| From | USAFacts <[email protected]> |

| Subject | See how much money the government collects per person |

| Date | February 14, 2023 2:30 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Plus, get facts and numbers behind Biden's State of the Union

Not displaying correctly? View this email in your browser ([link removed]) .

[link removed]

** How much does the government collect per person?

------------------------------------------------------------

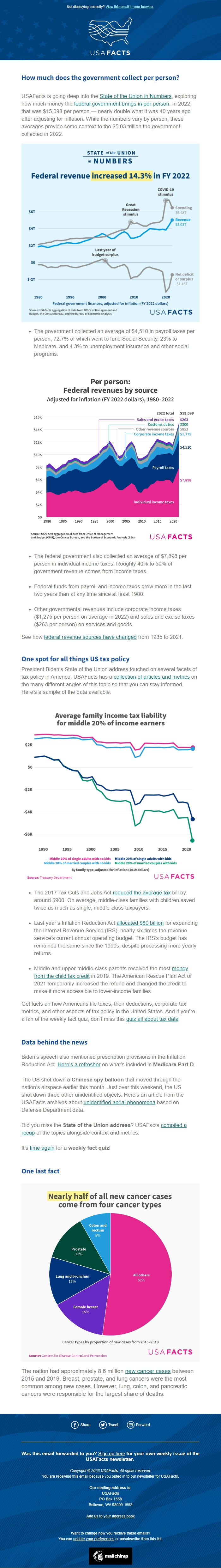

USAFacts is going deep into the State of the Union in Numbers ([link removed]) , exploring how much money the federal government brings in per person ([link removed]) . In 2022, that was $15,098 per person — nearly double what it was 40 years ago after adjusting for inflation. While the numbers vary by person, these averages provide some context to the $5.03 trillion the government collected in 2022.

[link removed]

* The government collected an average of $4,510 in payroll taxes per person, 72.7% of which went to fund Social Security, 23% to Medicare, and 4.3% to unemployment insurance and other social programs.

[link removed]

* The federal government also collected an average of $7,898 per person in individual income taxes. Roughly 40% to 50% of government revenue comes from income taxes.

* Federal funds from payroll and income taxes grew more in the last two years than at any time since at least 1980.

* Other governmental revenues include corporate income taxes ($1,275 per person on average in 2022) and sales and excise taxes ($263 per person) on services and goods.

See how federal revenue sources have changed ([link removed]) from 1935 to 2021.

One spot for all things US tax policy

President Biden’s State of the Union address touched on several facets of tax policy in America. USAFacts has a collection of articles and metrics ([link removed]) on the many different angles of this topic so that you can stay informed. Here’s a sample of the data available:

[link removed]

* The 2017 Tax Cuts and Jobs Act reduced the average tax ([link removed]) bill by around $900. On average, middle-class families with children saved twice as much as single, middle-class taxpayers.

* Last year’s Inflation Reduction Act allocated $80 billion ([link removed]) for expanding the Internal Revenue Service (IRS), nearly six times the revenue service’s current annual operating budget. The IRS’s budget has remained the same since the 1990s, despite processing more yearly returns.

* Middle and upper-middle-class parents received the most money from the child tax credit ([link removed]) in 2019. The American Rescue Plan Act of 2021 temporarily increased the refund and changed the credit to make it more accessible to lower-income families.

Get facts on how Americans file taxes, their deductions, corporate tax metrics, and other aspects of tax policy in the United States. And if you’re a fan of the weekly fact quiz, don’t miss this quiz all about tax data ([link removed]) .

Data behind the news

Biden’s speech also mentioned prescription provisions in the Inflation Reduction Act. Here’s a refresher ([link removed]) on what’s included in Medicare Part D.

The US shot down a Chinese spy balloon that moved through the nation’s airspace earlier this month. Just over this weekend, the US shot down three other unidentified objects. Here’s an article from the USAFacts archives about unidentified aerial phenomena ([link removed]) based on Defense Department data.

Did you miss the State of the Union address? USAFacts compiled a recap ([link removed]) of the topics alongside context and metrics.

It’s time again ([link removed]) for a weekly fact quiz!

One last fact

[link removed]

The nation had approximately 8.6 million new cancer cases ([link removed]) between 2015 and 2019. Breast, prostate, and lung cancers were the most common among new cases. However, lung, colon, and pancreatic cancers were responsible for the largest share of deaths.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FikH6Qb)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FikH6Qb)

** Forward ([link removed])

** Forward ([link removed])

Was this email forwarded to you? ** Sign up here ([link removed])

for your own weekly issue of the USAFacts newsletter.

Copyright © 2023 USAFacts, All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Not displaying correctly? View this email in your browser ([link removed]) .

[link removed]

** How much does the government collect per person?

------------------------------------------------------------

USAFacts is going deep into the State of the Union in Numbers ([link removed]) , exploring how much money the federal government brings in per person ([link removed]) . In 2022, that was $15,098 per person — nearly double what it was 40 years ago after adjusting for inflation. While the numbers vary by person, these averages provide some context to the $5.03 trillion the government collected in 2022.

[link removed]

* The government collected an average of $4,510 in payroll taxes per person, 72.7% of which went to fund Social Security, 23% to Medicare, and 4.3% to unemployment insurance and other social programs.

[link removed]

* The federal government also collected an average of $7,898 per person in individual income taxes. Roughly 40% to 50% of government revenue comes from income taxes.

* Federal funds from payroll and income taxes grew more in the last two years than at any time since at least 1980.

* Other governmental revenues include corporate income taxes ($1,275 per person on average in 2022) and sales and excise taxes ($263 per person) on services and goods.

See how federal revenue sources have changed ([link removed]) from 1935 to 2021.

One spot for all things US tax policy

President Biden’s State of the Union address touched on several facets of tax policy in America. USAFacts has a collection of articles and metrics ([link removed]) on the many different angles of this topic so that you can stay informed. Here’s a sample of the data available:

[link removed]

* The 2017 Tax Cuts and Jobs Act reduced the average tax ([link removed]) bill by around $900. On average, middle-class families with children saved twice as much as single, middle-class taxpayers.

* Last year’s Inflation Reduction Act allocated $80 billion ([link removed]) for expanding the Internal Revenue Service (IRS), nearly six times the revenue service’s current annual operating budget. The IRS’s budget has remained the same since the 1990s, despite processing more yearly returns.

* Middle and upper-middle-class parents received the most money from the child tax credit ([link removed]) in 2019. The American Rescue Plan Act of 2021 temporarily increased the refund and changed the credit to make it more accessible to lower-income families.

Get facts on how Americans file taxes, their deductions, corporate tax metrics, and other aspects of tax policy in the United States. And if you’re a fan of the weekly fact quiz, don’t miss this quiz all about tax data ([link removed]) .

Data behind the news

Biden’s speech also mentioned prescription provisions in the Inflation Reduction Act. Here’s a refresher ([link removed]) on what’s included in Medicare Part D.

The US shot down a Chinese spy balloon that moved through the nation’s airspace earlier this month. Just over this weekend, the US shot down three other unidentified objects. Here’s an article from the USAFacts archives about unidentified aerial phenomena ([link removed]) based on Defense Department data.

Did you miss the State of the Union address? USAFacts compiled a recap ([link removed]) of the topics alongside context and metrics.

It’s time again ([link removed]) for a weekly fact quiz!

One last fact

[link removed]

The nation had approximately 8.6 million new cancer cases ([link removed]) between 2015 and 2019. Breast, prostate, and lung cancers were the most common among new cases. However, lung, colon, and pancreatic cancers were responsible for the largest share of deaths.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FikH6Qb)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2FikH6Qb)

** Forward ([link removed])

** Forward ([link removed])

Was this email forwarded to you? ** Sign up here ([link removed])

for your own weekly issue of the USAFacts newsletter.

Copyright © 2023 USAFacts, All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: USAFacts

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp