| From | Fraser Institute <[email protected]> |

| Subject | Airline competition, Ontario tax burden, and economic freedom |

| Date | March 15, 2025 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Reduce airport-related fees and allow competition from foreign airlines to lower sky-high airfares for Canadians [[link removed]]

Clearing the Runway: Reforms to Enhance Air Travel Competition finds that Ottawa could reduce airfares for Canadian travellers and improve the consumer experience by aligning Canadian policies with those in other developed countries, including: Allowing a more flexible airport ownership structure, removing cabotage restrictions, reducing air travel-related taxes and fees, and streamlining non-safety related aviation regulations.

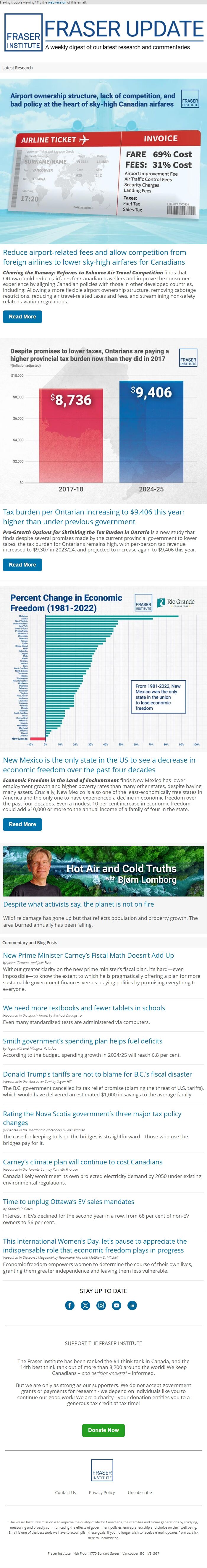

Read More [[link removed]] Tax burden per Ontarian increasing to $9,406 this year; higher than under previous government [[link removed]]

Pro-Growth Options for Shrinking the Tax Burden in Ontario is a new study that finds despite several promises made by the current provincial government to lower taxes, the tax burden for Ontarians remains high, with per-person tax revenue increased to $9,307 in 2023/24, and projected to increase again to $9,406 this year.

Read More [[link removed]] New Mexico is the only state in the US to see a decrease in economic freedom over the past four decades [[link removed]]

Economic Freedom in the Land of Enchantment finds New Mexico has lower employment growth and higher poverty rates than many other states, despite having many assets. Crucially, New Mexico is also one of the least-economically free states in America and the only one to have experienced a decline in economic freedom over the past four decades. Even a modest 10 per cent increase in economic freedom could add $10,000 or more to the annual income of a family of four in the state.

Read More [[link removed]] Despite what activists say, the planet is not on fire [[link removed]]

Wildfire damage has gone up but that reflects population and property growth. The area burned annually has been falling.

Commentary and Blog Posts New Prime Minister Carney’s Fiscal Math Doesn’t Add Up [[link removed]] by Jason Clemens, and Jake Fuss

Without greater clarity on the new prime minister’s fiscal plan, it’s hard—even impossible—to know the extent to which he is pragmatically offering a plan for more sustainable government finances versus playing politics by promising everything to everyone.

We need more textbooks and fewer tablets in schools [[link removed]] (Appeared in the Epoch Times) by Michael Zwaagstra

Even many standardized tests are administered via computers.

Smith government’s spending plan helps fuel deficits [[link removed]] by Tegan Hill and Milagros Palacios

According to the budget, spending growth in 2024/25 will reach 6.8 per cent.

Donald Trump’s tariffs are not to blame for B.C.’s fiscal disaster [[link removed]] (Appeared in the Vancouver Sun) by Tegan Hill

The B.C. government cancelled its tax relief promise (blaming the threat of U.S. tariffs), which would have delivered an estimated $1,000 in savings to the average family.

Rating the Nova Scotia government’s three major tax policy changes [[link removed]] (Appeared in the Macdonald Notebook) by Alex Whalen

The case for keeping tolls on the bridges is straightforward—those who use the bridges pay for it.

Carney’s climate plan will continue to cost Canadians [[link removed]] (Appeared in the Toronto Sun) by Kenneth P. Green

Canada likely won’t meet its own projected electricity demand by 2050 under existing environmental regulations.

Time to unplug Ottawa’s EV sales mandates [[link removed]] by Kenneth P. Green

Interest in EVs declined for the second year in a row, from 68 per cent of non-EV owners to 56 per cent.

This International Women’s Day, let’s pause to appreciate the indispensable role that economic freedom plays in progress [[link removed]] (Appeared in Discourse Magazine) by Rosemarie Fike and Matthew D. Mitchell

Economic freedom empowers women to determine the course of their own lives, granting them greater independence and leaving them less vulnerable.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Clearing the Runway: Reforms to Enhance Air Travel Competition finds that Ottawa could reduce airfares for Canadian travellers and improve the consumer experience by aligning Canadian policies with those in other developed countries, including: Allowing a more flexible airport ownership structure, removing cabotage restrictions, reducing air travel-related taxes and fees, and streamlining non-safety related aviation regulations.

Read More [[link removed]] Tax burden per Ontarian increasing to $9,406 this year; higher than under previous government [[link removed]]

Pro-Growth Options for Shrinking the Tax Burden in Ontario is a new study that finds despite several promises made by the current provincial government to lower taxes, the tax burden for Ontarians remains high, with per-person tax revenue increased to $9,307 in 2023/24, and projected to increase again to $9,406 this year.

Read More [[link removed]] New Mexico is the only state in the US to see a decrease in economic freedom over the past four decades [[link removed]]

Economic Freedom in the Land of Enchantment finds New Mexico has lower employment growth and higher poverty rates than many other states, despite having many assets. Crucially, New Mexico is also one of the least-economically free states in America and the only one to have experienced a decline in economic freedom over the past four decades. Even a modest 10 per cent increase in economic freedom could add $10,000 or more to the annual income of a family of four in the state.

Read More [[link removed]] Despite what activists say, the planet is not on fire [[link removed]]

Wildfire damage has gone up but that reflects population and property growth. The area burned annually has been falling.

Commentary and Blog Posts New Prime Minister Carney’s Fiscal Math Doesn’t Add Up [[link removed]] by Jason Clemens, and Jake Fuss

Without greater clarity on the new prime minister’s fiscal plan, it’s hard—even impossible—to know the extent to which he is pragmatically offering a plan for more sustainable government finances versus playing politics by promising everything to everyone.

We need more textbooks and fewer tablets in schools [[link removed]] (Appeared in the Epoch Times) by Michael Zwaagstra

Even many standardized tests are administered via computers.

Smith government’s spending plan helps fuel deficits [[link removed]] by Tegan Hill and Milagros Palacios

According to the budget, spending growth in 2024/25 will reach 6.8 per cent.

Donald Trump’s tariffs are not to blame for B.C.’s fiscal disaster [[link removed]] (Appeared in the Vancouver Sun) by Tegan Hill

The B.C. government cancelled its tax relief promise (blaming the threat of U.S. tariffs), which would have delivered an estimated $1,000 in savings to the average family.

Rating the Nova Scotia government’s three major tax policy changes [[link removed]] (Appeared in the Macdonald Notebook) by Alex Whalen

The case for keeping tolls on the bridges is straightforward—those who use the bridges pay for it.

Carney’s climate plan will continue to cost Canadians [[link removed]] (Appeared in the Toronto Sun) by Kenneth P. Green

Canada likely won’t meet its own projected electricity demand by 2050 under existing environmental regulations.

Time to unplug Ottawa’s EV sales mandates [[link removed]] by Kenneth P. Green

Interest in EVs declined for the second year in a row, from 68 per cent of non-EV owners to 56 per cent.

This International Women’s Day, let’s pause to appreciate the indispensable role that economic freedom plays in progress [[link removed]] (Appeared in Discourse Magazine) by Rosemarie Fike and Matthew D. Mitchell

Economic freedom empowers women to determine the course of their own lives, granting them greater independence and leaving them less vulnerable.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor