| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #9 – Estimated tax payments |

| Date | March 2, 2023 7:19 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

There are many ways to make estimated Minnesota tax payments. Check out our Estimated Tax page [ [link removed] ] for payment options, and give your clients our?payment record form [ [link removed] ]?to help them keep track of their payments.

*What if my client cannot remember what payments were made?*

Have your client contact us for all payments made for a specific tax year. If your client enters an incorrect amount for estimated payments, their return may be delayed.

*Can I cancel an estimated tax payment for my client? *

Yes. You can cancel payments made through our e-Services system before 5 p.m. Central time on the scheduled payment date. Go to our Online Services [ [link removed] ] and select *Search for a confirmation number *to locate and cancel your payment.

To cancel payments made through tax software, contact us.

*What if an estimated tax payment was applied to the wrong year? *

Contact us. We can review client accounts and make any needed changes. You must either have power of attorney on file with Revenue or have your client contact us.

*Can I request a list of all payments made on my client?s account?*

Yes. You must have a power of attorney on file for the tax type and years you are requesting payments. The report you receive includes the payment date, payment period, principal, interest, penalties, and payment plan or lien fees.

*Questions?*

Contact us.

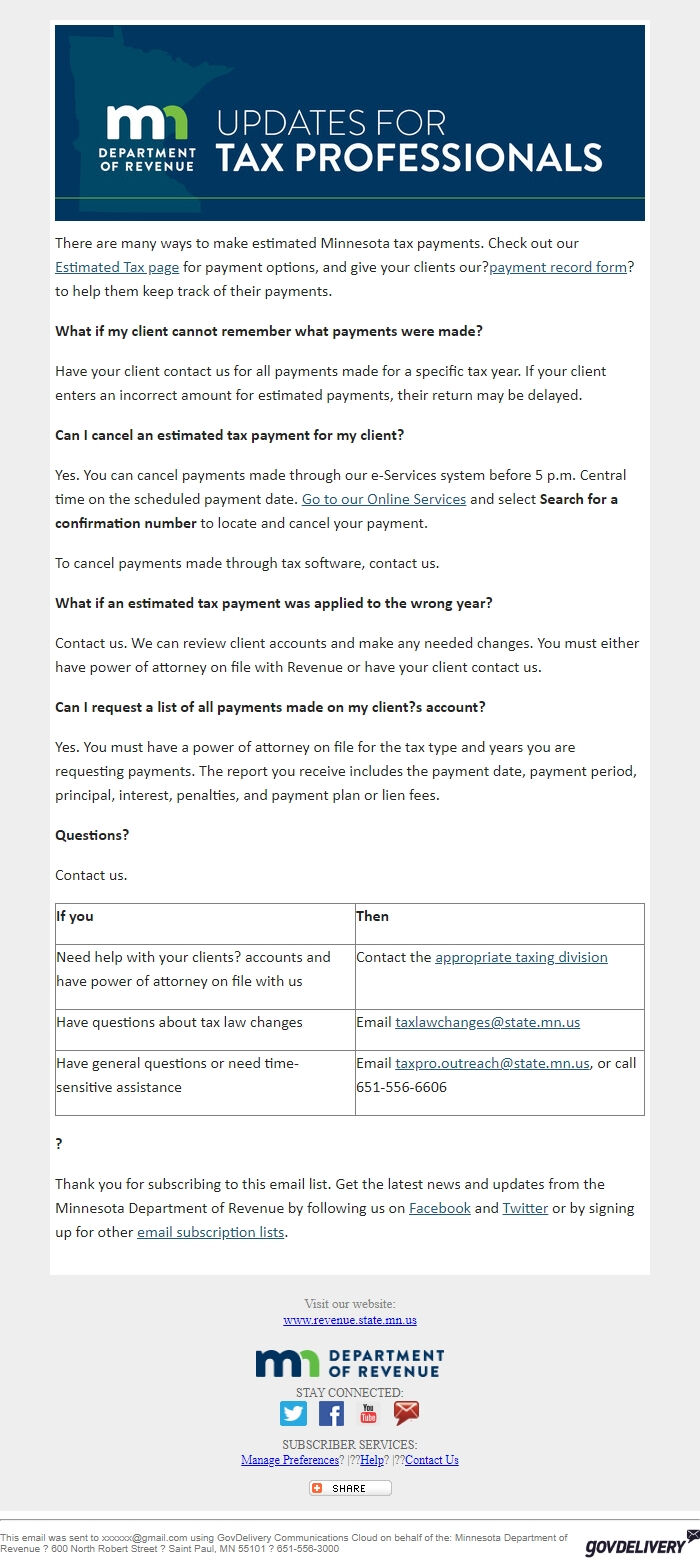

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions or need time-sensitive assistance

Email [email protected], or call 651-556-6606

*?*

Thank you for subscribing to this email list. Get the latest news and updates from the Minnesota Department of Revenue by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for other email subscription lists [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

There are many ways to make estimated Minnesota tax payments. Check out our Estimated Tax page [ [link removed] ] for payment options, and give your clients our?payment record form [ [link removed] ]?to help them keep track of their payments.

*What if my client cannot remember what payments were made?*

Have your client contact us for all payments made for a specific tax year. If your client enters an incorrect amount for estimated payments, their return may be delayed.

*Can I cancel an estimated tax payment for my client? *

Yes. You can cancel payments made through our e-Services system before 5 p.m. Central time on the scheduled payment date. Go to our Online Services [ [link removed] ] and select *Search for a confirmation number *to locate and cancel your payment.

To cancel payments made through tax software, contact us.

*What if an estimated tax payment was applied to the wrong year? *

Contact us. We can review client accounts and make any needed changes. You must either have power of attorney on file with Revenue or have your client contact us.

*Can I request a list of all payments made on my client?s account?*

Yes. You must have a power of attorney on file for the tax type and years you are requesting payments. The report you receive includes the payment date, payment period, principal, interest, penalties, and payment plan or lien fees.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions or need time-sensitive assistance

Email [email protected], or call 651-556-6606

*?*

Thank you for subscribing to this email list. Get the latest news and updates from the Minnesota Department of Revenue by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for other email subscription lists [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery