| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Trade Report for July 2023 |

| Date | September 12, 2023 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Trade Report

for July 2023

Below are highlights from the recently released trade data from the US Census Bureau and US Bureau of Economic Analysis. To view additional data and analysis related to the California economy visit our website at [[link removed]].

In July, the trade numbers for California showed the combined effect of the extended labor negotiations along with declining economic activity in China. In nominal terms, origin exports were down 8.6% compared to the prior year, and destination imports down more sharply at 16.2%. Overall trade flows through the state’s ports were off 11.7%.

In real terms, total trade through California ports has been down in every month so far this year compared to 2022 levels, and down in every month except March when compared to pre-pandemic 2019.

Export flows have been somewhat more variable but have tracked more closely to the 2022 results. Export activity, however, remains well below recovery levels when compared to 2019.

Import flows have been running below 2022, but in the prior 4 months were above the 2019 activity. July saw a reversal of this trend.

The combined effects of the extended labor uncertainty [[link removed]], pandemic congestion, rising costs due to state and regional regulations, and the diversifying shift away from a reliance on China sourcing has seen a continuous erosion in the previous dominance of California as the nation’s leading trade gateway. California has seen its share of total US trade drop from over a fifth in 2004, to the current level of just over 15% and continuing to drop on a 12-month moving basis. Currently, the primary mitigating factor slowing this shift has been drought [[link removed]] in Panama limiting the shift to trade routes through the Canal.

Over the past few decades, economic development in California has taken two decidedly different tracks. Following the economic disruptions in the early 1990s, the Bay Area turned to tech and its higher wage jobs promoting an expansion in upper income households. Southern California in contrast developed its trade base, promoting instead middle-class wage jobs especially to blue collar households. The resulting outcomes have had profoundly different effects on income opportunities and the state’s professed interests in combating income inequality.

The recent ratification [[link removed]] of the new West Coast labor agreement removes one barrier as the ports now turn to efforts to regain the lost market share that underpins this critical jobs and income base. The regulatory agencies, however, continue to throw up roadblocks, including state policies that push energy costs [[link removed]] ever higher even as other state and local policies push greater electrification of port activities, and in the latest attempt [[link removed]] which would impose a cap on overall trade flows and the middle class wage jobs base in Southern California.

Share of Goods Through US Ports 15.4% CA Share of Total Trade

Through US Ports

The share of total US goods trade (exports and imports) through California ports continued dropping to 15.36% (12 month moving average; compared to 15.43% in June 2023 and 16.50% in July 2022).

California remained the #2 state, behind Texas with 20.07% (compared to 20.10% in June 2023 and 19.24% in July 2022). Trade through the Atlantic port states was at 30.05% (compared to 29.92% in June 2023 and 29.67% in July 2022). Although declining, the state’s position as a leading trade portal forms the trade-related base for one of California’s largest centers of middle-class, blue-collar jobs. Transportation & Warehousing alone provided 791,400 in the most recent data for July 2023, and was the only blue-collar industry at this wage level showing expansion during the pandemic.

California Goods Exports -$1.3 Billion Change

in Exports

Total California goods exports were down $1.3 billion from July 2022 (down 8.6%). California remained in 2nd place with 8.84% of all US goods exports (12 month moving total), behind Texas at 22.36%.

California Goods Imports -$7.1 Billion Change

in Imports

Total California destination goods imports plunged $7.1 billion from July 2022 (down 16.2%).

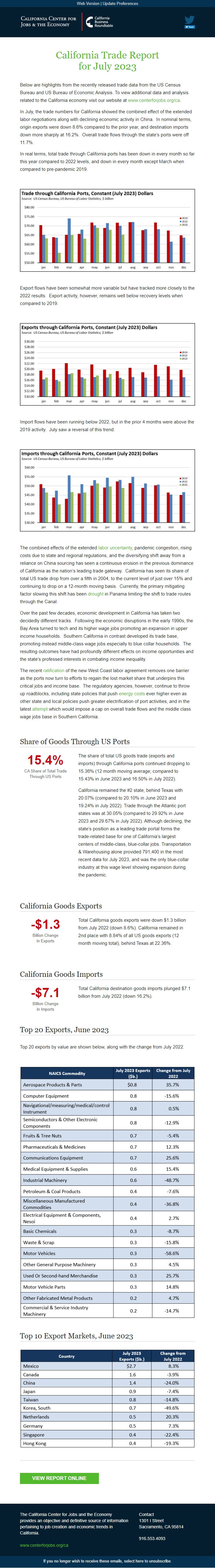

Top 20 Exports, June 2023

Top 20 exports by value are shown below, along with the change from July 2022.

Top 10 Export Markets, June 2023 View Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

for July 2023

Below are highlights from the recently released trade data from the US Census Bureau and US Bureau of Economic Analysis. To view additional data and analysis related to the California economy visit our website at [[link removed]].

In July, the trade numbers for California showed the combined effect of the extended labor negotiations along with declining economic activity in China. In nominal terms, origin exports were down 8.6% compared to the prior year, and destination imports down more sharply at 16.2%. Overall trade flows through the state’s ports were off 11.7%.

In real terms, total trade through California ports has been down in every month so far this year compared to 2022 levels, and down in every month except March when compared to pre-pandemic 2019.

Export flows have been somewhat more variable but have tracked more closely to the 2022 results. Export activity, however, remains well below recovery levels when compared to 2019.

Import flows have been running below 2022, but in the prior 4 months were above the 2019 activity. July saw a reversal of this trend.

The combined effects of the extended labor uncertainty [[link removed]], pandemic congestion, rising costs due to state and regional regulations, and the diversifying shift away from a reliance on China sourcing has seen a continuous erosion in the previous dominance of California as the nation’s leading trade gateway. California has seen its share of total US trade drop from over a fifth in 2004, to the current level of just over 15% and continuing to drop on a 12-month moving basis. Currently, the primary mitigating factor slowing this shift has been drought [[link removed]] in Panama limiting the shift to trade routes through the Canal.

Over the past few decades, economic development in California has taken two decidedly different tracks. Following the economic disruptions in the early 1990s, the Bay Area turned to tech and its higher wage jobs promoting an expansion in upper income households. Southern California in contrast developed its trade base, promoting instead middle-class wage jobs especially to blue collar households. The resulting outcomes have had profoundly different effects on income opportunities and the state’s professed interests in combating income inequality.

The recent ratification [[link removed]] of the new West Coast labor agreement removes one barrier as the ports now turn to efforts to regain the lost market share that underpins this critical jobs and income base. The regulatory agencies, however, continue to throw up roadblocks, including state policies that push energy costs [[link removed]] ever higher even as other state and local policies push greater electrification of port activities, and in the latest attempt [[link removed]] which would impose a cap on overall trade flows and the middle class wage jobs base in Southern California.

Share of Goods Through US Ports 15.4% CA Share of Total Trade

Through US Ports

The share of total US goods trade (exports and imports) through California ports continued dropping to 15.36% (12 month moving average; compared to 15.43% in June 2023 and 16.50% in July 2022).

California remained the #2 state, behind Texas with 20.07% (compared to 20.10% in June 2023 and 19.24% in July 2022). Trade through the Atlantic port states was at 30.05% (compared to 29.92% in June 2023 and 29.67% in July 2022). Although declining, the state’s position as a leading trade portal forms the trade-related base for one of California’s largest centers of middle-class, blue-collar jobs. Transportation & Warehousing alone provided 791,400 in the most recent data for July 2023, and was the only blue-collar industry at this wage level showing expansion during the pandemic.

California Goods Exports -$1.3 Billion Change

in Exports

Total California goods exports were down $1.3 billion from July 2022 (down 8.6%). California remained in 2nd place with 8.84% of all US goods exports (12 month moving total), behind Texas at 22.36%.

California Goods Imports -$7.1 Billion Change

in Imports

Total California destination goods imports plunged $7.1 billion from July 2022 (down 16.2%).

Top 20 Exports, June 2023

Top 20 exports by value are shown below, along with the change from July 2022.

Top 10 Export Markets, June 2023 View Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor