| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2023-03 |

| Date | January 20, 2023 9:44 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

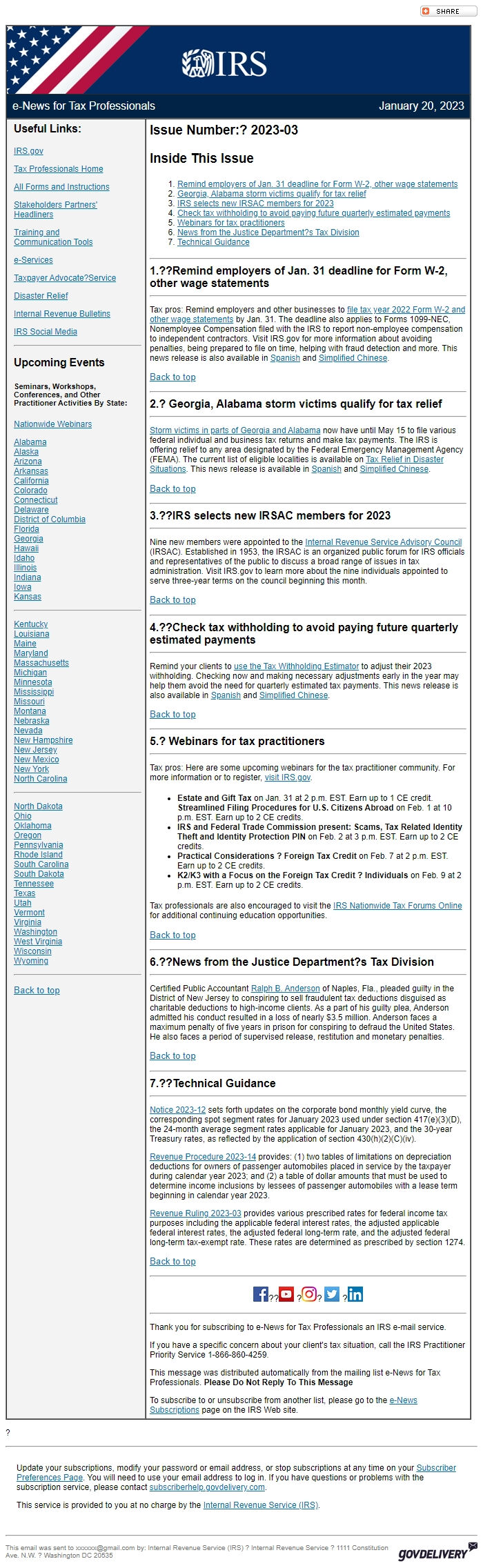

e-News for Tax Professionals January 20, 2023

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number:? 2023-03

Inside This Issue

* Remind employers of Jan. 31 deadline for Form W-2, other wage statements [ #First ]

* Georgia, Alabama storm victims qualify for tax relief [ #Second ]

* IRS selects new IRSAC members for 2023 [ #Third ]

* Check tax withholding to avoid paying future quarterly estimated payments [ #Fourth ]

* Webinars for tax practitioners [ #Fifth ]

* News from the Justice Department?s Tax Division [ #Sixth ]

* Technical Guidance [ #Seventh ]

________________________________________________________________________

*1.??Remind employers of Jan. 31 deadline for Form W-2, other wage statements*________________________________________________________________________

Tax pros: Remind employers and other businesses to file tax year 2022 Form W-2 and other wage statements [ [link removed] ] by Jan. 31. The deadline also applies to Forms 1099-NEC, Nonemployee Compensation filed with the IRS to report non-employee compensation to independent contractors. Visit IRS.gov for more information about avoiding penalties, being prepared to file on time, helping with fraud detection and more. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2.? Georgia, Alabama storm victims qualify for tax relief*________________________________________________________________________

Storm victims in parts of Georgia and Alabama [ [link removed] ] now have until May 15 to file various federal individual and business tax returns and make tax payments. The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). The current list of eligible localities is available on Tax Relief in Disaster Situations [ [link removed] ]. This news release is available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??IRS selects new IRSAC members for 2023*________________________________________________________________________

Nine new members were appointed to the Internal Revenue Service Advisory Council [ [link removed] ] (IRSAC). Established in 1953, the IRSAC is an organized public forum for IRS officials and representatives of the public to discuss a broad range of issues in tax administration. Visit IRS.gov to learn more about the nine individuals appointed to serve three-year terms on the council beginning this month.

Back to top [ #top ]

________________________________________________________________________

*4.??Check tax withholding to avoid paying future quarterly estimated payments*________________________________________________________________________

Remind your clients to use the Tax Withholding Estimator [ [link removed] ] to adjust their 2023 withholding. Checking now and making necessary adjustments early in the year may help them avoid the need for quarterly estimated tax payments. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*5.? Webinars for tax practitioners*________________________________________________________________________

Tax pros: Here are some upcoming webinars for the tax practitioner community. For more information or to register, visit IRS.gov [ [link removed] ].

* *Estate and Gift Tax* on Jan. 31 at 2 p.m. EST. Earn up to 1 CE credit.

*Streamlined Filing Procedures for U.S. Citizens Abroad* on Feb. 1 at 10 p.m. EST. Earn up to 2 CE credits.

* *IRS and Federal Trade Commission present: Scams, Tax Related Identity Theft and Identity Protection PIN* on Feb. 2 at 3 p.m. EST. Earn up to 2 CE credits.

* *Practical Considerations ? Foreign Tax Credit* on Feb. 7 at 2 p.m. EST. Earn up to 2 CE credits.

* *K2/K3 with a Focus on the Foreign Tax Credit ? Individuals* on Feb. 9 at 2 p.m. EST. Earn up to 2 CE credits.

Tax professionals are also encouraged to visit the IRS Nationwide Tax Forums Online [ [link removed] ] for additional continuing education opportunities.

Back to top [ #top ]

________________________________________________________________________

*6.??News from the Justice Department?s Tax Division*________________________________________________________________________

Certified Public Accountant Ralph B. Anderson [ [link removed] ] of Naples, Fla., pleaded guilty in the District of New Jersey to conspiring to sell fraudulent tax deductions disguised as charitable deductions to high-income clients. As a part of his guilty plea, Anderson admitted his conduct resulted in a loss of nearly $3.5 million. Anderson faces a maximum penalty of five years in prison for conspiring to defraud the United States. He also faces a period of supervised release, restitution and monetary penalties.

Back to top [ #top ]

________________________________________________________________________

*7.??Technical Guidance*________________________________________________________________________

Notice 2023-12 [ [link removed] ] sets forth updates on the corporate bond monthly yield curve, the corresponding spot segment rates for January 2023 used under section 417(e)(3)(D), the 24-month average segment rates applicable for January 2023, and the 30-year Treasury rates, as reflected by the application of section 430(h)(2)(C)(iv).

Revenue Procedure 2023-14 [ [link removed] ] provides: (1) two tables of limitations on depreciation deductions for owners of passenger automobiles placed in service by the taxpayer during calendar year 2023; and (2) a table of dollar amounts that must be used to determine income inclusions by lessees of passenger automobiles with a lease term beginning in calendar year 2023.

Revenue Ruling 2023-03 [ [link removed] ] provides various prescribed rates for federal income tax purposes including the applicable federal interest rates, the adjusted applicable federal interest rates, the adjusted federal long-term rate, and the adjusted federal long-term tax-exempt rate. These rates are determined as prescribed by section 1274.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Tax Professionals January 20, 2023

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number:? 2023-03

Inside This Issue

* Remind employers of Jan. 31 deadline for Form W-2, other wage statements [ #First ]

* Georgia, Alabama storm victims qualify for tax relief [ #Second ]

* IRS selects new IRSAC members for 2023 [ #Third ]

* Check tax withholding to avoid paying future quarterly estimated payments [ #Fourth ]

* Webinars for tax practitioners [ #Fifth ]

* News from the Justice Department?s Tax Division [ #Sixth ]

* Technical Guidance [ #Seventh ]

________________________________________________________________________

*1.??Remind employers of Jan. 31 deadline for Form W-2, other wage statements*________________________________________________________________________

Tax pros: Remind employers and other businesses to file tax year 2022 Form W-2 and other wage statements [ [link removed] ] by Jan. 31. The deadline also applies to Forms 1099-NEC, Nonemployee Compensation filed with the IRS to report non-employee compensation to independent contractors. Visit IRS.gov for more information about avoiding penalties, being prepared to file on time, helping with fraud detection and more. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2.? Georgia, Alabama storm victims qualify for tax relief*________________________________________________________________________

Storm victims in parts of Georgia and Alabama [ [link removed] ] now have until May 15 to file various federal individual and business tax returns and make tax payments. The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). The current list of eligible localities is available on Tax Relief in Disaster Situations [ [link removed] ]. This news release is available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??IRS selects new IRSAC members for 2023*________________________________________________________________________

Nine new members were appointed to the Internal Revenue Service Advisory Council [ [link removed] ] (IRSAC). Established in 1953, the IRSAC is an organized public forum for IRS officials and representatives of the public to discuss a broad range of issues in tax administration. Visit IRS.gov to learn more about the nine individuals appointed to serve three-year terms on the council beginning this month.

Back to top [ #top ]

________________________________________________________________________

*4.??Check tax withholding to avoid paying future quarterly estimated payments*________________________________________________________________________

Remind your clients to use the Tax Withholding Estimator [ [link removed] ] to adjust their 2023 withholding. Checking now and making necessary adjustments early in the year may help them avoid the need for quarterly estimated tax payments. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*5.? Webinars for tax practitioners*________________________________________________________________________

Tax pros: Here are some upcoming webinars for the tax practitioner community. For more information or to register, visit IRS.gov [ [link removed] ].

* *Estate and Gift Tax* on Jan. 31 at 2 p.m. EST. Earn up to 1 CE credit.

*Streamlined Filing Procedures for U.S. Citizens Abroad* on Feb. 1 at 10 p.m. EST. Earn up to 2 CE credits.

* *IRS and Federal Trade Commission present: Scams, Tax Related Identity Theft and Identity Protection PIN* on Feb. 2 at 3 p.m. EST. Earn up to 2 CE credits.

* *Practical Considerations ? Foreign Tax Credit* on Feb. 7 at 2 p.m. EST. Earn up to 2 CE credits.

* *K2/K3 with a Focus on the Foreign Tax Credit ? Individuals* on Feb. 9 at 2 p.m. EST. Earn up to 2 CE credits.

Tax professionals are also encouraged to visit the IRS Nationwide Tax Forums Online [ [link removed] ] for additional continuing education opportunities.

Back to top [ #top ]

________________________________________________________________________

*6.??News from the Justice Department?s Tax Division*________________________________________________________________________

Certified Public Accountant Ralph B. Anderson [ [link removed] ] of Naples, Fla., pleaded guilty in the District of New Jersey to conspiring to sell fraudulent tax deductions disguised as charitable deductions to high-income clients. As a part of his guilty plea, Anderson admitted his conduct resulted in a loss of nearly $3.5 million. Anderson faces a maximum penalty of five years in prison for conspiring to defraud the United States. He also faces a period of supervised release, restitution and monetary penalties.

Back to top [ #top ]

________________________________________________________________________

*7.??Technical Guidance*________________________________________________________________________

Notice 2023-12 [ [link removed] ] sets forth updates on the corporate bond monthly yield curve, the corresponding spot segment rates for January 2023 used under section 417(e)(3)(D), the 24-month average segment rates applicable for January 2023, and the 30-year Treasury rates, as reflected by the application of section 430(h)(2)(C)(iv).

Revenue Procedure 2023-14 [ [link removed] ] provides: (1) two tables of limitations on depreciation deductions for owners of passenger automobiles placed in service by the taxpayer during calendar year 2023; and (2) a table of dollar amounts that must be used to determine income inclusions by lessees of passenger automobiles with a lease term beginning in calendar year 2023.

Revenue Ruling 2023-03 [ [link removed] ] provides various prescribed rates for federal income tax purposes including the applicable federal interest rates, the adjusted applicable federal interest rates, the adjusted federal long-term rate, and the adjusted federal long-term tax-exempt rate. These rates are determined as prescribed by section 1274.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery