|

John,

This week, President Biden rallied the American people behind his proposal of a Billionaire Minimum Income Tax, which would ensure households worth over $100 million begin to pay a fairer share. This proposal is wildly popular with the American people―with 74% of likely voters supporting the plan, including majorities of Democrats, Republicans, and Independents.[1]

Add your name today to demand Congress act to pass the Billionaire Minimum Income Tax, which would raise at least $360 billion over 10 years from the very wealthiest households.

Together, we’re leading the national effort to pass the Billionaire Minimum Income Tax and create a tax code where the ultra-wealthy start paying more of their fair share.

Thank you,

Sarah Christopherson

Legislative and Policy Director

Americans for Tax Fairness Action Fund

[1] “Polling Compilation: Billionaires Income Tax Plans,” Americans for Tax Fairness, Oct. 5, 2022, and Impact Research Polling Memo, Sept. 20, 2022

-- Frank's email --

John,

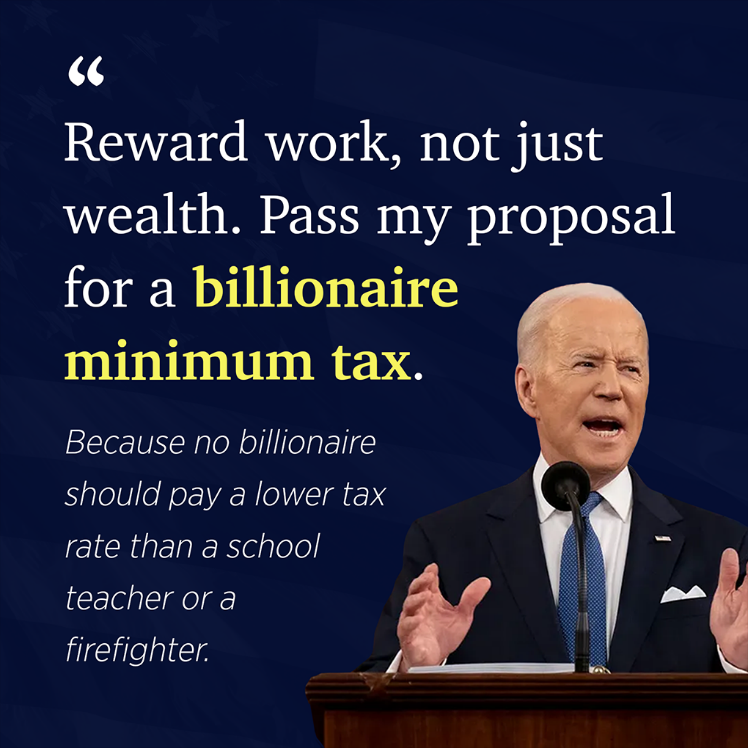

In his State of the Union address, President Biden called on Congress to pass the Billionaire Minimum Income Tax to ensure that households worth over $100 million begin to pay a fairer share in taxes:

Sign now to show you’re with President Biden, demanding Congress act to pass the Billionaire Minimum Income Tax Act.

Our tax code is riddled with loopholes that allow many ultra-wealthy to get away with paying little to nothing in federal income tax.

According to IRS data, in multiple years billionaires such as Jeff Bezos, Elon Musk, and Michael Bloomberg paid zero federal income taxes even as the gains they generated from their wealth grew by billions of dollars.[1] Over a recent nine-year period, the 400 richest billionaires paid an average effective federal income tax rate of only 8.2% when the growth in the value of their stock holdings is included in their income.[2] That’s less than the 13.3% average federal income tax rate for all taxpayers.[3]

The Billionaire Minimum Income Tax would ensure the very wealthiest Americans are paying an effective tax rate of at least 20% on their full income each year, including the increased value of their stock and other assets, whether they sell them or not. And it’s estimated to raise at least $360 billion over 10 years, which can be used to lower costs for working families on everything from healthcare to childcare to housing and more.[4]

At a time when everyday items such as food, clothing, and gas are draining the pockets of working people, and as the number of billionaires continues to rise―with their cumulative wealth growing by $1.2 trillion, or 40%, over the last five years―the American people demand policies that rein in this extreme concentration of wealth and use that revenue to invest in working families.[5]

Add your name today to call on Congress to pass a Billionaire Minimum Income Tax to finally make millionaires and billionaires pay a fairer share.

Together, we’re leading the national effort for an economy and a tax system that works for everyone, not just the wealthy few.

Frank Clemente

Executive Director

Americans for Tax Fairness Action Fund

[1] “Summary of ProPublica’s Report on Billionaire Tax Dodgers,” Americans for Tax Fairness, July 23, 2021

[2] “What Is the Average Federal Individual Income Tax Rate on the Wealthiest Americans?” The White House, Sep. 23, 2021

[3] “Summary of the Latest Federal Income Tax Data, 2022 Update,” Tax Foundation, Jan. 20, 2022

[4] “President’s Budget Rewards Work, Not Wealth with New Billionaire Minimum Income Tax,” The White House, March 28, 2022

[5] Americans for Tax Fairness analysis of Forbes billion data from Feb. 9, 2018 through Dec. 31, 2022

|