Email

Tax Professional Tip #8 – Education-Related Credits and Subtractions

| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #8 – Education-Related Credits and Subtractions |

| Date | February 23, 2023 5:19 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

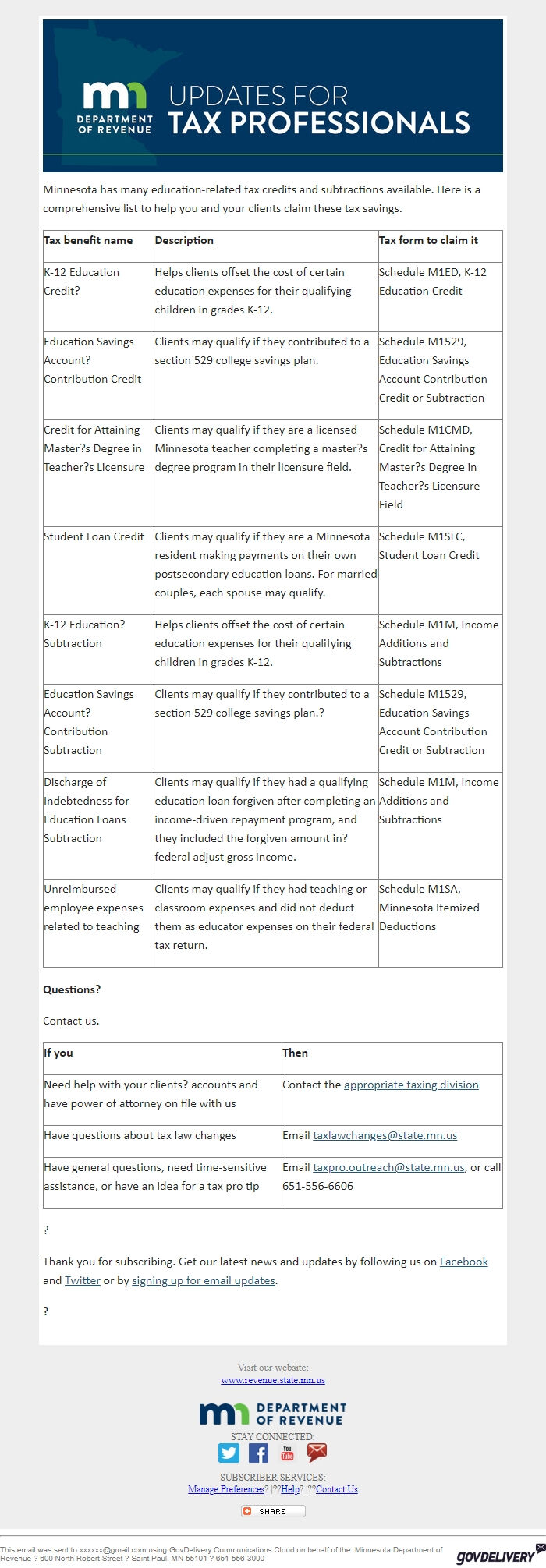

Minnesota has many education-related tax credits and subtractions available. Here is a comprehensive list to help you and your clients claim these tax savings.

*Tax benefit name*

*Description*

*Tax form to claim it*

K-12 Education Credit?

Helps clients offset the cost of certain education expenses for their qualifying children in grades K-12.

Schedule M1ED, K-12 Education Credit

Education Savings Account? Contribution Credit

Clients may qualify if they contributed to a section 529 college savings plan.

Schedule M1529, Education Savings Account Contribution Credit or Subtraction

Credit for Attaining Master?s Degree in Teacher?s Licensure

Clients may qualify if they are a licensed Minnesota teacher completing a master?s degree program in their licensure field.

Schedule M1CMD, Credit for Attaining Master?s Degree in Teacher?s Licensure Field

Student Loan Credit

Clients may qualify if they are a Minnesota resident making payments on their own postsecondary education loans. For married couples, each spouse may qualify.

Schedule M1SLC, Student Loan Credit

K-12 Education? Subtraction

Helps clients offset the cost of certain education expenses for their qualifying children in grades K-12.

Schedule M1M, Income Additions and Subtractions

Education Savings Account? Contribution Subtraction

Clients may qualify if they contributed to a section 529 college savings plan.?

Schedule M1529, Education Savings Account Contribution Credit or Subtraction

Discharge of Indebtedness for Education Loans Subtraction

Clients may qualify if they had a qualifying education loan forgiven after completing an income-driven repayment program, and they included the forgiven amount in? federal adjust gross income.

Schedule M1M, Income Additions and Subtractions

Unreimbursed employee expenses related to teaching

Clients may qualify if they had teaching or classroom expenses and did not deduct them as educator expenses on their federal tax return.

Schedule M1SA, Minnesota Itemized Deductions

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions, need time-sensitive assistance, or have an idea for a tax pro tip

Email [email protected], or call 651-556-6606

?

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for email updates [ [link removed] ].

*?*

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Minnesota has many education-related tax credits and subtractions available. Here is a comprehensive list to help you and your clients claim these tax savings.

*Tax benefit name*

*Description*

*Tax form to claim it*

K-12 Education Credit?

Helps clients offset the cost of certain education expenses for their qualifying children in grades K-12.

Schedule M1ED, K-12 Education Credit

Education Savings Account? Contribution Credit

Clients may qualify if they contributed to a section 529 college savings plan.

Schedule M1529, Education Savings Account Contribution Credit or Subtraction

Credit for Attaining Master?s Degree in Teacher?s Licensure

Clients may qualify if they are a licensed Minnesota teacher completing a master?s degree program in their licensure field.

Schedule M1CMD, Credit for Attaining Master?s Degree in Teacher?s Licensure Field

Student Loan Credit

Clients may qualify if they are a Minnesota resident making payments on their own postsecondary education loans. For married couples, each spouse may qualify.

Schedule M1SLC, Student Loan Credit

K-12 Education? Subtraction

Helps clients offset the cost of certain education expenses for their qualifying children in grades K-12.

Schedule M1M, Income Additions and Subtractions

Education Savings Account? Contribution Subtraction

Clients may qualify if they contributed to a section 529 college savings plan.?

Schedule M1529, Education Savings Account Contribution Credit or Subtraction

Discharge of Indebtedness for Education Loans Subtraction

Clients may qualify if they had a qualifying education loan forgiven after completing an income-driven repayment program, and they included the forgiven amount in? federal adjust gross income.

Schedule M1M, Income Additions and Subtractions

Unreimbursed employee expenses related to teaching

Clients may qualify if they had teaching or classroom expenses and did not deduct them as educator expenses on their federal tax return.

Schedule M1SA, Minnesota Itemized Deductions

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions, need time-sensitive assistance, or have an idea for a tax pro tip

Email [email protected], or call 651-556-6606

?

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for email updates [ [link removed] ].

*?*

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery