Email

Tax Professional Tip #6 – Minnesota tax brackets, standard deduction, and dependent exemptions

| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #6 – Minnesota tax brackets, standard deduction, and dependent exemptions |

| Date | February 9, 2023 7:35 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

*Minnesota Individual Income Tax Brackets*

Minnesota?s income tax brackets are recalculated each year based on the rate of inflation. The indexed brackets are adjusted by the inflation factor and the results are rounded to the nearest $10. (See?Minnesota Statute 290.06.) [ [link removed] ]

See income tax rates and brackets for tax years 2017 through 2023 on our website [ [link removed] ].

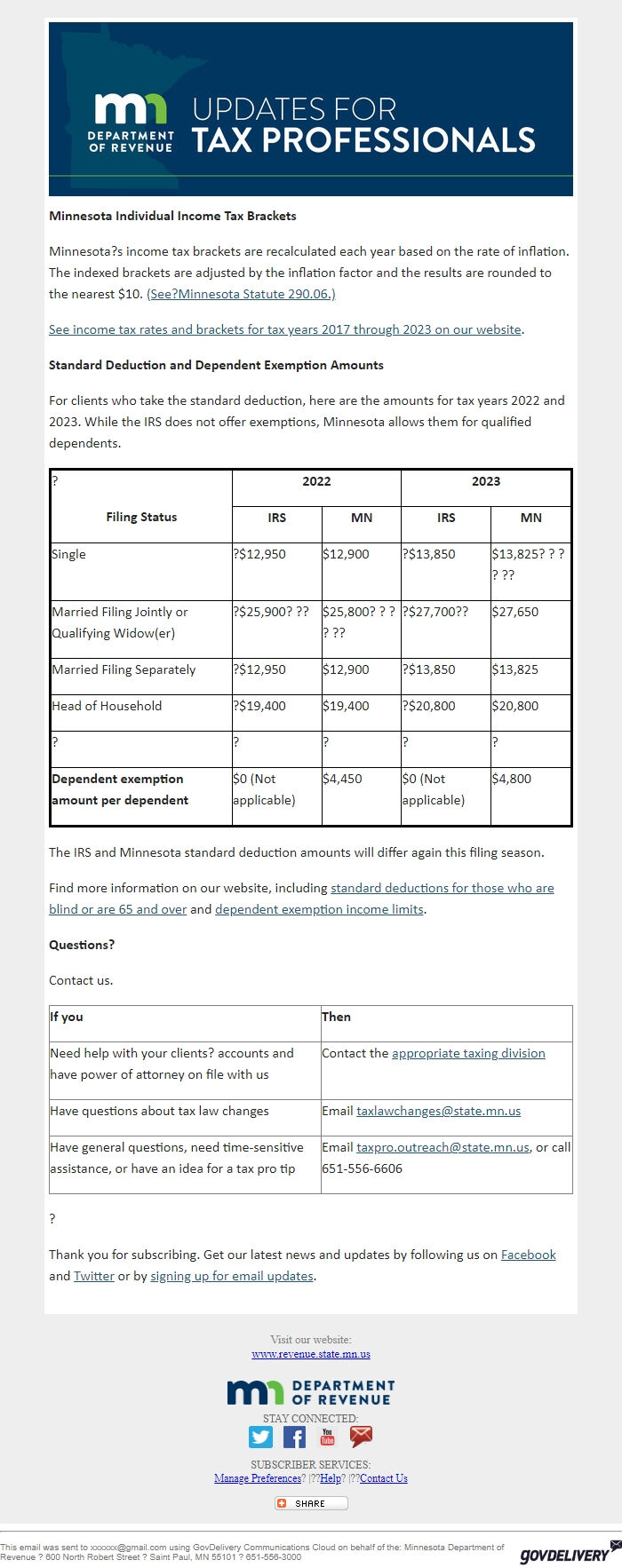

*Standard Deduction and Dependent Exemption Amounts*

For clients who take the standard deduction, here are the amounts for tax years 2022 and 2023. While the IRS does not offer exemptions, Minnesota allows them for qualified dependents.

?

*Filing Status*

*2022*

*2023*

*IRS*

*MN*

*IRS*

*MN*

Single

?$12,950

$12,900

?$13,850

$13,825? ? ? ? ??

Married Filing Jointly or Qualifying Widow(er)

?$25,900? ??

$25,800? ? ? ? ??

?$27,700??

$27,650

Married Filing Separately

?$12,950

$12,900

?$13,850

$13,825

Head of Household

?$19,400

$19,400

?$20,800

$20,800

?

?

?

?

?

*Dependent exemption amount per dependent*

$0 (Not applicable)

$4,450

$0 (Not applicable)

$4,800

The IRS and Minnesota standard deduction amounts will differ again this filing season.

Find more information on our website, including standard deductions for those who are blind or are 65 and over [ [link removed] ] and dependent exemption income limits [ [link removed] ].

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions, need time-sensitive assistance, or have an idea for a tax pro tip

Email [email protected], or call 651-556-6606

?

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

*Minnesota Individual Income Tax Brackets*

Minnesota?s income tax brackets are recalculated each year based on the rate of inflation. The indexed brackets are adjusted by the inflation factor and the results are rounded to the nearest $10. (See?Minnesota Statute 290.06.) [ [link removed] ]

See income tax rates and brackets for tax years 2017 through 2023 on our website [ [link removed] ].

*Standard Deduction and Dependent Exemption Amounts*

For clients who take the standard deduction, here are the amounts for tax years 2022 and 2023. While the IRS does not offer exemptions, Minnesota allows them for qualified dependents.

?

*Filing Status*

*2022*

*2023*

*IRS*

*MN*

*IRS*

*MN*

Single

?$12,950

$12,900

?$13,850

$13,825? ? ? ? ??

Married Filing Jointly or Qualifying Widow(er)

?$25,900? ??

$25,800? ? ? ? ??

?$27,700??

$27,650

Married Filing Separately

?$12,950

$12,900

?$13,850

$13,825

Head of Household

?$19,400

$19,400

?$20,800

$20,800

?

?

?

?

?

*Dependent exemption amount per dependent*

$0 (Not applicable)

$4,450

$0 (Not applicable)

$4,800

The IRS and Minnesota standard deduction amounts will differ again this filing season.

Find more information on our website, including standard deductions for those who are blind or are 65 and over [ [link removed] ] and dependent exemption income limits [ [link removed] ].

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions, need time-sensitive assistance, or have an idea for a tax pro tip

Email [email protected], or call 651-556-6606

?

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery