Email

Governor DeWine, Lt. Governor Husted Announce State Support for 54 Historic Rehabilitation Projects

| From | Gov. DeWine Comms <[email protected]> |

| Subject | Governor DeWine, Lt. Governor Husted Announce State Support for 54 Historic Rehabilitation Projects |

| Date | December 20, 2022 6:16 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

DeWine and Husted Masthead

*FOR IMMEDIATE RELEASE:*

December 20, 2022

*MEDIA CONTACTS:

*Dan Tierney: 614-644-0957

Jill Del Greco: 614-644-0957

LG: Hayley Carducci: 614-404-8616

Governor DeWine, Lt. Governor Husted Announce State Support for 54 Historic Rehabilitation Projects

(COLUMBUS, Ohio)?Ohio Governor Mike DeWine and Lt. Governor Jon Husted today announced state support for 54 rehabilitation projects that will restore 57 historic buildings across Ohio. The projects are expected to leverage approximately $1.01 billion in private investment.

The projects are being awarded funding as part of the Ohio Historic Preservation Tax Credit Program [ [link removed] ] (OHPTC), administered by the Ohio Department of Development.?In total, 21 communities across the state are receiving awards, which total $64,132,847 in tax credits.

?By rehabilitating these historic buildings today, we can preserve the heart of our communities for future generations of Ohioans,? said Governor DeWine. ?Once restored, these sites will help renew local communities and create additional opportunities for Ohioans.?

The awards will assist private developers in rehabilitating historic buildings in downtowns and neighborhoods. Many of the buildings are vacant today and generate little economic activity. Once rehabilitated, they will drive further investment and interest in adjacent property. Developers are not issued the tax credit until project construction is complete and all program requirements are verified.

?In many cases, it?s more expensive to revitalize an historic structure than it is to build a new one. Historic tax credits generate opportunity for communities by attracting investment that would not make financial sense otherwise,? said Lt. Governor Husted. ?When we preserve buildings that are part of a community?s historic legacy, we?re preserving the past and investing in the future of our great state.?

?Revitalizing these underutilized spaces creates new opportunities for Ohioans and the local neighborhood,? said Lydia Mihalik, director of the Ohio Department of Development. ?These are unique spaces in our communities, and once they are transformed, they will be catalysts for future economic development and growth.?

________________________________________________________________________

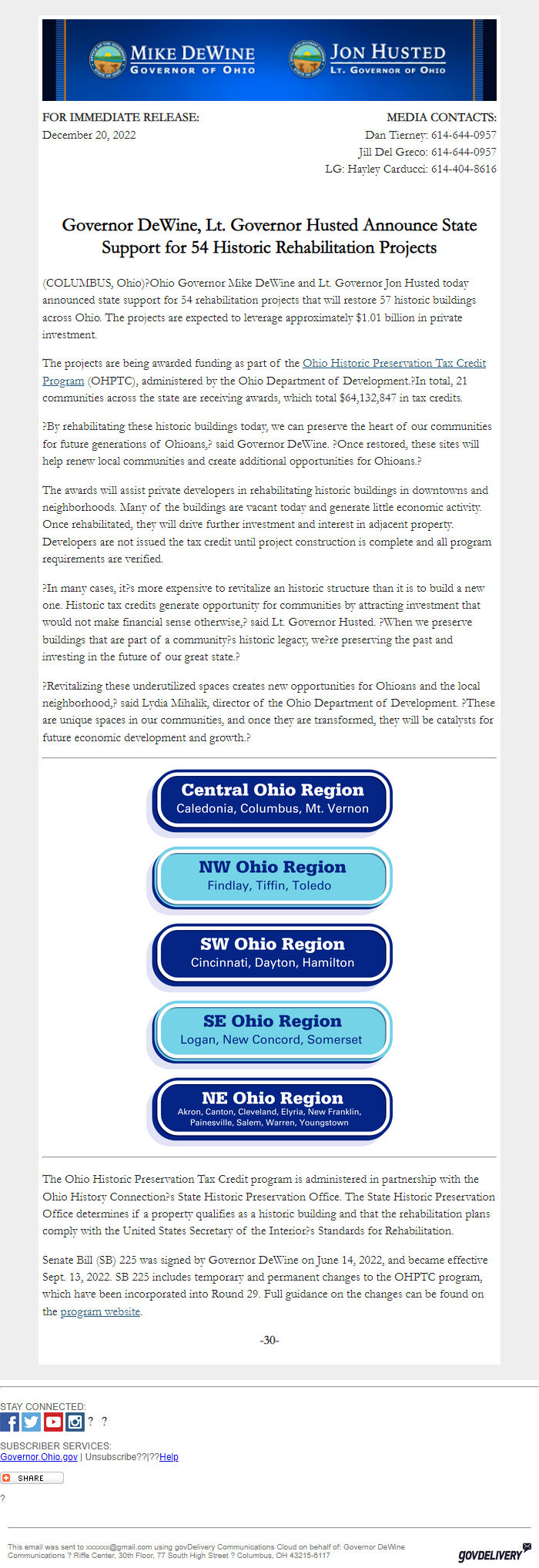

button [ [link removed] ]

button [ [link removed] ]

Button [ [link removed] ]

Button [ [link removed] ]

Button [ [link removed] ]

________________________________________________________________________

The Ohio Historic Preservation Tax Credit program is administered in partnership with the Ohio History Connection?s State Historic Preservation Office. The State Historic Preservation Office determines if a property qualifies as a historic building and that the rehabilitation plans comply with the United States Secretary of the Interior?s Standards for Rehabilitation.

Senate Bill (SB) 225 was signed by Governor DeWine on June 14, 2022, and became effective Sept. 13, 2022. SB 225 includes temporary and permanent changes to the OHPTC program, which have been incorporated into Round 29. Full guidance on the changes can be found on the program website [ [link removed] ].

*-30-*

________________________________________________________________________

STAY CONNECTED: Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] Visit us on YouTube [ [link removed] ] Visit us on Instagram [ [link removed] ] ? ?

SUBSCRIBER SERVICES:

Governor.Ohio.gov [ [link removed] ] | Unsubscribe [ [link removed] ]??|??Help [ [link removed] ]

Bookmark and Share [ [link removed] ]

?

________________________________________________________________________

This email was sent to [email protected] using govDelivery Communications Cloud on behalf of: Governor DeWine Communications ? Riffe Center, 30th Floor, 77 South High Street ? Columbus, OH 43215-6117 GovDelivery logo [ [link removed] ]

*FOR IMMEDIATE RELEASE:*

December 20, 2022

*MEDIA CONTACTS:

*Dan Tierney: 614-644-0957

Jill Del Greco: 614-644-0957

LG: Hayley Carducci: 614-404-8616

Governor DeWine, Lt. Governor Husted Announce State Support for 54 Historic Rehabilitation Projects

(COLUMBUS, Ohio)?Ohio Governor Mike DeWine and Lt. Governor Jon Husted today announced state support for 54 rehabilitation projects that will restore 57 historic buildings across Ohio. The projects are expected to leverage approximately $1.01 billion in private investment.

The projects are being awarded funding as part of the Ohio Historic Preservation Tax Credit Program [ [link removed] ] (OHPTC), administered by the Ohio Department of Development.?In total, 21 communities across the state are receiving awards, which total $64,132,847 in tax credits.

?By rehabilitating these historic buildings today, we can preserve the heart of our communities for future generations of Ohioans,? said Governor DeWine. ?Once restored, these sites will help renew local communities and create additional opportunities for Ohioans.?

The awards will assist private developers in rehabilitating historic buildings in downtowns and neighborhoods. Many of the buildings are vacant today and generate little economic activity. Once rehabilitated, they will drive further investment and interest in adjacent property. Developers are not issued the tax credit until project construction is complete and all program requirements are verified.

?In many cases, it?s more expensive to revitalize an historic structure than it is to build a new one. Historic tax credits generate opportunity for communities by attracting investment that would not make financial sense otherwise,? said Lt. Governor Husted. ?When we preserve buildings that are part of a community?s historic legacy, we?re preserving the past and investing in the future of our great state.?

?Revitalizing these underutilized spaces creates new opportunities for Ohioans and the local neighborhood,? said Lydia Mihalik, director of the Ohio Department of Development. ?These are unique spaces in our communities, and once they are transformed, they will be catalysts for future economic development and growth.?

________________________________________________________________________

button [ [link removed] ]

button [ [link removed] ]

Button [ [link removed] ]

Button [ [link removed] ]

Button [ [link removed] ]

________________________________________________________________________

The Ohio Historic Preservation Tax Credit program is administered in partnership with the Ohio History Connection?s State Historic Preservation Office. The State Historic Preservation Office determines if a property qualifies as a historic building and that the rehabilitation plans comply with the United States Secretary of the Interior?s Standards for Rehabilitation.

Senate Bill (SB) 225 was signed by Governor DeWine on June 14, 2022, and became effective Sept. 13, 2022. SB 225 includes temporary and permanent changes to the OHPTC program, which have been incorporated into Round 29. Full guidance on the changes can be found on the program website [ [link removed] ].

*-30-*

________________________________________________________________________

STAY CONNECTED: Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] Visit us on YouTube [ [link removed] ] Visit us on Instagram [ [link removed] ] ? ?

SUBSCRIBER SERVICES:

Governor.Ohio.gov [ [link removed] ] | Unsubscribe [ [link removed] ]??|??Help [ [link removed] ]

Bookmark and Share [ [link removed] ]

?

________________________________________________________________________

This email was sent to [email protected] using govDelivery Communications Cloud on behalf of: Governor DeWine Communications ? Riffe Center, 30th Floor, 77 South High Street ? Columbus, OH 43215-6117 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Office of the Ohio Governor

- Political Party: n/a

- Country: United States

- State/Locality: Ohio

- Office: n/a

-

Email Providers:

- govDelivery