| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2023-06 |

| Date | February 10, 2023 11:21 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Guidance on state tax payments; Saturday TAC hours; new direct-deposit feature for amended returns; and more

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Tax Professionals February 10, 2023

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

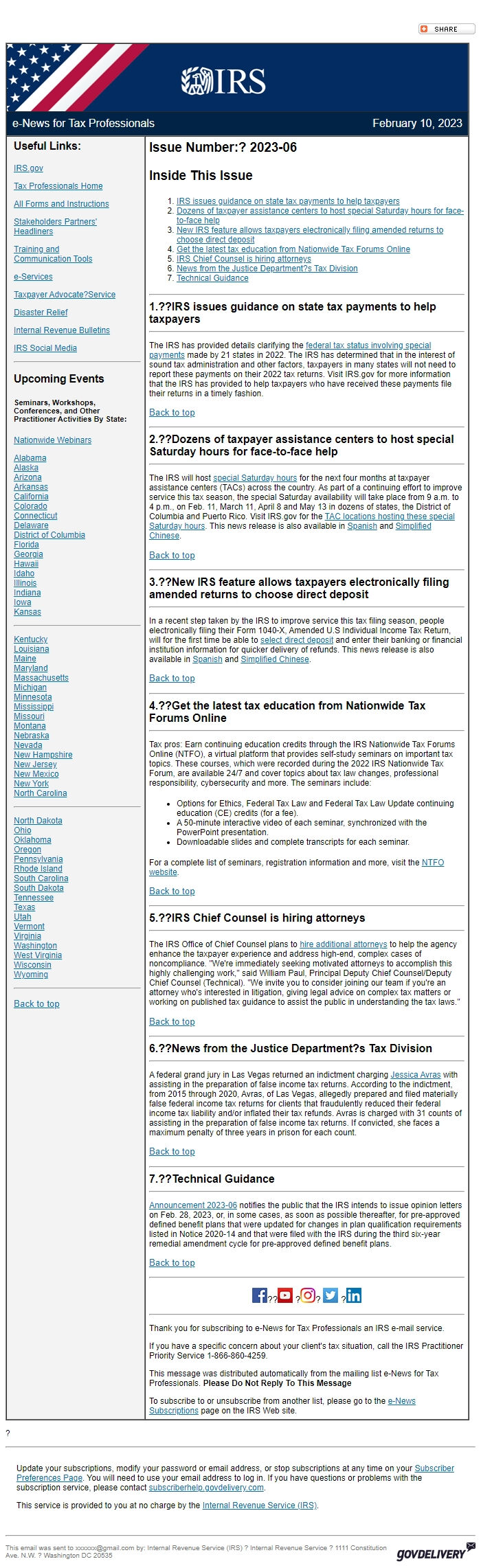

Issue Number:? 2023-06

Inside This Issue

* IRS issues guidance on state tax payments to help taxpayers [ #First ]

* Dozens of taxpayer assistance centers to host special Saturday hours for face-to-face help [ #Second ]

* New IRS feature allows taxpayers electronically filing amended returns to choose direct deposit [ #Third ]

* Get the latest tax education from Nationwide Tax Forums Online [ #Fourth ]

* IRS Chief Counsel is hiring attorneys [ #Fifth ]

* News from the Justice Department?s Tax Division [ #Sixth ]

* Technical Guidance [ #Seventh ]

________________________________________________________________________

*1.??IRS issues guidance on state tax payments to help taxpayers*________________________________________________________________________

The IRS has provided details clarifying the federal tax status involving special payments [ [link removed] ] made by 21 states in 2022. The IRS has determined that in the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns. Visit IRS.gov for more information that the IRS has provided to help taxpayers who have received these payments file their returns in a timely fashion.

Back to top [ #top ]

________________________________________________________________________

*2.??Dozens of taxpayer assistance centers to host special Saturday hours for face-to-face help*________________________________________________________________________

The IRS will host special Saturday hours [ [link removed] ] for the next four months at taxpayer assistance centers (TACs) across the country. As part of a continuing effort to improve service this tax season, the special Saturday availability will take place from 9 a.m. to 4 p.m., on Feb. 11, March 11, April 8 and May 13 in dozens of states, the District of Columbia and Puerto Rico. Visit IRS.gov for the TAC locations hosting these special Saturday hours [ [link removed] ]. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??New IRS feature allows taxpayers electronically filing amended returns to choose direct deposit*________________________________________________________________________

In a recent step taken by the IRS to improve service this tax filing season, people electronically filing their Form 1040-X, Amended U.S Individual Income Tax Return, will for the first time be able to select direct deposit [ [link removed] ] and enter their banking or financial institution information for quicker delivery of refunds. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*4.??Get the latest tax education from Nationwide Tax Forums Online*________________________________________________________________________

Tax pros: Earn continuing education credits through the IRS Nationwide Tax Forums Online (NTFO), a virtual platform that provides self-study seminars on important tax topics. These courses, which were recorded during the 2022 IRS Nationwide Tax Forum, are available 24/7 and cover topics about tax law changes, professional responsibility, cybersecurity and more. The seminars include:

* Options for Ethics, Federal Tax Law and Federal Tax Law Update continuing education (CE) credits (for a fee).

* A 50-minute interactive video of each seminar, synchronized with the PowerPoint presentation.

* Downloadable slides and complete transcripts for each seminar.

For a complete list of seminars, registration information and more, visit the NTFO website [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*5.??IRS Chief Counsel is hiring attorneys*________________________________________________________________________

The IRS Office of Chief Counsel plans to hire additional attorneys [ [link removed] ] to help the agency enhance the taxpayer experience and address high-end, complex cases of noncompliance. "We're immediately seeking motivated attorneys to accomplish this highly challenging work," said William Paul, Principal Deputy Chief Counsel/Deputy Chief Counsel (Technical). "We invite you to consider joining our team if you're an attorney who's interested in litigation, giving legal advice on complex tax matters or working on published tax guidance to assist the public in understanding the tax laws."

Back to top [ #top ]

________________________________________________________________________

*6.??News from the Justice Department?s Tax Division*________________________________________________________________________

A federal grand jury in Las Vegas returned an indictment charging Jessica Avras [ [link removed] ] with assisting in the preparation of false income tax returns. According to the indictment, from 2015 through 2020, Avras, of Las Vegas, allegedly prepared and filed materially false federal income tax returns for clients that fraudulently reduced their federal income tax liability and/or inflated their tax refunds. Avras is charged with 31 counts of assisting in the preparation of false income tax returns. If convicted, she faces a maximum penalty of three years in prison for each count.

Back to top [ #top ]

________________________________________________________________________

*7.??Technical Guidance*________________________________________________________________________

Announcement 2023-06 [ [link removed] ] notifies the public that the IRS intends to issue opinion letters on Feb. 28, 2023, or, in some cases, as soon as possible thereafter, for pre-approved defined benefit plans that were updated for changes in plan qualification requirements listed in Notice 2020-14 and that were filed with the IRS during the third six-year remedial amendment cycle for pre-approved defined benefit plans.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Tax Professionals February 10, 2023

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number:? 2023-06

Inside This Issue

* IRS issues guidance on state tax payments to help taxpayers [ #First ]

* Dozens of taxpayer assistance centers to host special Saturday hours for face-to-face help [ #Second ]

* New IRS feature allows taxpayers electronically filing amended returns to choose direct deposit [ #Third ]

* Get the latest tax education from Nationwide Tax Forums Online [ #Fourth ]

* IRS Chief Counsel is hiring attorneys [ #Fifth ]

* News from the Justice Department?s Tax Division [ #Sixth ]

* Technical Guidance [ #Seventh ]

________________________________________________________________________

*1.??IRS issues guidance on state tax payments to help taxpayers*________________________________________________________________________

The IRS has provided details clarifying the federal tax status involving special payments [ [link removed] ] made by 21 states in 2022. The IRS has determined that in the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns. Visit IRS.gov for more information that the IRS has provided to help taxpayers who have received these payments file their returns in a timely fashion.

Back to top [ #top ]

________________________________________________________________________

*2.??Dozens of taxpayer assistance centers to host special Saturday hours for face-to-face help*________________________________________________________________________

The IRS will host special Saturday hours [ [link removed] ] for the next four months at taxpayer assistance centers (TACs) across the country. As part of a continuing effort to improve service this tax season, the special Saturday availability will take place from 9 a.m. to 4 p.m., on Feb. 11, March 11, April 8 and May 13 in dozens of states, the District of Columbia and Puerto Rico. Visit IRS.gov for the TAC locations hosting these special Saturday hours [ [link removed] ]. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??New IRS feature allows taxpayers electronically filing amended returns to choose direct deposit*________________________________________________________________________

In a recent step taken by the IRS to improve service this tax filing season, people electronically filing their Form 1040-X, Amended U.S Individual Income Tax Return, will for the first time be able to select direct deposit [ [link removed] ] and enter their banking or financial institution information for quicker delivery of refunds. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*4.??Get the latest tax education from Nationwide Tax Forums Online*________________________________________________________________________

Tax pros: Earn continuing education credits through the IRS Nationwide Tax Forums Online (NTFO), a virtual platform that provides self-study seminars on important tax topics. These courses, which were recorded during the 2022 IRS Nationwide Tax Forum, are available 24/7 and cover topics about tax law changes, professional responsibility, cybersecurity and more. The seminars include:

* Options for Ethics, Federal Tax Law and Federal Tax Law Update continuing education (CE) credits (for a fee).

* A 50-minute interactive video of each seminar, synchronized with the PowerPoint presentation.

* Downloadable slides and complete transcripts for each seminar.

For a complete list of seminars, registration information and more, visit the NTFO website [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*5.??IRS Chief Counsel is hiring attorneys*________________________________________________________________________

The IRS Office of Chief Counsel plans to hire additional attorneys [ [link removed] ] to help the agency enhance the taxpayer experience and address high-end, complex cases of noncompliance. "We're immediately seeking motivated attorneys to accomplish this highly challenging work," said William Paul, Principal Deputy Chief Counsel/Deputy Chief Counsel (Technical). "We invite you to consider joining our team if you're an attorney who's interested in litigation, giving legal advice on complex tax matters or working on published tax guidance to assist the public in understanding the tax laws."

Back to top [ #top ]

________________________________________________________________________

*6.??News from the Justice Department?s Tax Division*________________________________________________________________________

A federal grand jury in Las Vegas returned an indictment charging Jessica Avras [ [link removed] ] with assisting in the preparation of false income tax returns. According to the indictment, from 2015 through 2020, Avras, of Las Vegas, allegedly prepared and filed materially false federal income tax returns for clients that fraudulently reduced their federal income tax liability and/or inflated their tax refunds. Avras is charged with 31 counts of assisting in the preparation of false income tax returns. If convicted, she faces a maximum penalty of three years in prison for each count.

Back to top [ #top ]

________________________________________________________________________

*7.??Technical Guidance*________________________________________________________________________

Announcement 2023-06 [ [link removed] ] notifies the public that the IRS intends to issue opinion letters on Feb. 28, 2023, or, in some cases, as soon as possible thereafter, for pre-approved defined benefit plans that were updated for changes in plan qualification requirements listed in Notice 2020-14 and that were filed with the IRS during the third six-year remedial amendment cycle for pre-approved defined benefit plans.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery