|

John,

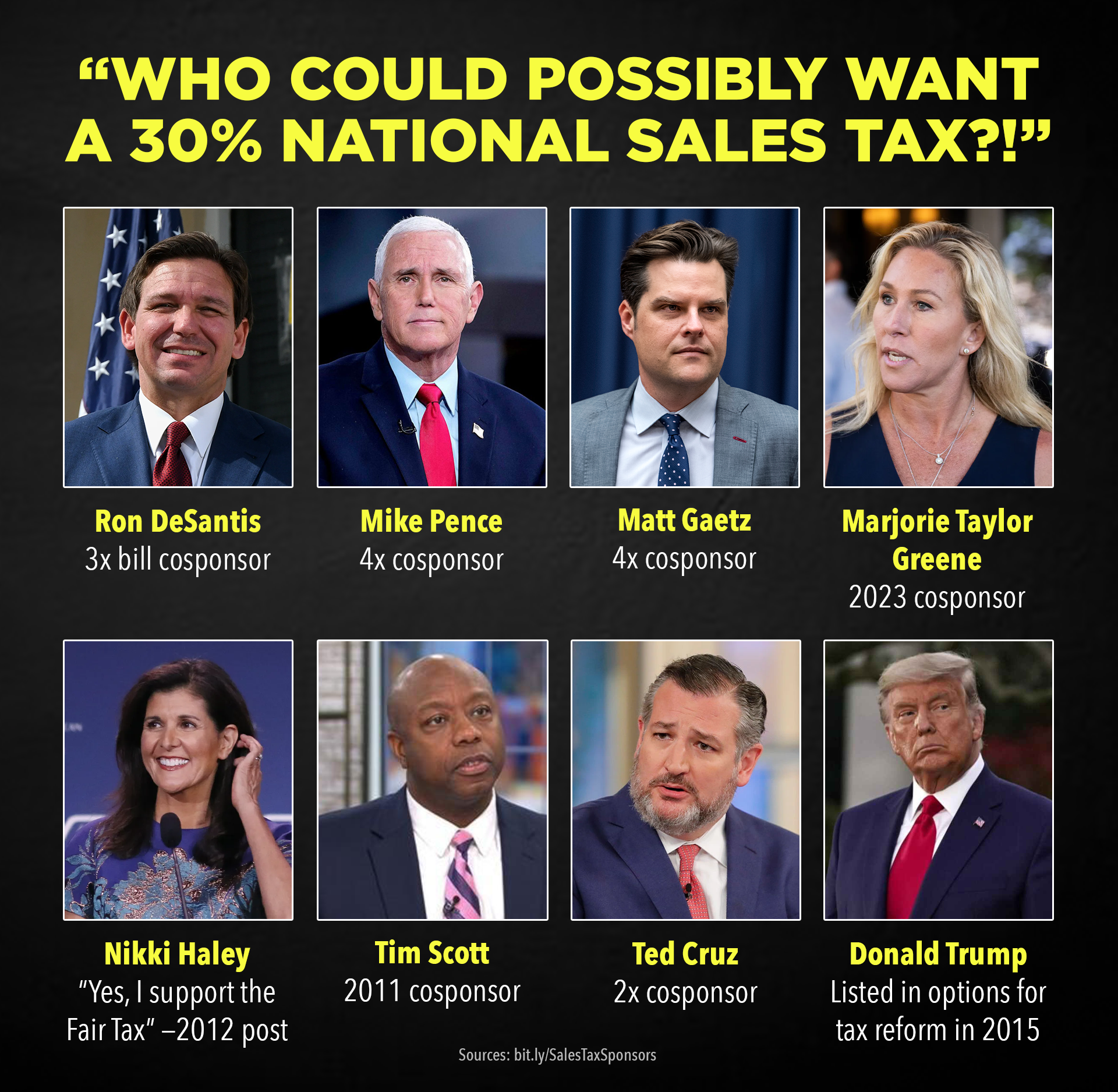

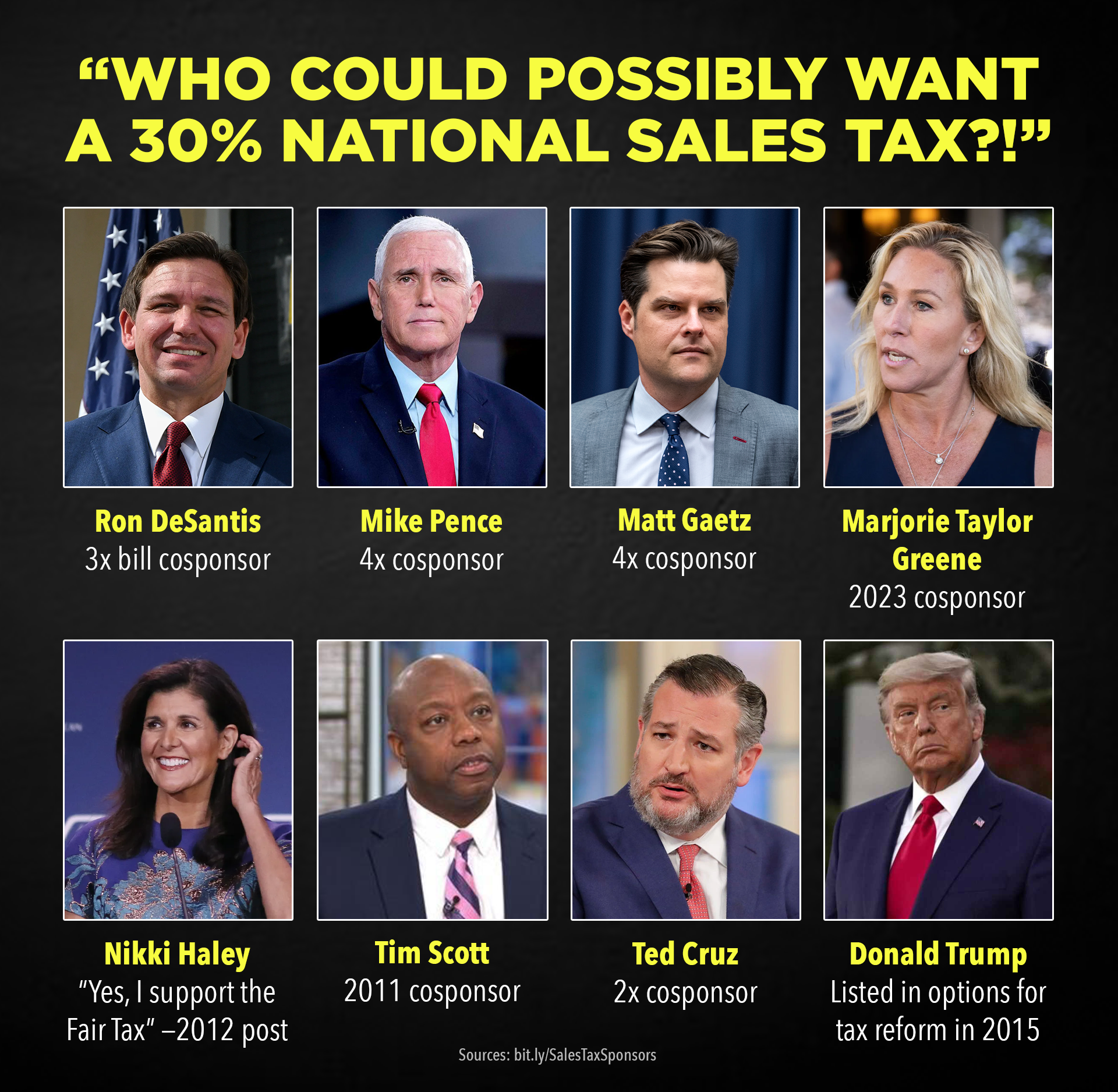

From Ron DeSantis to Mike Pence to Nikki Haley, leading Republicans are lining up to show just how extreme they can be in slashing taxes paid by their millionaire and billionaire donors.

Help us bring our latest infographic below to thousands of people to fight back against the Republican plan to abolish the IRS and abolish the entire federal tax code in favor of a regressive 30% national sales tax. It will dramatically cut taxes on the rich while making working families pay way more out of pocket.

Pitch in today to hold Republicans accountable and fight for a tax code that makes the wealthy pay their fair share.

Abolishing the federal income tax code in favor of a flat national sales tax of 30% is no longer a fringe issue in the Republican Party.

On issue after issue, from voting rights to abortion rights to workers’ rights and more, Republicans represent a small minority of Americans.

The vast majority of Americans are with us in demanding the wealthy and corporations pay their fair share.[1] Donate today to rally the American public against this bad GOP plan to slash taxes on the wealthy and dramatically increase out-of-pocket expenses for all Americans.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we are leading the national movement demanding the wealthy start paying their fair share in taxes.

Andrea Haverdink

Digital Director

Americans for Tax Fairness Action Fund

[1] “Polling Compilation: Inflation Reduction Act, Biden’s Tax Plan, Taxing the Wealthy & Corporations, Tax Cuts & Jobs Act,” Americans for Tax Fairness, Dec. 1, 2022

-- Frank's email --

John,

Abolishing the federal tax code in favor of a regressive 30% national sales tax used to be a fringe issue in the Republican Party. Not anymore:

Each of these leading Republicans supports legislation that will abolish the IRS and abolish the entire federal tax code, from income taxes to the payroll taxes that fund Social Security and Medicare, to estate and gift taxes only paid by the very wealthy.

They support legislation that will replace those taxes with a 30% national sales tax that will dramatically cut taxes on the rich while making working families pay way more out of pocket.

Speaker of the House Kevin McCarthy has already committed to holding a vote on this bill. Rush a donation today to help us bring our latest infographic above to folks across the country and shine a spotlight on the GOP plan to raise taxes on working people.

Republicans claim to care about inflation, but it will take a national sales tax of between 30% – 60% on all goods and services to make up for abolishing federal income, payroll, estate, and gift taxes.[1] This will dramatically increase out-of-pocket expenses for all Americans.

While our current tax code is riddled with loopholes that allow the wealthy to avoid paying their fair share in taxes, the federal income tax is still much more progressive than a flat sales tax.

An Institute on Taxation and Economic Policy study shows that the top 1% pays just a 0.9% average share of their income in state sales taxes compared to a 7.1% share for the lowest-income households.[2] So, this new Republican bill would shift who pays taxes by A LOT.

Fight back against the Republican plan to slash taxes paid by the wealthy and increase taxes paid by working- and low-income families. Donate today!

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Republicans are increasingly out of touch with everyday Americans who overwhelmingly believe that the wealthy and corporations should pay their fair share in taxes. Thank you for fighting back against policies that further rig our economy and our tax system toward the wealthy and powerful.

Frank Clemente

Executive Director

Americans for Tax Fairness Action Fund

[1] “'Fair Tax’ Plan Would Abolish the IRS and Shift Federal Taxes from the Wealthy to the Rest of Us,” Institute on Taxation and Economic Policy, Jan. 11, 2023

[2] “Who Pays? 6th Edition,” Institute on Taxation and Economic Policy

|