly complex. But here’s what I will say:

It’s really bad for the country, especially for some of our neediest citizens. Even Republican Lisa Murkowski, who voted for the bill, offered this understatement of the day [ [link removed] ]: “I know that in many parts of the country, there are Americans that are not going to be advantaged by this bill.”

It balloons our debt, which means the interest on that debt will cost taxpayers a lot more. Over time, that will take money away from the things that the federal government can—and should—be spending money on.

Democrats have a unique opportunity to position themselves as the party of responsive, responsible, and restrained government.

Article summary:

The government already spends nearly $900 billion per year paying interest on our debt. It’s about to go way up, to about $1.6 trillion by 2034.

For a party that’s complained for years about America’s ballooning federal debt, Republican hypocrisy on this bill is staggering.

Younger voters believe that the federal government is wasteful, and young people are very concerned that they’ll never attain financial security. Democrats have a chance to win back young voters, if they can be responsive to that (reasonable) fear.

Context on the “Big Beautiful Bill”

Before I get into anything related to how much it costs: the policies themselves are really bad. A few examples:

Nonpartisan government estimates suggest that 11.8 million Americans will lose their health insurance [ [link removed] ] because of Medicaid cuts.

Cuts to food stamps (SNAP [ [link removed] ]) will impact many of the 40+ million Americans [ [link removed] ] who rely on the program.

It drastically cuts support for clean energy in a way that will increase energy costs [ [link removed] ], to say nothing of the impact it’ll have on the climate.

For a bill that’s set to extend tax cuts for many Americans, it’s remarkable how unpopular it is [ [link removed] ]: 54% of Americans believe it’ll have a “mostly negative” impact on the country, and only 30% say its impact will be “mostly positive.”

Context on how much our debt costs us

I’m not an economist, and I don’t have any strong opinion on what the “right” levels of debt are for the country—lots of much smarter, much better educated people than I disagree on that question. But as a statement of fact: the more the national debt grows, the more taxpayers have to spend on interest payments. And we’re about to add $3,300,000,000,000 ($3.3 trillion) to our debt [ [link removed] ], if not more.

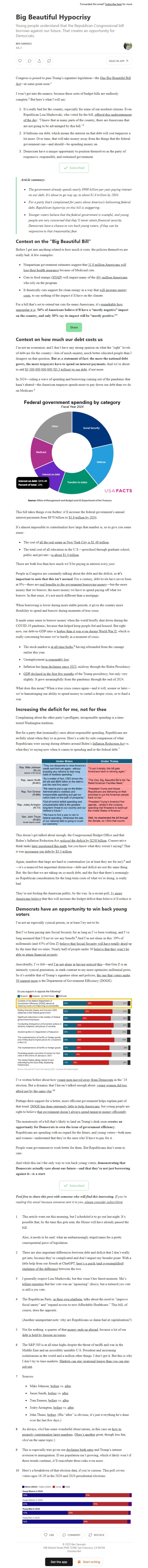

In 2024—riding a wave of spending and borrowing coming out of the pandemic that hasn’t abated—the American taxpayer spends more to pay down our debt than we do on Medicare.

This bill takes things even further: it’ll increase the federal government’s annual interest payments from $870 billion to $1.6 trillion by 2034 [ [link removed] ].

It’s almost impossible to contextualize how large that number is, so to give you some sense:

The cost of all the real estate in New York City is $1.48 trillion [ [link removed] ].

The total cost of all education in the U.S.—preschool through graduate school, public and private—is about $1.4 trillion [ [link removed] ].

Those are both less than how much we’ll be paying in interest every year.

People in Congress are constantly talking about the debt and the deficit, so it’s important to note that this isn’t normal. For a century, debt levels have never been at 0%—there are real benefits to the government borrowing money [ [link removed] ]—but the more money that we borrow, the more money we have to spend paying off what we borrow. In that sense, it’s not much different than a mortgage.

When borrowing is lower during more stable periods, it gives the country more flexibility to spend and borrow during moments of true crisis.

It made some sense to borrow money when the world briefly shut down during the COVID-19 pandemic, because that helped keep people fed and housed. But right now, our debt-to-GDP ratio is higher than it was even during World War II [ [link removed] ], which is really concerning because we’re hardly in a moment of crisis:

The stock market is at all-time highs [ [link removed] ], having rebounded from the carnage earlier this year.

Unemployment is reasonably low [ [link removed] ].

Inflation has been declining since 2023 [ [link removed] ], midway through the Biden Presidency.

GDP declined in the first few months [ [link removed] ] of the Trump presidency, but only very slightly. It grew meaningfully from the pandemic through the end of 2024.

What does this mean? When a true crisis comes again—and it will, sooner or later—we’re hamstringing our ability to spend money to curtail a deeper crisis, or to fund a war.

Increasing the deficit for me, not for thee

Complaining about the other party’s profligate, irresponsible spending is a time-tested Washington tradition.

But for a party that (nominally) cares about responsible spending, Republicans are awfully silent when they’re in power. Here’s a side-by-side comparison of what Republicans were saying during debates around Biden’s Inflation Reduction Act [ [link removed] ] vs. what they’re saying now when it comes to spending and/or the federal debt.

This doesn’t get talked about enough: the Congressional Budget Office said that Biden’s Inflation Reduction Act reduced [ [link removed] ] the deficit by $238 billion [ [link removed] ]. Conservative think tanks later questioned this math [ [link removed] ], but you know what they weren’t saying? That it was increasing our debt by $3.3 trillion [ [link removed] ].

Again, numbers that large are hard to contextualize (or at least they are for me), and—it’s a nuanced but important distinction—debt and deficit are not the same thing. But: the fact that we are taking on so much debt, and the fact that there’s seemingly no Republican consideration for the long-term costs of what we’re doing, is really bad.

They’re not fooling the American public, by the way. In a recent poll, 3× more Americans believe [ [link removed] ] that this will increase the budget deficit than believe it’ll reduce it.

Democrats have an opportunity to win back young voters

I’m not an especially cynical person, or at least I try not to be.

But I’ve been paying into Social Security for as long as I’ve been working, and I’ve long assumed that I’ll never see any benefit. And I’m not alone in this: 39% of millennials (and 45% of Gen Z) believe that Social Security will have totally dried [ [link removed] ] up by the time that we retire. Nearly half of people under 30 believe that they won’t be able to attain financial security [ [link removed] ].

Anecdotally, I’ve felt—and I’m [ [link removed] ] not [ [link removed] ] alone [ [link removed] ] in [ [link removed] ] having [ [link removed] ] noticed [ [link removed] ] this [ [link removed] ]—that Gen Z is an intensely cynical generation, in stark contrast to my more optimistic millennial peers. So it’s notable that of Trump’s signature ideas and policies, the one that voters under 30 support most [ [link removed] ] is the Department of Government Efficiency (DOGE):

I’ve written before about how young men moved away from Democrats [ [link removed] ] in the ’24 election. But a dynamic that I haven’t talked enough about: young women did too, albeit not by the same clip [ [link removed] ].

Perhaps their support for a better, more efficient government helps explain part of that trend. DOGE has done extremely little to help Americans [ [link removed] ], but young people are right to believe that government doesn’t always spend taxpayer money efficiently [ [link removed] ].

The monstrosity of a bill that’s likely to land on Trump’s desk soon creates an opportunity for Democrats to own the issue of government efficiency. Republicans are spending with no regard for the future, and young voters—both men and women—understand that they’re the ones who’ll have to pay for it.

People want government to work better for them. But Republicans don’t seem to care.

And while this isn’t the only way to win back young voters, demonstrating that Democrats actually care about our future—and that they’re not just borrowing against it—is a start.

Feel free to share this post with someone who will find this interesting. If you’re reading this email because someone sent it to you, please consider subscribing [ [link removed] ].

Unsubscribe [link removed]?

Congress is poised to pass Trump’s signature legislation—the One Big Beautiful Bill Act [ [link removed] ]—at some point soon.

I won’t get into the nuance, because these sorts of budget bills are endlessly complex. But here’s what I will say:

It’s really bad for the country, especially for some of our neediest citizens. Even Republican Lisa Murkowski, who voted for the bill, offered this understatement of the day [ [link removed] ]: “I know that in many parts of the country, there are Americans that are not going to be advantaged by this bill.”

It balloons our debt, which means the interest on that debt will cost taxpayers a lot more. Over time, that will take money away from the things that the federal government can—and should—be spending money on.

Democrats have a unique opportunity to position themselves as the party of responsive, responsible, and restrained government.

Article summary:

The government already spends nearly $900 billion per year paying interest on our debt. It’s about to go way up, to about $1.6 trillion by 2034.

For a party that’s complained for years about America’s ballooning federal debt, Republican hypocrisy on this bill is staggering.

Younger voters believe that the federal government is wasteful, and young people are very concerned that they’ll never attain financial security. Democrats have a chance to win back young voters, if they can be responsive to that (reasonable) fear.

Context on the “Big Beautiful Bill”

Before I get into anything related to how much it costs: the policies themselves are really bad. A few examples:

Nonpartisan government estimates suggest that 11.8 million Americans will lose their health insurance [ [link removed] ] because of Medicaid cuts.

Cuts to food stamps (SNAP [ [link removed] ]) will impact many of the 40+ million Americans [ [link removed] ] who rely on the program.

It drastically cuts support for clean energy in a way that will increase energy costs [ [link removed] ], to say nothing of the impact it’ll have on the climate.

For a bill that’s set to extend tax cuts for many Americans, it’s remarkable how unpopular it is [ [link removed] ]: 54% of Americans believe it’ll have a “mostly negative” impact on the country, and only 30% say its impact will be “mostly positive.”

Context on how much our debt costs us

I’m not an economist, and I don’t have any strong opinion on what the “right” levels of debt are for the country—lots of much smarter, much better educated people than I disagree on that question. But as a statement of fact: the more the national debt grows, the more taxpayers have to spend on interest payments. And we’re about to add $3,300,000,000,000 ($3.3 trillion) to our debt [ [link removed] ], if not more.

In 2024—riding a wave of spending and borrowing coming out of the pandemic that hasn’t abated—the American taxpayer spends more to pay down our debt than we do on Medicare.

This bill takes things even further: it’ll increase the federal government’s annual interest payments from $870 billion to $1.6 trillion by 2034 [ [link removed] ].

It’s almost impossible to contextualize how large that number is, so to give you some sense:

The cost of all the real estate in New York City is $1.48 trillion [ [link removed] ].

The total cost of all education in the U.S.—preschool through graduate school, public and private—is about $1.4 trillion [ [link removed] ].

Those are both less than how much we’ll be paying in interest every year.

People in Congress are constantly talking about the debt and the deficit, so it’s important to note that this isn’t normal. For a century, debt levels have never been at 0%—there are real benefits to the government borrowing money [ [link removed] ]—but the more money that we borrow, the more money we have to spend paying off what we borrow. In that sense, it’s not much different than a mortgage.

When borrowing is lower during more stable periods, it gives the country more flexibility to spend and borrow during moments of true crisis.

It made some sense to borrow money when the world briefly shut down during the COVID-19 pandemic, because that helped keep people fed and housed. But right now, our debt-to-GDP ratio is higher than it was even during World War II [ [link removed] ], which is really concerning because we’re hardly in a moment of crisis:

The stock market is at all-time highs [ [link removed] ], having rebounded from the carnage earlier this year.

Unemployment is reasonably low [ [link removed] ].

Inflation has been declining since 2023 [ [link removed] ], midway through the Biden Presidency.

GDP declined in the first few months [ [link removed] ] of the Trump presidency, but only very slightly. It grew meaningfully from the pandemic through the end of 2024.

What does this mean? When a true crisis comes again—and it will, sooner or later—we’re hamstringing our ability to spend money to curtail a deeper crisis, or to fund a war.

Increasing the deficit for me, not for thee

Complaining about the other party’s profligate, irresponsible spending is a time-tested Washington tradition.

But for a party that (nominally) cares about responsible spending, Republicans are awfully silent when they’re in power. Here’s a side-by-side comparison of what Republicans were saying during debates around Biden’s Inflation Reduction Act [ [link removed] ] vs. what they’re saying now when it comes to spending and/or the federal debt.

This doesn’t get talked about enough: the Congressional Budget Office said that Biden’s Inflation Reduction Act reduced [ [link removed] ] the deficit by $238 billion [ [link removed] ]. Conservative think tanks later questioned this math [ [link removed] ], but you know what they weren’t saying? That it was increasing our debt by $3.3 trillion [ [link removed] ].

Again, numbers that large are hard to contextualize (or at least they are for me), and—it’s a nuanced but important distinction—debt and deficit are not the same thing. But: the fact that we are taking on so much debt, and the fact that there’s seemingly no Republican consideration for the long-term costs of what we’re doing, is really bad.

They’re not fooling the American public, by the way. In a recent poll, 3× more Americans believe [ [link removed] ] that this will increase the budget deficit than believe it’ll reduce it.

Democrats have an opportunity to win back young voters

I’m not an especially cynical person, or at least I try not to be.

But I’ve been paying into Social Security for as long as I’ve been working, and I’ve long assumed that I’ll never see any benefit. And I’m not alone in this: 39% of millennials (and 45% of Gen Z) believe that Social Security will have totally dried [ [link removed] ] up by the time that we retire. Nearly half of people under 30 believe that they won’t be able to attain financial security [ [link removed] ].

Anecdotally, I’ve felt—and I’m [ [link removed] ] not [ [link removed] ] alone [ [link removed] ] in [ [link removed] ] having [ [link removed] ] noticed [ [link removed] ] this [ [link removed] ]—that Gen Z is an intensely cynical generation, in stark contrast to my more optimistic millennial peers. So it’s notable that of Trump’s signature ideas and policies, the one that voters under 30 support most [ [link removed] ] is the Department of Government Efficiency (DOGE):

I’ve written before about how young men moved away from Democrats [ [link removed] ] in the ’24 election. But a dynamic that I haven’t talked enough about: young women did too, albeit not by the same clip [ [link removed] ].

Perhaps their support for a better, more efficient government helps explain part of that trend. DOGE has done extremely little to help Americans [ [link removed] ], but young people are right to believe that government doesn’t always spend taxpayer money efficiently [ [link removed] ].

The monstrosity of a bill that’s likely to land on Trump’s desk soon creates an opportunity for Democrats to own the issue of government efficiency. Republicans are spending with no regard for the future, and young voters—both men and women—understand that they’re the ones who’ll have to pay for it.

People want government to work better for them. But Republicans don’t seem to care.

And while this isn’t the only way to win back young voters, demonstrating that Democrats actually care about our future—and that they’re not just borrowing against it—is a start.

Feel free to share this post with someone who will find this interesting. If you’re reading this email because someone sent it to you, please consider subscribing [ [link removed] ].

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a