Email

Gov. Justice signs largest tax cut in West Virginia history into law

| From | Governor Jim Justice <[email protected]> |

| Subject | Gov. Justice signs largest tax cut in West Virginia history into law |

| Date | March 7, 2023 9:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Reform package includes triggers to completely eliminate Personal Income Tax over time

A message for John xxxxxx - [email protected]

View this email in your browser ([link removed])

FOR IMMEDIATE RELEASE

Tuesday, March 7, 2023

** Gov. Justice signs largest tax cut in West Virginia history into law

------------------------------------------------------------

Reform package includes triggers to completely eliminate Personal Income Tax over time

WATCH FULL EVENT ([link removed]) | VIEW PHOTO ALBUM ([link removed])

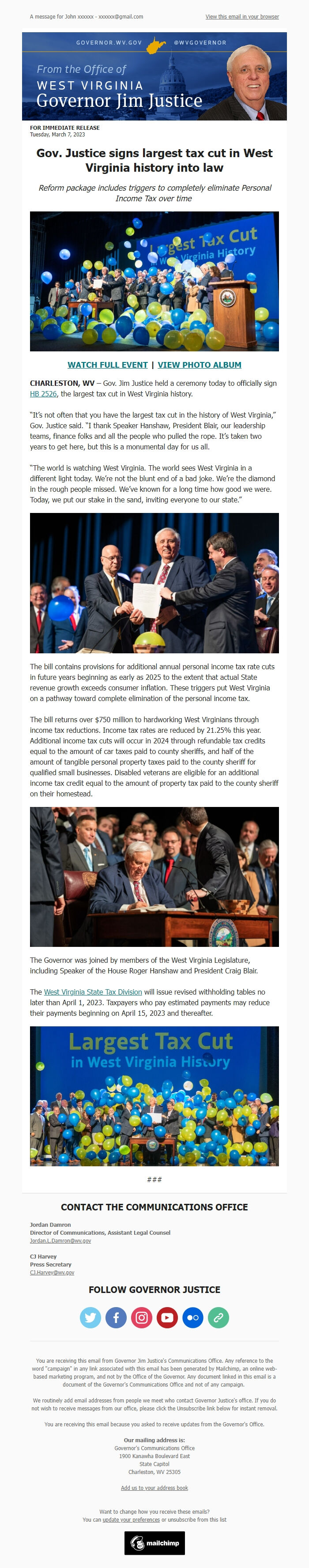

CHARLESTON, WV – Gov. Jim Justice held a ceremony today to officially sign HB 2526 ([link removed]) , the largest tax cut in West Virginia history.

“It’s not often that you have the largest tax cut in the history of West Virginia,” Gov. Justice said. “I thank Speaker Hanshaw, President Blair, our leadership teams, finance folks and all the people who pulled the rope. It’s taken two years to get here, but this is a monumental day for us all.

“The world is watching West Virginia. The world sees West Virginia in a different light today. We’re not the blunt end of a bad joke. We’re the diamond in the rough people missed. We’ve known for a long time how good we were. Today, we put our stake in the sand, inviting everyone to our state.”

The bill contains provisions for additional annual personal income tax rate cuts in future years beginning as early as 2025 to the extent that actual State revenue growth exceeds consumer inflation. These triggers put West Virginia on a pathway toward complete elimination of the personal income tax.

The bill returns over $750 million to hardworking West Virginians through income tax reductions. Income tax rates are reduced by 21.25% this year. Additional income tax cuts will occur in 2024 through refundable tax credits equal to the amount of car taxes paid to county sheriffs, and half of the amount of tangible personal property taxes paid to the county sheriff for qualified small businesses. Disabled veterans are eligible for an additional income tax credit equal to the amount of property tax paid to the county sheriff on their homestead.

The Governor was joined by members of the West Virginia Legislature, including Speaker of the House Roger Hanshaw and President Craig Blair.

The West Virginia State Tax Division ([link removed]) will issue revised withholding tables no later than April 1, 2023. Taxpayers who pay estimated payments may reduce their payments beginning on April 15, 2023 and thereafter.

###

============================================================

CONTACT THE COMMUNICATIONS OFFICE

Jordan Damron

Director of Communications, Assistant Legal Counsel

** [email protected] (mailto:[email protected])

CJ Harvey

Press Secretary

** [email protected] (mailto:[email protected])

FOLLOW GOVERNOR JUSTICE

** Gov. Justice on Twitter ([link removed])

** Gov. Justice on Facebook ([link removed])

** Gov. Justice on Instagram ([link removed])

** Gov. Justice on YouTube ([link removed])

** Gov. Justice on Flickr ([link removed])

** Governor's Website ([link removed])

You are receiving this email from Governor Jim Justice's Communications Office. Any reference to the word "campaign" in any link associated with this email has been generated by Mailchimp, an online web-based marketing program, and not by the Office of the Governor. Any document linked in this email is a document of the Governor's Communications Office and not of any campaign.

We routinely add email addresses from people we meet who contact Governor Justice's office. If you do not wish to receive messages from our office, please click the Unsubscribe link below for instant removal.

You are receiving this email because you asked to receive updates from the Governor's Office.

Our mailing address is:

Governor's Communications Office

1900 Kanawha Boulevard East

State Capitol

Charleston, WV 25305

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

Email Marketing Powered by Mailchimp

[link removed]

A message for John xxxxxx - [email protected]

View this email in your browser ([link removed])

FOR IMMEDIATE RELEASE

Tuesday, March 7, 2023

** Gov. Justice signs largest tax cut in West Virginia history into law

------------------------------------------------------------

Reform package includes triggers to completely eliminate Personal Income Tax over time

WATCH FULL EVENT ([link removed]) | VIEW PHOTO ALBUM ([link removed])

CHARLESTON, WV – Gov. Jim Justice held a ceremony today to officially sign HB 2526 ([link removed]) , the largest tax cut in West Virginia history.

“It’s not often that you have the largest tax cut in the history of West Virginia,” Gov. Justice said. “I thank Speaker Hanshaw, President Blair, our leadership teams, finance folks and all the people who pulled the rope. It’s taken two years to get here, but this is a monumental day for us all.

“The world is watching West Virginia. The world sees West Virginia in a different light today. We’re not the blunt end of a bad joke. We’re the diamond in the rough people missed. We’ve known for a long time how good we were. Today, we put our stake in the sand, inviting everyone to our state.”

The bill contains provisions for additional annual personal income tax rate cuts in future years beginning as early as 2025 to the extent that actual State revenue growth exceeds consumer inflation. These triggers put West Virginia on a pathway toward complete elimination of the personal income tax.

The bill returns over $750 million to hardworking West Virginians through income tax reductions. Income tax rates are reduced by 21.25% this year. Additional income tax cuts will occur in 2024 through refundable tax credits equal to the amount of car taxes paid to county sheriffs, and half of the amount of tangible personal property taxes paid to the county sheriff for qualified small businesses. Disabled veterans are eligible for an additional income tax credit equal to the amount of property tax paid to the county sheriff on their homestead.

The Governor was joined by members of the West Virginia Legislature, including Speaker of the House Roger Hanshaw and President Craig Blair.

The West Virginia State Tax Division ([link removed]) will issue revised withholding tables no later than April 1, 2023. Taxpayers who pay estimated payments may reduce their payments beginning on April 15, 2023 and thereafter.

###

============================================================

CONTACT THE COMMUNICATIONS OFFICE

Jordan Damron

Director of Communications, Assistant Legal Counsel

** [email protected] (mailto:[email protected])

CJ Harvey

Press Secretary

** [email protected] (mailto:[email protected])

FOLLOW GOVERNOR JUSTICE

** Gov. Justice on Twitter ([link removed])

** Gov. Justice on Facebook ([link removed])

** Gov. Justice on Instagram ([link removed])

** Gov. Justice on YouTube ([link removed])

** Gov. Justice on Flickr ([link removed])

** Governor's Website ([link removed])

You are receiving this email from Governor Jim Justice's Communications Office. Any reference to the word "campaign" in any link associated with this email has been generated by Mailchimp, an online web-based marketing program, and not by the Office of the Governor. Any document linked in this email is a document of the Governor's Communications Office and not of any campaign.

We routinely add email addresses from people we meet who contact Governor Justice's office. If you do not wish to receive messages from our office, please click the Unsubscribe link below for instant removal.

You are receiving this email because you asked to receive updates from the Governor's Office.

Our mailing address is:

Governor's Communications Office

1900 Kanawha Boulevard East

State Capitol

Charleston, WV 25305

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Office of the West Virginia Governor

- Political Party: n/a

- Country: United States

- State/Locality: West Virginia

- Office: n/a

-

Email Providers:

- MailChimp