Email

Federal and provincial debt interest costs, B.C.'s prosperity gap, and The circular economy

| From | Fraser Institute <[email protected]> |

| Subject | Federal and provincial debt interest costs, B.C.'s prosperity gap, and The circular economy |

| Date | February 4, 2023 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

-------------

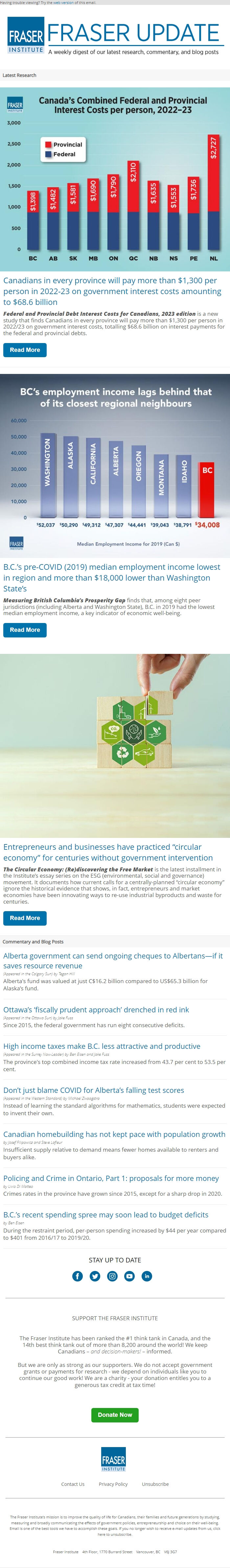

Canadians in every province will pay more than $1,300 per person in 2022-23 on government interest costs amounting to $68.6 billion

Federal and Provincial Debt Interest Costs for Canadians, 2023 edition is a new study that finds Canadians in every province will pay more than $1,300 per person in 2022/23 on government interest costs, totalling $68.6 billion on interest payments for the federal and provincial debts.

Read More [[link removed]]

B.C.’s pre-COVID (2019) median employment income lowest in region and more than $18,000 lower than Washington State’s

Measuring British Columbia’s Prosperity Gap finds that, among eight peer jurisdictions (including Alberta and Washington State), B.C. in 2019 had the lowest median employment income, a key indicator of economic well-being.

Read More [[link removed]]

Entrepreneurs and businesses have practiced “circular economy” for centuries without government intervention

The Circular Economy: (Re)discovering the Free Market is the latest installment in the Institute’s essay series on the ESG (environmental, social and governance) movement. It documents how current calls for a centrally-planned “circular economy” ignore the historical evidence that shows, in fact, entrepreneurs and market economies have been innovating ways to re-use industrial byproducts and waste for centuries.

Read More [[link removed]]

Commentary and Blog Posts

-------------

Alberta government can send ongoing cheques to Albertans—if it saves resource revenue [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill

Alberta's fund was valued at just C$16.2 billion compared to US$65.3 billion for Alaska’s fund.

Ottawa’s ‘fiscally prudent approach’ drenched in red ink [[link removed]]

(Appeared in the Ottawa Sun) by Jake Fuss

Since 2015, the federal government has run eight consecutive deficits.

High income taxes make B.C. less attractive and productive [[link removed]]

(Appeared in the Surrey Now-Leader) by Ben Eisen and Jake Fuss

The province's top combined income tax rate increased from 43.7 per cent to 53.5 per cent.

Don’t just blame COVID for Alberta’s falling test scores [[link removed]]

(Appeared in the Western Standard) by Michael Zwaagstra

Instead of learning the standard algorithms for mathematics, students were expected to invent their own.

Canadian homebuilding has not kept pace with population growth [[link removed]]

by Josef Filipowicz and Steve Lafleur

Insufficient supply relative to demand means fewer homes available to renters and buyers alike.

Policing and Crime in Ontario, Part 1: proposals for more money [[link removed]]

by Livio Di Matteo

Crimes rates in the province have grown since 2015, except for a sharp drop in 2020.

B.C.’s recent spending spree may soon lead to budget deficits [[link removed]]

by Ben Eisen

During the restraint period, per-person spending increased by $44 per year compared to $401 from 2016/17 to 2019/20.

SUPPORT THE FRASER INSTITUTE

-------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

-------------

Canadians in every province will pay more than $1,300 per person in 2022-23 on government interest costs amounting to $68.6 billion

Federal and Provincial Debt Interest Costs for Canadians, 2023 edition is a new study that finds Canadians in every province will pay more than $1,300 per person in 2022/23 on government interest costs, totalling $68.6 billion on interest payments for the federal and provincial debts.

Read More [[link removed]]

B.C.’s pre-COVID (2019) median employment income lowest in region and more than $18,000 lower than Washington State’s

Measuring British Columbia’s Prosperity Gap finds that, among eight peer jurisdictions (including Alberta and Washington State), B.C. in 2019 had the lowest median employment income, a key indicator of economic well-being.

Read More [[link removed]]

Entrepreneurs and businesses have practiced “circular economy” for centuries without government intervention

The Circular Economy: (Re)discovering the Free Market is the latest installment in the Institute’s essay series on the ESG (environmental, social and governance) movement. It documents how current calls for a centrally-planned “circular economy” ignore the historical evidence that shows, in fact, entrepreneurs and market economies have been innovating ways to re-use industrial byproducts and waste for centuries.

Read More [[link removed]]

Commentary and Blog Posts

-------------

Alberta government can send ongoing cheques to Albertans—if it saves resource revenue [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill

Alberta's fund was valued at just C$16.2 billion compared to US$65.3 billion for Alaska’s fund.

Ottawa’s ‘fiscally prudent approach’ drenched in red ink [[link removed]]

(Appeared in the Ottawa Sun) by Jake Fuss

Since 2015, the federal government has run eight consecutive deficits.

High income taxes make B.C. less attractive and productive [[link removed]]

(Appeared in the Surrey Now-Leader) by Ben Eisen and Jake Fuss

The province's top combined income tax rate increased from 43.7 per cent to 53.5 per cent.

Don’t just blame COVID for Alberta’s falling test scores [[link removed]]

(Appeared in the Western Standard) by Michael Zwaagstra

Instead of learning the standard algorithms for mathematics, students were expected to invent their own.

Canadian homebuilding has not kept pace with population growth [[link removed]]

by Josef Filipowicz and Steve Lafleur

Insufficient supply relative to demand means fewer homes available to renters and buyers alike.

Policing and Crime in Ontario, Part 1: proposals for more money [[link removed]]

by Livio Di Matteo

Crimes rates in the province have grown since 2015, except for a sharp drop in 2020.

B.C.’s recent spending spree may soon lead to budget deficits [[link removed]]

by Ben Eisen

During the restraint period, per-person spending increased by $44 per year compared to $401 from 2016/17 to 2019/20.

SUPPORT THE FRASER INSTITUTE

-------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor