Email

RELEASE: PHOTOS: Gov. Whitmer Announces Support for Bills to Roll Back Retirement Tax, Boost Working Families Tax Credit

| From | Michigan Executive Office of the Governor <[email protected]> |

| Subject | RELEASE: PHOTOS: Gov. Whitmer Announces Support for Bills to Roll Back Retirement Tax, Boost Working Families Tax Credit |

| Date | January 12, 2023 9:29 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Governor Whitmer Header [ [link removed] ]

*FOR IMMEDIATE RELEASE?*??

January 12, 2023???

Contact: [email protected]?

?

*Gov. Whitmer Announces Support for Bills to Roll Back Retirement Tax, Boost Working Families Tax Credit*?

"Rolling back retirement will save half a million households an average of $1,000 a year and WFTC will deliver a combined $3,000 refund to 700,000 households"?

???

*LANSING, Mich *? Today, Governor Gretchen Whitmer joined Senate Majority Leader Winnie Brinks, Speaker of the House Joe Tate, and members of the Michigan Legislature to announce the introduction of bills to roll back the retirement tax and increase the Working Families Tax Credit, lowering costs for Michigan?s working families.?

?

?I?m excited to come together with my partners in the Michigan Legislature to announce these bills that will deliver tax fairness for seniors and working families as we all face high costs brought on by inflation,? said *Governor Whitmer*. ?Right now, families are facing the pinch and every dollar saved will make a difference, especially for our seniors and working families. Rolling back the retirement tax and boosting the Working Families Tax Credit will offer real, immediate relief to Michiganders. We will get these tax changes to put money back in people?s pockets done in the weeks ahead.??

?

?Today, we take a step towards helping Michiganders keep more money in their pockets, where it belongs,? said *Lt. Governor Garlin Gilchrist II*. ?Right now, seniors and working families are facing?rising costs and difficult conversations about how to put food on the table or whether to defer dreams2 of higher education. Governor Whitmer and I are excited to work alongside our legislative partners to deliver relief and help every Michigander reach their full potential.??

?

?The new Senate Democratic Majority will be laser-focused on tackling the challenges our state is facing right now so that we may pave the way for a brighter, better future,? *Senate Majority Leader Winnie Brinks (D-Grand Rapids)* said. ?A key component of this effort is helping more folks keep more of their hard-earned dollars in their pockets. One of the most impactful ways we can do that, while also infusing more money into our economy, is by increasing the Earned Income Tax Credit to address the needs of struggling Michiganders. Michiganders can expect that, in the weeks and months ahead, Democrats will continue to deliver on solutions that help improve family budgets in every community across the state.??

?

?Increased costs hit those on fixed incomes the hardest,? said *Speaker Joe Tate*.? ?The state should not rely on retirees to bear the cost of government. House Democrats are committed to making good on our promises to deliver meaningful relief to Michiganders and that starts with the repeal of the retirement tax and increased tax credits for our hardworking families.?We are ready to work with our partners in the Senate to deliver these bills to the Governor?s desk.??

?

Rolling back the retirement tax will save half a million Michigan households an average of?$1,000 a year or more. Additionally, increasing the Working Families Tax Credit will deliver an average $3,000 or more to 700,000 homes and directly benefit half of the kids in Michigan.

?

?For far too long, the retirement tax has been a heavy burden on an already financially vulnerable population in our state and continues to this day to impact new waves of retirees,? said *Paula D. Cunningham, ARRP Michigan State Director*.? ?Millions of Michiganders who worked hard and played by the rules have seen their retirement undercut by this tax, forcing many to go back to work or delay retirement. AARP has fought this tax from the start and today we stand with the governor to repeal this tax and urge our state legislators to get it done.?? ?

?

?Raising children, taking care of a child with special needs or an elderly loved one is precious yet expensive! Along with the cost of child care, these realities have kept so many -- particularly women -- out of the workforce,? said *Jametta Lilly, Chief Executive Officer of Detroit Parent Network*.??It is wonderful to see meaningful action by our leaders to introduce legislation that will provide families in Detroit and across the state refunds that will benefit almost one million children! We know that 80% of families in Detroit, Inkster, Flint, Benton Harbor, will benefit from the average refund of $3,000 per family! This is an income game changer for our families. And a reminder how we vote matters. With these types of policies, parents, you and your children are moving Michigan forward!??

?

"Michigan's labor movement has prioritized the repeal of the retirement tax since the day former Governor Snyder imposed this unfair and harmful tax," said *Ron Bieber, President of the Michigan AFL-CIO*. "Gretchen Whitmer has always been a champion for Michigan's working men and women. Our retirees are grateful to have a Governor and a new pro-worker legislature that will prioritize their dignity and the security of the retirements they earned through a lifetime of hard work."?

?

Expanding the Working Families Tax Credit will boost incomes, assist businesses in finding employees to fill jobs, and support Michigan?s families at a time when inflation is impacting households across the country,? said *Luke Forrest, Executive Director of Community Economic Development Association of Michigan*. ?Communities across our state will be thrilled to see more hard-earned money back in the pockets of their workers? helping families afford the basics while also stimulating our local economies.??

?

?Hard-working Michiganders shouldn?t have to struggle to pay for necessities, and the Working Families Tax Credit expansion will provide them with a much-needed cash infusion,? said *Kim Trent*, who leads the task force and is the *Deputy Director of Prosperity with the Department of Labor and Economic Opportunity*. ?The Poverty Task Force will continue advocating and working hard to push for additional anti-poverty strategies that will support families across the state who are struggling economically. This is a significant step toward improving the lives of low-income families and ensuring every Michigander has access to economic opportunity and prosperity.??

?

"I'm thankful to see the governor and legislators work together to provide relief for seniors," said *Michigan Association of Retired School Personnel Executive Director Royce Humm*. "Michigan seniors deserve to retire with dignity and rolling back the retirement tax will allow Michiganders, who have worked hard their whole lives, to keep every dime of what they've earned."?

?

?The Michigan Education Association strongly supports Governor Whitmer?s proposal to provide much-needed tax relief to retirees and working families. Many Michigan educators planned for their retirement expecting that their pensions would be tax-free, but they had the rug pulled out from under them through an unfair tax hike on those who could least afford it,? said *Paula Herbart, Michigan Education Association President and veteran Macomb County teacher*. We urge legislators to support the governor?s proposal to repeal the retirement tax and put some much-needed money back into the hands of Michigan seniors and families.??

?

Today?s announcement builds on the Whitmer administration?s work helping Michiganders keep more of their hard-earned money. The governor signed bipartisan legislation to cut the cost of prescriptions and protect Michiganders from surprise medical billing, worked with the Michigan Legislature to bring down the cost of auto insurance and deliver $400 auto refund checks to every Michigan driver, and ended the tampon tax. ?

?

?Repealing the retirement tax will help those on a fixed income. With the price of food, utilities, and other living expenses going up so high, it would be helpful to have some extra money to cover those expenses,? said *Kathy Carlson, retired AFSCME*.?

??

?The retirement tax hurts our most vulnerable citizens while the wealthiest laugh the whole way to the bank, paying next to nothing in taxes,? said *Adam Saari, UP Field Rep, Bricklayers Local 2*.?

?

?Every Michigan resident deserves the right to retire with dignity after spending their career building Michigan into what it is today. Repealing the retirement tax and putting hard earned dollars back in the pockets of Michigan?s retirees is good for our retirees and good for our economy,? said *Ryan Stern, MI Building Trades Council member and sheet metal worker*.?

?

The administration has expanded access to quality, affordable child care to 150,000 more kids. The Whitmer administration also established the Michigan Reconnect program putting more than 100,000 Michiganders on a tuition-free path to higher education and skills training and set up the Michigan Achievement Scholarship lowering the cost of college by thousands of dollars a year.?

?

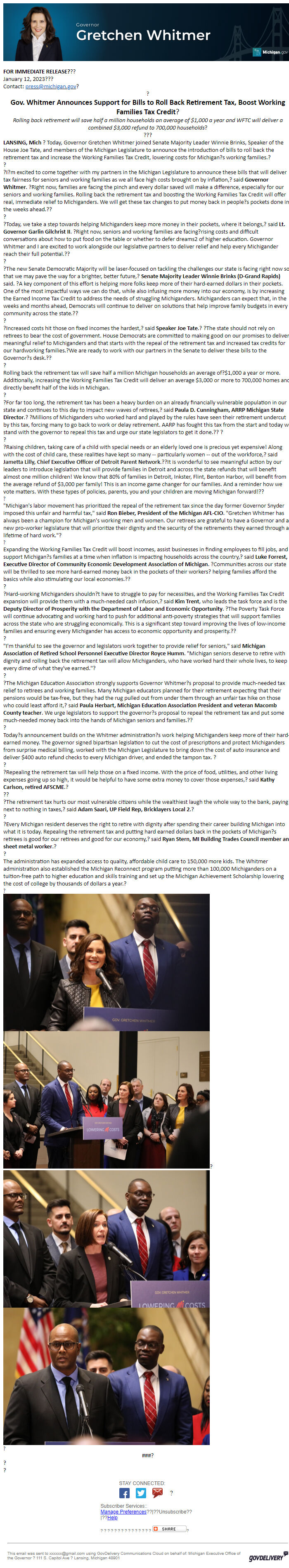

Governor Gretchen Whitmer speaking at podium with a crowd of elected officials and Michiganders standing behind them

Lieutenant Governor Garlin Gilchrist II speaking at podium with a crowd of elected officials and Michiganders standing behind them?

Senate Majority Leader Winnie Brinks speaking at the podium with elected officials and Michiganders behind them

Speaker Joe Tate speaking at the podium with elected officials and Michiganders behind them

?

###?

?

?

STAY CONNECTED: Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] [ [link removed] ]Sign up for email updates [ [link removed] ] [ [link removed] ] ?

Subscriber Services::

Manage Preferences [ [link removed] ]??|??Unsubscribe [ [link removed] ]??|??Help [ [link removed] ]

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Bookmark and Share [ [link removed] ]?

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Executive Office of the Governor ? 111 S. Capitol Ave ? Lansing, Michigan 48901 GovDelivery logo [ [link removed] ]

*FOR IMMEDIATE RELEASE?*??

January 12, 2023???

Contact: [email protected]?

?

*Gov. Whitmer Announces Support for Bills to Roll Back Retirement Tax, Boost Working Families Tax Credit*?

"Rolling back retirement will save half a million households an average of $1,000 a year and WFTC will deliver a combined $3,000 refund to 700,000 households"?

???

*LANSING, Mich *? Today, Governor Gretchen Whitmer joined Senate Majority Leader Winnie Brinks, Speaker of the House Joe Tate, and members of the Michigan Legislature to announce the introduction of bills to roll back the retirement tax and increase the Working Families Tax Credit, lowering costs for Michigan?s working families.?

?

?I?m excited to come together with my partners in the Michigan Legislature to announce these bills that will deliver tax fairness for seniors and working families as we all face high costs brought on by inflation,? said *Governor Whitmer*. ?Right now, families are facing the pinch and every dollar saved will make a difference, especially for our seniors and working families. Rolling back the retirement tax and boosting the Working Families Tax Credit will offer real, immediate relief to Michiganders. We will get these tax changes to put money back in people?s pockets done in the weeks ahead.??

?

?Today, we take a step towards helping Michiganders keep more money in their pockets, where it belongs,? said *Lt. Governor Garlin Gilchrist II*. ?Right now, seniors and working families are facing?rising costs and difficult conversations about how to put food on the table or whether to defer dreams2 of higher education. Governor Whitmer and I are excited to work alongside our legislative partners to deliver relief and help every Michigander reach their full potential.??

?

?The new Senate Democratic Majority will be laser-focused on tackling the challenges our state is facing right now so that we may pave the way for a brighter, better future,? *Senate Majority Leader Winnie Brinks (D-Grand Rapids)* said. ?A key component of this effort is helping more folks keep more of their hard-earned dollars in their pockets. One of the most impactful ways we can do that, while also infusing more money into our economy, is by increasing the Earned Income Tax Credit to address the needs of struggling Michiganders. Michiganders can expect that, in the weeks and months ahead, Democrats will continue to deliver on solutions that help improve family budgets in every community across the state.??

?

?Increased costs hit those on fixed incomes the hardest,? said *Speaker Joe Tate*.? ?The state should not rely on retirees to bear the cost of government. House Democrats are committed to making good on our promises to deliver meaningful relief to Michiganders and that starts with the repeal of the retirement tax and increased tax credits for our hardworking families.?We are ready to work with our partners in the Senate to deliver these bills to the Governor?s desk.??

?

Rolling back the retirement tax will save half a million Michigan households an average of?$1,000 a year or more. Additionally, increasing the Working Families Tax Credit will deliver an average $3,000 or more to 700,000 homes and directly benefit half of the kids in Michigan.

?

?For far too long, the retirement tax has been a heavy burden on an already financially vulnerable population in our state and continues to this day to impact new waves of retirees,? said *Paula D. Cunningham, ARRP Michigan State Director*.? ?Millions of Michiganders who worked hard and played by the rules have seen their retirement undercut by this tax, forcing many to go back to work or delay retirement. AARP has fought this tax from the start and today we stand with the governor to repeal this tax and urge our state legislators to get it done.?? ?

?

?Raising children, taking care of a child with special needs or an elderly loved one is precious yet expensive! Along with the cost of child care, these realities have kept so many -- particularly women -- out of the workforce,? said *Jametta Lilly, Chief Executive Officer of Detroit Parent Network*.??It is wonderful to see meaningful action by our leaders to introduce legislation that will provide families in Detroit and across the state refunds that will benefit almost one million children! We know that 80% of families in Detroit, Inkster, Flint, Benton Harbor, will benefit from the average refund of $3,000 per family! This is an income game changer for our families. And a reminder how we vote matters. With these types of policies, parents, you and your children are moving Michigan forward!??

?

"Michigan's labor movement has prioritized the repeal of the retirement tax since the day former Governor Snyder imposed this unfair and harmful tax," said *Ron Bieber, President of the Michigan AFL-CIO*. "Gretchen Whitmer has always been a champion for Michigan's working men and women. Our retirees are grateful to have a Governor and a new pro-worker legislature that will prioritize their dignity and the security of the retirements they earned through a lifetime of hard work."?

?

Expanding the Working Families Tax Credit will boost incomes, assist businesses in finding employees to fill jobs, and support Michigan?s families at a time when inflation is impacting households across the country,? said *Luke Forrest, Executive Director of Community Economic Development Association of Michigan*. ?Communities across our state will be thrilled to see more hard-earned money back in the pockets of their workers? helping families afford the basics while also stimulating our local economies.??

?

?Hard-working Michiganders shouldn?t have to struggle to pay for necessities, and the Working Families Tax Credit expansion will provide them with a much-needed cash infusion,? said *Kim Trent*, who leads the task force and is the *Deputy Director of Prosperity with the Department of Labor and Economic Opportunity*. ?The Poverty Task Force will continue advocating and working hard to push for additional anti-poverty strategies that will support families across the state who are struggling economically. This is a significant step toward improving the lives of low-income families and ensuring every Michigander has access to economic opportunity and prosperity.??

?

"I'm thankful to see the governor and legislators work together to provide relief for seniors," said *Michigan Association of Retired School Personnel Executive Director Royce Humm*. "Michigan seniors deserve to retire with dignity and rolling back the retirement tax will allow Michiganders, who have worked hard their whole lives, to keep every dime of what they've earned."?

?

?The Michigan Education Association strongly supports Governor Whitmer?s proposal to provide much-needed tax relief to retirees and working families. Many Michigan educators planned for their retirement expecting that their pensions would be tax-free, but they had the rug pulled out from under them through an unfair tax hike on those who could least afford it,? said *Paula Herbart, Michigan Education Association President and veteran Macomb County teacher*. We urge legislators to support the governor?s proposal to repeal the retirement tax and put some much-needed money back into the hands of Michigan seniors and families.??

?

Today?s announcement builds on the Whitmer administration?s work helping Michiganders keep more of their hard-earned money. The governor signed bipartisan legislation to cut the cost of prescriptions and protect Michiganders from surprise medical billing, worked with the Michigan Legislature to bring down the cost of auto insurance and deliver $400 auto refund checks to every Michigan driver, and ended the tampon tax. ?

?

?Repealing the retirement tax will help those on a fixed income. With the price of food, utilities, and other living expenses going up so high, it would be helpful to have some extra money to cover those expenses,? said *Kathy Carlson, retired AFSCME*.?

??

?The retirement tax hurts our most vulnerable citizens while the wealthiest laugh the whole way to the bank, paying next to nothing in taxes,? said *Adam Saari, UP Field Rep, Bricklayers Local 2*.?

?

?Every Michigan resident deserves the right to retire with dignity after spending their career building Michigan into what it is today. Repealing the retirement tax and putting hard earned dollars back in the pockets of Michigan?s retirees is good for our retirees and good for our economy,? said *Ryan Stern, MI Building Trades Council member and sheet metal worker*.?

?

The administration has expanded access to quality, affordable child care to 150,000 more kids. The Whitmer administration also established the Michigan Reconnect program putting more than 100,000 Michiganders on a tuition-free path to higher education and skills training and set up the Michigan Achievement Scholarship lowering the cost of college by thousands of dollars a year.?

?

Governor Gretchen Whitmer speaking at podium with a crowd of elected officials and Michiganders standing behind them

Lieutenant Governor Garlin Gilchrist II speaking at podium with a crowd of elected officials and Michiganders standing behind them?

Senate Majority Leader Winnie Brinks speaking at the podium with elected officials and Michiganders behind them

Speaker Joe Tate speaking at the podium with elected officials and Michiganders behind them

?

###?

?

?

STAY CONNECTED: Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] [ [link removed] ]Sign up for email updates [ [link removed] ] [ [link removed] ] ?

Subscriber Services::

Manage Preferences [ [link removed] ]??|??Unsubscribe [ [link removed] ]??|??Help [ [link removed] ]

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Bookmark and Share [ [link removed] ]?

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Executive Office of the Governor ? 111 S. Capitol Ave ? Lansing, Michigan 48901 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Office of the Governor of Michigan

- Political Party: n/a

- Country: United States

- State/Locality: MIchigan

- Office: n/a

-

Email Providers:

- govDelivery