|

|

|

|

Welcome to The Disclosure Digest, a weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

Three states consider bills barring public agencies from requiring donor information from 501(c)s

Iowa, Oklahoma, and Tennessee are considering legislation that would bar public agencies from requiring 501(c) nonprofit entities to provide them with personal information about their donors.

The bills share identical definitions of "public agencies" and "personal information." They also assign the same penalties for noncompliance.

- "Public agency" definition: any state or local governmental entity.

- "Personal information" definition: any "list, record, register, registry, roll, roster, or other compilation of data that directly or indirectly identifies a person as a member, supporter, or volunteer of, or donor of financial or nonfinancial support to, any entity which is exempt from taxation under section 501(c) of the federal Internal Revenue Code."

- Penalties for noncompliance: A maximum $1,000 fine, imprisonment for up to 90 days, or both for knowing violations.

What is the political context?

All three states are Republican trifectas, meaning Republicans in each state hold the governorship and majorities in both legislative chambers. Detailed information on legislative status is provided below.

- Iowa HF697 was introduced March 11, 2019. Its floor manager in the House is Rep. Steven Holt (R), chair of the House Judiciary Committee. The bill was set to be considered at a House Judiciary Committee hearing scheduled for Jan. 22.

- Oklahoma SB1491 is slated to be introduced Sen. Julie Daniels (R), chair of the Senate Judiciary Committee, on Feb. 3, 2020.

- Tennessee HB1719 was introduced by Reps. Ryan Williams (R) and Scott Cepicky (R) on Jan. 22, 2020.

Have other states considered similar legislation? What were the reactions?

Michigan lawmakers approved a similar bill, SB1176, in 2018. Governor Rick Snyder (R) vetoed it.

- In an op-ed for The Detroit News, Sean Parnell, vice-president of public policy for the Philanthropy Roundtable, wrote:

|

“

|

Michiganians are no stranger to anonymous giving, whether it’s the tens of millions of dollars given to support the Kalamazoo Promise or the numerous small anonymous gifts made through sites like GoFundMe.com. The Personal Privacy Protection Act ensures these and countless other acts of kindness can remain private if the giver wishes, while doing nothing to undermine Michigan’s laws regarding disclosure of campaign donations or punishing fraud by nonprofits. If Michigan wants to continue to

encourage philanthropic giving, passage of this bill should be a priority.

|

”

|

- Opposing the bill, the Campaign Legal Center's Erin Cholpak wrote,

|

“

|

While other states have been working to close loopholes that have allowed the increasing role of dark money in election campaigns, SB 1176 would codify those loopholes as enforceable law in Michigan. … And even if SB 1176 ultimately exempts campaign finance disclosure requirements from its broad disclosure ban, the bill will still make it easier for Michigan lawmakers to hide any conflicts of interest and could facilitate a rise of pay-to-play politics by shielding such arrangements from public

scrutiny.

|

”

|

|

The big picture

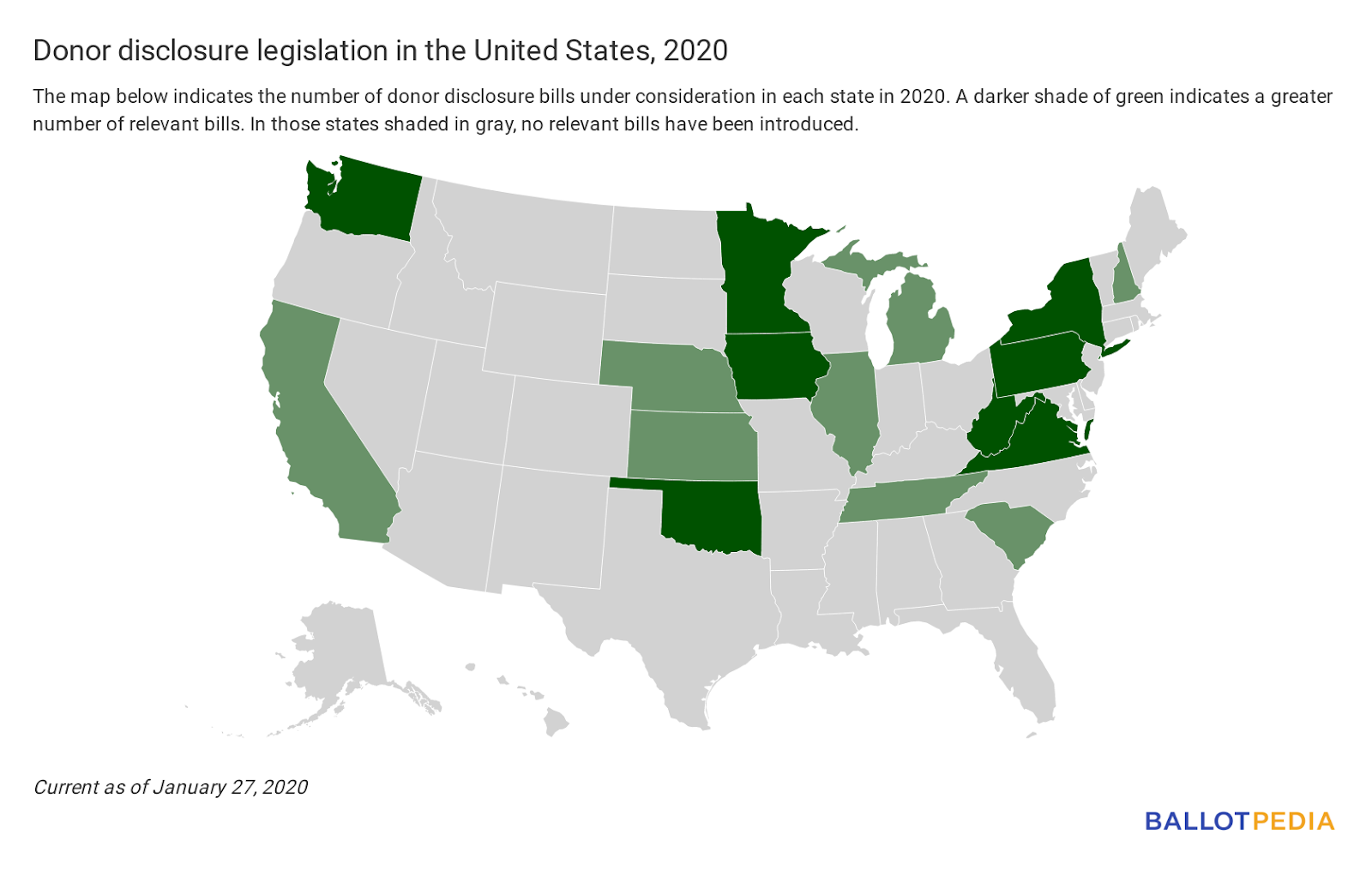

Number of relevant bills by state

We're currently tracking 37 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here for a complete list of all the bills we're tracking.

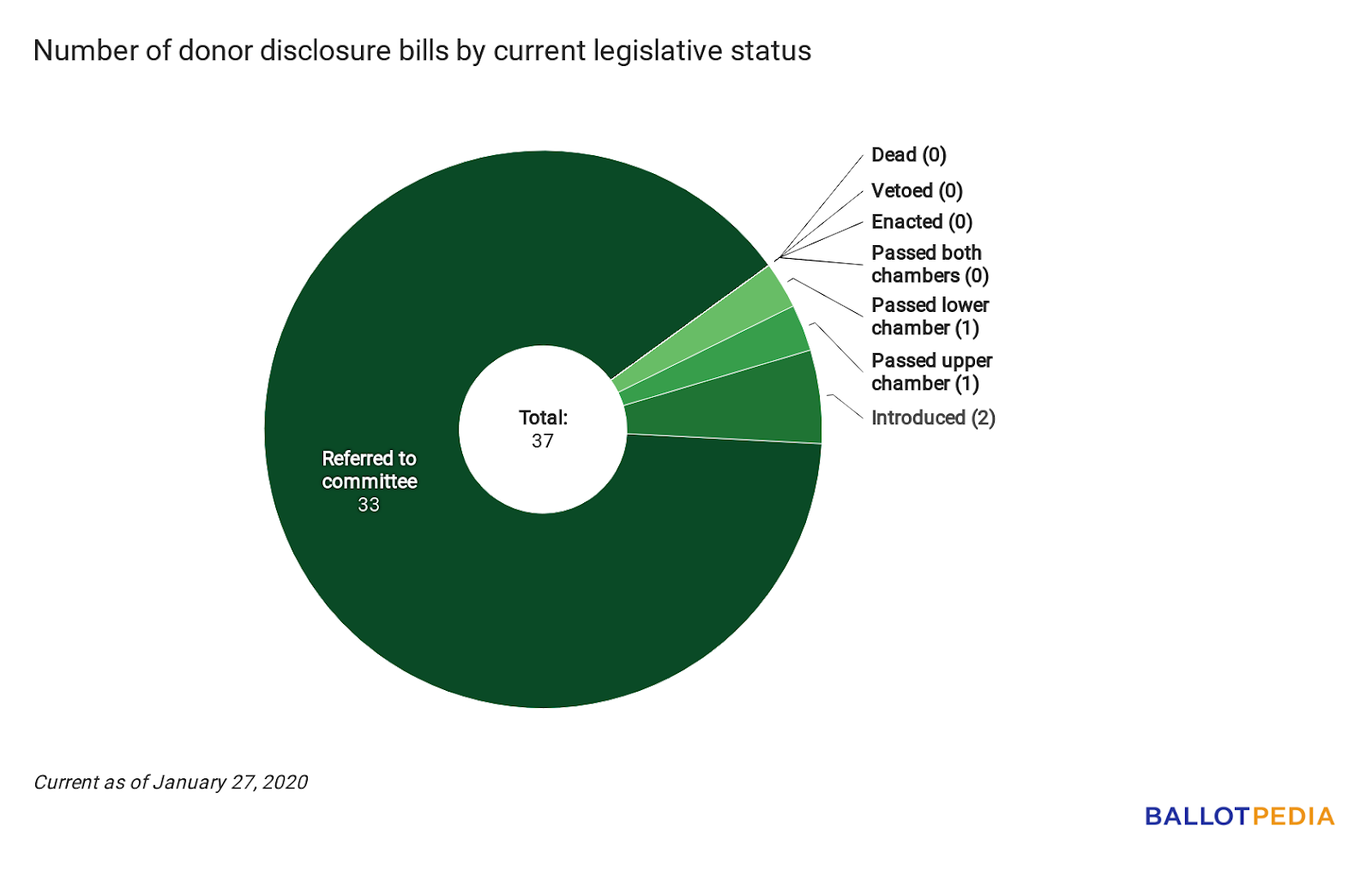

Number of relevant bills by current legislative status

Number of relevant bills by partisan status of sponsor(s)

|

Recent legislative actions

Below is a complete list of legislative actions taken on relevant bills in the past week. Bills are listed in alphabetical order, first by state then by bill number.

- Iowa HF697: This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

- House Judiciary Committee hearing Jan. 22.

- Oklahoma SB1491: This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

- Pre-filed for introduction Feb. 3.

- Tennessee HB1719: This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

- Virginia HB849: This bill would subject political campaign communications made via online platforms to the same disclosure requirements currently applied to print media, television, and radio advertisements.

- Approved by House Privileges and Elections Committee Jan. 24.

- Virginia SB979: This bill extends the applicability of the state's campaign finance disclosure act to candidates for directors or soil and water conservation districts.

- Engrossed by Senate Jan. 24.

- West Virginia SB581: This bill expands disclosure requirements for covered transfers, which are defined as any transfers or payments of funds made by one person to another for campaign-related disbursements (i.e., independent expenditures consisting of public or electioneering communications).

- Introduced and referred to Senate Judiciary Committee Jan. 22.

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations. |

|

|

|

|