Email

A Responsible Budget for Mississippi – update from your favorite think tank

| From | Douglas Carswell <[email protected]> |

| Subject | A Responsible Budget for Mississippi – update from your favorite think tank |

| Date | December 31, 2022 1:44 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser ([link removed])

Dear Jack,

In 2022 Mississippi made significant tax cuts, reducing the state income tax from around 7 percent to a flat 4 percent. These tax cuts will directly benefit over a million Mississippi workers and help make our state more prosperous.

Now working with a former White House economist, Vance Ginn Ph.D., the Mississippi Center for Public Policy is publishing a Responsible Mississippi Budget for the next financial year. Read it here ([link removed]) .

Here is a Mississippi budget that every conservative lawmaker ought to be able to support. Why?

Conservatives that are serious about limiting the size of government need to follow a simple fiscal rule; government spending should not increase faster than the rate of population growth plus inflation.

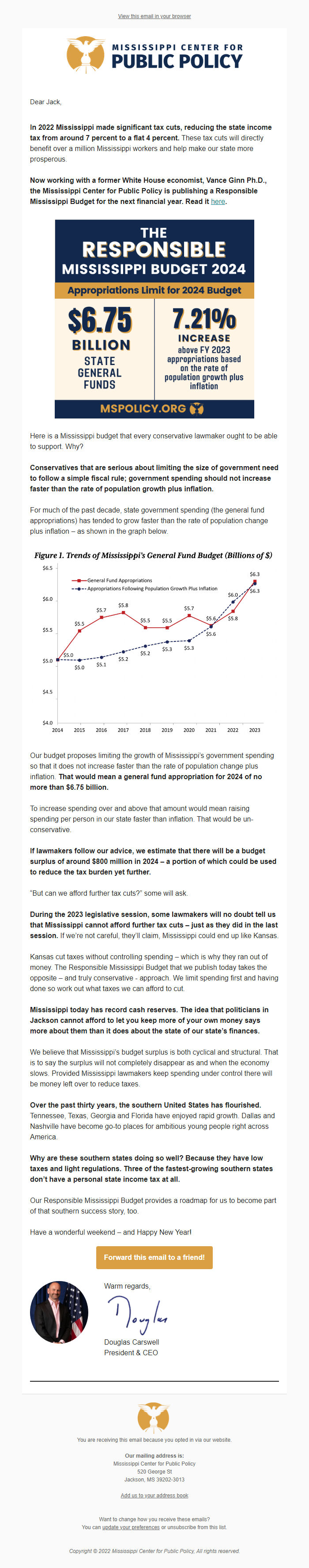

For much of the past decade, state government spending (the general fund appropriations) has tended to grow faster than the rate of population change plus inflation – as shown in the graph below.

Our budget proposes limiting the growth of Mississippi’s government spending so that it does not increase faster than the rate of population change plus inflation. That would mean a general fund appropriation for 2024 of no more than $6.75 billion.

To increase spending over and above that amount would mean raising spending per person in our state faster than inflation. That would be un-conservative.

If lawmakers follow our advice, we estimate that there will be a budget surplus of around $800 million in 2024 – a portion of which could be used to reduce the tax burden yet further.

“But can we afford further tax cuts?” some will ask.

During the 2023 legislative session, some lawmakers will no doubt tell us that Mississippi cannot afford further tax cuts – just as they did in the last session. If we’re not careful, they’ll claim, Mississippi could end up like Kansas.

Kansas cut taxes without controlling spending – which is why they ran out of money. The Responsible Mississippi Budget that we publish today takes the opposite – and truly conservative - approach. We limit spending first and having done so work out what taxes we can afford to cut.

Mississippi today has record cash reserves. The idea that politicians in Jackson cannot afford to let you keep more of your own money says more about them than it does about the state of our state’s finances.

We believe that Mississippi’s budget surplus is both cyclical and structural. That is to say the surplus will not completely disappear as and when the economy slows. Provided Mississippi lawmakers keep spending under control there will be money left over to reduce taxes.

Over the past thirty years, the southern United States has flourished. Tennessee, Texas, Georgia and Florida have enjoyed rapid growth. Dallas and Nashville have become go-to places for ambitious young people right across America.

Why are these southern states doing so well? Because they have low taxes and light regulations. Three of the fastest-growing southern states don’t have a personal state income tax at all.

Our Responsible Mississippi Budget provides a roadmap for us to become part of that southern success story, too.

Have a wonderful weekend – and Happy New Year!

Forward this email to a friend! ([link removed])

Warm regards,

Douglas Carswell

President & CEO

============================================================

You are receiving this email because you opted in via our website.

Our mailing address is:

Mississippi Center for Public Policy

520 George St

Jackson, MS 39202-3013

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Copyright © 2022 Mississippi Center for Public Policy, All rights reserved.

Dear Jack,

In 2022 Mississippi made significant tax cuts, reducing the state income tax from around 7 percent to a flat 4 percent. These tax cuts will directly benefit over a million Mississippi workers and help make our state more prosperous.

Now working with a former White House economist, Vance Ginn Ph.D., the Mississippi Center for Public Policy is publishing a Responsible Mississippi Budget for the next financial year. Read it here ([link removed]) .

Here is a Mississippi budget that every conservative lawmaker ought to be able to support. Why?

Conservatives that are serious about limiting the size of government need to follow a simple fiscal rule; government spending should not increase faster than the rate of population growth plus inflation.

For much of the past decade, state government spending (the general fund appropriations) has tended to grow faster than the rate of population change plus inflation – as shown in the graph below.

Our budget proposes limiting the growth of Mississippi’s government spending so that it does not increase faster than the rate of population change plus inflation. That would mean a general fund appropriation for 2024 of no more than $6.75 billion.

To increase spending over and above that amount would mean raising spending per person in our state faster than inflation. That would be un-conservative.

If lawmakers follow our advice, we estimate that there will be a budget surplus of around $800 million in 2024 – a portion of which could be used to reduce the tax burden yet further.

“But can we afford further tax cuts?” some will ask.

During the 2023 legislative session, some lawmakers will no doubt tell us that Mississippi cannot afford further tax cuts – just as they did in the last session. If we’re not careful, they’ll claim, Mississippi could end up like Kansas.

Kansas cut taxes without controlling spending – which is why they ran out of money. The Responsible Mississippi Budget that we publish today takes the opposite – and truly conservative - approach. We limit spending first and having done so work out what taxes we can afford to cut.

Mississippi today has record cash reserves. The idea that politicians in Jackson cannot afford to let you keep more of your own money says more about them than it does about the state of our state’s finances.

We believe that Mississippi’s budget surplus is both cyclical and structural. That is to say the surplus will not completely disappear as and when the economy slows. Provided Mississippi lawmakers keep spending under control there will be money left over to reduce taxes.

Over the past thirty years, the southern United States has flourished. Tennessee, Texas, Georgia and Florida have enjoyed rapid growth. Dallas and Nashville have become go-to places for ambitious young people right across America.

Why are these southern states doing so well? Because they have low taxes and light regulations. Three of the fastest-growing southern states don’t have a personal state income tax at all.

Our Responsible Mississippi Budget provides a roadmap for us to become part of that southern success story, too.

Have a wonderful weekend – and Happy New Year!

Forward this email to a friend! ([link removed])

Warm regards,

Douglas Carswell

President & CEO

============================================================

You are receiving this email because you opted in via our website.

Our mailing address is:

Mississippi Center for Public Policy

520 George St

Jackson, MS 39202-3013

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Copyright © 2022 Mississippi Center for Public Policy, All rights reserved.

Message Analysis

- Sender: Mississippi Center for Public Policy

- Political Party: n/a

- Country: United States

- State/Locality: Mississippi

- Office: n/a

-

Email Providers:

- MailChimp