|

|

|

|

Welcome to the Tuesday, Jan. 28, Brew. Here’s what’s in store for you as you start your day:

- Eighteen states have one party that has won a record number of consecutive gubernatorial elections

- Michigan city councilwoman faces recall election

- Utah legislature to repeal tax law after signatures submitted for veto referendum

|

Eighteen states have one party that has won a record number of consecutive gubernatorial elections

One-party dominance of a statewide office over a long period of time is hard to do. But in 18 states, one party has won the governorship in more consecutive elections than at any time in the state’s history. The longest of these streaks—for Democrats in Oregon and Republicans in Utah—each go back 10 elections.

There are currently 12 states in the midst of record-long Republican winning streaks and six states in the middle of record-long Democratic winning streaks. Five of those win streaks are records for either party in the state. Republicans have record-long streaks in Utah (10 elections) and Idaho (7) and Democrats have record-long streaks in Oregon (10 elections), Washington (9), and West Virginia (6).

Current West Virginia Gov. Jim Justice (R) was elected while a member of the Democratic Party in 2016 and changed his party affiliation in August 2017. He is running for re-election on Nov. 3, 2020, as a Republican.

The longest gubernatorial winning streak in U.S. history for either party was in Georgia, where Democrats won all 52 gubernatorial elections between 1871 and 1998. The longest Republican winning streak was in Vermont, where the party won all 49 gubernatorial elections between 1867 and 1960. The state with the shortest record-long streak is Alaska, where no party has won more than three consecutive gubernatorial elections.

Of the 11 states holding gubernatorial elections this year, six parties have the potential to match or extend record winning streaks. Of those, three are all-time state record streaks for either party—for Republicans in Utah and Democrats in Washington and West Virginia.

To learn more about gubernatorial election winning streaks in all 50 states, click on the link below.

|

|

Michigan city councilwoman faces recall election

A city councilwoman in Jackson, Michigan—Kelsey Heck—will face a recall election May 5 after the Jackson County Elections Clerk's Office announced Jan. 21 that enough signatures were collected to force the recall. A total of 226 valid signatures were required to trigger the recall election and organizers submitted 320 signatures on Dec. 17, 2019.

Jackson resident Susan Murdie initiated the recall effort in July 2019. The stated reasons for the recall were Heck’s approval of a contract with the Michigan Department of Transportation and for voting in favor of an ordinance authorizing relocation assistance for displaced tenants.

Heck said the recall stems from her appointment to the council seat in September 2018. Murdie was also a candidate for the position. Heck said the city's charter should be changed to allow for special elections to fill vacancies on the city council.

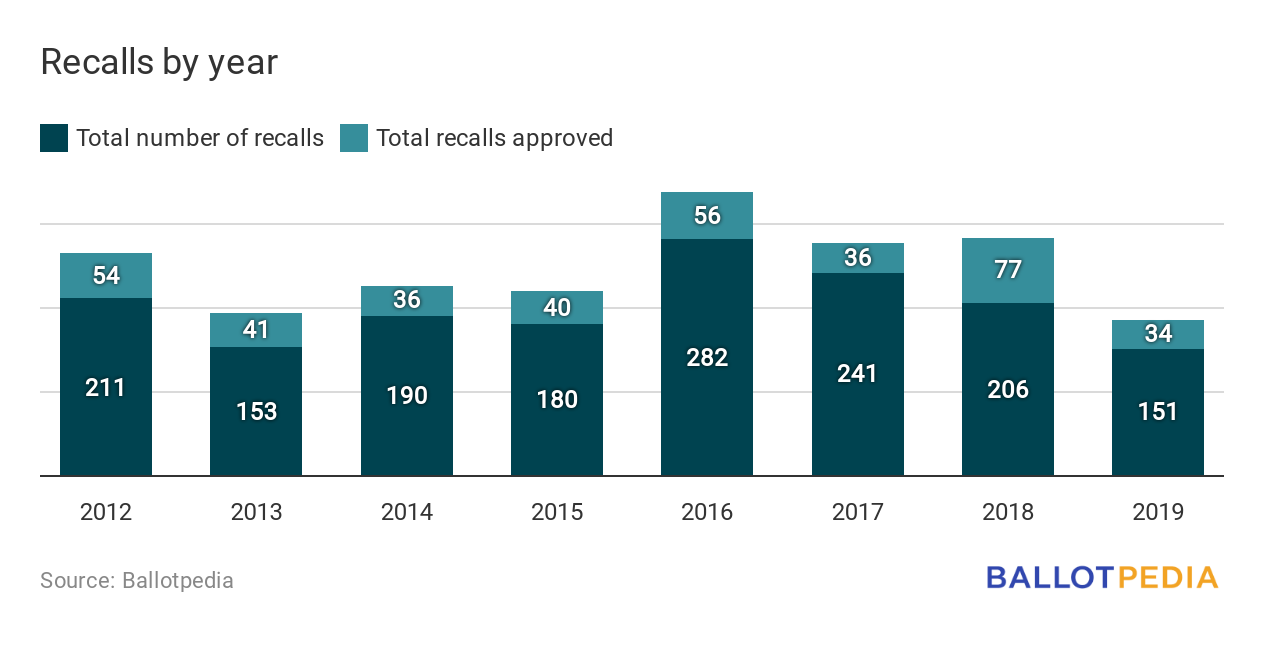

As detailed in our 2019 Recall Analysis, Ballotpedia covered 151 recall efforts against 230 elected officials last year. This represented a 27% decline compared to the 206 recall efforts that targeted 299 officials in 2018. In addition to fewer recalls overall, fewer elected officials were successfully removed from office. Of the 66 officials whose recalls reached the ballot, 34—or 52%—were recalled. In 2018 and 2017, 63 and 58 percent of recall efforts, respectively, were successful.

|

Utah legislature to repeal tax law after signatures submitted for veto referendum

We brought you the story last week about a group that said it filed more than 150,000 signatures with the Utah Secretary of State to place a veto referendum on the ballot regarding Utah Senate Bill 2001 (SB 2001), titled Tax Restructuring Revisions.

A veto referendum is a type of citizen-initiated ballot measure that asks voters whether to uphold or repeal a law passed by the state legislature. The number of signatures required to qualify a veto referendum for the ballot in Utah is 115,869.

On the day this item appeared in the Brew—Jan. 23—Utah Governor Gary Herbert (R), Senate President Stuart Adams (R), and House Speaker Brad R. Wilson (R) announced that the legislature would repeal SB 2001 during the first week of the new legislative session, rendering the veto referendum effort moot.

In a joint press release, Herbert, Adams, and Wilson said, “We applaud those who have engaged in the civic process and made their voices heard. We are not foes on a political battlefield, we are all Utahns committed to getting our tax policy right. That work is just beginning...Once the repeal is signed into law, the legislature will begin work under the reinstated tax code to prepare the fiscal year 2021 state budget. Repealing SB 2001 will enable the legislature to draft the budget without the uncertainty of a referendum potentially changing the tax code midway through the budget year.

Utah Director of Elections Justin Lee said county clerks will continue verifying signatures submitted for the veto referendum and that the state legislature is being asked to clarify what will happen if the tax reform bill is repealed and the referendum qualifies for the ballot.

Among other things, SB 2001 made the following tax-related changes:

- decrease the individual income tax rate;

- decrease the corporate franchise tax and corporate income tax rate;

- change how the personal exemption tax credit is calculated;

- create a nonrefundable tax credit for social security benefits;

- increase the sales tax on food and food ingredients;

- create a refundable grocery tax credit;

- create a sales tax exemption for menstrual products; and

- create a tax on gasoline (motor fuel) and special fuels, and add a new tax on diesel fuel.

SB 2001 passed the legislature in a special session on Dec. 12, 2019, and Herbert signed it into law on Dec. 18. The state House 43-27 in favor of the measure. The state Senate approved the final version, 19-7. No Democrats in either the House or Senate voted in favor of the bill. Thirteen GOP legislators voted against the bill.

|

|

Ballotpedia depends on the support of our readers.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

|

|

|

|

|