Feb. 15, 2023

Permission to republish original opeds and cartoons granted.

As inflation remains elevated at 6.4 percent, there is still a bumpy road ahead for the U.S. economy

|

|

Senate Should Reject Radical FCC nominee

By Rick Manning

The Federal Communications Commission oversees regulations impacting our nation’s broadcasters. Rules creating an important and delicate balance to ensure the airwaves meet the needs of the public whether they be in the most rural parts of America or the most urban.

President Joe Biden has continued to mistakenly push the nomination of Gigi Sohn, who has failed to garner the necessary votes for Senate confirmation in both 2021 and 2022. Now, he is pressing the Senate once more for this radical nominee’s confirmation. A confirmation which would tip the balance on the FCC.

Every nominee brings their own baggage and that is to be expected, but Ms. Sohn is carrying a truck load. As a private citizen she has advocated that the FCC deny the licenses of broadcasters who she perceives present too conservative of a viewpoint. It is fine for her to hold these views, but it is not okay for her to be confirmed to serve on the FCC, where she will have power to impose this government driven information censorship on the broadcasting community.

While unfortunately, the left no longer believes in the adage that I don’t agree with what you say, but will fight to the death to defend your right to say it, instead replacing it with your language offends me so I’m going to have you de-platformed so no one can hear it.

But even those who think banning speech that is not approved by those in power in the federal government is fine should be concerned about Gigi Sohn’s record of irresponsibility as an advisor to a past FCC Chairman. Ms. Sohn has the audacity to leak information with the goal of submarining a bipartisan compromise which she opposed.

Commissions like the FCC depend upon the members being able to trust one another to have frank and honest discussions between members and staff in order to come to conclusions on many issues confronting them. Sohn’s demonstrated willingness to undermine this process because the end result doesn’t meet her radical philosophy.

Senate Minority Leader Mitch McConnell rejected Sohn today saying, “The country needs our FCC commissioners to be thoughtful, sober, nonpartisan referees. Not activists and ideologues who want to bend our airwaves to their agenda.”

He is right. America faces many problems in the upcoming couple of years, the last thing we need is a partisan wrecking crew in charge of the FCC disrupting our over the airwaves broadcast system. There simply is no place on a body as important to freedom of expression as our nation’s FCC for a speech banning radical idealogue like Gigi Sohn.

Americans for Limited Government strongly urges the U.S. Senate to reject her nomination when and if it should come to the floor.

Rick Manning is the Presidnet of Americans for Limited Government.

To view online: https://dailytorch.com/2023/02/senate-should-reject-radical-fcc-nominee/

Video: Senator Rand Paul Introduces Bill To END Vax Discrimination

To view online: https://www.youtube.com/watch?v=33AwWd54JWc

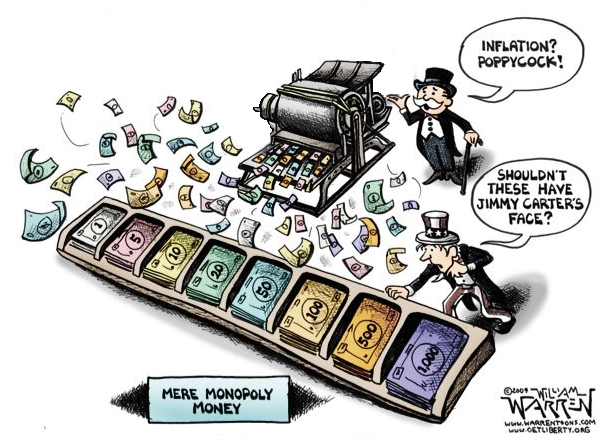

As inflation remains elevated at 6.4 percent, there is still a bumpy road ahead for the U.S. economy

By Robert Romano

Consumer inflation remains elevated 6.4 percent over the past 12 months, with a 0.5 percent increase in January, according to the latest data from the U.S. Bureau of Labor Statistics.

Food was up 0.5 percent—and 10.1 percent for the past year.

Energy was up 2 percent, including a 2.4 percent jump in gasoline. Overall, it’s up 1.5 percent the past year at current levels.

Also, utility gas service was up 6.7 percent, following a 3.5 percent jump in December. It’s up 26.7 percent the past year.

Shelter was up 0.7 percent—up 7.9 percent the past year.

And transportation was up 0.9 percent, with a 14.6 percent jump the past year.

The continued, elevated, upward movement in prices comes as the Federal Reserve has decreased the size of its interest rate hikes.

In its Feb. 1 meeting of the Board of Governors, the Fed kept hiking its own policy rate, now reaching 4.5 to 4.75 percent, and it’s not over yet as the central bank said it “anticipates that ongoing increases in the target range” could be necessary going forward.

According to the central bank’s statement, “the Committee decided to raise the target range for the federal funds rate to 4-1/2 to 4-3/4 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

The truth is there’s still a lot of excess dollars in the system left over from the Covid monetary expansion, where more than $6 trillion was spent, borrowed and printed into existence to offset the economic lockdowns, production halts and the temporary spike in unemployment, where 25 million Americans lost their jobs.

As a result the M2 money supply increased dramatically from $15.3 trillion in Feb. 2020 to a peak of $22 trillion by April 2022, a massive 43.7 percent, leading to the inflation spike, where consumer inflation reached 9.1 percent in June 2022. In fact, by the time Russia invaded Ukraine in Feb. 2022—further worsening global supply issues—consumer inflation was already north of 7.5 percent.

The inflation was going to happen anyway. It was too much money ($6 trillion) chasing too few goods (Covid production halts).

Even at the Fed’s current elevated interest rates, the M2 money supply has now decreased from its highs to $21.3 trillion, but is that enough to cool off the inflation and return to price stability? Perhaps hoping not to pop the bubble on its own, the Federal Funds Rate still remains a couple points below the consumer inflation rate, as the central bank appears to be cautiously hoping inflation will come down on its own.

But that usually happens in recessions with the unemployment rate spiking. Unemployment is still at quite historic lows of 3.4 percent. That might explain the sticky high prices, but also the ongoing labor shortages as the Baby Boomers continue retiring en masse.

In that sense, the U.S. economy looks more like a wartime economy than anything else. There, the civilian labor shortages are caused by drafts, artificially lowering the pool of working age men and relatively lower unemployment rates. In the current case, the labor shortages are caused by poor long-term fertility, which in the U.S. is down to 1.63 babies per woman in 2020 and dropping, below the replacement rate. It went down below 2 babies per woman in 2010, and it’s been 13 years, and so the resulting labor force declines will not even begin to be felt for another three years, and then should be continuing to be felt for several years to come.

Those are simultaneous inflationary and deflationary pressures, which if policy makers cannot figure out what the downstream effects of both are, could keep them guessing. But what the Fed usually does is treat the symptoms. Inflation remains elevated, and so expect more interest rate hikes. And then when the recession comes, expect them to lower rates again. It could be a bump road ahead. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.

To view online: https://dailytorch.com/2023/02/as-inflation-remains-elevated-at-6-4-percent-there-is-still-a-bumpy-road-ahead-for-the-u-s-economy/