Email

Tax Professional Tip #12 – Power of attorney and accessing client tax information

| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #12 – Power of attorney and accessing client tax information |

| Date | March 24, 2023 2:05 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

The Minnesota Department of Revenue can disclose confidential client information to you if you have power of attorney for your client.

*How do I get power of attorney for my clients?*

You have several options:

* To have your clients grant you full or limited authority to act on their behalf, send us Form REV184i, Individual or Sole Proprietor Power of Attorney [ [link removed] ], or Form REV184b, Business Power of Attorney [ [link removed] ].

* To have your clients grant you a one-time release of private or nonpublic data, send us Form REV185i, Authorization to Release Individual or Sole Proprietor Tax Information [ [link removed] ], or Form REV185b, Authorization to Release Business Tax Information [ [link removed] ].

* Send us federal Form 2848 [ [link removed] ]. Section 3 of this form must state ?Minnesota? (or ?MN?) or a Minnesota tax form number with specific tax years and tax types.

* Have your clients check the box on the bottom of their Minnesota return that reads: ?I authorize the Minnesota Department of Revenue to discuss this return with my paid preparer or the third-party designee indicated on my federal return.?

We will not accept power of attorney forms (including Form REV184) with revision dates of October 2012 or earlier.

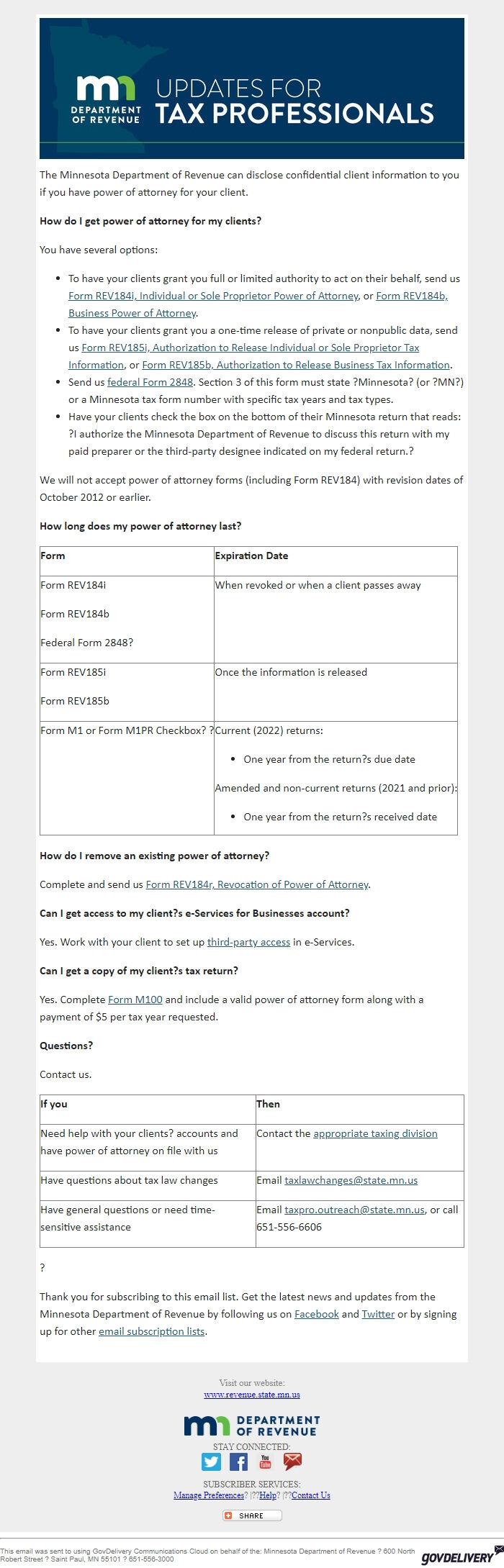

*How long does my power of attorney last?*

*Form*

*Expiration Date*

Form REV184i

Form REV184b

Federal Form 2848?

When revoked or when a client passes away

Form REV185i

Form REV185b

Once the information is released

Form M1 or Form M1PR Checkbox? ?

Current (2022) returns:

* One year from the return?s due date

Amended and non-current returns (2021 and prior):

* One year from the return?s received date

*How do I remove an existing power of attorney?*

Complete and send us Form REV184r, Revocation of Power of Attorney [ [link removed] ].

*Can I get access to my client?s e-Services for Businesses account? *

Yes. Work with your client to set up third-party access [ [link removed] ] in e-Services.

*Can I get a copy of my client?s tax return? *

Yes. Complete Form M100 [ [link removed] ] and include a valid power of attorney form along with a payment of $5 per tax year requested.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions or need time-sensitive assistance

Email [email protected], or call 651-556-6606

?

Thank you for subscribing to this email list. Get the latest news and updates from the Minnesota Department of Revenue by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for other email subscription lists [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

The Minnesota Department of Revenue can disclose confidential client information to you if you have power of attorney for your client.

*How do I get power of attorney for my clients?*

You have several options:

* To have your clients grant you full or limited authority to act on their behalf, send us Form REV184i, Individual or Sole Proprietor Power of Attorney [ [link removed] ], or Form REV184b, Business Power of Attorney [ [link removed] ].

* To have your clients grant you a one-time release of private or nonpublic data, send us Form REV185i, Authorization to Release Individual or Sole Proprietor Tax Information [ [link removed] ], or Form REV185b, Authorization to Release Business Tax Information [ [link removed] ].

* Send us federal Form 2848 [ [link removed] ]. Section 3 of this form must state ?Minnesota? (or ?MN?) or a Minnesota tax form number with specific tax years and tax types.

* Have your clients check the box on the bottom of their Minnesota return that reads: ?I authorize the Minnesota Department of Revenue to discuss this return with my paid preparer or the third-party designee indicated on my federal return.?

We will not accept power of attorney forms (including Form REV184) with revision dates of October 2012 or earlier.

*How long does my power of attorney last?*

*Form*

*Expiration Date*

Form REV184i

Form REV184b

Federal Form 2848?

When revoked or when a client passes away

Form REV185i

Form REV185b

Once the information is released

Form M1 or Form M1PR Checkbox? ?

Current (2022) returns:

* One year from the return?s due date

Amended and non-current returns (2021 and prior):

* One year from the return?s received date

*How do I remove an existing power of attorney?*

Complete and send us Form REV184r, Revocation of Power of Attorney [ [link removed] ].

*Can I get access to my client?s e-Services for Businesses account? *

Yes. Work with your client to set up third-party access [ [link removed] ] in e-Services.

*Can I get a copy of my client?s tax return? *

Yes. Complete Form M100 [ [link removed] ] and include a valid power of attorney form along with a payment of $5 per tax year requested.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions or need time-sensitive assistance

Email [email protected], or call 651-556-6606

?

Thank you for subscribing to this email list. Get the latest news and updates from the Minnesota Department of Revenue by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for other email subscription lists [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery