| From | American Energy Alliance <[email protected]> |

| Subject | Move along |

| Date | March 23, 2023 3:57 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Your Daily Energy News

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 03/23/2023

Subscribe Now ([link removed])

** President Biden vetoed legislation that would have prevented President Biden from sacrificing your 401(k) on the alter of climate. No wonder he went out of his way not to explain himself.

------------------------------------------------------------

Cowboy State Daily ([link removed]) (3/21/23) reports: "In the wake of a continued pressure to consider environmental impacts of financial investments, including President Joe Biden’s support of the practice, financial planners say people can take control of their own investment plans. As he promised, Biden vetoed a bipartisan bill that would’ve shot down a U.S. Department of Labor rule allowing consideration of progressive political values in retirement fund investing through environment, social and governance (ESG) ratings...Alex Stevens, manager of policy and communications for the Institute for Energy Research, told Cowboy State Daily that people can take the fight against ESG into their own hands regarding their own retirement savings. Since 2017, Stevens said, ESG funds have averaged an annual return about 2% less than the broader market. The lower performance of high-rated ESG funds should

concern people whose retirement savings depend on fund managers seeking the highest rate of return for their investments. 'It’s incumbent on people to talk with the institutions that handle their retirement funds. They can express their concerns about ESG, and they can make it clear to the people that are handling their money that they want them to focus on maximizing returns and not on politics,' Stevens said. Stevens said that large institutions might not respond to a single person’s concerns, but if enough people voice their opposition to mixing politics and investing, managers will start to get the message."

[link removed]

** "One might think that the current obsession with identity politics and racial disparities knows no bounds. But California’s climate champions show no hesitation in embracing regulatory mandates that even they admit will affect working-class and racial-minority households disproportionately."

------------------------------------------------------------

– Jennifer Hernandez, The Breakthrough Institute ([link removed])

============================================================

Is Biden really going to side with the Chinese and against domestic miners, AGAIN?

** Bloomberg ([link removed])

(3/22/23) reports: "The interpretation of a few words of regulation by the US Treasury Department could upend expectations for how tens of billions of dollars in new electric-vehicle tax incentives will be distributed, according to Bloomberg discussions with a dozen manufacturing executives, battery analysts and government officials. At stake over the coming weeks is the extent to which a critical part of the battery supply chain will end up being made in North America or remain where it’s currently concentrated, in Asia. 'There are specific factories — and there are thousands of jobs tied to those — that are hanging in the balance,' said J.B. Straubel, the founder of battery materials maker Redwood Materials Inc. and a co-founder of Tesla. By the end of the month, Treasury is expected to issue guidance for tens of billions of dollars in EV incentives over the next decade. One of the most consequential parts involves complex rules for where the most valuable battery materials must be made

in order to qualify for the $7,500 EV subsidy in the 2022 Inflation Reduction Act. A white paper released by the department on Dec. 29 described its intentions for the forthcoming guidance. It would treat anode and cathode active materials as processed critical minerals rather than as battery components, as they are categorized in another section of the text of the IRA itself. That change would widely expand the countries where the materials can be sourced under the law."

A war on natural gas is a war on American families.

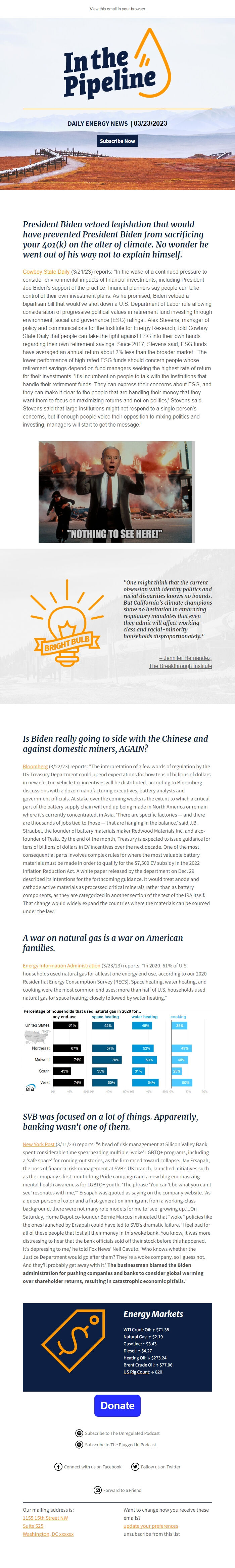

** Energy Information Administration ([link removed])

(3/23/23) reports: "In 2020, 61% of U.S. households used natural gas for at least one energy end use, according to our 2020 Residential Energy Consumption Survey (RECS). Space heating, water heating, and cooking were the most common end uses; more than half of U.S. households used natural gas for space heating, closely followed by water heating."

** ([link removed])

SVB was focused on a lot of things. Apparently, banking wasn't one of them.

** New York Post ([link removed])

(3/11/23) reports: "A head of risk management at Silicon Valley Bank spent considerable time spearheading multiple 'woke' LGBTQ+ programs, including a 'safe space' for coming-out stories, as the firm raced toward collapse. Jay Ersapah, the boss of financial risk management at SVB’s UK branch, launched initiatives such as the company’s first month-long Pride campaign and a new blog emphasizing mental health awareness for LGBTQ+ youth. 'The phrase ‘You can’t be what you can’t see’ resonates with me,’" Ersapah was quoted as saying on the company website. 'As a queer person of color and a first-generation immigrant from a working-class background, there were not many role models for me to ‘see’ growing up.'...On Saturday, Home Depot co-founder Bernie Marcus insinuated that “woke” policies like the ones launched by Ersapah could have led to SVB’s dramatic failure. 'I feel bad for all of these people that lost all their money in this woke bank. You know, it was more distressing to hear that

the bank officials sold off their stock before this happened. It’s depressing to me,' he told Fox News’ Neil Cavuto. 'Who knows whether the Justice Department would go after them? They’re a woke company, so I guess not. And they’ll probably get away with it.' The businessman blamed the Biden administration for pushing companies and banks to consider global warming over shareholder returns, resulting in catastrophic economic pitfalls."

Energy Markets

WTI Crude Oil: ↑ $71.38

Natural Gas: ↑ $2.19

Gasoline: ~ $3.43

Diesel: ↑ $4.27

Heating Oil: ↓ $273.24

Brent Crude Oil: ↑ $77.06

** US Rig Count ([link removed])

: ↓ 820

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 03/23/2023

Subscribe Now ([link removed])

** President Biden vetoed legislation that would have prevented President Biden from sacrificing your 401(k) on the alter of climate. No wonder he went out of his way not to explain himself.

------------------------------------------------------------

Cowboy State Daily ([link removed]) (3/21/23) reports: "In the wake of a continued pressure to consider environmental impacts of financial investments, including President Joe Biden’s support of the practice, financial planners say people can take control of their own investment plans. As he promised, Biden vetoed a bipartisan bill that would’ve shot down a U.S. Department of Labor rule allowing consideration of progressive political values in retirement fund investing through environment, social and governance (ESG) ratings...Alex Stevens, manager of policy and communications for the Institute for Energy Research, told Cowboy State Daily that people can take the fight against ESG into their own hands regarding their own retirement savings. Since 2017, Stevens said, ESG funds have averaged an annual return about 2% less than the broader market. The lower performance of high-rated ESG funds should

concern people whose retirement savings depend on fund managers seeking the highest rate of return for their investments. 'It’s incumbent on people to talk with the institutions that handle their retirement funds. They can express their concerns about ESG, and they can make it clear to the people that are handling their money that they want them to focus on maximizing returns and not on politics,' Stevens said. Stevens said that large institutions might not respond to a single person’s concerns, but if enough people voice their opposition to mixing politics and investing, managers will start to get the message."

[link removed]

** "One might think that the current obsession with identity politics and racial disparities knows no bounds. But California’s climate champions show no hesitation in embracing regulatory mandates that even they admit will affect working-class and racial-minority households disproportionately."

------------------------------------------------------------

– Jennifer Hernandez, The Breakthrough Institute ([link removed])

============================================================

Is Biden really going to side with the Chinese and against domestic miners, AGAIN?

** Bloomberg ([link removed])

(3/22/23) reports: "The interpretation of a few words of regulation by the US Treasury Department could upend expectations for how tens of billions of dollars in new electric-vehicle tax incentives will be distributed, according to Bloomberg discussions with a dozen manufacturing executives, battery analysts and government officials. At stake over the coming weeks is the extent to which a critical part of the battery supply chain will end up being made in North America or remain where it’s currently concentrated, in Asia. 'There are specific factories — and there are thousands of jobs tied to those — that are hanging in the balance,' said J.B. Straubel, the founder of battery materials maker Redwood Materials Inc. and a co-founder of Tesla. By the end of the month, Treasury is expected to issue guidance for tens of billions of dollars in EV incentives over the next decade. One of the most consequential parts involves complex rules for where the most valuable battery materials must be made

in order to qualify for the $7,500 EV subsidy in the 2022 Inflation Reduction Act. A white paper released by the department on Dec. 29 described its intentions for the forthcoming guidance. It would treat anode and cathode active materials as processed critical minerals rather than as battery components, as they are categorized in another section of the text of the IRA itself. That change would widely expand the countries where the materials can be sourced under the law."

A war on natural gas is a war on American families.

** Energy Information Administration ([link removed])

(3/23/23) reports: "In 2020, 61% of U.S. households used natural gas for at least one energy end use, according to our 2020 Residential Energy Consumption Survey (RECS). Space heating, water heating, and cooking were the most common end uses; more than half of U.S. households used natural gas for space heating, closely followed by water heating."

** ([link removed])

SVB was focused on a lot of things. Apparently, banking wasn't one of them.

** New York Post ([link removed])

(3/11/23) reports: "A head of risk management at Silicon Valley Bank spent considerable time spearheading multiple 'woke' LGBTQ+ programs, including a 'safe space' for coming-out stories, as the firm raced toward collapse. Jay Ersapah, the boss of financial risk management at SVB’s UK branch, launched initiatives such as the company’s first month-long Pride campaign and a new blog emphasizing mental health awareness for LGBTQ+ youth. 'The phrase ‘You can’t be what you can’t see’ resonates with me,’" Ersapah was quoted as saying on the company website. 'As a queer person of color and a first-generation immigrant from a working-class background, there were not many role models for me to ‘see’ growing up.'...On Saturday, Home Depot co-founder Bernie Marcus insinuated that “woke” policies like the ones launched by Ersapah could have led to SVB’s dramatic failure. 'I feel bad for all of these people that lost all their money in this woke bank. You know, it was more distressing to hear that

the bank officials sold off their stock before this happened. It’s depressing to me,' he told Fox News’ Neil Cavuto. 'Who knows whether the Justice Department would go after them? They’re a woke company, so I guess not. And they’ll probably get away with it.' The businessman blamed the Biden administration for pushing companies and banks to consider global warming over shareholder returns, resulting in catastrophic economic pitfalls."

Energy Markets

WTI Crude Oil: ↑ $71.38

Natural Gas: ↑ $2.19

Gasoline: ~ $3.43

Diesel: ↑ $4.27

Heating Oil: ↓ $273.24

Brent Crude Oil: ↑ $77.06

** US Rig Count ([link removed])

: ↓ 820

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp