| From | Fraser Institute <[email protected]> |

| Subject | Understanding health care, and Upper-income taxes |

| Date | January 25, 2020 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

==============

FRASER UPDATE

==============

A weekly digest of our latest research, commentary and blog posts.

-----------------

Latest Research Jan 20-26, 2020

-----------------

Canada remains only high-income universal health-care country to eschew private medical insurance

Understanding Universal Health Care Reform Options: Private Insurance finds that among 17 high-income countries with universal health care—including Australia, Germany, Switzerland and the Netherlands—all of them use private health insurance in some capacity to pay for medically necessary health-care costs, except Canada. Crucially, among those countries with comparable data, Canada has the longest wait times for medical necessary treatment.

Read More ([link removed])

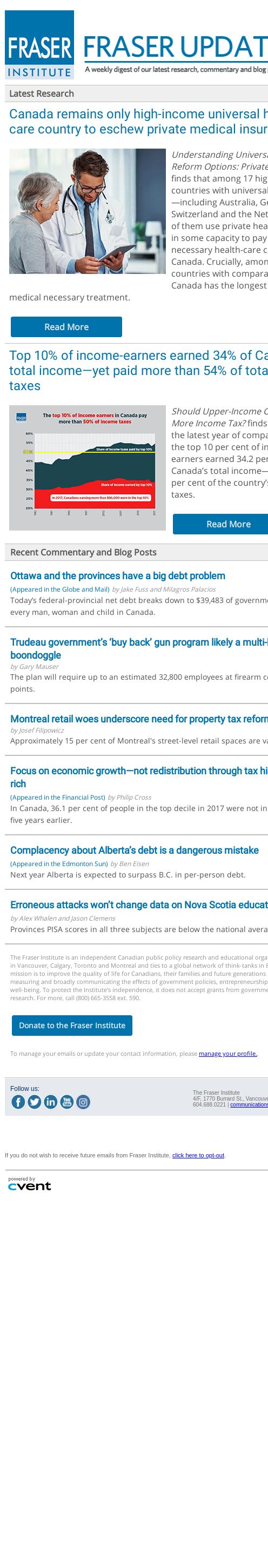

Top 10% of income-earners earned 34% of Canada’s total income—yet paid more than 54% of total income taxes

Should Upper-Income Canadians Pay More Income Tax? finds that in 2017, the latest year of comparable data, the top 10 per cent of income-earners earned 34.2 per cent of Canada’s total income—yet paid 54.6 per cent of the country’s total income taxes.

Read More ([link removed])

Recent Commentary and Blog Posts

-----------------

Ottawa and the provinces have a big debt problem ([link removed])

(Appeared in the Globe and Mail) by Jake Fuss and Milagros Palacios.

Today’s federal-provincial net debt breaks down to $39,483 of government debt for every man, woman and child in Canada.

Trudeau government’s ‘buy back’ gun program likely a multi-billion boondoggle ([link removed])

by Gary Mauser.

The plan will require up to an estimated 32,800 employees at firearm collection points.

Montreal retail woes underscore need for property tax reform ([link removed])

by Josef Filipowicz.

Approximately 15 per cent of Montreal's street-level retail spaces are vacant.

Focus on economic growth—not redistribution through tax hikes on the rich ([link removed])

(Appeared in the Financial Post) by Philip Cross.

In Canada, 36.1 per cent of people in the top decile in 2017 were not in the top decile five years earlier.

Complacency about Alberta’s debt is a dangerous mistake ([link removed])

(Appeared in the Edmonton Sun) by Ben Eisen.

Next year Alberta is expected to surpass B.C. in per-person debt.

Erroneous attacks won’t change data on Nova Scotia education ([link removed])

by Alex Whalen and Jason Clemens.

Provinces PISA scores in all three subjects are below the national average.

The Fraser Institute is an independent Canadian public policy research and educational organization with offices in Vancouver, Calgary, Toronto and Montreal and ties to a global network of think-tanks in 87 countries. Its mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. To protect the Institute's independence, it does not accept grants from governments or contracts for research. For more, call (800) 665-3558 ext. 590.

Donate to the Fraser Institute ([link removed])

To manage your emails or update your contact information, please [link removed] (manage your profile.).

The Fraser Institute

4/F, 1770 Burrard St., Vancouver BC V6J 3G7 Canada

604.688.0221 | [email protected]

If you do not wish to receive future emails from Fraser Institute, go to:

[link removed] (click here to opt-out)

Powered by Cvent

FRASER UPDATE

==============

A weekly digest of our latest research, commentary and blog posts.

-----------------

Latest Research Jan 20-26, 2020

-----------------

Canada remains only high-income universal health-care country to eschew private medical insurance

Understanding Universal Health Care Reform Options: Private Insurance finds that among 17 high-income countries with universal health care—including Australia, Germany, Switzerland and the Netherlands—all of them use private health insurance in some capacity to pay for medically necessary health-care costs, except Canada. Crucially, among those countries with comparable data, Canada has the longest wait times for medical necessary treatment.

Read More ([link removed])

Top 10% of income-earners earned 34% of Canada’s total income—yet paid more than 54% of total income taxes

Should Upper-Income Canadians Pay More Income Tax? finds that in 2017, the latest year of comparable data, the top 10 per cent of income-earners earned 34.2 per cent of Canada’s total income—yet paid 54.6 per cent of the country’s total income taxes.

Read More ([link removed])

Recent Commentary and Blog Posts

-----------------

Ottawa and the provinces have a big debt problem ([link removed])

(Appeared in the Globe and Mail) by Jake Fuss and Milagros Palacios.

Today’s federal-provincial net debt breaks down to $39,483 of government debt for every man, woman and child in Canada.

Trudeau government’s ‘buy back’ gun program likely a multi-billion boondoggle ([link removed])

by Gary Mauser.

The plan will require up to an estimated 32,800 employees at firearm collection points.

Montreal retail woes underscore need for property tax reform ([link removed])

by Josef Filipowicz.

Approximately 15 per cent of Montreal's street-level retail spaces are vacant.

Focus on economic growth—not redistribution through tax hikes on the rich ([link removed])

(Appeared in the Financial Post) by Philip Cross.

In Canada, 36.1 per cent of people in the top decile in 2017 were not in the top decile five years earlier.

Complacency about Alberta’s debt is a dangerous mistake ([link removed])

(Appeared in the Edmonton Sun) by Ben Eisen.

Next year Alberta is expected to surpass B.C. in per-person debt.

Erroneous attacks won’t change data on Nova Scotia education ([link removed])

by Alex Whalen and Jason Clemens.

Provinces PISA scores in all three subjects are below the national average.

The Fraser Institute is an independent Canadian public policy research and educational organization with offices in Vancouver, Calgary, Toronto and Montreal and ties to a global network of think-tanks in 87 countries. Its mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. To protect the Institute's independence, it does not accept grants from governments or contracts for research. For more, call (800) 665-3558 ext. 590.

Donate to the Fraser Institute ([link removed])

To manage your emails or update your contact information, please [link removed] (manage your profile.).

The Fraser Institute

4/F, 1770 Burrard St., Vancouver BC V6J 3G7 Canada

604.688.0221 | [email protected]

If you do not wish to receive future emails from Fraser Institute, go to:

[link removed] (click here to opt-out)

Powered by Cvent

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a