|

John,

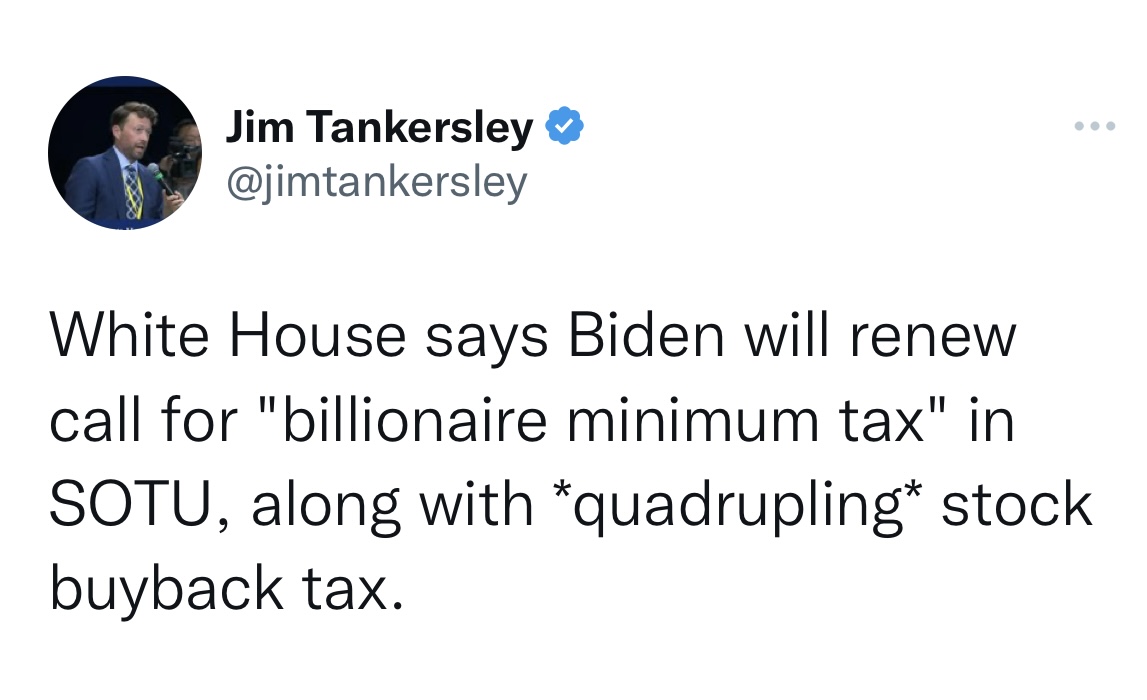

Tonight, President Biden will deliver his first State of the Union address before the new session of Congress and, according to one New York Times economic reporter, we have an idea of what the president is going to talk about:

Americans for Tax Fairness Action Fund has been leading the national effort to pass the Billionaire Minimum Income Tax and an overwhelming majority of Americans are with us.[1] (We also played a leading role in getting Congress to craft the 1% stock buybacks tax.) Now we just need Congress to act.

Power our campaign―alongside President Biden―to ensure billionaires start paying taxes on their wealth gains each year, just like working people pay on our wages. Donate today!

Over the last five years the number of American billionaires rose from 590 to 713, and their cumulative wealth grew by $1.2 trillion—or 40%.[2] Yet, many billionaires don’t pay close to their fair share of taxes and typically pay a lower average tax rate than many working families.

The Billionaire Minimum Income Tax Act would ensure that every household worth over $100 million is paying an effective tax rate of at least 20% on their full income each year, including the increased value of their stock and other assets whether they sell them or not.

Donate today to fight for a tax system and economy where billionaires finally start paying a fairer share in taxes. When they do, we can invest in critical programs that lower costs for working people―from healthcare to housing and more.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we’re reminding Congress that 74% of likely voters support the Billionaire Minimum Income Tax―and that it includes a majority of Democrats, Republicans, and Independents.[1]

Thank you,

Frank Clemente

Executive Director

Americans for Tax Fairness Action Fund

[1] “Polling Compilation: Billionaires Income Tax Plans,” Americans for Tax Fairness, Oct. 5, 2022, and Impact Research Polling Memo, Sept. 20, 2022

[2] Americans for Tax Fairness analysis of Forbes billion data from Feb. 9, 2018 through Dec. 31, 2022

|