| From | Rights Action <[email protected]> |

| Subject | Important legal victory for Guatemalan women in Hudbay Minerals lawsuits |

| Date | January 24, 2020 1:25 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

as new CEO mulls over future of company

[link removed] Share ([link removed])

[link removed] https%3A%2F%2Fmailchi.mp%2Frightsaction%2Fimportant-legal-victory-for-guatemalan-women-in-hudbay-minerals-lawsuits Tweet ([link removed] https%3A%2F%2Fmailchi.mp%2Frightsaction%2Fimportant-legal-victory-for-guatemalan-women-in-hudbay-minerals-lawsuits)

[link removed] Forward ([link removed])

Rights Action

January 24, 2020

*******

Important legal victory for Guatemalan women in Hudbay Minerals lawsuits, as new CEO mulls over future of company

[link removed]

“On Wednesday, [Hudbay Minerals] lost its latest motion to block the [Guatemalan] plaintiffs from amending their complaint to add new details about the assaults, allegedly perpetrated by private security forces, military and the police.”

“Documents from the case suggest Hudbay has likely spent millions of dollars litigating the case. Cost outlines show that one of its lawyers at Fasken, Robert Harrison, billed at an hourly rate that equated to $925 an hour in 2015, and plaintiff lawyers involved in the case said litigation has involved hundreds of hours at minimum.”

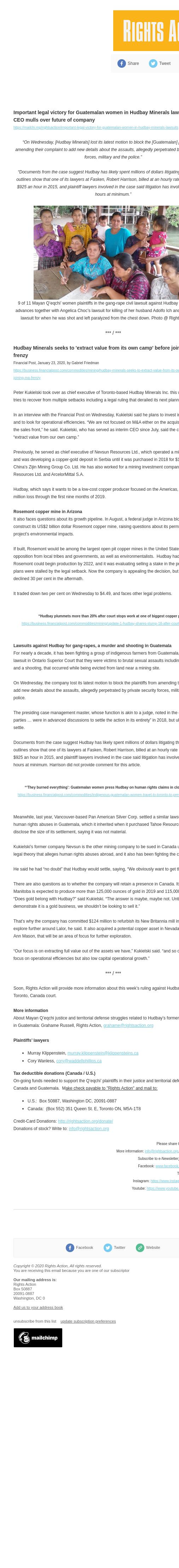

9 of 11 Mayan Q’eqchi’ women plaintiffs in the gang-rape civil lawsuit against Hudbay Minerals, which advances together with Angelica Choc’s lawsuit for killing of her husband Adolfo Ich and German Chub’s lawsuit for when he was shot and left paralyzed from the chest down. Photo @ Rights Action, 2019

*** / ***

Hudbay Minerals seeks to 'extract value from its own camp' before joining M&A frenzy

Financial Post, January 23, 2020, by Gabriel Friedman

[link removed]

Peter Kukielski took over as chief executive of Toronto-based Hudbay Minerals Inc. this week as the miner tries to recover from multiple setbacks including a legal ruling that derailed its next planned mine.

In an interview with the Financial Post on Wednesday, Kukielski said he plans to invest in existing assets and to look for operational efficiencies. “We are not focused on M&A either on the acquisitions front or on the sales front,” he said. Kukielski, who has served as interim CEO since July, said the company can “extract value from our own camp.”

Previously, he served as chief executive of Nevsun Resources Ltd., which operated a mine in Ethiopia and was developing a copper-gold deposit in Serbia until it was purchased in 2018 for $1.4 billion by China’s Zijin Mining Group Co. Ltd. He has also worked for a mining investment company, Teck Resources Ltd. and ArcelorMittal S.A.

Hudbay, which says it wants to be a low-cost copper producer focused on the Americas, posted a $343-million loss through the first nine months of 2019.

Rosemont copper mine in Arizona

It also faces questions about its growth pipeline. In August, a federal judge in Arizona blocked its plans to construct its US$2 billion dollar Rosemont copper mine, raising questions about its permits and the project’s environmental impacts.

If built, Rosemont would be among the largest open pit copper mines in the United States, but has faced opposition from local tribes and governments, as well as environmentalists. Hudbay had hoped Rosemont could begin production by 2022, and it was evaluating selling a stake in the project, but those plans were stalled by the legal setback. Now the company is appealing the decision, but its stock has declined 30 per cent in the aftermath.

It traded down two per cent on Wednesday to $4.49, and faces other legal problems.

Background

“Hudbay plummets more than 20% after court stops work at one of biggest copper projects in the U.S.”, [link removed]

Lawsuits against Hudbay for gang-rapes, a murder and shooting in Guatemala

For nearly a decade, it has been fighting a group of indigenous farmers from Guatemala, who allege in a lawsuit in Ontario Superior Court that they were victims to brutal sexual assaults including gang rapes, and a shooting, that occurred while being evicted from land near a mining site.

On Wednesday, the company lost its latest motion to block the plaintiffs from amending their complaint to add new details about the assaults, allegedly perpetrated by private security forces, military and the police.

The presiding case management master, whose function is akin to a judge, noted in the decision that “the parties … were in advanced discussions to settle the action in its entirety” in 2018, but ultimately did not settle.

Documents from the case suggest Hudbay has likely spent millions of dollars litigating the case. Cost outlines show that one of its lawyers at Fasken, Robert Harrison, billed at an hourly rate that equated to $925 an hour in 2015, and plaintiff lawyers involved in the case said litigation has involved hundreds of hours at minimum. Harrison did not provide comment for this article.

Background

“‘They burned everything’: Guatemalan women press Hudbay on human rights claims in closely watched case”, [link removed]

Meanwhile, last year, Vancouver-based Pan American Silver Corp. settled a similar lawsuit that alleged human rights abuses in Guatemala, which it inherited when it purchased Tahoe Resources Ltd. It did not disclose the size of its settlement, saying it was not material.

Kukielski’s former company Nevsun is the other mining company to be sued in Canada under the same legal theory that alleges human rights abuses abroad, and it also has been fighting the case.

He said he had “no doubt” that Hudbay would settle, saying, “We obviously want to get that behind us.”

There are also questions as to whether the company will retain a presence in Canada. Its Lalor mine in Manitoba is expected to produce more than 125,000 ounces of gold in 2019 and 115,000 tonnes of zinc. “Does gold belong with Hudbay?” said Kukielski. “The answer is maybe, maybe not. Until we can really demonstrate it is a gold business, we shouldn’t be looking to sell it.”

That’s why the company has committed $124 million to refurbish its New Britannia mill in Manitoba and explore further around Lalor, he said. It also acquired a potential copper asset in Nevada in 2018, called Ann Mason, that will be an area of focus for further exploration.

“Our focus is on extracting full value out of the assets we have,” Kukielski said. “and so our goal is to focus on operational efficiencies but also low capital operational growth.”

*** / ***

Soon, Rights Action will provide more information about this week’s ruling against Hudbay Minerals in a Toronto, Canada court.

More information

About Mayan Q’eqchi justice and territorial defense struggles related to Hudbay’s former mining operation in Guatemala: Grahame Russell, Rights Action, [email protected] (mailto:[email protected])

Plaintiffs’ lawyers

* Murray Klippenstein, [email protected] (mailto:[email protected])

* Cory Wanless, [email protected] (mailto:[email protected])

Tax deductible donations (Canada / U.S.)

On-going funds needed to support the Q’eqchi’ plaintiffs in their justice and territorial defense struggles in Canada and Guatemala. M[INS: ake check payable to "Rights Action" and mail to: :INS]

* U.S.: Box 50887, Washington DC, 20091-0887

* Canada: (Box 552) 351 Queen St. E, Toronto ON, M5A-1T8

Credit-Card Donations: [link removed]

Donations of stock? Write to: [email protected] (mailto:[email protected])

Please share this information widely

More information: [email protected] (mailto:[email protected]) , www.rightsaction.org ([link removed])

Subscribe to e-Newsletter[INS: : :INS] [INS: www.rightsaction.org ([link removed]) :INS]

Facebook: [INS: www.facebook.com/RightsAction.org :INS]

Twitter: @RightsAction

Instagram: [link removed]

Youtube: [link removed]

[link removed] Facebook ([link removed])

[link removed] Twitter ([link removed])

[link removed] Website ([link removed])

============================================================

Copyright © 2020 Rights Action, All rights reserved.

You are receiving this email because you are one of our subscriptor

Our mailing address is:

Rights Action

Box 50887

20091-0887

Washington, DC 0

USA

** unsubscribe from this list ([link removed])

** update subscription preferences ([link removed])

Email Marketing Powered by Mailchimp

[link removed]

[link removed] Share ([link removed])

[link removed] https%3A%2F%2Fmailchi.mp%2Frightsaction%2Fimportant-legal-victory-for-guatemalan-women-in-hudbay-minerals-lawsuits Tweet ([link removed] https%3A%2F%2Fmailchi.mp%2Frightsaction%2Fimportant-legal-victory-for-guatemalan-women-in-hudbay-minerals-lawsuits)

[link removed] Forward ([link removed])

Rights Action

January 24, 2020

*******

Important legal victory for Guatemalan women in Hudbay Minerals lawsuits, as new CEO mulls over future of company

[link removed]

“On Wednesday, [Hudbay Minerals] lost its latest motion to block the [Guatemalan] plaintiffs from amending their complaint to add new details about the assaults, allegedly perpetrated by private security forces, military and the police.”

“Documents from the case suggest Hudbay has likely spent millions of dollars litigating the case. Cost outlines show that one of its lawyers at Fasken, Robert Harrison, billed at an hourly rate that equated to $925 an hour in 2015, and plaintiff lawyers involved in the case said litigation has involved hundreds of hours at minimum.”

9 of 11 Mayan Q’eqchi’ women plaintiffs in the gang-rape civil lawsuit against Hudbay Minerals, which advances together with Angelica Choc’s lawsuit for killing of her husband Adolfo Ich and German Chub’s lawsuit for when he was shot and left paralyzed from the chest down. Photo @ Rights Action, 2019

*** / ***

Hudbay Minerals seeks to 'extract value from its own camp' before joining M&A frenzy

Financial Post, January 23, 2020, by Gabriel Friedman

[link removed]

Peter Kukielski took over as chief executive of Toronto-based Hudbay Minerals Inc. this week as the miner tries to recover from multiple setbacks including a legal ruling that derailed its next planned mine.

In an interview with the Financial Post on Wednesday, Kukielski said he plans to invest in existing assets and to look for operational efficiencies. “We are not focused on M&A either on the acquisitions front or on the sales front,” he said. Kukielski, who has served as interim CEO since July, said the company can “extract value from our own camp.”

Previously, he served as chief executive of Nevsun Resources Ltd., which operated a mine in Ethiopia and was developing a copper-gold deposit in Serbia until it was purchased in 2018 for $1.4 billion by China’s Zijin Mining Group Co. Ltd. He has also worked for a mining investment company, Teck Resources Ltd. and ArcelorMittal S.A.

Hudbay, which says it wants to be a low-cost copper producer focused on the Americas, posted a $343-million loss through the first nine months of 2019.

Rosemont copper mine in Arizona

It also faces questions about its growth pipeline. In August, a federal judge in Arizona blocked its plans to construct its US$2 billion dollar Rosemont copper mine, raising questions about its permits and the project’s environmental impacts.

If built, Rosemont would be among the largest open pit copper mines in the United States, but has faced opposition from local tribes and governments, as well as environmentalists. Hudbay had hoped Rosemont could begin production by 2022, and it was evaluating selling a stake in the project, but those plans were stalled by the legal setback. Now the company is appealing the decision, but its stock has declined 30 per cent in the aftermath.

It traded down two per cent on Wednesday to $4.49, and faces other legal problems.

Background

“Hudbay plummets more than 20% after court stops work at one of biggest copper projects in the U.S.”, [link removed]

Lawsuits against Hudbay for gang-rapes, a murder and shooting in Guatemala

For nearly a decade, it has been fighting a group of indigenous farmers from Guatemala, who allege in a lawsuit in Ontario Superior Court that they were victims to brutal sexual assaults including gang rapes, and a shooting, that occurred while being evicted from land near a mining site.

On Wednesday, the company lost its latest motion to block the plaintiffs from amending their complaint to add new details about the assaults, allegedly perpetrated by private security forces, military and the police.

The presiding case management master, whose function is akin to a judge, noted in the decision that “the parties … were in advanced discussions to settle the action in its entirety” in 2018, but ultimately did not settle.

Documents from the case suggest Hudbay has likely spent millions of dollars litigating the case. Cost outlines show that one of its lawyers at Fasken, Robert Harrison, billed at an hourly rate that equated to $925 an hour in 2015, and plaintiff lawyers involved in the case said litigation has involved hundreds of hours at minimum. Harrison did not provide comment for this article.

Background

“‘They burned everything’: Guatemalan women press Hudbay on human rights claims in closely watched case”, [link removed]

Meanwhile, last year, Vancouver-based Pan American Silver Corp. settled a similar lawsuit that alleged human rights abuses in Guatemala, which it inherited when it purchased Tahoe Resources Ltd. It did not disclose the size of its settlement, saying it was not material.

Kukielski’s former company Nevsun is the other mining company to be sued in Canada under the same legal theory that alleges human rights abuses abroad, and it also has been fighting the case.

He said he had “no doubt” that Hudbay would settle, saying, “We obviously want to get that behind us.”

There are also questions as to whether the company will retain a presence in Canada. Its Lalor mine in Manitoba is expected to produce more than 125,000 ounces of gold in 2019 and 115,000 tonnes of zinc. “Does gold belong with Hudbay?” said Kukielski. “The answer is maybe, maybe not. Until we can really demonstrate it is a gold business, we shouldn’t be looking to sell it.”

That’s why the company has committed $124 million to refurbish its New Britannia mill in Manitoba and explore further around Lalor, he said. It also acquired a potential copper asset in Nevada in 2018, called Ann Mason, that will be an area of focus for further exploration.

“Our focus is on extracting full value out of the assets we have,” Kukielski said. “and so our goal is to focus on operational efficiencies but also low capital operational growth.”

*** / ***

Soon, Rights Action will provide more information about this week’s ruling against Hudbay Minerals in a Toronto, Canada court.

More information

About Mayan Q’eqchi justice and territorial defense struggles related to Hudbay’s former mining operation in Guatemala: Grahame Russell, Rights Action, [email protected] (mailto:[email protected])

Plaintiffs’ lawyers

* Murray Klippenstein, [email protected] (mailto:[email protected])

* Cory Wanless, [email protected] (mailto:[email protected])

Tax deductible donations (Canada / U.S.)

On-going funds needed to support the Q’eqchi’ plaintiffs in their justice and territorial defense struggles in Canada and Guatemala. M[INS: ake check payable to "Rights Action" and mail to: :INS]

* U.S.: Box 50887, Washington DC, 20091-0887

* Canada: (Box 552) 351 Queen St. E, Toronto ON, M5A-1T8

Credit-Card Donations: [link removed]

Donations of stock? Write to: [email protected] (mailto:[email protected])

Please share this information widely

More information: [email protected] (mailto:[email protected]) , www.rightsaction.org ([link removed])

Subscribe to e-Newsletter[INS: : :INS] [INS: www.rightsaction.org ([link removed]) :INS]

Facebook: [INS: www.facebook.com/RightsAction.org :INS]

Twitter: @RightsAction

Instagram: [link removed]

Youtube: [link removed]

[link removed] Facebook ([link removed])

[link removed] Twitter ([link removed])

[link removed] Website ([link removed])

============================================================

Copyright © 2020 Rights Action, All rights reserved.

You are receiving this email because you are one of our subscriptor

Our mailing address is:

Rights Action

Box 50887

20091-0887

Washington, DC 0

USA

** unsubscribe from this list ([link removed])

** update subscription preferences ([link removed])

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Rights Action

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp