Email

Tax Professional Tip #5 – Income tax treatment for Frontline Worker Pay

| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #5 – Income tax treatment for Frontline Worker Pay |

| Date | January 26, 2023 6:24 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

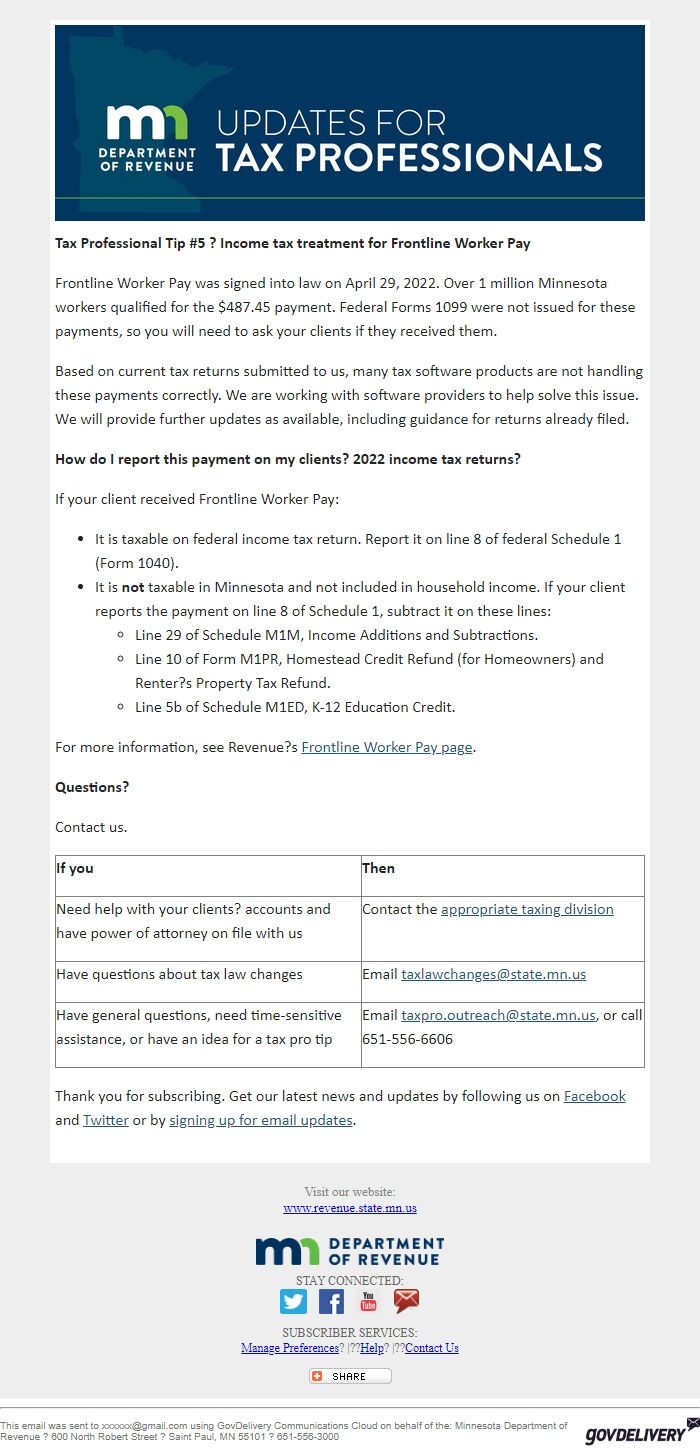

*Tax Professional Tip #5 ? Income tax treatment for Frontline Worker Pay*

Frontline Worker Pay was signed into law on April 29, 2022. Over 1 million Minnesota workers qualified for the $487.45 payment. Federal Forms 1099 were not issued for these payments, so you will need to ask your clients if they received them.

Based on current tax returns submitted to us, many tax software products are not handling these payments correctly. We are working with software providers to help solve this issue. We will provide further updates as available, including guidance for returns already filed.

*How do I report this payment on my clients? 2022 income tax returns?*

If your client received Frontline Worker Pay:

* It is taxable on federal income tax return. Report it on line 8 of federal Schedule 1 (Form 1040).

* It is *not* taxable in Minnesota and not included in household income. If your client reports the payment on line 8 of Schedule 1, subtract it on these lines:

* Line 29 of Schedule M1M, Income Additions and Subtractions.

* Line 10 of Form M1PR, Homestead Credit Refund (for Homeowners) and Renter?s Property Tax Refund.

* Line 5b of Schedule M1ED, K-12 Education Credit.

For more information, see Revenue?s Frontline Worker Pay page [ [link removed] ].

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions, need time-sensitive assistance, or have an idea for a tax pro tip

Email [email protected], or call 651-556-6606

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

*Tax Professional Tip #5 ? Income tax treatment for Frontline Worker Pay*

Frontline Worker Pay was signed into law on April 29, 2022. Over 1 million Minnesota workers qualified for the $487.45 payment. Federal Forms 1099 were not issued for these payments, so you will need to ask your clients if they received them.

Based on current tax returns submitted to us, many tax software products are not handling these payments correctly. We are working with software providers to help solve this issue. We will provide further updates as available, including guidance for returns already filed.

*How do I report this payment on my clients? 2022 income tax returns?*

If your client received Frontline Worker Pay:

* It is taxable on federal income tax return. Report it on line 8 of federal Schedule 1 (Form 1040).

* It is *not* taxable in Minnesota and not included in household income. If your client reports the payment on line 8 of Schedule 1, subtract it on these lines:

* Line 29 of Schedule M1M, Income Additions and Subtractions.

* Line 10 of Form M1PR, Homestead Credit Refund (for Homeowners) and Renter?s Property Tax Refund.

* Line 5b of Schedule M1ED, K-12 Education Credit.

For more information, see Revenue?s Frontline Worker Pay page [ [link removed] ].

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate taxing division [ [link removed] ]

Have questions about tax law changes

Email [email protected]

Have general questions, need time-sensitive assistance, or have an idea for a tax pro tip

Email [email protected], or call 651-556-6606

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery