| From | Civic Action <[email protected]> |

| Subject | The Tapback: Spoiler Alert |

| Date | July 25, 2023 7:37 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

SPOILER ALERT

The Biden Administration has proposed new rules [[link removed]] which would apply more stringent standards to the review of corporate mega-mergers by requiring regulators to consider all of the various ways that buyouts can impact workers and communities. It’s an overdue but straightforward application of the basic idea underlying why anticompetitive mergers are regulated in the first place: without intervention, concentrated corporate power will only grow more concentrated and more powerful .

But of course, that’s not how former Treasury Secretary and notorious trickle-down Democrat Larry Summers sees it. Fresh off a months-long campaign to push the Federal Reserve to continue raising interest rates until millions of people are thrown out of work, Summers last week told an interviewer [[link removed]] that the new rules under discussion are “ problematic territory ” and amounted to… a “war on business.” Has it simply never occurred to Summers that the companies which would be protected from unfair competition are… also businesses?

Make it make sense.

Three Numbers [[link removed]]

1.9% GDP growth [[link removed]] is now projected for the first half of the year by the economic forecasters at Morgan Stanley [[link removed]] . They quadrupled the level growth anticipated in an earlier forecast after considering the “boom in large-scale infrastructure” and “broad strength” in manufacturing construction being unleashed by the Biden administration’s middle-out economic policies.

61% of Americans [[link removed]] agree that “ a lot [[link removed]] ” of the responsibility for the price increases of the past couple years ought to be attributed to corporations taking advantage of economic conditions to boost their profit margins . Among the most popular ideas to address the epidemic of greedflation: strengthening supply chains, and fining companies engaged in price gouging.

$18.5 billion [[link removed]] has been scammed from investors by people who appeared on the Forbes “ 30 under 30 [[link removed]] ” list before their fraud was exposed. Alumni include financial aid fraudster Charlie Javice, deposed crypto king Sam Bankman-Fried , and “pharma bro” Martin Shkreli.

A Chart [[link removed]]

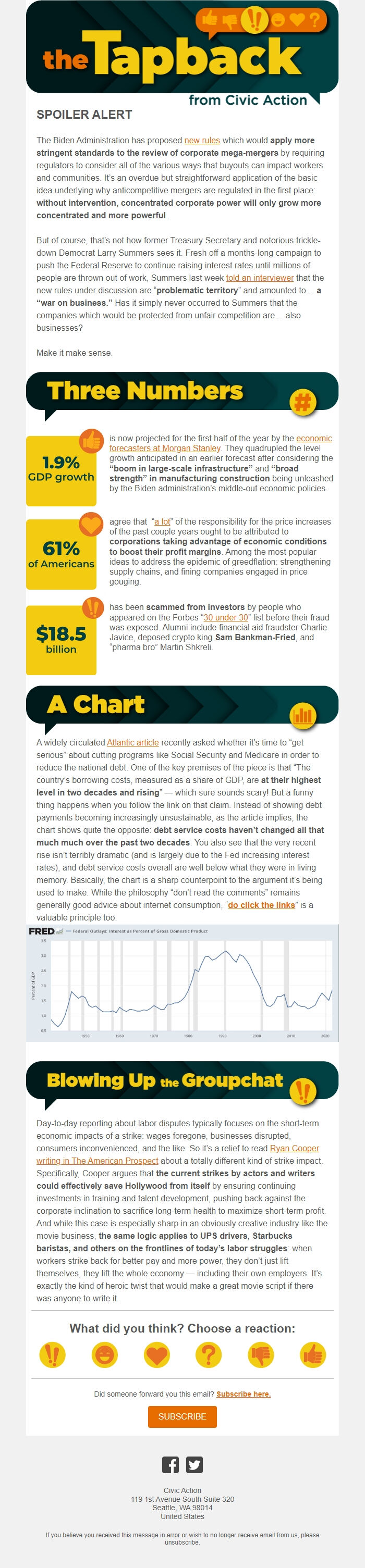

A widely circulated Atlantic article [[link removed]] recently asked whether it’s time to “get serious” about cutting programs like Social Security and Medicare in order to reduce the national debt. One of the key premises of the piece is that “The country’s borrowing costs, measured as a share of GDP, are at their highest level in two decades and rising ” — which sure sounds scary! But a funny thing happens when you follow the link on that claim. Instead of showing debt payments becoming increasingly unsustainable, as the article implies, the chart shows quite the opposite: debt service costs haven’t changed all that much much over the past two decades . You also see that the very recent rise isn’t terribly dramatic (and is largely due to the Fed increasing interest rates), and debt service costs overall are well below what they were in living memory. Basically, the chart is a sharp counterpoint to the argument it’s being used to make. While the philosophy “don’t read the comments” remains generally good advice about internet consumption, “ do click the links [[link removed]] ” is a valuable principle too.

Chart showing real average wages for all workers vs. production/non-supervisory workers (private sector) [[link removed]]

Blowing up the Groupchat [[link removed]]

Day-to-day reporting about labor disputes typically focuses on the short-term economic impacts of a strike: wages foregone, businesses disrupted, consumers inconvenienced, and the like. So it’s a relief to read Ryan Cooper writing in The American Prospect [[link removed]] about a totally different kind of strike impact. Specifically, Cooper argues that the current strikes by actors and writers could effectively save Hollywood from itself by ensuring continuing investments in training and talent development, pushing back against the corporate inclination to sacrifice long-term health to maximize short-term profit. And while this case is especially sharp in an obviously creative industry like the movie business, the same logic applies to UPS drivers, Starbucks baristas, and others on the frontlines of today’s labor struggles : when workers strike back for better pay and more power, they don’t just lift themselves, they lift the whole economy — including their own employers. It’s exactly the kind of heroic twist that would make a great movie script if there was anyone to write it.

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

The Biden Administration has proposed new rules [[link removed]] which would apply more stringent standards to the review of corporate mega-mergers by requiring regulators to consider all of the various ways that buyouts can impact workers and communities. It’s an overdue but straightforward application of the basic idea underlying why anticompetitive mergers are regulated in the first place: without intervention, concentrated corporate power will only grow more concentrated and more powerful .

But of course, that’s not how former Treasury Secretary and notorious trickle-down Democrat Larry Summers sees it. Fresh off a months-long campaign to push the Federal Reserve to continue raising interest rates until millions of people are thrown out of work, Summers last week told an interviewer [[link removed]] that the new rules under discussion are “ problematic territory ” and amounted to… a “war on business.” Has it simply never occurred to Summers that the companies which would be protected from unfair competition are… also businesses?

Make it make sense.

Three Numbers [[link removed]]

1.9% GDP growth [[link removed]] is now projected for the first half of the year by the economic forecasters at Morgan Stanley [[link removed]] . They quadrupled the level growth anticipated in an earlier forecast after considering the “boom in large-scale infrastructure” and “broad strength” in manufacturing construction being unleashed by the Biden administration’s middle-out economic policies.

61% of Americans [[link removed]] agree that “ a lot [[link removed]] ” of the responsibility for the price increases of the past couple years ought to be attributed to corporations taking advantage of economic conditions to boost their profit margins . Among the most popular ideas to address the epidemic of greedflation: strengthening supply chains, and fining companies engaged in price gouging.

$18.5 billion [[link removed]] has been scammed from investors by people who appeared on the Forbes “ 30 under 30 [[link removed]] ” list before their fraud was exposed. Alumni include financial aid fraudster Charlie Javice, deposed crypto king Sam Bankman-Fried , and “pharma bro” Martin Shkreli.

A Chart [[link removed]]

A widely circulated Atlantic article [[link removed]] recently asked whether it’s time to “get serious” about cutting programs like Social Security and Medicare in order to reduce the national debt. One of the key premises of the piece is that “The country’s borrowing costs, measured as a share of GDP, are at their highest level in two decades and rising ” — which sure sounds scary! But a funny thing happens when you follow the link on that claim. Instead of showing debt payments becoming increasingly unsustainable, as the article implies, the chart shows quite the opposite: debt service costs haven’t changed all that much much over the past two decades . You also see that the very recent rise isn’t terribly dramatic (and is largely due to the Fed increasing interest rates), and debt service costs overall are well below what they were in living memory. Basically, the chart is a sharp counterpoint to the argument it’s being used to make. While the philosophy “don’t read the comments” remains generally good advice about internet consumption, “ do click the links [[link removed]] ” is a valuable principle too.

Chart showing real average wages for all workers vs. production/non-supervisory workers (private sector) [[link removed]]

Blowing up the Groupchat [[link removed]]

Day-to-day reporting about labor disputes typically focuses on the short-term economic impacts of a strike: wages foregone, businesses disrupted, consumers inconvenienced, and the like. So it’s a relief to read Ryan Cooper writing in The American Prospect [[link removed]] about a totally different kind of strike impact. Specifically, Cooper argues that the current strikes by actors and writers could effectively save Hollywood from itself by ensuring continuing investments in training and talent development, pushing back against the corporate inclination to sacrifice long-term health to maximize short-term profit. And while this case is especially sharp in an obviously creative industry like the movie business, the same logic applies to UPS drivers, Starbucks baristas, and others on the frontlines of today’s labor struggles : when workers strike back for better pay and more power, they don’t just lift themselves, they lift the whole economy — including their own employers. It’s exactly the kind of heroic twist that would make a great movie script if there was anyone to write it.

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction