| From | Civic Action <[email protected]> |

| Subject | The Tapback: Tip of the hat |

| Date | July 24, 2024 1:31 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Logo for The Tapback from Civic Action [[link removed]]

TIP OF THE HAT

You may have thought tipping culture was already out of hand , but, well, you were wrong. Because according to a new report [[link removed]] from the Consumer Finance Protection Bureau, some companies providing so-called "payday advance" loans actually request that consumers provide them tips … for the service of letting them access their own paychecks a few days early.

It’s pretty clear that the entire point of inserting a tip screen in this kind of transaction is to fool customers into adding the tip unwillingly. Because while it’s true that some customers do appreciate the opportunity to provide tips as a way of acknowledging good service (or to somewhat compensate for low wages in the service sector), there are approximately zero people on planet Earth who would be inclined to tip a company which is providing them a loan against their own paycheck . Nobody wants to tip a bank teller or throw a gratuity at the CoinStar machine. Surely nobody wants to do this either. And yet these loan companies are out there hustling for tips, hoping customers get confused or think they don’t have a choice but to chip in something extra, and then claiming it’s all just voluntary .

Make it make sense.

Three Numbers [[link removed]]

15% more eviction filings [[link removed]] have been made in large Sunbelt cities, as compared to the number of eviction filings [[link removed]] before the pandemic. Other regions have seen smaller increases in evictions , due largely to increased legal protections for renters in those cities.

45% of warehouse workers [[link removed]] at Amazon were injured during Prime Day 2019 , according to a new report [[link removed]] from the US Senate. The company insisted that injury rates are down and complained that the report “was not shared with us before publishing.”

$45 million [[link removed]] was paid by hedge fund honcho [[link removed]] Ken Griffith for a fossilized stegosaurus named Apex. After his purchase, Griffith promised that “ Apex was born in America and is going to stay in America!”

A Chart [[link removed]]

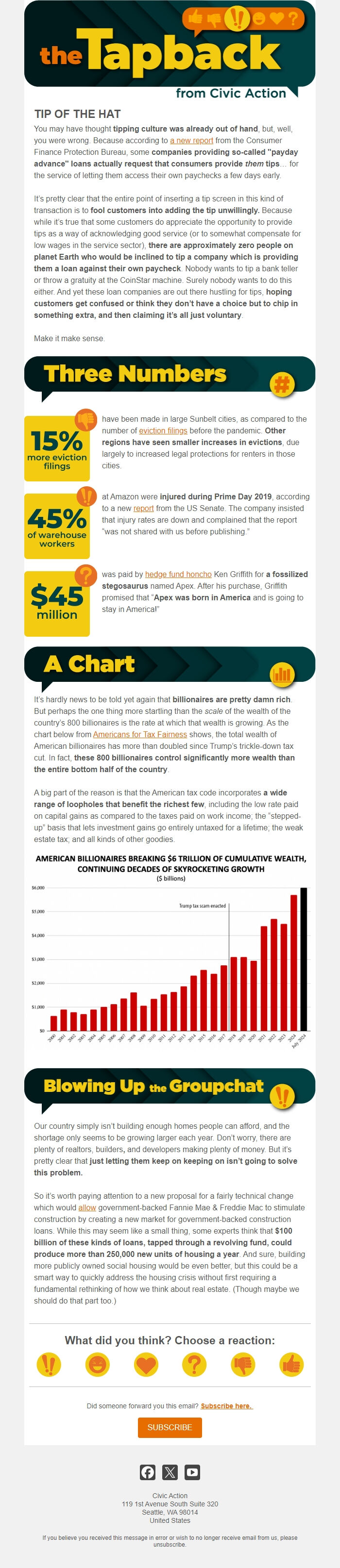

It’s hardly news to be told yet again that billionaires are pretty damn rich . But perhaps the one thing more startling than the scale of the wealth of the country’s 800 billionaires is the rate at which that wealth is growing. As the chart below from Americans for Tax Fairness [[link removed]] shows, the total wealth of American billionaires has more than doubled since Trump’s trickle-down tax cut. In fact, these 800 billionaires control significantly more wealth than the entire bottom half of the country .

A big part of the reason is that the American tax code incorporates a wide range of loopholes that benefit the richest few , including the low rate paid on capital gains as compared to the taxes paid on work income; the “stepped-up” basis that lets investment gains go entirely untaxed for a lifetime; the weak estate tax; and all kinds of other goodies.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

Our country simply isn’t building enough homes people can afford, and the shortage only seems to be growing larger each year. Don’t worry, there are plenty of realtors, builders , and developers making plenty of money. But it’s pretty clear that just letting them keep on keeping on isn’t going to solve this problem.

So it’s worth paying attention to a new proposal for a fairly technical change which would allow [[link removed]] government-backed Fannie Mae & Freddie Mac to stimulate construction by creating a new market for government-backed construction loans. While this may seem like a small thing, some experts think that $100 billion of these kinds of loans, tapped through a revolving fund, could produce more than 250,000 new units of housing a year . And sure, building more publicly owned social housing would be even better, but this could be a smart way to quickly address the housing crisis without first requiring a fundamental rethinking of how we think about real estate. (Though maybe we should do that part too.)

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

TIP OF THE HAT

You may have thought tipping culture was already out of hand , but, well, you were wrong. Because according to a new report [[link removed]] from the Consumer Finance Protection Bureau, some companies providing so-called "payday advance" loans actually request that consumers provide them tips … for the service of letting them access their own paychecks a few days early.

It’s pretty clear that the entire point of inserting a tip screen in this kind of transaction is to fool customers into adding the tip unwillingly. Because while it’s true that some customers do appreciate the opportunity to provide tips as a way of acknowledging good service (or to somewhat compensate for low wages in the service sector), there are approximately zero people on planet Earth who would be inclined to tip a company which is providing them a loan against their own paycheck . Nobody wants to tip a bank teller or throw a gratuity at the CoinStar machine. Surely nobody wants to do this either. And yet these loan companies are out there hustling for tips, hoping customers get confused or think they don’t have a choice but to chip in something extra, and then claiming it’s all just voluntary .

Make it make sense.

Three Numbers [[link removed]]

15% more eviction filings [[link removed]] have been made in large Sunbelt cities, as compared to the number of eviction filings [[link removed]] before the pandemic. Other regions have seen smaller increases in evictions , due largely to increased legal protections for renters in those cities.

45% of warehouse workers [[link removed]] at Amazon were injured during Prime Day 2019 , according to a new report [[link removed]] from the US Senate. The company insisted that injury rates are down and complained that the report “was not shared with us before publishing.”

$45 million [[link removed]] was paid by hedge fund honcho [[link removed]] Ken Griffith for a fossilized stegosaurus named Apex. After his purchase, Griffith promised that “ Apex was born in America and is going to stay in America!”

A Chart [[link removed]]

It’s hardly news to be told yet again that billionaires are pretty damn rich . But perhaps the one thing more startling than the scale of the wealth of the country’s 800 billionaires is the rate at which that wealth is growing. As the chart below from Americans for Tax Fairness [[link removed]] shows, the total wealth of American billionaires has more than doubled since Trump’s trickle-down tax cut. In fact, these 800 billionaires control significantly more wealth than the entire bottom half of the country .

A big part of the reason is that the American tax code incorporates a wide range of loopholes that benefit the richest few , including the low rate paid on capital gains as compared to the taxes paid on work income; the “stepped-up” basis that lets investment gains go entirely untaxed for a lifetime; the weak estate tax; and all kinds of other goodies.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

Our country simply isn’t building enough homes people can afford, and the shortage only seems to be growing larger each year. Don’t worry, there are plenty of realtors, builders , and developers making plenty of money. But it’s pretty clear that just letting them keep on keeping on isn’t going to solve this problem.

So it’s worth paying attention to a new proposal for a fairly technical change which would allow [[link removed]] government-backed Fannie Mae & Freddie Mac to stimulate construction by creating a new market for government-backed construction loans. While this may seem like a small thing, some experts think that $100 billion of these kinds of loans, tapped through a revolving fund, could produce more than 250,000 new units of housing a year . And sure, building more publicly owned social housing would be even better, but this could be a smart way to quickly address the housing crisis without first requiring a fundamental rethinking of how we think about real estate. (Though maybe we should do that part too.)

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction