| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #7 – Return verification letters |

| Date | February 16, 2023 9:21 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

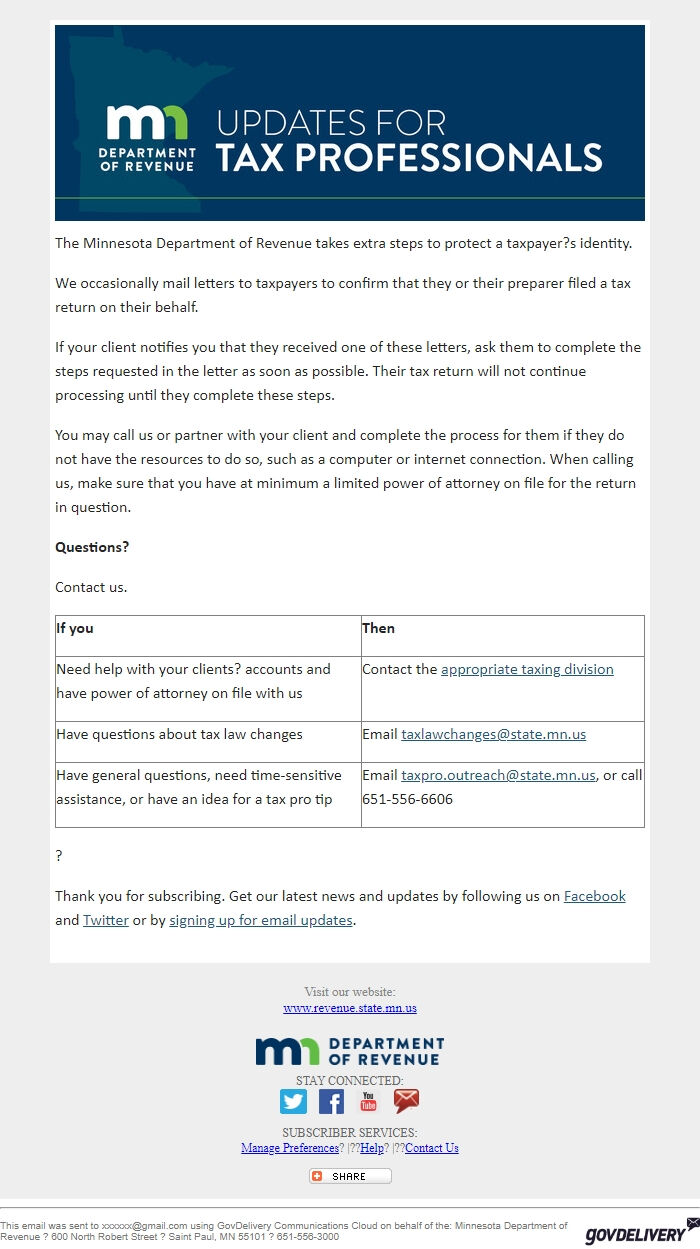

The Minnesota Department of Revenue takes extra steps to protect a taxpayer?s identity.

We occasionally mail letters to taxpayers to confirm that they or their preparer filed a tax return on their behalf.

If your client notifies you that they received one of these letters, ask them to complete the steps requested in the letter as soon as possible. Their tax return will not continue processing until they complete these steps.

You may call us or partner with your client and complete the process for them if they do not have the resources to do so, such as a computer or internet connection. When calling us, make sure that you have at minimum a limited power of attorney on file for the return in question.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions, need time-sensitive assistance, or have an idea for a tax pro tip

Email [email protected], or call 651-556-6606

?

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

The Minnesota Department of Revenue takes extra steps to protect a taxpayer?s identity.

We occasionally mail letters to taxpayers to confirm that they or their preparer filed a tax return on their behalf.

If your client notifies you that they received one of these letters, ask them to complete the steps requested in the letter as soon as possible. Their tax return will not continue processing until they complete these steps.

You may call us or partner with your client and complete the process for them if they do not have the resources to do so, such as a computer or internet connection. When calling us, make sure that you have at minimum a limited power of attorney on file for the return in question.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions, need time-sensitive assistance, or have an idea for a tax pro tip

Email [email protected], or call 651-556-6606

?

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery