| From | Fraser Institute <[email protected]> |

| Subject | The Federal fiscal anchor, and Cost of business subsidies |

| Date | March 18, 2023 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Latest Research 30 per cent chance Ottawa fails to meet its fiscal goal over 10-year period; likelihood of failure jumps to 53 per cent over 20 years [[link removed]]

Stress Testing the Federal Fiscal Anchor finds that that there is a 30 per cent chance that the federal debt to GDP ratio will increase over a 10-year time period, meaning the federal government would fail to achieve its core fiscal goal.

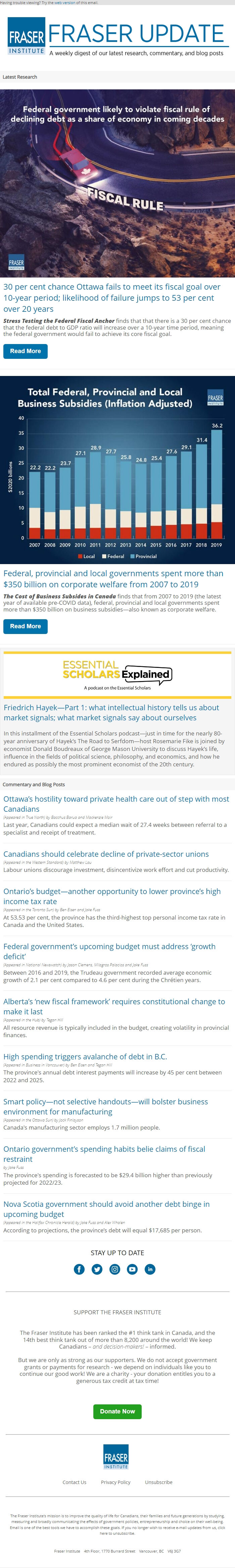

Read More [[link removed]] Federal, provincial and local governments spent more than $350 billion on corporate welfare from 2007 to 2019 [[link removed]]

The Cost of Business Subsides in Canada finds that from 2007 to 2019 (the latest year of available pre-COVID data), federal, provincial and local governments spent more than $350 billion on business subsidies—also known as corporate welfare.

Read More [[link removed]] Friedrich Hayek—Part 1: what intellectual history tells us about market signals; what market signals say about ourselves [[link removed]]

In this installment of the Essential Scholars podcast—just in time for the nearly 80-year anniversary of Hayek’s The Road to Serfdom—host Rosemarie Fike is joined by economist Donald Boudreaux of George Mason University to discuss Hayek’s life, influence in the fields of political science, philosophy, and economics, and how he endured as possibly the most prominent economist of the 20th century.

Commentary and Blog Posts Ottawa’s hostility toward private health care out of step with most Canadians [[link removed]] (Appeared in True North) by Bacchus Barua and Mackenzie Moir

Last year, Canadians could expect a median wait of 27.4 weeks between referral to a specialist and receipt of treatment.

Canadians should celebrate decline of private-sector unions [[link removed]] (Appeared in the Western Standard) by Matthew Lau

Labour unions discourage investment, disincentivize work effort and cut productivity.

Ontario’s budget—another opportunity to lower province’s high income tax rate [[link removed]] (Appeared in the Toronto Sun) by Ben Eisen and Jake Fuss

At 53.53 per cent, the province has the third-highest top personal income tax rate in Canada and the United States.

Federal government’s upcoming budget must address ‘growth deficit’ [[link removed]] (Appeared in National Newswatch) by Jason Clemens, Milagros Palacios and Jake Fuss

Between 2016 and 2019, the Trudeau government recorded average economic growth of 2.1 per cent compared to 4.6 per cent during the Chrétien years.

Alberta’s ‘new fiscal framework’ requires constitutional change to make it last [[link removed]] (Appeared in the Hub) by Tegan Hill

All resource revenue is typically included in the budget, creating volatility in provincial finances.

High spending triggers avalanche of debt in B.C. [[link removed]] (Appeared in Business in Vancouver) by Ben Eisen and Tegan Hill

The province's annual debt interest payments will increase by 45 per cent between 2022 and 2025.

Smart policy—not selective handouts—will bolster business environment for manufacturing [[link removed]] (Appeared in the Ottawa Sun) by Jock Finlayson

Canada's manufacturing sector employs 1.7 million people.

Ontario government’s spending habits belie claims of fiscal restraint [[link removed]] by Jake Fuss

The province's spending is forecasted to be $29.4 billion higher than previously projected for 2022/23.

Nova Scotia government should avoid another debt binge in upcoming budget [[link removed]] (Appeared in the Halifax Chronicle Herald) by Jake Fuss and Alex Whalen

According to projections, the province’s debt will equal $17,685 per person.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Stress Testing the Federal Fiscal Anchor finds that that there is a 30 per cent chance that the federal debt to GDP ratio will increase over a 10-year time period, meaning the federal government would fail to achieve its core fiscal goal.

Read More [[link removed]] Federal, provincial and local governments spent more than $350 billion on corporate welfare from 2007 to 2019 [[link removed]]

The Cost of Business Subsides in Canada finds that from 2007 to 2019 (the latest year of available pre-COVID data), federal, provincial and local governments spent more than $350 billion on business subsidies—also known as corporate welfare.

Read More [[link removed]] Friedrich Hayek—Part 1: what intellectual history tells us about market signals; what market signals say about ourselves [[link removed]]

In this installment of the Essential Scholars podcast—just in time for the nearly 80-year anniversary of Hayek’s The Road to Serfdom—host Rosemarie Fike is joined by economist Donald Boudreaux of George Mason University to discuss Hayek’s life, influence in the fields of political science, philosophy, and economics, and how he endured as possibly the most prominent economist of the 20th century.

Commentary and Blog Posts Ottawa’s hostility toward private health care out of step with most Canadians [[link removed]] (Appeared in True North) by Bacchus Barua and Mackenzie Moir

Last year, Canadians could expect a median wait of 27.4 weeks between referral to a specialist and receipt of treatment.

Canadians should celebrate decline of private-sector unions [[link removed]] (Appeared in the Western Standard) by Matthew Lau

Labour unions discourage investment, disincentivize work effort and cut productivity.

Ontario’s budget—another opportunity to lower province’s high income tax rate [[link removed]] (Appeared in the Toronto Sun) by Ben Eisen and Jake Fuss

At 53.53 per cent, the province has the third-highest top personal income tax rate in Canada and the United States.

Federal government’s upcoming budget must address ‘growth deficit’ [[link removed]] (Appeared in National Newswatch) by Jason Clemens, Milagros Palacios and Jake Fuss

Between 2016 and 2019, the Trudeau government recorded average economic growth of 2.1 per cent compared to 4.6 per cent during the Chrétien years.

Alberta’s ‘new fiscal framework’ requires constitutional change to make it last [[link removed]] (Appeared in the Hub) by Tegan Hill

All resource revenue is typically included in the budget, creating volatility in provincial finances.

High spending triggers avalanche of debt in B.C. [[link removed]] (Appeared in Business in Vancouver) by Ben Eisen and Tegan Hill

The province's annual debt interest payments will increase by 45 per cent between 2022 and 2025.

Smart policy—not selective handouts—will bolster business environment for manufacturing [[link removed]] (Appeared in the Ottawa Sun) by Jock Finlayson

Canada's manufacturing sector employs 1.7 million people.

Ontario government’s spending habits belie claims of fiscal restraint [[link removed]] by Jake Fuss

The province's spending is forecasted to be $29.4 billion higher than previously projected for 2022/23.

Nova Scotia government should avoid another debt binge in upcoming budget [[link removed]] (Appeared in the Halifax Chronicle Herald) by Jake Fuss and Alex Whalen

According to projections, the province’s debt will equal $17,685 per person.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor