Email

Utility CEOs received $2.7 billion in executive compensation from 2017 – 2021

| From | Energy and Policy Institute <[email protected]> |

| Subject | Utility CEOs received $2.7 billion in executive compensation from 2017 – 2021 |

| Date | January 9, 2023 1:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** Utility CEOs received $2.7 billion in executive compensation from 2017 – 2021 ([link removed])

------------------------------------------------------------

By Joe Smyth on Jan 08, 2023 11:24 pm

Investor-owned electric and gas utilities paid their CEOs $2.7 billion between 2017 and 2021, according to corporate data reviewed by the Energy and Policy Institute.

CEOs for the 58 companies reviewed for this analysis received more than $629 million in 2021, a nearly 40% increase from the $451 million paid in 2017. That is far higher than the 14.8% Consumer Price Index inflation rate ([link removed]) from January 2017 to December 2021.

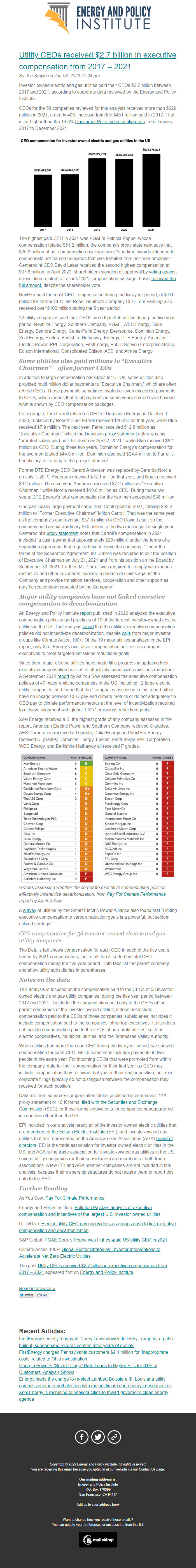

Utility CEO Compensation

The highest paid CEO in 2021 was PG&E’s Patricia Poppe, whose compensation totaled $51.2 million; the company’s proxy statement says that $35.8 million of her compensation package were “one-time awards intended to compensate her for compensation that was forfeited from her prior employer.” Centerpoint CEO David Lesar received the second highest compensation at $37.8 million; in April 2022, shareholders signaled disapproval by voting against ([link removed]) a resolution related to Lesar’s 2021 compensation package. Lesar received the full amount ([link removed]) , despite the shareholder vote.

NextEra paid the most CEO compensation during the five-year period, at $111 million for former CEO Jim Robo. Southern Company CEO Tom Fanning also received over $100 million during the 5 year period.

22 utility companies paid their CEOs more than $50 million during the five year period: NextEra Energy, Southern Company, PG&E, WEC Energy, Duke Energy, Sempra Energy, CenterPoint Energy, Eversource, Dominion Energy, Xcel Energy, Exelon, Berkshire Hathaway, Entergy, DTE Energy, American Electric Power, PPL Corporation, FirstEnergy, Public Service Enterprise Group, Edison International, Consolidated Edison, AES, and Atmos Energy.

** Some utilities also paid millions to “Executive Chairmen” – often former CEOs

------------------------------------------------------------

In addition to large compensation packages for CEOs, some utilities also provided multi-million dollar payments to “Executive Chairmen,” which are often retired CEOs. Those payments sometimes rivaled or even exceeded payments to CEOs, which means that total payments in some years soared even beyond what is shown by CEO compensation packages.

For example, Tom Farrell retired as CEO of Dominion Energy on October 1, 2020, replaced by Robert Blue; Farrell received $16 million that year, while Blue received $7.9 million. The next year, Farrell received $12.8 million as “Executive Chairman,” which the Dominion proxy statement ([link removed](ADA).pdf) notes was his “prorated salary paid until his death on April 2, 2021,” while Blue received $8.1 million as CEO. During those two years, Dominion Energy’s compensation for the two men totaled $44.9 million. Dominion also paid $24.4 million to Farrell’s beneficiary, according to the proxy statement.

Former DTE Energy CEO Gerard Anderson was replaced by Gerardo Norcia on July 1, 2019; Anderson received $12.1 million that year, and Norcia received $8.2 million. The next year, Anderson received $7.2 million as “Executive Chairman,” while Norcia received $10.6 million as CEO. During those two years, DTE Energy’s total compensation for the two men exceeded $38 million.

One particularly large payment came from Centerpoint in 2021, totaling $32.2 million to “Former Executive Chairman” Milton Carroll. That was the same year as the company’s controversial $37.8 million to CEO David Lesar, so the company paid an extraordinary $70 million to the two men in just a single year. Centerpoint’s proxy statement ([link removed]) notes that Carroll’s compensation in 2021 included “a cash payment of approximately $28 million” under the terms of a separation agreement that required him to leave the company: “Under the terms of the Separation Agreement, Mr. Carroll was required to exit the position of Executive Chairman on July 21, 2021 and from his position on the Board by September 30, 2021. Further, Mr. Carroll was required to comply with various restrictive and other covenants, execute a release of claims against the Company and provide transition services, cooperation and other support as may

be reasonably requested by the Company.”

** Major utility companies have not linked executive compensation to decarbonization

------------------------------------------------------------

An Energy and Policy Institute report ([link removed]) published in 2020 analyzed the executive compensation policies and practices of 19 of the largest investor-owned electric utilities in the US. That analysis found ([link removed]) that the utilities’ executive compensation policies did not incentivize decarbonization, despite calls ([link removed]) from major investor groups like Climate Action 100+. Of the 19 major utilities analyzed in the EPI report, only Xcel Energy’s executive compensation policies encouraged executives to meet targeted emissions reductions goals.

Since then, major electric utilities have made little progress in updating their executive compensation policies to effectively incentivize emissions reductions. A September 2022 report ([link removed]) by As You Sow assessed the executive compensation policies of 47 major emitting companies in the US, including 12 large electric utility companies, and found that the “companies assessed in this report either have no linkage between CEO pay and climate metrics or do not adequately tie CEO pay to climate performance metrics at the level of incentivization required to achieve alignment with global 1.5° C emissions reduction goals.”

Xcel Energy received a B, the highest grade of any company assessed in the report. American Electric Power and Southern Company received C grades; AES Corporation received a D grade; Duke Energy and NextEra Energy received D- grades; Dominion Energy, Exelon, FirstEnergy, PPL Corporation, WEC Energy, and Berkshire Hathaway all received F grades.

Grades assessing whether the corporate executive compensation policies effectively incentivize decarbonization, from Pay For Climate Performance ([link removed]) report by As You Sow

A survey ([link removed]) of utilities by the Smart Electric Power Alliance also found that “Linking executive compensation to carbon reduction goals is a powerful, but seldom utilized strategy.”

** CEO compensation for 58 investor-owned electric and gas utility companies

------------------------------------------------------------

IFRAME: [1][link removed]

The Details tab shows compensation for each CEO in each of the five years, sorted by 2021 compensation; the Totals tab is sorted by total CEO compensation during the five year period. Both tabs list the parent company, and show utility subsidiaries in parentheses.

** Notes on the data

------------------------------------------------------------

This analysis is focused on the compensation paid to the CEOs of 58 investor-owned electric and gas utility companies, during the five year period between 2017 and 2021. It includes the compensation paid only to the CEOs of the parent companies of the investor-owned utilities; it does not include compensation paid to the CEOs of those companies’ subsidiaries, nor does it include compensation paid to the companies’ other top executives. It also does not include compensation paid to the CEOs of non-profit utilities, such as electric cooperatives, municipal utilities, and the Tennessee Valley Authority.

When utilities had more than one CEO during the five-year period, we showed compensation for each CEO, which sometimes includes payments to two people in the same year. For incoming CEOs that were promoted from within the company, data for their compensation for their first year as CEO may include compensation they received that year in their earlier position, because corporate filings typically do not distinguish between the compensation they received for each position.

Data are from summary compensation tables published in companies’ 14A proxy statement or 10-K forms, filed with the Securities and Exchange Commission ([link removed]) (SEC), or those forms’ equivalents for companies headquartered in countries other than the US.

EPI included in our analysis nearly all of the investor-owned electric utilities that are members of the Edison Electric Institute ([link removed]) (EEI), and investor-owned gas utilities that are represented on the American Gas Association (AGA) board of directors ([link removed]) . EEI is the trade association for investor-owned electric utilities in the US, and AGA is the trade association for investor-owned gas utilities in the US; several utility companies (or their subsidiaries) are members of both trade associations. A few EEI and AGA member companies are not included in this analysis, because their ownership structures do not require them to report this data to the SEC.

** Further Reading

------------------------------------------------------------

As You Sow: Pay For Climate Performance ([link removed])

Energy and Policy Institute: Pollution Payday: analysis of executive compensation and incentives of the largest U.S. investor-owned utilities ([link removed])

UtilityDive: Electric utility CEO pay gap widens as groups push to link executive compensation and decarbonization ([link removed])

S&P Global: PG&E Corp.’s Poppe was highest-paid US utility CEO in 2021 ([link removed])

Climate Action 100+: Global Sector Strategies: Investor Interventions to Accelerate Net Zero Electric Utilities ([link removed])

The post Utility CEOs received $2.7 billion in executive compensation from 2017 – 2021 ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

References

1. [link removed]

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** FirstEnergy secretly ‘engaged’ Corey Lewandowski to lobby Trump for a public bailout, subpoenaed records confirm after years of denials ([link removed])

** FirstEnergy charged Pennsylvania customers $2.4 million for ‘inappropriate costs’ related to Ohio investigation ([link removed])

** Georgia Power’s “Smart Usage” Rate Leads to Higher Bills for 61% of Customers, Analysis Shows ([link removed])

** Entergy leads the charge to re-elect Lambert Boissiere III, Louisiana utility commissioner in runoff election with major climate and energy consequences ([link removed])

** Xcel Energy is recruiting Minnesota cities to thwart governor’s clean energy agenda ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2023 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By Joe Smyth on Jan 08, 2023 11:24 pm

Investor-owned electric and gas utilities paid their CEOs $2.7 billion between 2017 and 2021, according to corporate data reviewed by the Energy and Policy Institute.

CEOs for the 58 companies reviewed for this analysis received more than $629 million in 2021, a nearly 40% increase from the $451 million paid in 2017. That is far higher than the 14.8% Consumer Price Index inflation rate ([link removed]) from January 2017 to December 2021.

Utility CEO Compensation

The highest paid CEO in 2021 was PG&E’s Patricia Poppe, whose compensation totaled $51.2 million; the company’s proxy statement says that $35.8 million of her compensation package were “one-time awards intended to compensate her for compensation that was forfeited from her prior employer.” Centerpoint CEO David Lesar received the second highest compensation at $37.8 million; in April 2022, shareholders signaled disapproval by voting against ([link removed]) a resolution related to Lesar’s 2021 compensation package. Lesar received the full amount ([link removed]) , despite the shareholder vote.

NextEra paid the most CEO compensation during the five-year period, at $111 million for former CEO Jim Robo. Southern Company CEO Tom Fanning also received over $100 million during the 5 year period.

22 utility companies paid their CEOs more than $50 million during the five year period: NextEra Energy, Southern Company, PG&E, WEC Energy, Duke Energy, Sempra Energy, CenterPoint Energy, Eversource, Dominion Energy, Xcel Energy, Exelon, Berkshire Hathaway, Entergy, DTE Energy, American Electric Power, PPL Corporation, FirstEnergy, Public Service Enterprise Group, Edison International, Consolidated Edison, AES, and Atmos Energy.

** Some utilities also paid millions to “Executive Chairmen” – often former CEOs

------------------------------------------------------------

In addition to large compensation packages for CEOs, some utilities also provided multi-million dollar payments to “Executive Chairmen,” which are often retired CEOs. Those payments sometimes rivaled or even exceeded payments to CEOs, which means that total payments in some years soared even beyond what is shown by CEO compensation packages.

For example, Tom Farrell retired as CEO of Dominion Energy on October 1, 2020, replaced by Robert Blue; Farrell received $16 million that year, while Blue received $7.9 million. The next year, Farrell received $12.8 million as “Executive Chairman,” which the Dominion proxy statement ([link removed](ADA).pdf) notes was his “prorated salary paid until his death on April 2, 2021,” while Blue received $8.1 million as CEO. During those two years, Dominion Energy’s compensation for the two men totaled $44.9 million. Dominion also paid $24.4 million to Farrell’s beneficiary, according to the proxy statement.

Former DTE Energy CEO Gerard Anderson was replaced by Gerardo Norcia on July 1, 2019; Anderson received $12.1 million that year, and Norcia received $8.2 million. The next year, Anderson received $7.2 million as “Executive Chairman,” while Norcia received $10.6 million as CEO. During those two years, DTE Energy’s total compensation for the two men exceeded $38 million.

One particularly large payment came from Centerpoint in 2021, totaling $32.2 million to “Former Executive Chairman” Milton Carroll. That was the same year as the company’s controversial $37.8 million to CEO David Lesar, so the company paid an extraordinary $70 million to the two men in just a single year. Centerpoint’s proxy statement ([link removed]) notes that Carroll’s compensation in 2021 included “a cash payment of approximately $28 million” under the terms of a separation agreement that required him to leave the company: “Under the terms of the Separation Agreement, Mr. Carroll was required to exit the position of Executive Chairman on July 21, 2021 and from his position on the Board by September 30, 2021. Further, Mr. Carroll was required to comply with various restrictive and other covenants, execute a release of claims against the Company and provide transition services, cooperation and other support as may

be reasonably requested by the Company.”

** Major utility companies have not linked executive compensation to decarbonization

------------------------------------------------------------

An Energy and Policy Institute report ([link removed]) published in 2020 analyzed the executive compensation policies and practices of 19 of the largest investor-owned electric utilities in the US. That analysis found ([link removed]) that the utilities’ executive compensation policies did not incentivize decarbonization, despite calls ([link removed]) from major investor groups like Climate Action 100+. Of the 19 major utilities analyzed in the EPI report, only Xcel Energy’s executive compensation policies encouraged executives to meet targeted emissions reductions goals.

Since then, major electric utilities have made little progress in updating their executive compensation policies to effectively incentivize emissions reductions. A September 2022 report ([link removed]) by As You Sow assessed the executive compensation policies of 47 major emitting companies in the US, including 12 large electric utility companies, and found that the “companies assessed in this report either have no linkage between CEO pay and climate metrics or do not adequately tie CEO pay to climate performance metrics at the level of incentivization required to achieve alignment with global 1.5° C emissions reduction goals.”

Xcel Energy received a B, the highest grade of any company assessed in the report. American Electric Power and Southern Company received C grades; AES Corporation received a D grade; Duke Energy and NextEra Energy received D- grades; Dominion Energy, Exelon, FirstEnergy, PPL Corporation, WEC Energy, and Berkshire Hathaway all received F grades.

Grades assessing whether the corporate executive compensation policies effectively incentivize decarbonization, from Pay For Climate Performance ([link removed]) report by As You Sow

A survey ([link removed]) of utilities by the Smart Electric Power Alliance also found that “Linking executive compensation to carbon reduction goals is a powerful, but seldom utilized strategy.”

** CEO compensation for 58 investor-owned electric and gas utility companies

------------------------------------------------------------

IFRAME: [1][link removed]

The Details tab shows compensation for each CEO in each of the five years, sorted by 2021 compensation; the Totals tab is sorted by total CEO compensation during the five year period. Both tabs list the parent company, and show utility subsidiaries in parentheses.

** Notes on the data

------------------------------------------------------------

This analysis is focused on the compensation paid to the CEOs of 58 investor-owned electric and gas utility companies, during the five year period between 2017 and 2021. It includes the compensation paid only to the CEOs of the parent companies of the investor-owned utilities; it does not include compensation paid to the CEOs of those companies’ subsidiaries, nor does it include compensation paid to the companies’ other top executives. It also does not include compensation paid to the CEOs of non-profit utilities, such as electric cooperatives, municipal utilities, and the Tennessee Valley Authority.

When utilities had more than one CEO during the five-year period, we showed compensation for each CEO, which sometimes includes payments to two people in the same year. For incoming CEOs that were promoted from within the company, data for their compensation for their first year as CEO may include compensation they received that year in their earlier position, because corporate filings typically do not distinguish between the compensation they received for each position.

Data are from summary compensation tables published in companies’ 14A proxy statement or 10-K forms, filed with the Securities and Exchange Commission ([link removed]) (SEC), or those forms’ equivalents for companies headquartered in countries other than the US.

EPI included in our analysis nearly all of the investor-owned electric utilities that are members of the Edison Electric Institute ([link removed]) (EEI), and investor-owned gas utilities that are represented on the American Gas Association (AGA) board of directors ([link removed]) . EEI is the trade association for investor-owned electric utilities in the US, and AGA is the trade association for investor-owned gas utilities in the US; several utility companies (or their subsidiaries) are members of both trade associations. A few EEI and AGA member companies are not included in this analysis, because their ownership structures do not require them to report this data to the SEC.

** Further Reading

------------------------------------------------------------

As You Sow: Pay For Climate Performance ([link removed])

Energy and Policy Institute: Pollution Payday: analysis of executive compensation and incentives of the largest U.S. investor-owned utilities ([link removed])

UtilityDive: Electric utility CEO pay gap widens as groups push to link executive compensation and decarbonization ([link removed])

S&P Global: PG&E Corp.’s Poppe was highest-paid US utility CEO in 2021 ([link removed])

Climate Action 100+: Global Sector Strategies: Investor Interventions to Accelerate Net Zero Electric Utilities ([link removed])

The post Utility CEOs received $2.7 billion in executive compensation from 2017 – 2021 ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

References

1. [link removed]

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** FirstEnergy secretly ‘engaged’ Corey Lewandowski to lobby Trump for a public bailout, subpoenaed records confirm after years of denials ([link removed])

** FirstEnergy charged Pennsylvania customers $2.4 million for ‘inappropriate costs’ related to Ohio investigation ([link removed])

** Georgia Power’s “Smart Usage” Rate Leads to Higher Bills for 61% of Customers, Analysis Shows ([link removed])

** Entergy leads the charge to re-elect Lambert Boissiere III, Louisiana utility commissioner in runoff election with major climate and energy consequences ([link removed])

** Xcel Energy is recruiting Minnesota cities to thwart governor’s clean energy agenda ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2023 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp