|

John,

Thanks to you and our national allies, we’ve already sent more than 150,000 letters to members of Congress to raise, not cut, corporate taxes in the last two weeks of this session of Congress. But billion-dollar corporations―that are already enjoying record-low taxes―are lobbying for even more tax breaks in must-pass, year-end legislation.

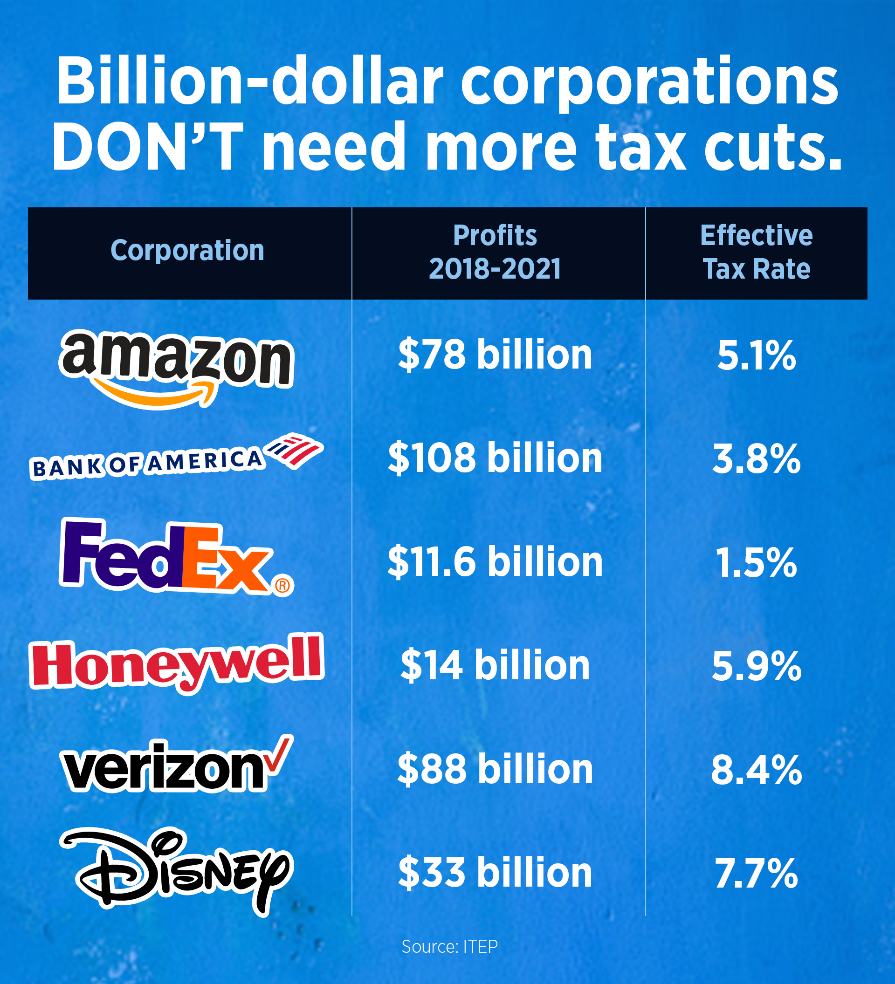

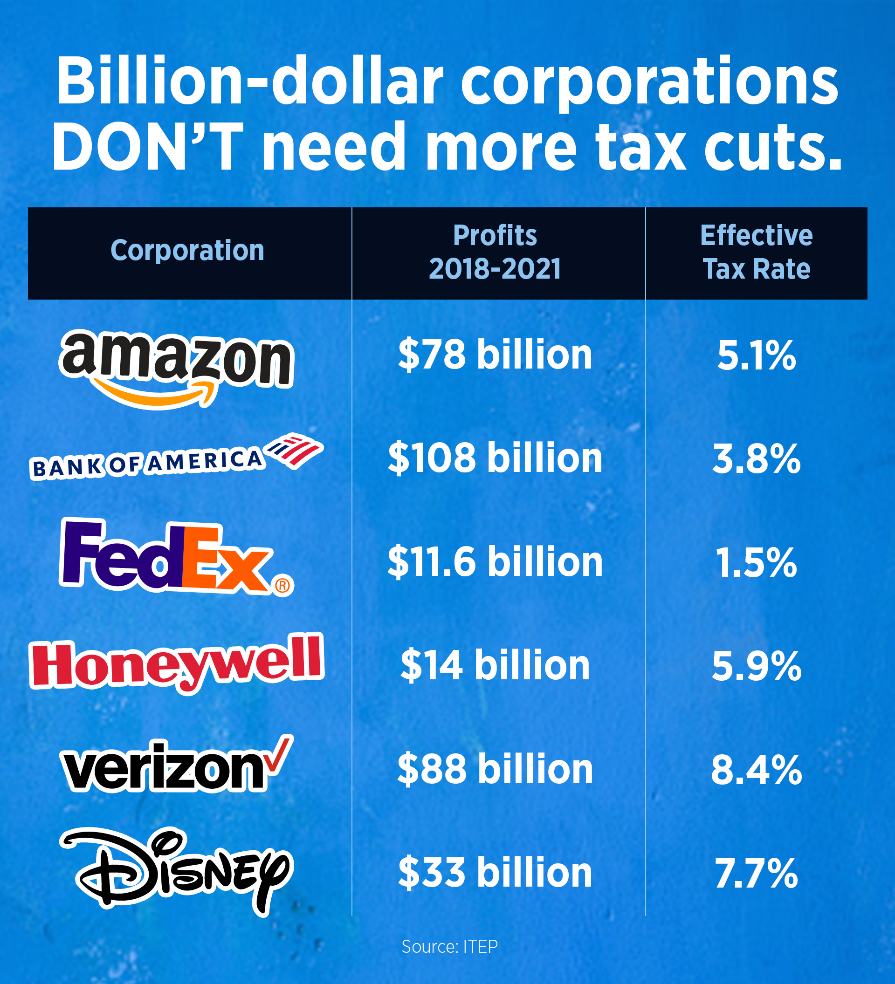

Check out our latest infographic below, then chip in today to help shine a spotlight on corporate greed and how corporations like Amazon and FedEx are raking in billions while paying significantly lower tax rates than most Americans.

Instead of doubling down on the failed Trump-GOP tax scam, Congress should raise the corporate income tax rate and make sure corporations start paying their fair share! When they do, we can create an economy that works for all of us, not just the wealthy few.

Frank Clemente

Executive Director

Americans for Tax Fairness Action Fund

-- Andrea's email --

John,

We’re fighting to keep corporate tax cuts out of must-past, end-of-year legislation. And, thanks to you, we’ve already sent more than 150,000 letters to members of Congress.

Right now, billion-dollar corporations are raking in record profits while paying historically low income tax rates. And they’re lobbying Congress for even more handouts.

We have less than two weeks to stop a bad deal that could hand up to $600 billion in tax breaks to major, profitable corporations. Help us demand Congress raise, not cut, corporate taxes.

Check out our latest infographic below, showing just a few of the corporations that are lobbying Congress for even more tax breaks. Then pitch in today to bring this graphic to thousands of people and fight to hold greedy, profitable corporations accountable.

In 2021, corporations recorded annual profits of $2.8 trillion, up 25% from the year before. And, in 2022, they’re enjoying the highest profit margin in over 70 years.[1]

The Trump-GOP tax scam that passed in 2017 gave corporations a 40% federal income tax cut, contributing to their explosive profits now. The scam added $1.6 trillion to the federal deficit over 10 years.[2]

Now, even as major, profitable corporations are price gouging the American people, they are demanding that Congress give them a new round of tax breaks before year’s end.

Donate today to hold greedy, billion-dollar corporations accountable and demand Congress raise, not cut, corporate taxes during the lame-duck session.

Together, we’re fighting for an economy that puts working people first.

Andrea Haverdink

Digital Director

Americans for Tax Fairness Action Fund

[1] “Congress should raise, not cut, corporate taxes during the lame-duck session,” Americans for Tax Fairness, Nov. 17, 2022

[2] “The Budget and Economic Outlook: 2022 to 2032,” Congressional Budget Office, May 25, 2022

|