March 14, 2023

Permission to republish original opeds and cartoons granted.

Inflation still elevated at 6.0 percent past year as the Fed eyes more interest rate hikes to tame inflation, but can the banks take it?

By Robert Romano

Consumer inflation the past 12 months has increased 6.0 percent, down from 6.4 percent a month ago—a 0.8 percent increase from Feb. 2022 just fell off the 12-month chart reading—according to the latest data compiled by the Bureau of Labor Statistics as the Federal Reserve continues to eye further rate hikes in order to tame what has been persistent inflation.

A 2 percent decrease in gasoline and a 13.6 percent decrease in used cars and trucks was offset by a 9.2 percent increase in fuel oil and a 5.8 percent increase in new vehicles.

There was a whopping 12.9 percent increase in electricity and a 14.3 percent increase in utility (piped) gas service, indicating continued high demand for energy services.

There was a 9.5 percent increase in food.

Plus, an 8.1 percent increase in shelter.

And a 14.6 percent increase in transportation services.

Plus, a 3.3 percent increase in apparel, a 3.2 percent increase in medical care commodities and a 2.1 percent increase in medical care services.

Now all eyes are on the Federal Reserve as it eyes further increases in interest rates, a controversial stance now with the regional bank failures of Silicon Valley Bank in California—which was upside down on some of its treasuries holdings after buying bonds at a much lower rate—and also Signature Bank in New York, which had allowed for cryptocurrency deposits.

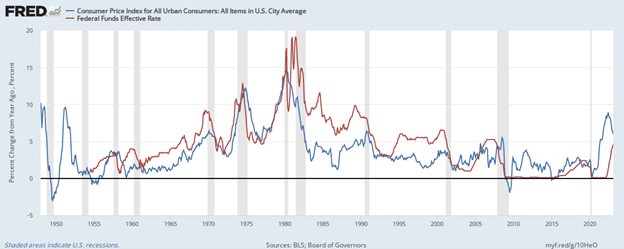

When the Fed last met at its Feb. 1 meeting it kept hiking the Federal Funds Rate to 4.5 to 4.75 percent as the central bank stated it “anticipates that ongoing increases in the target range” could be necessary going forward.

According to the central bank’s statement, “the Committee decided to raise the target range for the federal funds rate to 4-1/2 to 4-3/4 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

Markets are now pricing in an expected 0.25 percent increase in the Federal Funds Rate—the rate the Fed lends to other banks—at the Fed’s upcoming meeting next week. So far, the Fed seems to be staying the course, and after taking emergency measures to guarantee more than $1 trillion of uninsured deposits out of the $20.8 trillion deposits nationwide, a key question could be whether there is still enough confidence in banks going forward. Bank failures are a key recession warning signal.

By increasing interest rates on banks, who in turn pass on the costs to borrowers via higher consumer interest rates, the excess money supply from Covid spending is now slowly being destroyed. More than $6 trillion was spent, borrowed and printed in response to the economic lockdowns, production halts and the temporary spike in unemployment as 25 million Americans temporarily lost their jobs.

The M2 money supply increased dramatically from $15.3 trillion in Feb. 2020 to a peak of $22 trillion by April 2022, a massive 43.7 percent, leading to the inflation spike, where consumer inflation reached 9.1 percent in June 2022. By the time Russia invaded Ukraine in Feb. 2022—further worsening global supply issues—consumer inflation was already north of 7.5 percent. The M2 money supply has now decreased a bit to $21.1 trillion.

Inflation and rising interest rates—we have both right now—are often the catalyst for the economy overheating, as consumers max out on their credit and then stop spending to service that debt. The annual growth of consumer credit appears to have peaked at 8.1 percent in Oct. 2022, flattening slightly to 7.8 percent annualized by Dec. 2022 and then ticked up to 7.9 percent Jan. 2023.

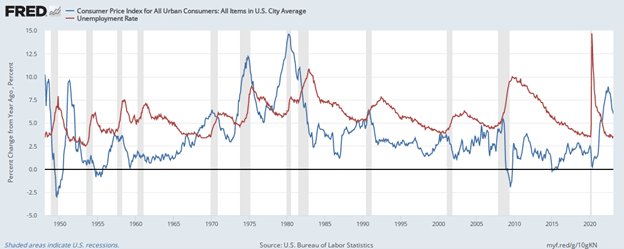

In recessions, peak inflation and employment is usually followed by a drop in overall inflation and a subsequent increase in the unemployment rate, with the process averaging about 15 months in the postwar period and a range as few as 3 months to as many as 39 months, according to Bureau of Labor Statistics data.

In recent history, since 2000, the Fed has tended to keep interest rates below that of the consumer inflation rate — not dissimilar to the 1970s — only hiking interest rates until they get above the consumer inflation rate, whereas from 1980 to 2000, it tended to keep interest rates above inflation to tame the Great Inflation of the 1970s and 1980s.

It's the classic dilemma for the Fed. If the central bank were to pause rate hikes or start decreasing rates in response to the stress on regional banks, for example, inflation might kick up again as easy money once again flows back into the system. In the 1970s, inflation kept spiraling upwards because the Fed was unwilling to experience pain, and in the process, the economy would overheat and we’d get recessions and increases in unemployment all the same. The lesson was to tame inflation to begin with.

Meaning, with all red lights flashing in the economy anyway, a recession is highly likely in the current scenario, and yet the Fed still has not taken the Federal Funds Rate above that of the consumer inflation rate. Now with inflation down to 6 percent for the past year, getting to that level is within striking distance.

The choices appear to be higher rates now, followed by more unemployment, or even higher inflation later, necessitating even higher rates and potentially even higher unemployment later. A recession is already baked into the cake. Choose your poison.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Cartoon: Toxic Insanity

By A.F. Branco

Click here for a higher level resolution version.

To view online: https://dailytorch.com/2023/03/cartoon-toxic-insanity/

Video: BAILOUT: Did The Fed Just Guarantee $1 TRILLION In Uninsured Deposits? Silicon Valley Bank FALLOUT!

To view online: https://www.youtube.com/watch?v=qjVs7zqZ2I0

Is the $230 billion Silicon Valley and Signature bank takeovers by FDIC crashing regional banks?

March 13, 2023, Fairfax, Va.—Americans for Limited Government President Rick Manning today issued the following statement in response to President Joe Biden, U.S. Treasury, the Federal Reserve and the FDIC’s decision to bail out uninsured depositors in Silicon Valley Bank and Signature Bank and put the banks into FDIC receivership to the tune of $230 billion:

“The failure of SVB Bank and Signature Bank and their announced $230 billion bailout by the U.S. Treasury, Federal Reserve and FDIC should alert Congress to a power they ceded to the executive branch in the 2010 Dodd-Frank legislation. Under the law, Congress will not be asked to appropriate a single dollar and yet the $230 billion bailout’s costs will be paid by additional fees and higher interest rates on loans and credit cards on the American people.

“The scary and yet untold part of this story is that SVB Bank and Signature Bank are just a potential tip of the $20.8 trillion total deposit iceberg, including $1 trillion of uninsured deposits, that the federal government has implicitly just guaranteed in full in a bid to shore up the banking system. In fact, the easiest outcome to predict was that the share prices of small and regional banks would be pummeled—and they are now—as investors and depositors flee from otherwise solvent smaller banks.

“What’s the incentive to hold a stock of a regional bank that might be put into receivership? The decision by Treasury and the Fed put the two regional banks into receivership, under the law, and shareholders got nothing, making the investment in small banks much riskier. Meaning, you can sell your shares today in a regional bank, and get some percent of your investment, or wait for your receivership tomorrow, and you get nothing.

“Once again, this massive liability has been assumed without a current vote in Congress, based on the very predictable outcome of Congress writing itself out of the bank bailout process through creation of the authority for the executive branch to declare almost anything in the U.S. economy systemically risky. The possible good news is that Congress may now revisit Dodd-Frank in order to avert what could become a vicious cycle of ‘fail and bail.’

“Under the current law, with assessments on financial institutions with $50 billion or more of assets being the funding source, in addition to the Fed, the $230 billion bailout shockingly accounts for just 1.1 percent of all the $20.8 trillion deposits nationwide, including $1 trillion of uninsured deposits. These new assessments will put the country’s biggest banks under additional stress, with the potential of the weakest failing, creating a potential avalanche of future bank defaults. The Fed is immediately using a new credit window to deal with this problem, and no matter what happens, more than 95 percent of deposits appear to be guaranteed, but that’s also a part of the problem. Congress needs to reevaluate Dodd-Frank and investigate how SVB Bank and Signature Bank became underwater in the first place, so that an examination of any policies that might have contributed to the problem, including mandatory purchases of U.S. treasuries, played a role.”

To view online: https://getliberty.org/2023/03/is-the-230-billion-silicon-valley-and-signature-bank-takeovers-by-fdic-crashing-regional-banks/