Feb. 27, 2023

Permission to republish original opeds and cartoons granted.

Trump vows ban on $8.4 trillion ESG juggernaut that is violating federal antitrust laws by halting expansion of U.S. energy production and violating Title VII of Civil Rights Act with racial, gender hiring quotas

By Robert Romano

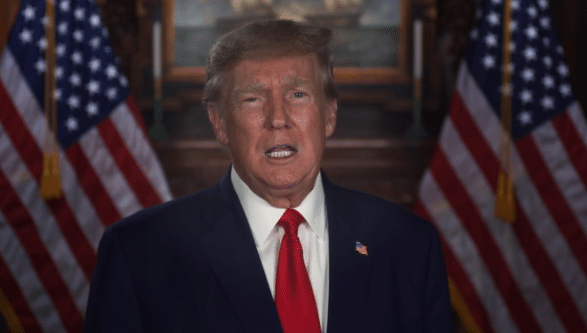

Former President Donald Trump, who is once again running for president as Republican in 2024, has promised in a video post on Truth Social to ban via executive order and changes to federal law Environmental, Social and Governance (ESG) retirement investments that have led to divestment from traditional U.S. energy production in violation of federal antitrust laws and racial and gender hiring quotas that appear to violate Title VII of the Civil Rights Act.

ESG investments in the U.S. have grown to $8.4 trillion in 2022, according to the latest data by the USSIF, The Forum for Sustainable and Responsible Investment.

“When I’m in the White House I will sign an executive order and with Congress’ support a law to keep politics away from America’s retirement accounts forever. I will demand that funds invest your money to help you, not them, but to help you, not to help radical left communists…” Trump said in the video, promising an executive order that will direct departments and agencies to end these perverse subsidies.

Here, Trump is in part referring to changes made to federal regulations including the Employment Retirement Income Security Act (ERISA) by the Barack Obama Labor Department in 2015 allowing ESG investments into tax-deferred, employer-based retirement savings accounts like the $6.3 trillion 401(k) market and other .

A 2020 regulation by the Trump Labor Department watered this regulation down a bit, mirroring a 2008 regulation by the George W. Bush Labor Department, but was promptly overturned via a May 2021 executive order by President Joe Biden defining climate change a financial risk under ERISA and affirmed later via a 2022 regulation by the Biden Labor Department. The 2008 regulation was actually a revision of a 1994 regulation by the Bill Clinton Labor Department, which in turn were revisions to the rules made by prior administrations.

These attempts to hold back ESG depend on fiduciary rules, that state as long as investments remain profitable commensurate with other non-ESG investments, then environmental, social and other factors may be taken into consideration when making economically targeted investments.

All of these rules are based on the fiduciary duties and obligations defined under federal law in 29 U.S.C. Section 1104, which states, “a fiduciary shall discharge his duties with respect to a plan solely in the interest of the participants and beneficiaries and… for the exclusive purpose of … providing benefits to participants and their beneficiaries; and … defraying reasonable expenses of administering the plan; … with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims; … by diversifying the investments of the plan so as to minimize the risk of large losses, unless under the circumstances it is clearly prudent not to do so; and … in accordance with the documents and instruments governing the plan insofar as such documents and instruments are consistent with the provisions of this subchapter and subchapter III.”

Contrary to former President Trump’s claim that he “issued an historic rule banning Wall Street and employers from pouring your 401(k)s, pensions and retirement accounts into so-called ESG… investments for political reasons,” none of these rules, including the one issued by his Labor Department ever did away with ESG. I don’t believe Trump is lying at all, instead, perhaps his advisors told him what he did somehow banned it, but it’s simply not true, Mr. President. If only it were true.

Like the 2008 Bush Labor Department regulation — and every other rulemaking on this subject in fact — the 2020 Trump Labor Department once again affirmed the “all things being equal” test. None have dared to overturn that via a rulemaking.

The 2020 rulemaking stated, “Under the final rule, plan fiduciaries, when making decisions on investments and investment courses of action, must focus solely on the plan’s financial risks and returns and keep the interests of plan participants and beneficiaries in their plan benefits paramount. The fundamental principle is that an ERISA fiduciary’s evaluation of plan investments must be focused solely on economic considerations that have a material effect on the risk and return of an investment based on appropriate investment horizons, consistent with the plan’s funding policy and investment policy objectives. The corollary principle is that ERISA fiduciaries must never sacrifice investment returns, take on additional investment risk, or pay higher fees to promote non-pecuniary benefits or goals.”

So far, so good, but then the Trump Labor Department, like every single Labor Department before it, affirmed ESG investments would continue to be allowed by fiduciaries: “The final rule recognizes that there are instances where one or more environmental, social, or governance factors will present an economic business risk or opportunity that corporate officers, directors, and qualified investment professionals would appropriately treat as material economic considerations under generally accepted investment theories.”

Repeat: “[T]here are instances where one or more environmental, social, or governance factors will present an economic business risk…”

That is no ban, Mr. President. It’s an authorization that explicitly left it up to fiduciaries to decide what financial risk factors there were. One could say it was “neutral” at best, which is to say, again, it did nothing to stop ESG investments.

But, in fact, the Labor Department explicitly stated there was no ban, and discouraged that interpretation of the rulemaking in 2020, stating, “Many commenters interpreted paragraph (c)(3)(iii) of the proposal as a ban on any investment alternative serving as a [Qualified Default Investment Alternative] QDIA if the investment alternative (or any component of the investment alternative) was constructed using any ‘E’, ‘S’, or ‘G’ factor even if such factor was pecuniary in nature… (i.e., it has a material effect on the risk and/or return of the investment based on an appropriate time horizon)… That was not the Department’s intention or, in the Department’s view, a reasonable reading of paragraph (c)(3)(iii) of the proposal. The intent behind that paragraph, rather, was to prohibit an investment alternative (or any component of the investment alternative) whose investment objectives or principal strategies included a nonfinancial goal from being a QDIA… The foregoing misinterpretation notwithstanding, some commenters supported a ban on any investment alternative serving as a QDIA if the investment alternative (or any component of the investment alternative) was constructed using ESG factors… This refocusing is an acknowledgement that individual ‘E’, ‘S’, and ‘G’ factors can be both pecuniary and non-pecuniary in nature, and that the selection of ESG funds is not per se prudent or imprudent.”

To be fair, Trump did stop the now $714 billion federal Thrift Savings Plan (TSP) Thrift Savings Plan from making similar kinds of investments, which did not begin making such investments until 2022 after President Joe Biden gave it the green light.

As ESG investing has continued to grow by trillions of dollars globally, the 2020 rule, and likely every rule after it, whether by a future Trump administration or another Republican administration, will almost continue to apply the “all things being equal” test — unless something dramatically changes.

Nor do these rules either impact the $11.7 trillion Individual Retirement Accounts (IRAs) market or the $10 trillion in state and local government retirement investments.

Nor does the Labor Department rule impact the $714 billion federal Thrift Savings Plan (TSP) for federal employee retirees that began investing in ESG funds in 2022, following other state government employee retirement funds in California, New York, Colorado, Connecticut, Maine, Maryland and Oregon.

In other words, the Labor Department rule only touches employer-based defined benefit and defined contribution plans, which total about $11.9 trillion currently, but only make up 36.8 percent of the $32.3 trillion retirement savings market nationwide.

Therefore, the Labor Department is not exclusively an appropriate vehicle for addressing ESG. It is required, but it can only ever address little more than one-third of the problem — assuming Republican administration officials in the future, whether Trump, Ron DeSantis, or somebody else, even truly view this as a problem that needs addressing.

The truth is, if the Labor Department’s “all things being equal test” continues to be the gold standard for ESG, and Republican candidates accept this on face value, naively and misleadingly believing that if companies get woke, they’ll go broke, then nothing at all will change about this issue.

The fact is, ESG has been insanely profitable for both companies and investors, but not in a good way. Let’s look at U.S. oil companies.

The largest oil producers in the U.S. do not appear to have major plans to increase production through 2025, a review of U.S. Energy Information Agency (EIA) data and corporate reports of U.S.-based oil companies reveals, despite oil prices being over $100 per barrel and inflation raging at 7.9 percent the last twelve months.

According to EIA, U.S. oil production will reach 12 million barrels per day in 2022 and 12.6 million barrels per day in 2023, a return to pre-Covid production levels that peaked at 12.9 million barrels per day in Nov. 2019.

But what about over the long term? A look at top U.S. oil producers reveals that these companies have been pivoting away from carbon-based energy for years. In short, they’re going green.

Last year, ExxonMobil, the largest producer in the U.S., announced that it would produce about 3.7 million barrels of oil a day — about 18 percent of all U.S. consumption — from its facilities throughout the world, a level which would remain relatively unchanged through 2025. This year, the estimate for 2022 was up slightly to 3.8 million barrels a day, expected to rise to 4.2 million barrels a day by 2027.

Long term, ExxonMobil reports in its 2020 corporate annual report that it is “Positioning for a Lower-Carbon Energy Future” by “working to develop breakthrough solutions in areas such as carbon capture, biofuels, hydrogen, and energy-efficiency process technology that can help achieve the Paris Agreement objectives. In early 2021 ExxonMobil announced the creation of a new business, ExxonMobil Low Carbon Solutions, to commercialize low-carbon technologies.”

According to ExxonMobil President Neil Chapman, speaking on March 2 to investors, “we will reduce the emissions in our existing operations. We’re aiming for net-zero Scope 1 and 2 emissions at our operated facilities by 2050.” And in the U.S., Exxon’s net zero plans will be attained on the Permian basin by 2030.

BlackRock, a hedge fund with more than $9 trillion of assets under management, have placed green activists onto the board of Exxon to make it a “not-oil” company, thanks to ESG. Other hedge funds like Vanguard also make significant ESG investments.

As for Chevron, the second largest U.S.-based producer, it currently produces about 3 million barrels a day, expected to rise by just 500,000 barrels per day by 2025 to 3.5 million barrels per day.

In Chevron’s 2020 corporate annual report, it promised “higher returns in a lower-carbon future” by “reducing the carbon intensity of our operations and assets, prioritizing the projects that return the largest reduction in carbon emissions at the lowest cost to customers and society… increasing renewables and offsets in support of our business…. [and] investing in low-carbon technologies to enable commercial solutions while leveraging our capabilities and operations to advance technologies such as carbon capture and hydrogen.” Chevron also has similarly set a goal to be a net-zero carbon emitter by 2050.

But it has led to catastrophe. Besides making Europe and the West increasingly dependent on energy from adversaries like Russia, inflation is on fire. Thanks to the energy crisis, even major environmental criteria investment beneficiaries like Tesla CEO Elon Musk are calling for an increase in oil and gas production in a bid to offset Russia, writing on Twitter on March 8: “Hate to say it, but we need to increase oil & gas output immediately. Extraordinary times demand extraordinary measures.”

These are explicit Environmental, Social and Governance (ESG) goals being pursued by the largest oil companies in the U.S., particularly goals to support the Paris Climate Accords and to reduce carbon emissions to zero.

In both companies’ cases, the strategies short-term include deploying carbon capture technologies as well as reducing onsite carbon emissions on existing production facilities, and more investment in green energies. Long term, however, they are sealing the fate of carbon-based energies, by embracing an investment model that calls for their extinction.

Ultimately, that will mean less oil production, and yet, by restricting the U.S. oil supply, oil companies make more money. It’s that simple. It is more profitable for the green cartel to act as a cartel.

In fact, in 2022, Exxon posted more than double the profits it did in 2021, growing from $23 billion to $55.7 billion in 2022, which was more than 2008’s $45.2 billion. By restricting oil supplies, oil companies like Exxon posted record profits.

Get woke, go broke is a big lie, but a comforting one that Republicans, conservatives and libertarians will undoubtedly continue to tell themselves as they pretend mightily that the free market’s “invisible hand” will intervene any minute now. Ineffective fiduciary rules for retirement plans that only impact a third of the market will save us, they promise! No, they won’t.

Beside the fact that these are not anything close to free markets — at all — the “all things being equal” test by the Labor Department, even if it were applied to every retirement account in America, would do almost nothing to stop this. Energy abundance would drive the price of oil down, and might be less profitable, even if it is in the nation’s interest to be energy independent. Even the market’s current downturn—which was almost certainly caused by ESG’s bid for production slowdowns that caused the inflation in the first place—will be felt across the board to ESG and non-ESG alike, likely making it impossible for fiduciaries to discern who did better.

Besides, fiduciaries are not supposed to make considerations such as “what if everyone buys into ESG and bad things happen overall and America is weakened?” By definition, those are “non-pecuniary” considerations the law and the Labor Department under Republicans seeks to avoid even while seemingly allowing it. The real problem here is the discretion that is allowed under the law, which almost certainly needs to be tightened up by Congress under its Article I, Section 8 explicit power to regulate commerce if there is to be any hope of reining in the ESG juggernaut.

Simply put, we do not want our nation’s energy independence to be dependent on pencil-neck fiduciaries who will only ever interpret federal regulations and bottom lines, and have every financial interest in pursuing these perverse incentives and subsidies. The dirty secret is these perverse incentives and subsidies do benefit investors, and yet Trump is right in his video when he states that these radical, left-wing policies “destroy countries.”

In fact, the perverse incentives that ESG poses on constraining U.S. energy production were not lost on former Arizona Attorney General Mark Brnovich and former Nebraska Attorney General Doug Peterson and 17 other Republican Attorneys General that threatened the $10 trillion hedge fund BlackRock with antitrust legal action in an Aug. 4, 2022 letter to BlackRock CEO Larry Fink accusing the company of “intentionally restrain[ing] and harm[ing] the competitiveness of the energy markets” with its market dominance of retirement investments.

Brnovich and Peterson added, “coordinated conduct with other financial institutions to impose net-zero [carbon emissions by 2050] … raises antitrust concerns. Group boycotts, restraining trade, or concerted refusals to deal, ‘clearly run afoul of’ Section 1 of the Sherman Act [according to the Supreme Court]. Section 1 prohibits ‘[e]very … combination … , or conspiracy, in restraint of trade or commerce.’ Regarding the definition of a ‘combination,’ the Supreme Court has held that this language prohibits ‘concerted action.’”

Here, Brnovich, Peterson and the other GOP Attorneys General lay out a case that BlackRock’s push for net zero carbon emissions, through its coordinated efforts with investment banks via Environmental, Social and Governance (ESG) funds to restrict the flow of capital to carbon-based energies like oil and coal, are engaged in a type of anticompetitive collusion prohibited by federal antitrust laws. It’s prohibited because although it is profitable, it is bad for consumers and bad for the country as a whole, but sadly, these laws have been watered down by years of poor federal court decisions, else, why is this still happening?

U.S. corporations appear to be all in on BlackRock’s investing scam, with a recent KPMG survey finding 82 percent of U.S. corporations are touting ESG sustainability goals in their corporate filings. I’d add, even though doing so by no means guarantees inclusion in hedge funds’ ESG funds like BlackRock, Vanguard, etc.

In other words, ESG investing is so successful in shifting companies to the stakeholder capitalism model that companies are adopting ESG goals of their own accord — in mere hopes of getting some that investment money by virtue signaling — without necessarily even boosting their companies’ capitalization. It’s like trying to boost your odds of winning the lottery by promoting the lottery. It doesn’t quite work that way.

In his annual shareholder letter to investors in 2022, BlackRock CEO Larry Fink said the war in Ukraine, the supply crisis and the inflation would all lead to even more green energy in the future: “Longer-term, I believe that recent events will actually accelerate the shift toward greener sources of energy in many parts of the world.” Particularly, the inflation of carbon-based energy would make green energy more price competitive: “Higher energy prices will also meaningfully reduce the green premium for clean technologies and enable renewables, EVs and other clean technologies to be much more competitive economically,” Fink said.

As a result, ESG is said to be worth $41 trillion this year globally, and $50 trillion by 2025, about one-third of all assets under management, according to Bloomberg. On the other hand, USSIF referenced above actually lowered its perspective on what truly constitutes ESG investing. It had previously stated the United States’ stake in ESG totaled $17 trillion, but now it is saying $8.4 trillion, in a bid to discount double-counting and so-called “greenwashing” investments.

Leaving aside disputes about what is and is not ESG—this dispute is actually being used as a basis for the Securities and Exchange Commission (SEC) to impose and enforce ESG on publicly traded corporations via a June 2022 proposed regulation—and therefore how large it actually is, there are other laws that ESG openly breaks, including Title VII of the Civil Rights Act against employment discrimination on the basis of race, sex and religion.

Diversity hiring quotas like these might appear to run afoul of the 1964 Civil Rights Act’s prohibition on employment discrimination on the basis of race or sex: “It shall be an unlawful employment practice for an employer… to fail or refuse to hire or to discharge any individual, or otherwise to discriminate against any individual with respect to his compensation, terms, conditions, or privileges of employment, because of such individual’s race, color, religion, sex, or national origin; or … to limit, segregate, or classify his employees or applicants for employment in any way which would deprive or tend to deprive any individual of employment opportunities or otherwise adversely affect his status as an employee, because of such individual’s race, color, religion, sex, or national origin.”

However, thanks to the 1979 ruling by the Supreme Court ruling Steelworkers v. Weber which ruled that employment policies that racial preferences on the basis of race and sex in favor of women and minorities, which plaintiffs argued was reverse discrimination, were not a violation of the Civil Rights Act, in effect legalizing employment discrimination against whites and males. This was a sharp departure from more racially neutral interpretations of the Civil Rights Act by federal courts that preceded the decision.

Then Associate Justice William Rehnquist, who would go on to become the Court’s 16th Chief Justice in 1986, in his dissenting opinion, compared the Court’s rewriting of the Civil Rights Act to the totalitarian regime portrayed in George Orwell’s 1984, writing that law was written plainly, “Taken in its normal meaning, and as understood by all Members of Congress who spoke to the issue during the legislative debates, this language prohibits a covered employer from considering race when making an employment decision, whether the race be black or white.”

Rehnquist blasted the majority of the court, adding, “the Court behaves much like the Orwellian speaker earlier described, as if it had been handed a note indicating that Title VII would lead to a result unacceptable to the Court if interpreted here as it was in our prior decisions. … Now we are told that the legislative history of Title VII shows that employers are free to discriminate on the basis of race: an employer may, in the Court’s words, ‘trammel the interests of the white employees’ in favor of black employees in order to eliminate ‘racial imbalance.’… Our earlier interpretations of Title VII, like the banners and posters decorating the square in Oceania, were all wrong.”

Here’s the interesting twist. The majority of the current Supreme Court are all considered acolytes of Rehnquist. All were regarded as constitutionalists, originalists and textualists when they were nominated by conservative presidents George H.W. Bush, George W. Bush and Donald Trump, the latter of whom just secured an historic 6 to 3 majority on the nation’s highest court with Justices Neil Gorsuch, Brett Kavanaugh and Amy Coney Barrett.

Today, the question of reverse discrimination posed by ESG’s Diversity & Inclusion corporate policies might be decided differently by today’s Supreme Court more than 40 years later. It would be up to those fired or cancelled to make the case they were discriminated against on the basis of race and/or sex.

As it is, corporate America’s racial and gender diversity preferences in favor of women and minorities, including at America’s biggest entertainment companies absolutely “discriminate[s] … because of such individual’s race, color, religion, sex, or national origin.”

Just look at media and the entertainment industry.

AT&T first included D&I objectives in Sept. 2018 after its then-merger with Time Warner (it has since divested WarnerMedia to Discovery) was completed. In its 2018 report, AT&T’s then-CEO Randall Stephenson announced the company’s new Diversity & Inclusion Policy, “I am proud of our commitment to a diverse and inclusive workforce. WarnerMedia’s new Diversity & Inclusion Policy, announced in September, is a pioneering media industry commitment to give more opportunities to women, people of color and individuals from other underrepresented groups – both in front of and behind the camera.”

As for the other companies, Disney, which owns Marvel Comics, states in its 2020 report, “Diversity and inclusion (D&I). Our [Diversity & Inclusion] D&I objectives are to build teams that reflect the life experiences of our audiences, while employing and supporting a diverse array of voices in our creative and production content. Established six pillars that serve as the foundation for our D&I commitments – transparency, accountability, representation, content, community, and culture. Created a pipeline of next-generation creative executives from underrepresented backgrounds through programs such as the Executive Incubator, Creative Talent Development and Inclusion (CTDI), and the Disney Launchpad: Shorts Incubator. Championed targeted development programs for underrepresented talent. Hosted a series of culture-changing, innovation and learning opportunities to spark dialogue among employees, leaders, Disney talent and external experts. Sponsored over 70 employee-led Business Employee Resource Groups (BERGs) that represent and support the diverse communities that make up our workforce. The BERGs facilitate networking and connections with peers, outreach and mentoring, leadership and skill development and cross-cultural business.”

Mattel, which owns properties like He-Man, in its 2020 report stated its Diversity & Inclusion commitments: “As a purpose-driven company, we have raised the bar on our commitment to corporate citizenship… Diversity, Equality and Inclusion (“DEI”) is another key priority for Mattel, and we are building on our long heritage in this important area by continuing to advance our DEI efforts across the Company and representing diversity and inclusivity in our products.”

Discovery, which will control WarnerMedia including DC Comics in 2022, in its 2020 report announced its own Diversity & Inclusion objectives: “Our DE&I objective is to foster a culture of equity, inclusion, and mutual respect. In 2020 we emphasized our DE&I focus through Mosaic – our Diversity, Equity and Inclusion activation. Mosaic covers a range of initiatives, including: Unconscious Bias, Respect & Integrity; Allyship; Recruitment and Career Development; Content Diversity; Supplier Diversity; and Social Impact. We sponsor over 30 chapters of Employee Resource Groups (“ERGs”) across the globe with more than 2,500 members. ERGs draw upon their collection of unique experiences to help drive our mission of fostering a diverse and inclusive environment and provide important insights to our diversity, equity and inclusion initiatives… We have a department dedicated to social good that builds and oversees consumer and employee-facing initiatives and campaigns. We leverage our platforms, resources, and employee base to make an impact in our communities and with our key nonprofit partners. We have corporate partnerships aimed at addressing childhood hunger, racial injustice and wildlife preservation.”

And Hasbro in its 2020 report announced explicit racial and gender hiring quotas: “Diversity & Inclusion Goals: Increase the percentage of women in director and above roles globally to 50% by 2025. Expand ethnically and racially diverse employee representation in the U.S. to 25% by 2025. Include a 50% diverse slate of candidates for all open U.S. positions where there is underrepresentation.”

From a personnel point of view, when big mergers happen alongside the institution of Diversity & Inclusion policies, while, male, conservative Republicans are purged if they dare speak up. Or maybe the work just dries up.

And it’s not isolated to just the entertainment industry. It’s across the board. A March 2021 ESG Report by Pfizer set 2025 "opportunity parity goals” including "increasing our minority representation from 19% to 32% and doubling the underrepresented population of African Americans/Blacks and Hispanics/Latinos." Those are racial hiring quotas.

But Diversity & Inclusion goals go even further than just violating Title VII of the Civil Rights Act.

In some cases, they support human experimentation on children. More generally, but no less pernicious, in 2021, nearly 300 companies including NBC, Paramount, Sony, Google, Twitter, Facebook, Apple, Intuit, Microsoft, Adobe, Amazon, AT&T, T-Mobile, and almost all the big banks, etc. signed a letter stating "We are deeply concerned by the bills being introduced in state houses across the country that single out LGBTQ individuals - many specifically targeting transgender youth - for exclusion or differential treatment. Laws that would affect access to medical care for transgender people, parental rights, social and family services, student sports, or access to public facilities such as restrooms, unnecessarily and uncharitably single out already marginalized groups for additional disadvantage."

These statements are all in favor of "access to medical care for transgender people" including for "transgender youth" since they oppose any bills that would exclude them from anything. And many of them are public utilities, financial institutions, social media, etc. that we all depend on, essentially. This is yet another reason why just having a few tremendous hedge funds and money managers controlling all access to capital, whether from institutional investors like banks or individual retirement accounts via ESG is such a problem. Why? Because if you support laws that would prohibit underage child mutilation, in these “inclusive” companies, you’ll be fired.

Just ask former Disney actress Gina Carano, who was eventually fired from the popular show, The Mandalorian, in part because she didn’t want to use pronouns in her Twitter biography. She also spoke out against Covid lockdowns, and shared a warning against dehumanizing your neighbors on the basis of their political or religious beliefs, as it might lead to genocides such as the Holocaust.

Either you talk the talk on Diversity & Inclusion, or there is no place for you. Meaning, in publicly traded corporations that accept ESG monies, you toe the line, or you’re out.

More broadly, ESG supports polices that include critical race theory training in corporate environments. In 2021, Fox Business’ Tyler O’Neill reported, “Major corporations had 'woke' trainings exposed in 2021,” writing, “Disney, Coca-Cola, American Express, Bank of America, Lowe's and Pfizer faced accusations that they trained employees on certain ‘woke’ ideas, such as putting ‘marginalized’ staff above ‘privileged’ staff, learning to ‘decolonize’ their minds’ and combating aspects of an alleged ‘White supremacy culture,’ such as perfectionism, individualism and objectivity. These ideas trace back to critical race theory (CRT) — a framework that involves deconstructing aspects of society to discover systemic racism beneath the surface. Current and former employees at American Express told Fox News that the change began after the police-involved killing of George Floyd in May 2020, but the ‘woke’ trainings came to light in 2021.”

I could go on and on, but I’m already three hours past my deadline. So, what could the federal government do under a new Trump administration, or some other Republican administration, but also Republican state governors and state legislatures, and also GOP state Attorneys General, since we know Democrats love these policies and won’t do anything?

1) Congress, the Labor Department, the federal Thrift Savings Plan and states should ban any investment by retirement plans into companies that are violating Title VII of the Civil Rights Act. Congress has explicit power under the Fourteenth Amendment to pass laws guaranteeing the equal protection of the law. Diversity & Inclusion’s racial and gender-based hiring quotas are an explicit, flagrant violation of federal laws, but also state laws. And so, state Republican Attorneys General should enforce those laws on companies in their states, in addition to state legislatures putting in place prohibitions for investments not merely for public pensions in ESG, but private retirement accounts. Congress has an explicit power under the Fourteenth Amendment to pass laws that guarantee equal protection. It’s about time they were enforced.

2) State Republican Attorneys General might also wish to challenge Labor Department, SEC, IRS and state rules that explicitly allow for Diversity & Inclusion racial and gender hiring quotas as an ESG factor in violation of Title VII, along with the Securities and Exchange Commission’s rulemakings that will enforce ESG on companies that don’t go along with those policies. The SEC is attempting to make certain that companies that tout ESG are sticking to what they say. Why are illegal racial and gender hiring quotas being incentivized by federal regulations? Perhaps state Attorneys General should ask the Supreme Court if it’s even allowed.

3) Similarly, Congress, the Labor Department, the federal Thrift Savings Plan and states should ban any investment by retirement plans into companies that are violating federal and state antitrust laws by engaging in divestment from U.S. carbon energy production that we still need, which is price gouging Americans at the gas pump, leading to inflation and favoring green companies. That’s collusion, and it’s illegal. Congress has an explicit power to craft antitrust legislation under Article I, Section 8’s power to regulate commerce. It’s about time they were enforced.

4) Congress has absolute power to raise taxes on anything they want. The saying goes, when you want more of something, you subsidize it, and when you want less of something, you tax it. Republicans in Congress could rescind wind production and solar tax credits, but they could also go much, much further. Tax deferment for retirement savings is optional. Both Congress and the IRS could explicitly ban tax deferment for Individual Retirement Accounts into investments that violated Title VII of the Civil Rights Act and federal antitrust laws.

5) A future president and state governors can issue executive orders executing the above suggestions in their relevant jurisdictions, by barring government and private retirement funds from investing in companies that brag about violating federal and state antitrust and civil rights laws.

It's quite simple. ESG violates federal and state antitrust and civil rights laws. It’s time to enforce the law. No more excuses, and no more wishful thinking. It does not matter what Republicans’ past failures on this issue have been. What matters is what we do about it now. Yes, ban it, Mr. President, Congress and state Republican governors — before it’s too late.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.