| From | USAFacts <[email protected]> |

| Subject | Tax burdens, explained |

| Date | February 28, 2023 2:32 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Plus, the state of US infrastructure

Not displaying correctly? View this email in your browser ([link removed]) .

[link removed]

** The data on your tax burden

------------------------------------------------------------

Which states rely the most on taxes? Are your property taxes high compared to other states? Get the answers with this new interactive explanation of state tax burdens ([link removed]) .

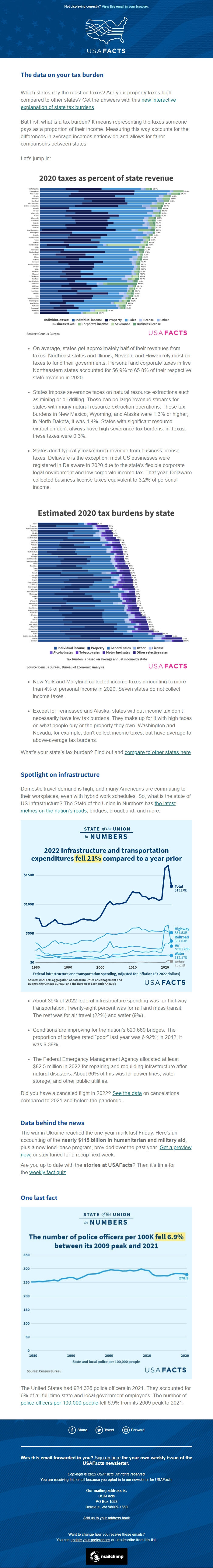

But first: what is a tax burden? It means representing the taxes someone pays as a proportion of their income. Measuring this way accounts for the differences in average incomes nationwide and allows for fairer comparisons between states.

Let's jump in:

[link removed]

* On average, states get approximately half of their revenues from taxes. Northeast states and Illinois, Nevada, and Hawaii rely most on taxes to fund their governments. Personal and corporate taxes in five Northeastern states accounted for 56.9% to 65.8% of their respective state revenue in 2020.

* States impose severance taxes on natural resource extractions such as mining or oil drilling. These can be large revenue streams for states with many natural resource extraction operations. These tax burdens in New Mexico, Wyoming, and Alaska were 1.3% or higher; in North Dakota, it was 4.4%. States with significant resource extraction don't always have high severance tax burdens: in Texas, these taxes were 0.3%.

* States don’t typically make much revenue from business license taxes. Delaware is the exception: most US businesses were registered in Delaware in 2020 due to the state’s flexible corporate legal environment and low corporate income tax. That year, Delaware collected business license taxes equivalent to 3.2% of personal income.

[link removed]

* New York and Maryland collected income taxes amounting to more than 4% of personal income in 2020. Seven states do not collect income taxes.

* Except for Tennessee and Alaska, states without income tax don’t necessarily have low tax burdens. They make up for it with high taxes on what people buy or the property they own. Washington and Nevada, for example, don't collect income taxes, but have average to above-average tax burdens.

What’s your state’s tax burden? Find out and compare to other states ([link removed]) here ([link removed]) .

Spotlight on infrastructure

Domestic travel demand is high, and many Americans are commuting to their workplaces, even with hybrid work schedules. So, what is the state of US infrastructure? The State of the Union in Numbers has the latest metrics on the nation’s roads ([link removed]) , bridges, broadband, and more.

[link removed]

* About 39% of 2022 federal infrastructure spending was for highway transportation. Twenty-eight percent was for rail and mass transit. The rest was for air travel (22%) and water (9%).

* Conditions are improving for the nation’s 620,669 bridges. The proportion of bridges rated “poor” last year was 6.92%; in 2012, it was 9.39%.

* The Federal Emergency Management Agency allocated at least $82.5 million in 2022 for repairing and rebuilding infrastructure after natural disasters. About 66% of this was for power lines, water storage, and other public utilities.

Did you have a canceled flight in 2022? See the data ([link removed]) on cancelations compared to 2021 and before the pandemic.

Data behind the news

The war in Ukraine reached the one-year mark last Friday. Here's an accounting of the nearly $115 billion in humanitarian and military aid, plus a new lend-lease program, provided over the past year. Get a preview now ([link removed]) , or stay tuned for a recap next week.

Are you up to date with the stories at USAFacts? Then it’s time for the weekly fact quiz ([link removed]) .

One last fact

[link removed]

The United States had 924,326 police officers in 2021. They accounted for 6% of all full-time state and local government employees. The number of police officers per 100,000 people ([link removed]) fell 6.9% from its 2009 peak to 2021.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FilKkQA)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FilKkQA)

** Forward ([link removed])

** Forward ([link removed])

Was this email forwarded to you? ** Sign up here ([link removed])

for your own weekly issue of the USAFacts newsletter.

Copyright © 2023 USAFacts, All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Not displaying correctly? View this email in your browser ([link removed]) .

[link removed]

** The data on your tax burden

------------------------------------------------------------

Which states rely the most on taxes? Are your property taxes high compared to other states? Get the answers with this new interactive explanation of state tax burdens ([link removed]) .

But first: what is a tax burden? It means representing the taxes someone pays as a proportion of their income. Measuring this way accounts for the differences in average incomes nationwide and allows for fairer comparisons between states.

Let's jump in:

[link removed]

* On average, states get approximately half of their revenues from taxes. Northeast states and Illinois, Nevada, and Hawaii rely most on taxes to fund their governments. Personal and corporate taxes in five Northeastern states accounted for 56.9% to 65.8% of their respective state revenue in 2020.

* States impose severance taxes on natural resource extractions such as mining or oil drilling. These can be large revenue streams for states with many natural resource extraction operations. These tax burdens in New Mexico, Wyoming, and Alaska were 1.3% or higher; in North Dakota, it was 4.4%. States with significant resource extraction don't always have high severance tax burdens: in Texas, these taxes were 0.3%.

* States don’t typically make much revenue from business license taxes. Delaware is the exception: most US businesses were registered in Delaware in 2020 due to the state’s flexible corporate legal environment and low corporate income tax. That year, Delaware collected business license taxes equivalent to 3.2% of personal income.

[link removed]

* New York and Maryland collected income taxes amounting to more than 4% of personal income in 2020. Seven states do not collect income taxes.

* Except for Tennessee and Alaska, states without income tax don’t necessarily have low tax burdens. They make up for it with high taxes on what people buy or the property they own. Washington and Nevada, for example, don't collect income taxes, but have average to above-average tax burdens.

What’s your state’s tax burden? Find out and compare to other states ([link removed]) here ([link removed]) .

Spotlight on infrastructure

Domestic travel demand is high, and many Americans are commuting to their workplaces, even with hybrid work schedules. So, what is the state of US infrastructure? The State of the Union in Numbers has the latest metrics on the nation’s roads ([link removed]) , bridges, broadband, and more.

[link removed]

* About 39% of 2022 federal infrastructure spending was for highway transportation. Twenty-eight percent was for rail and mass transit. The rest was for air travel (22%) and water (9%).

* Conditions are improving for the nation’s 620,669 bridges. The proportion of bridges rated “poor” last year was 6.92%; in 2012, it was 9.39%.

* The Federal Emergency Management Agency allocated at least $82.5 million in 2022 for repairing and rebuilding infrastructure after natural disasters. About 66% of this was for power lines, water storage, and other public utilities.

Did you have a canceled flight in 2022? See the data ([link removed]) on cancelations compared to 2021 and before the pandemic.

Data behind the news

The war in Ukraine reached the one-year mark last Friday. Here's an accounting of the nearly $115 billion in humanitarian and military aid, plus a new lend-lease program, provided over the past year. Get a preview now ([link removed]) , or stay tuned for a recap next week.

Are you up to date with the stories at USAFacts? Then it’s time for the weekly fact quiz ([link removed]) .

One last fact

[link removed]

The United States had 924,326 police officers in 2021. They accounted for 6% of all full-time state and local government employees. The number of police officers per 100,000 people ([link removed]) fell 6.9% from its 2009 peak to 2021.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FilKkQA)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FilKkQA)

** Forward ([link removed])

** Forward ([link removed])

Was this email forwarded to you? ** Sign up here ([link removed])

for your own weekly issue of the USAFacts newsletter.

Copyright © 2023 USAFacts, All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: USAFacts

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp