Feb. 20, 2023

Permission to republish original opeds and cartoons granted.

Unadjusted unemployment continued claims up 755,000 since Oct. 2022 after peak inflation. When will unemployment begin to tick upward?

By Robert Romano

Non-seasonally adjusted unemployment continued claims have steadily increased by 755,000 since Oct. 2022, the latest data from the U.S. Department of Labor shows, amid a smattering of layoffs in certain sectors as labor markets continue to show signs they have no further room for expansion amid sticky elevated inflation, interest rates and as households are reaching the max on their credit cards.

There are now 1.95 million Americans who keep coming back for continued unemployment assistance, from its 1.19 million level in October.

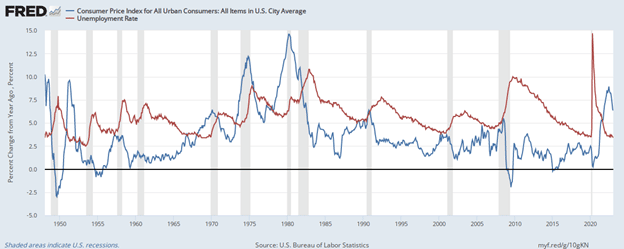

This comes after peak inflation—I should add, we hope it was peak inflation—was reached in June 2022 at about 9 percent over the 12-month stretch, and remains elevated but has slowed to 6.4 percent in the latest reading. Which, is what usually happens as inflation and overall unemployment tend to run opposite of one another throughout the entire postwar period, looking at Bureau of Labor Statistics data over the long haul.

In Jan. 1948, consumer inflation peaked at 10.2 percent and by Oct. 1949, unemployment had ticked up to a high of 7.9 percent before receding as the recovery ensued.

In April 1951, inflation topped off at 9.6 percent, and by Sept. 1954, the recession had come and unemployment reached 6.1 percent.

In March 1957, inflation reached its high in the business cycle of 3.6 percent—it actually doesn’t matter if it gets to really high levels or not, just that the peak is reached—and by July 1958 unemployment had reached 7.5 percent.

In Feb. 1970, inflation hit 6.4 percent and by Dec. 1970, unemployment hit 5.6 percent.

In Nov. 1974, inflation peaked at 12.2 percent and by June 1975, unemployment hit 8.8 percent.

In April 1980, inflation hit its highest level in the post war period at 14.6 percent, and by July 1980 unemployment—which was already creeping upward—had immediately ticked up to 7.8 percent from 6.3 percent in March 1980.

In Sept. 1981, inflation had hit another high of 10.96 percent, and by Nov. 1982, unemployment had reached 10.8 percent.

In Dec. 1990, inflation reached 6.25 percent, followed by 7.8 percent unemployment in July 1992.

In March 2000, inflation peaked at 3.76—remember, the size of the inflation doesn’t matter, just that it reach its pinnacle in the business cycle—and by June 2003, unemployment reached 6.3 percent before subsiding.

In Aug. 2008, inflation peaked at 5.3 percent and by Oct. 2009 unemployment had skyrocketed to 10 percent.

And in the Covid recession, it’s tougher to gauge because the recession was not caused by the economy overheating per se but by the artificial economic lockdowns and production halts as people were subsidized by governments not to work. That said, inflation had peaked in July 2018 at 2.85 percent and by April 2020, unemployment hit 14.7 percent.

Like clockwork, in every single recession, peak inflation and employment was followed by a dipping of the inflation rate and an increase in the unemployment rate, sometimes by a lot, and sometimes by a bit. On average, the process appears to take about 15 months, but the range is as few as 3 months to as many as 39 months.

In our current instance, with the levels of unemployment continued claims coming in, though, it is not yet discernible in the unemployment rate itself, which remains at historic lows of 3.4 percent. It appears that if peak inflation was indeed the 9 percent rate we saw in June 2022, then all of the unemployment remains ahead of us, whatever size that might be.

Of course there are other factors, including the Federal Reserve’s posture on interest rates determined to tackle the consumer inflation. So far, the Fed has not dared to bring the Federal Funds Rate, which effectively is at 4.3 percent, while the consumer inflation rate is at 6.4 percent.

When the Fed raises interest rates on banks in this manner, which in turn hikes interest rates on consumers, it soaks up the additional dollars that were created during the economy’s expansion period. That means that debt service costs are increasing at the same time as consumer prices, which eventually interdicts consumer spending, softening demand and that’s when the unemployment kicks upward.

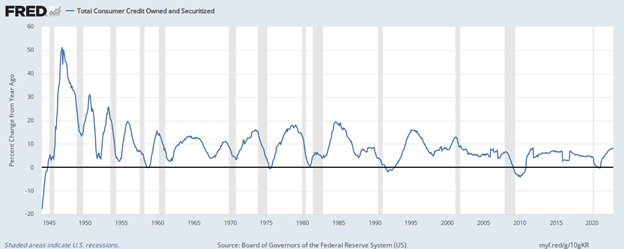

Sure enough, the annual growth of consumer credit appears to have just hit a seeming high of 8.1 percent in Oct. 2022, and has flattened and is slightly down to 7.8 percent annualized in Dec. 2022.

The implication is that the either the Fed is waiting for or hoping that consumer inflation will get below that of the Federal Funds Rate without it having to pop the bubble itself. That said, wartime spending or other emergency spending by Congress or Fed easing could also reinstate the inflation cycle, too, although the Fed appears to remain committed to tightening on the current circumstances, and with the U.S. House of Representatives controlled by Republicans, divided government has a habit of cooling spending.

As the Fed continues to hike interest rates, albeit at a slower pace than before, consumer interest costs will continue to rise until they capitulate on spending, demand weakens and the layoffs begin at a larger pace. But, how high unemployment will go in what appears to be an imminent recession could in many ways be tamed by the ongoing labor shortages brought on by low fertility rates and the Baby Boomer retirement wave, akin to a wartime draft situation where the unemployment rate remains artificially low. And we might be on the brink of war anyway, so there’s that.

Assuming no world wars, this is where we appear to be the current cycle, past peak inflation and awaiting a commensurate upturn in joblessness. Unless 9 percent inflation in June 2022 was not peak inflation — there’s a small chance but it’s still possible — and then we might need to reset our clocks. But the weekly unadjusted continued unemployment claims are still worth keeping your eyes on. As usual, stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Video: Americans Fleeing California

Billionaire John Arnold's group sent millions to groups that backed 'defunding' police

by Gabe Kaminsky

Left-wing advocacy groups that have supported the controversial "defund" police movement have received tens of millions of dollars from a Texas billionaire who has backed efforts across the United States to overhaul the criminal justice system, records show.

John Arnold, a former Enron executive, has emerged as a major donor to organizations that have supported policies such as cashless bail that Republicans argue lead to crime spikes. Through his limited liability corporation, Arnold Ventures, the billionaire has steered $17.2 million to four organizations behind efforts and calls to strip law enforcement of crucial resources, according to records reviewed by the Washington Examiner.

"Arnold Ventures opposes calls to defund the police," a spokesperson for the LLC told the Washington Examiner. "We are guided by the objective of improving public safety. Research shows that law enforcement can be effective at reducing violent crime and plays an integral role in ensuring community safety."

Arnold's donations through the years from his LLC have remained relatively obscure, despite other major philanthropists like George Soros gaining prominent attention in media outlets. Arnold Ventures does not legally have to disclose entities that it awards grants to, but the LLC says on its website that it has delivered hundreds of millions in criminal justice grants since 2015.

The Washington Examiner revealed in January that AV has bankrolled left-leaning criminal justice policy blueprints in Indiana and "racial justice" research, which experts say could harm public safety if implemented.

"We support fair and effective policing, which is policing that is accountable to communities and helps advance community safety," the AV spokesperson added. "We have partnered with law enforcement departments across the country in support of research on effective policing practices."

Following the murder of George Floyd in May 2020, progressive groups launched comprehensive defund the police initiatives. Cities such as Minneapolis, Minnesota, approved policies that diverted funding from law enforcement to other entities and projects. Still, many have backpedaled dramatically as violent crime rippled during and after the social justice riots of 2020.

One organization that AV has bankrolled is Worth Rises, which is dedicated to “dismantling the prison industry." Worth Rises, a New York-based nonprofit group that in 2021 received $75,000 from AV for "general support," is a major proponent of defunding police.

"Yes, more than ever," Bianca Tylek, executive director of Worth Rises, told the Washington Examiner when asked if the group still supports the movement.

Worth Rises has called to "dismantle" police and urged state legislatures to roll back budgets. Tylek, a Harvard Law School graduate in 2016, was once an equal justice works fellow at the Brennan Center for Justice, a liberal social justice group heavily funded by Soros.

"Yes, we must #DefundPolice," tweeted Worth Rises in June 2020. "We cannot reform a system designed to brutalize and exploit Black people. We must dismantle it. We do that by removing its financial power. It's time we unpack how police and prisons are funded."

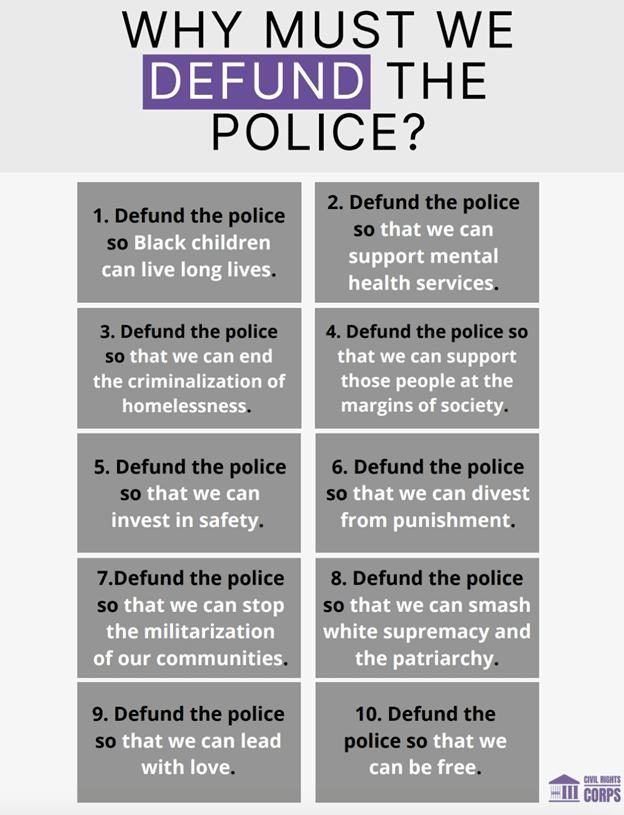

Civil Rights Corps, a nonprofit group in Washington, D.C., aiming to confront "systemic injustice" and the purported "white supremacy and economic inequality" of the legal system, received $1 million from AV between 2020 and 2022, records show. The group has taken aim at the bail system and litigates on issues related to it.

In 2021, Civil Rights Corps published a memo that listed several reasons why defunding the police is allegedly a good policy. These included claims that black children would live longer, that people would be more "free," and that the U.S. would benefit from a "punishment" divestment.

Credit/Civil Rights Corps

"The idea that police protect communities from violent crime is a myth," tweeted Civil Rights Corps in March 2022. "They disrupt, target, and often inflict violence on black and brown communities. Police don’t promote safety, they commit the violent crime they claim to protect us from."

"Abolition of #police and systems is not just about introducing legislation in the names of victims and giving police more money & training — it’s about dismantling the system and creating a new system of 'public safety,'" the group added.

Forward Justice, a North Carolina nonprofit group "dedicated to advancing racial, social, and economic justice in the U.S. South," received $325,000 from AV in 2020 to "end the practice in North Carolina of funding criminal-support systems through harmful and unjust legal fines and fees," records show.

The group issued a "statement of solidarity in 2020 that called to "dismantle the systems of racism and oppression that have gripped this nation for centuries."

"We must defund and demilitarize the police, end qualified immunity for killer cops, create community accountability and review boards with subpoena power, and invest in the brilliance of our communities to begin the institutional reckoning that must take place to create a fair and equitable criminal legal system," the statement read.

Another group that has supported defunding the police while taking cash from AV is the Vera Institute of Justice, a left-leaning research and policy hub. AV has granted over $15.8 million to the institute between 2016 and 2022 for issues related to bail reform and prosecutor research, as well as prison pilot programs.

In June 2020, the institute published an article called "Protecting Black Lives: The Crisis of American Policing," noting it is "committed to dismantling the current culture of policing and working toward solutions that defund police and shift power to communities."

"We’re building on this unique moment of public awareness, outrage, and calls to defund the police."

Scott Walter, president of the Capital Research Center, a conservative investigative think tank, said it's "sad" to see how John Arnold has continued to overlap in his donations with the likes of Soros and Meta CEO Mark Zuckerberg.

"Oddly, as he moves leftward, Arnold has taken to whining when anyone points out what he’s doing," he told the Washington Examiner.

Civil Rights Corps, the Vera Institute of Justice, and Forward Justice did not reply to requests for comment.

To view online: https://www.washingtonexaminer.com/news/justice/billionaire-john-arnolds-group-sent-millions-groups-backed-defunding-police