| From | Jerrick Adams <[email protected]> |

| Subject | New Jersey donor disclosure law faces legal challenges |

| Date | July 29, 2019 5:54 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

In this first monthly edition of the Disclosure Digest we look at the latest on the NJ donor disclosure law that headlined our last edition

------------------------------------------------------------

------------------------------------------------------------

Welcome to _The Disclosure Digest_, our weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

Today's issue marks our first monthly edition. During the first half of the year, we published on a weekly basis. From here on out, we will publish monthly.

** NEW JERSEY DONOR DISCLOSURE LAW FACES LEGAL CHALLENGES

------------------------------------------------------------

On June 25, Americans for Prosperity filed a lawsuit in U.S. District Court alleging New Jersey S150 ([link removed]) , which amended the New Jersey Campaign Contributions and Expenditures Reporting Act ([link removed]) , violates the First Amendment.

* _Who are the parties to the suit? _

* Americans for Prosperity ([link removed]) , the plaintiff, is a 501(c)(4) political advocacy group that describes itself as "an organization of grassroots leaders who engage citizens in the name of limited government and free markets on the local, state and federal levels." The defendants are New Jersey Attorney General Gurbir Grewal ([link removed]) (D) and the commissioners of the Election Law Enforcement Commission: Eric Jaso, Stephen Holden, and Marguerite Simon.

* ___What is at issue?_

* Attorneys for Americans for Prosperity wrote ([link removed]) . "The First Amendment safeguards individuals’ rights to associate privately and advocate anonymously throughout the United States. … Protecting the integrity of elections may be a sufficiently important reason to justify, under exacting scrutiny, regulation of electioneering communications, but the same is not true of issue advocacy. Rammed through in a rush to exact political revenge, [S150] obliterates this fundamental distinction and oversteps constitutional bounds by subjecting issue advocacy to the formidable regulations and burdens properly reserved for electioneering."

* _What does the legislation do?_

* S150 defines an independent expenditure committee as any person or group organized under sections 501(c)(4) ([link removed])(4)) or 527 ([link removed]) of the Internal Revenue Code that spends $3,000 or more annually to influence or provide political information about any of the following:

* "the outcome of any election or the nomination, election, or defeat of any person to any state or local elective public office"

* "the passage or defeat of any public question, legislation, or regulation"

* Independent expenditure committees will be required to disclose all expenditures exceeding $3,000. These committees will also be required to disclose the identities of their donors who contribute $10,000 or more.

* _Political context_: New Jersey is a Democratic trifecta, meaning Democrats control the governorship and both chambers of the state Legislature.

* ___How have the defendants responded? _

* Neither the attorney general nor the Election Law Enforcement Commission have commented publicly on the litigation.

* The case, Americans for Prosperity v. Grewal ([link removed]) (case number 3:19-cv-14228), was filed in the U.S. District Court for the District of New Jersey.

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** WHAT WE'RE READING

------------------------------------------------------------

* Politico, "Treasury defends move to halt nonprofit disclosures amid Wyden threat," July 17, 2019 ([link removed])

* San Francisco Examiner, "Voters to decide on increased campaign finance disclosures, new limits on contributions," July 15, 2019 ([link removed])

* The Hill, "Democrats press IRS on guidance reducing donor disclosure requirements," July 11, 2019 ([link removed])

* New Jersey Law Journal, "'Dark Money' Donor Law Faces Free Speech Challenge by Koch-Backed Group," June 26, 2019 ([link removed])

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

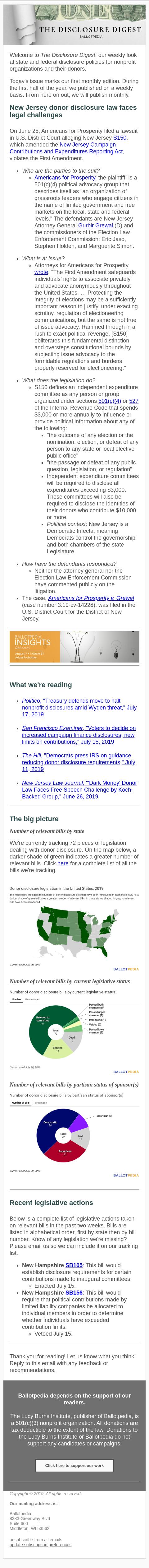

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 72 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

[link removed]

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

[link removed]

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills in the past two weeks. Bills are listed in alphabetical order, first by state then by bill number. Know of any legislation we're missing? Please email us so we can include it on our tracking list.

* NEW HAMPSHIRE SB105 ([link removed]) : This bill would establish disclosure requirements for certain contributions made to inaugural committees.

* Enacted July 15.

* NEW HAMPSHIRE SB156 ([link removed]) : This bill would require that political contributions made by limited liability companies be allocated to individual members in order to determine whether individuals have exceeded contribution limits.

* Vetoed July 15.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2019, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails [link removed]

** update subscription preferences [link removed]

------------------------------------------------------------

------------------------------------------------------------

Welcome to _The Disclosure Digest_, our weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

Today's issue marks our first monthly edition. During the first half of the year, we published on a weekly basis. From here on out, we will publish monthly.

** NEW JERSEY DONOR DISCLOSURE LAW FACES LEGAL CHALLENGES

------------------------------------------------------------

On June 25, Americans for Prosperity filed a lawsuit in U.S. District Court alleging New Jersey S150 ([link removed]) , which amended the New Jersey Campaign Contributions and Expenditures Reporting Act ([link removed]) , violates the First Amendment.

* _Who are the parties to the suit? _

* Americans for Prosperity ([link removed]) , the plaintiff, is a 501(c)(4) political advocacy group that describes itself as "an organization of grassroots leaders who engage citizens in the name of limited government and free markets on the local, state and federal levels." The defendants are New Jersey Attorney General Gurbir Grewal ([link removed]) (D) and the commissioners of the Election Law Enforcement Commission: Eric Jaso, Stephen Holden, and Marguerite Simon.

* ___What is at issue?_

* Attorneys for Americans for Prosperity wrote ([link removed]) . "The First Amendment safeguards individuals’ rights to associate privately and advocate anonymously throughout the United States. … Protecting the integrity of elections may be a sufficiently important reason to justify, under exacting scrutiny, regulation of electioneering communications, but the same is not true of issue advocacy. Rammed through in a rush to exact political revenge, [S150] obliterates this fundamental distinction and oversteps constitutional bounds by subjecting issue advocacy to the formidable regulations and burdens properly reserved for electioneering."

* _What does the legislation do?_

* S150 defines an independent expenditure committee as any person or group organized under sections 501(c)(4) ([link removed])(4)) or 527 ([link removed]) of the Internal Revenue Code that spends $3,000 or more annually to influence or provide political information about any of the following:

* "the outcome of any election or the nomination, election, or defeat of any person to any state or local elective public office"

* "the passage or defeat of any public question, legislation, or regulation"

* Independent expenditure committees will be required to disclose all expenditures exceeding $3,000. These committees will also be required to disclose the identities of their donors who contribute $10,000 or more.

* _Political context_: New Jersey is a Democratic trifecta, meaning Democrats control the governorship and both chambers of the state Legislature.

* ___How have the defendants responded? _

* Neither the attorney general nor the Election Law Enforcement Commission have commented publicly on the litigation.

* The case, Americans for Prosperity v. Grewal ([link removed]) (case number 3:19-cv-14228), was filed in the U.S. District Court for the District of New Jersey.

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** WHAT WE'RE READING

------------------------------------------------------------

* Politico, "Treasury defends move to halt nonprofit disclosures amid Wyden threat," July 17, 2019 ([link removed])

* San Francisco Examiner, "Voters to decide on increased campaign finance disclosures, new limits on contributions," July 15, 2019 ([link removed])

* The Hill, "Democrats press IRS on guidance reducing donor disclosure requirements," July 11, 2019 ([link removed])

* New Jersey Law Journal, "'Dark Money' Donor Law Faces Free Speech Challenge by Koch-Backed Group," June 26, 2019 ([link removed])

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 72 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

[link removed]

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

[link removed]

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills in the past two weeks. Bills are listed in alphabetical order, first by state then by bill number. Know of any legislation we're missing? Please email us so we can include it on our tracking list.

* NEW HAMPSHIRE SB105 ([link removed]) : This bill would establish disclosure requirements for certain contributions made to inaugural committees.

* Enacted July 15.

* NEW HAMPSHIRE SB156 ([link removed]) : This bill would require that political contributions made by limited liability companies be allocated to individual members in order to determine whether individuals have exceeded contribution limits.

* Vetoed July 15.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2019, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails [link removed]

** update subscription preferences [link removed]

Message Analysis

- Sender: Ballotpedia

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Litmus