|

|

Nobel Laureate Economist Paul Krugman Details Decades of GOP Plans to Cut Social Security and Medicare |

|

Despite some Republicans’ claims to the contrary, columnist and economist Paul Krugman reminded readers this week that many in the GOP do want to eviscerate Social Security and Medicare, writing that "to believe otherwise requires both willful naïveté and amnesia about 40 years of political history.” |

|

|

Paul Krugman |

|

After President Biden’s State of the Union address last week, Senate Republican Leader Mitch McConnell (KY), had tried to distance his party from Sen. Rick Scott’s (FL) proposal to sunset all federal government programs, including Social Security and Medicare after five years; that would force Congress to reauthorize them. However, Krugman wasn’t buying McConnell’s argument when McConnell said, "that was the Scott plan, that’s not a Republican plan.” |

|

On MSNBC’s The Beat with Ari Melber Monday, Krugman said, “Republicans learned that being too explicit about what it is many of them want to do hurts them badly......Mitch McConnell hates the fact that Rick Scott said [it]. That's not saying that Mitch McConnell is actually opposed to doing it, he just wants somebody else's fingerprints to be on it."

“Senate Republican Leader McConnell is trying to confuse us,” agreed Robert Roach, Jr., President of the Alliance. “He has been at the forefront of an effort to cut Social Security and Medicare for years. He would like us to forget, but retirees will make sure the American people have the facts.”

Earlier today Sen. Scott responded to widespread criticism of his "Rescue America" plan to sunset all federal legislation and edited the document to exempt “Social Security, Medicare, national security, veterans benefits, and other essential services.” However, this document was not the only time he has said that Social Security and Medicare must be altered. |

|

Congressional Republican Agenda Would Increase the Debt by Over $3 Trillion

|

|

The White House released a new fact sheet this week showing that the House Republicans’ legislative agenda would increase the national debt by over $3 trillion over 10 years.

The first bill passed by the new Republican House majority would increase the debt by $114 billion by preventing the IRS from ensuring the wealthiest Americans and corporations pay their fair share in taxes.

Congressional Republicans have also proposed repealing — and are even running ads attacking — reforms President Biden signed to lower prescription drug prices for people on Medicare. Repealing these policies means Medicare would pay more to the drug corporations, increase prices for beneficiaries, and add $159 billion to the deficit.

House Republicans want to repeal several tax increases on large corporations that President Biden signed into law That would add another $296 billion to the debt.

The House GOP also wants to extend the expiring 2017 Trump tax cuts, giving Americans with incomes over $4 million per year a $175,000 tax increase. That would result in a $2.7 trillion debt increase.

“Republicans are saying we must increase the retirement age and cut Social Security and Medicare benefits to reduce the debt,” said Joseph Peters, Jr., Secretary-Treasurer of the Alliance. “In reality they want to cut the benefits we’ve earned to provide even more tax breaks to the wealthiest Americans and big corporations.”

Download a copy of the White House Fact Sheet here. |

|

Senators Sanders and Warren, Reps. Schakowsky and Hoyle Introduce Legislation to Expand Social Security |

|

As Republicans threaten cuts to Social Security and other essential federal programs, Sens. Bernie Sanders (VT) and Elizabeth Warren (MA), along with Reps. Jan Schakowsky (IL) and Val Hoyle (OR), introduced legislation Monday that would expand Social Security benefits by $200 a month across the board and ensure Social Security is fully funded for the next 75 years.

The bill would not raise taxes on the 93% of American households that make $250,000 or less per year.

S. 393, the Social Security Expansion Act, also increases Cost-Of-Living-Adjustments by adopting the Consumer Price Index for the Elderly (CPI-E) and updates the Special Minimum Benefit for Social Security recipients by making it easier to qualify, helping low-income workers to stay out of poverty.

The bill does not, however, repeal the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO), which prevents 2.5 million retirees from receiving all of the Social Security benefits they have earned. The Alliance supports both Social Security expansion and repeal of the unfair WEP-GPO provisions.

“Social Security should be expanded, not cut or changed,” said Richard Fiesta, Executive Director of the Alliance. “This bill shows that we can strengthen Social Security for current and future generations - and increase benefits - if we require the wealthiest American households to pay their fair share of Social Security taxes." |

|

One in Four American Older Adults Needed Long Term Care for Themselves or a Loved One Last Year |

|

Twenty-four percent of U.S. adults ages 50 and older say they, or a loved one, needed long-term care in the past year, according to a recent Nexus Insights survey.

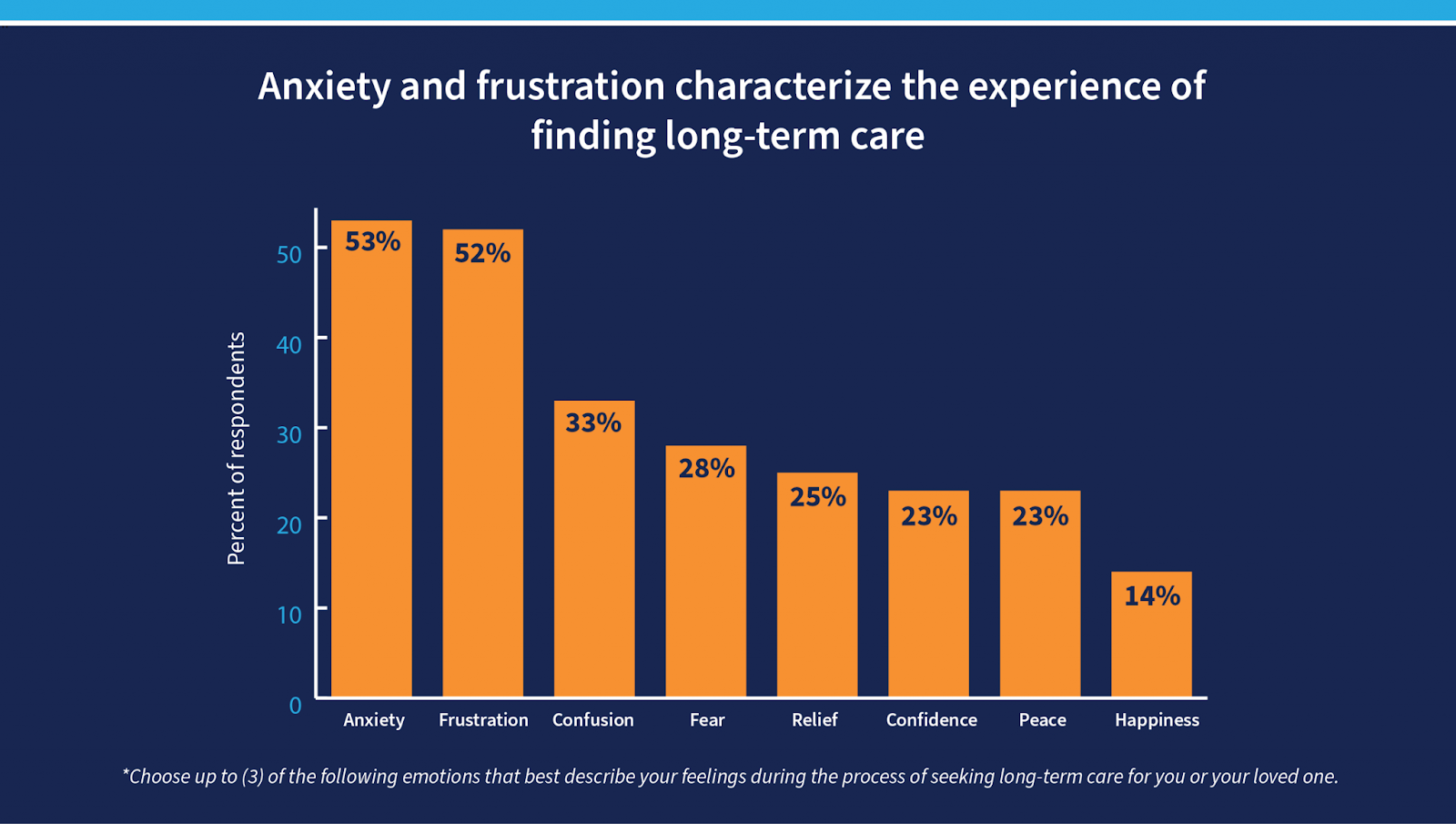

According to the survey, most older adults said the process of selecting long-term care caused anxiety (53%) and frustration (52%). Few said they felt confident (23%) or at peace (23%) while making a choice.

Respondents also said it was extremely important to have additional information about the cost of care and options to pay for it (69%) and the different types of long-term care services available (63%). |

|

|

Source: Nexus Insights |

|

“These findings serve as another reminder that solving the long term care crisis is important for all Americans,” said President Roach. “We need affordable, safe, high-quality long term care options in this country. Too many Americans of all ages are forced to put their own economic security at risk to take care of a loved one who needs care.” |

|

Thanks for reading. Every day, we're fighting to lower prescription drug prices and protect retirees' earned benefits and health care. But we can't do it without your help. Please support our work by donating below. |

|

|

|

|

Alliance for Retired Americans | 815 16th Street, NW | Washington, DC 20006 | www.retiredamericans.org