| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2023-01 |

| Date | January 6, 2023 9:07 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Final corrections of tax year 2020 accounts; estimated tax payments due; tax relief for NY storm victims; and more

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

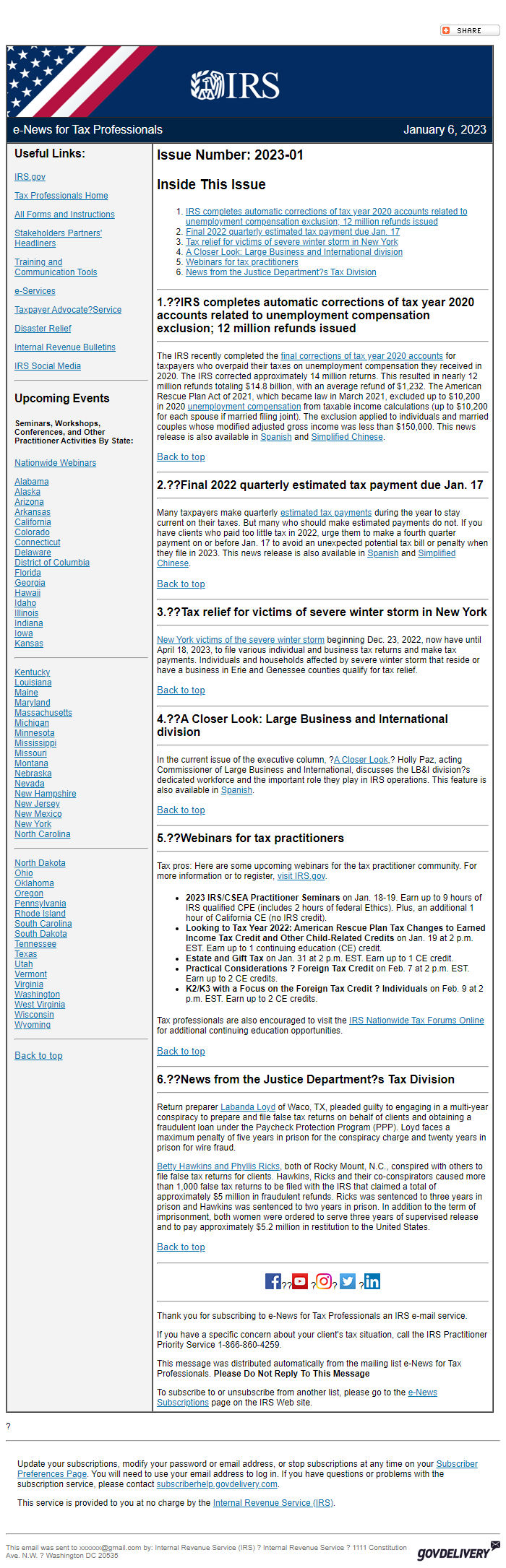

IRS.gov Banner

e-News for Tax Professionals January 6, 2023

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2023-01

Inside This Issue

* IRS completes automatic corrections of tax year 2020 accounts related to unemployment compensation exclusion; 12 million refunds issued [ #First ]

* Final 2022 quarterly estimated tax payment due Jan. 17 [ #Second ]

* Tax relief for victims of severe winter storm in New York [ #Third ]

* A Closer Look: Large Business and International division [ #Fourth ]

* Webinars for tax practitioners [ #Fifth ]

* News from the Justice Department?s Tax Division [ #Sixth ]

________________________________________________________________________

*1.??IRS completes automatic corrections of tax year 2020 accounts related to unemployment compensation exclusion; 12 million refunds issued*________________________________________________________________________

The IRS recently completed the final corrections of tax year 2020 accounts [ [link removed] ] for taxpayers who overpaid their taxes on unemployment compensation they received in 2020. The IRS corrected approximately 14 million returns. This resulted in nearly 12 million refunds totaling $14.8 billion, with an average refund of $1,232. The American Rescue Plan Act of 2021, which became law in March 2021, excluded up to $10,200 in 2020 unemployment compensation [ [link removed] ] from taxable income calculations (up to $10,200 for each spouse if married filing joint). The exclusion applied to individuals and married couples whose modified adjusted gross income was less than $150,000. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2.??Final 2022 quarterly estimated tax payment due Jan. 17*________________________________________________________________________

Many taxpayers make quarterly estimated tax payments [ [link removed] ] during the year to stay current on their taxes. But many who should make estimated payments do not. If you have clients who paid too little tax in 2022, urge them to make a fourth quarter payment on or before Jan. 17 to avoid an unexpected potential tax bill or penalty when they file in 2023. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??Tax relief for victims of severe winter storm in New York*________________________________________________________________________

New York victims of the severe winter storm [ [link removed] ] beginning Dec. 23, 2022, now have until April 18, 2023, to file various individual and business tax returns and make tax payments. Individuals and households affected by severe winter storm that reside or have a business in Erie and Genessee counties qualify for tax relief.

Back to top [ #top ]

________________________________________________________________________

*4.??A Closer Look: Large Business and International division*________________________________________________________________________

In the current issue of the executive column, ?A Closer Look [ [link removed] ],? Holly Paz, acting Commissioner of Large Business and International, discusses the LB&I division?s dedicated workforce and the important role they play in IRS operations. This feature is also available in Spanish [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*5.??Webinars for tax practitioners*________________________________________________________________________

Tax pros: Here are some upcoming webinars for the tax practitioner community. For more information or to register, visit IRS.gov [ [link removed] ].

* *2023 IRS/CSEA Practitioner Seminars* on Jan. 18-19. Earn up to 9 hours of IRS qualified CPE (includes 2 hours of federal Ethics). Plus, an additional 1 hour of California CE (no IRS credit).

* *Looking to Tax Year 2022: American Rescue Plan Tax Changes to Earned Income Tax Credit and Other Child-Related Credits* on Jan. 19 at 2 p.m. EST. Earn up to 1 continuing education (CE) credit.

* *Estate and Gift Tax* on Jan. 31 at 2 p.m. EST. Earn up to 1 CE credit.

* *Practical Considerations ? Foreign Tax Credit* on Feb. 7 at 2 p.m. EST. Earn up to 2 CE credits.

* *K2/K3 with a Focus on the Foreign Tax Credit ? Individuals* on Feb. 9 at 2 p.m. EST. Earn up to 2 CE credits.

Tax professionals are also encouraged to visit the IRS Nationwide Tax Forums Online [ [link removed] ] for additional continuing education opportunities.

Back to top [ #top ]

________________________________________________________________________

*6.??News from the Justice Department?s Tax Division*________________________________________________________________________

Return preparer Labanda Loyd [ [link removed] ] of Waco, TX, pleaded guilty to engaging in a multi-year conspiracy to prepare and file false tax returns on behalf of clients and obtaining a fraudulent loan under the Paycheck Protection Program (PPP). Loyd faces a maximum penalty of five years in prison for the conspiracy charge and twenty years in prison for wire fraud.

Betty Hawkins and Phyllis Ricks [ [link removed] ], both of Rocky Mount, N.C., conspired with others to file false tax returns for clients. Hawkins, Ricks and their co-conspirators caused more than 1,000 false tax returns to be filed with the IRS that claimed a total of approximately $5 million in fraudulent refunds. Ricks was sentenced to three years in prison and Hawkins was sentenced to two years in prison. In addition to the term of imprisonment, both women were ordered to serve three years of supervised release and to pay approximately $5.2 million in restitution to the United States.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Tax Professionals January 6, 2023

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2023-01

Inside This Issue

* IRS completes automatic corrections of tax year 2020 accounts related to unemployment compensation exclusion; 12 million refunds issued [ #First ]

* Final 2022 quarterly estimated tax payment due Jan. 17 [ #Second ]

* Tax relief for victims of severe winter storm in New York [ #Third ]

* A Closer Look: Large Business and International division [ #Fourth ]

* Webinars for tax practitioners [ #Fifth ]

* News from the Justice Department?s Tax Division [ #Sixth ]

________________________________________________________________________

*1.??IRS completes automatic corrections of tax year 2020 accounts related to unemployment compensation exclusion; 12 million refunds issued*________________________________________________________________________

The IRS recently completed the final corrections of tax year 2020 accounts [ [link removed] ] for taxpayers who overpaid their taxes on unemployment compensation they received in 2020. The IRS corrected approximately 14 million returns. This resulted in nearly 12 million refunds totaling $14.8 billion, with an average refund of $1,232. The American Rescue Plan Act of 2021, which became law in March 2021, excluded up to $10,200 in 2020 unemployment compensation [ [link removed] ] from taxable income calculations (up to $10,200 for each spouse if married filing joint). The exclusion applied to individuals and married couples whose modified adjusted gross income was less than $150,000. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2.??Final 2022 quarterly estimated tax payment due Jan. 17*________________________________________________________________________

Many taxpayers make quarterly estimated tax payments [ [link removed] ] during the year to stay current on their taxes. But many who should make estimated payments do not. If you have clients who paid too little tax in 2022, urge them to make a fourth quarter payment on or before Jan. 17 to avoid an unexpected potential tax bill or penalty when they file in 2023. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??Tax relief for victims of severe winter storm in New York*________________________________________________________________________

New York victims of the severe winter storm [ [link removed] ] beginning Dec. 23, 2022, now have until April 18, 2023, to file various individual and business tax returns and make tax payments. Individuals and households affected by severe winter storm that reside or have a business in Erie and Genessee counties qualify for tax relief.

Back to top [ #top ]

________________________________________________________________________

*4.??A Closer Look: Large Business and International division*________________________________________________________________________

In the current issue of the executive column, ?A Closer Look [ [link removed] ],? Holly Paz, acting Commissioner of Large Business and International, discusses the LB&I division?s dedicated workforce and the important role they play in IRS operations. This feature is also available in Spanish [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*5.??Webinars for tax practitioners*________________________________________________________________________

Tax pros: Here are some upcoming webinars for the tax practitioner community. For more information or to register, visit IRS.gov [ [link removed] ].

* *2023 IRS/CSEA Practitioner Seminars* on Jan. 18-19. Earn up to 9 hours of IRS qualified CPE (includes 2 hours of federal Ethics). Plus, an additional 1 hour of California CE (no IRS credit).

* *Looking to Tax Year 2022: American Rescue Plan Tax Changes to Earned Income Tax Credit and Other Child-Related Credits* on Jan. 19 at 2 p.m. EST. Earn up to 1 continuing education (CE) credit.

* *Estate and Gift Tax* on Jan. 31 at 2 p.m. EST. Earn up to 1 CE credit.

* *Practical Considerations ? Foreign Tax Credit* on Feb. 7 at 2 p.m. EST. Earn up to 2 CE credits.

* *K2/K3 with a Focus on the Foreign Tax Credit ? Individuals* on Feb. 9 at 2 p.m. EST. Earn up to 2 CE credits.

Tax professionals are also encouraged to visit the IRS Nationwide Tax Forums Online [ [link removed] ] for additional continuing education opportunities.

Back to top [ #top ]

________________________________________________________________________

*6.??News from the Justice Department?s Tax Division*________________________________________________________________________

Return preparer Labanda Loyd [ [link removed] ] of Waco, TX, pleaded guilty to engaging in a multi-year conspiracy to prepare and file false tax returns on behalf of clients and obtaining a fraudulent loan under the Paycheck Protection Program (PPP). Loyd faces a maximum penalty of five years in prison for the conspiracy charge and twenty years in prison for wire fraud.

Betty Hawkins and Phyllis Ricks [ [link removed] ], both of Rocky Mount, N.C., conspired with others to file false tax returns for clients. Hawkins, Ricks and their co-conspirators caused more than 1,000 false tax returns to be filed with the IRS that claimed a total of approximately $5 million in fraudulent refunds. Ricks was sentenced to three years in prison and Hawkins was sentenced to two years in prison. In addition to the term of imprisonment, both women were ordered to serve three years of supervised release and to pay approximately $5.2 million in restitution to the United States.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery