| From | Internal Revenue Service (IRS) <[email protected]> |

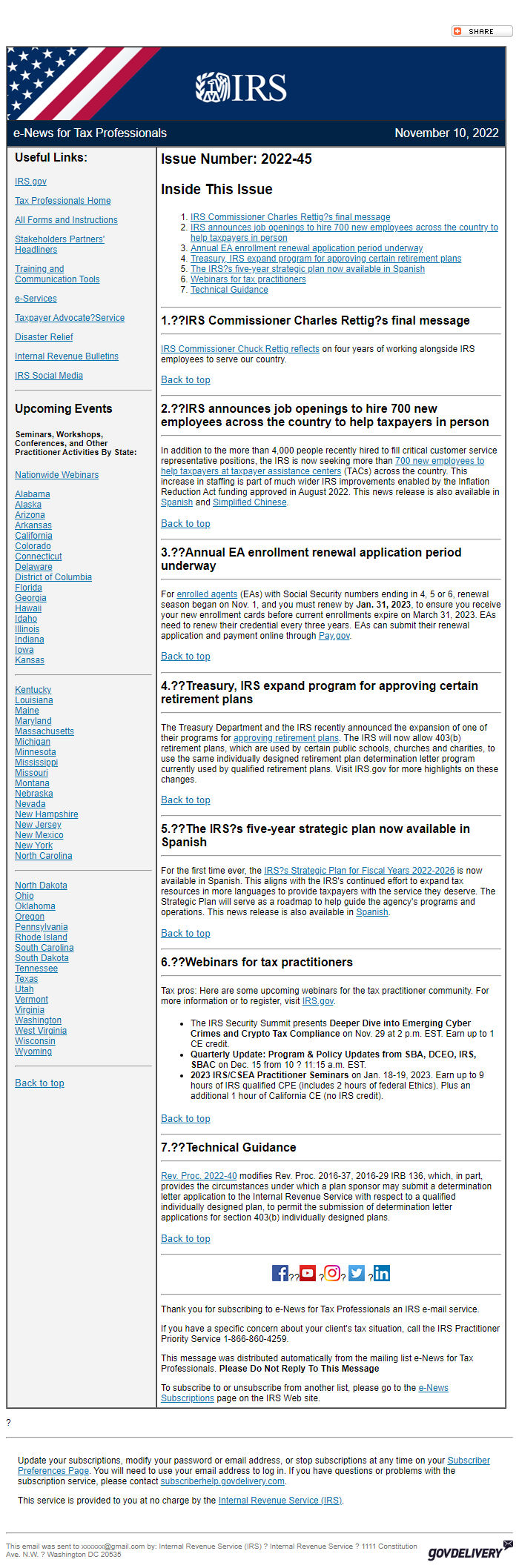

| Subject | e-News for Tax Professionals 2022-45 |

| Date | November 10, 2022 10:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

IRS Commissioner Rettig's final message; 700 new employees to staff TACs; EA enrollment period; and more

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Tax Professionals November 10, 2022

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2022-45

Inside This Issue

* IRS Commissioner Charles Rettig?s final message [ #First ]

* IRS announces job openings to hire 700 new employees across the country to help taxpayers in person [ #Second ]

* Annual EA enrollment renewal application period underway [ #Third ]

* Treasury, IRS expand program for approving certain retirement plans [ #Fourth ]

* The IRS?s five-year strategic plan now available in Spanish [ #Fifth ]

* Webinars for tax practitioners [ #Sixth ]

* Technical Guidance [ #Seventh ]

________________________________________________________________________

*1.??IRS Commissioner Charles Rettig?s final message*________________________________________________________________________

IRS Commissioner Chuck Rettig reflects [ [link removed] ] on four years of working alongside IRS employees to serve our country.

Back to top [ #top ]

________________________________________________________________________

*2.??IRS announces job openings to hire 700 new employees across the country to help taxpayers in person*________________________________________________________________________

In addition to the more than 4,000 people recently hired to fill critical customer service representative positions, the IRS is now seeking more than 700 new employees to help taxpayers at taxpayer assistance centers [ [link removed] ] (TACs) across the country. This increase in staffing is part of much wider IRS improvements enabled by the Inflation Reduction Act funding approved in August 2022. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??Annual EA enrollment renewal application period underway*________________________________________________________________________

For enrolled agents [ [link removed] ] (EAs) with Social Security numbers ending in 4, 5 or 6, renewal season began on Nov. 1, and you must renew by *Jan. 31, 2023*, to ensure you receive your new enrollment cards before current enrollments expire on March 31, 2023. EAs need to renew their credential every three years. EAs can submit their renewal application and payment online through Pay.gov [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*4.??Treasury, IRS expand program for approving certain retirement plans*________________________________________________________________________

The Treasury Department and the IRS recently announced the expansion of one of their programs for approving retirement plans [ [link removed] ]. The IRS will now allow 403(b) retirement plans, which are used by certain public schools, churches and charities, to use the same individually designed retirement plan determination letter program currently used by qualified retirement plans. Visit IRS.gov for more highlights on these changes.

Back to top [ #top ]

________________________________________________________________________

*5.??The IRS?s five-year strategic plan now available in Spanish*________________________________________________________________________

For the first time ever, the IRS?s Strategic Plan for Fiscal Years 2022-2026 [ [link removed] ] is now available in Spanish. This aligns with the IRS's continued effort to expand tax resources in more languages to provide taxpayers with the service they deserve. The Strategic Plan will serve as a roadmap to help guide the agency's programs and operations. This news release is also available in Spanish [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*6.??Webinars for tax practitioners*________________________________________________________________________

Tax pros: Here are some upcoming webinars for the tax practitioner community. For more information or to register, visit IRS.gov [ [link removed] ].

* The IRS Security Summit presents *Deeper Dive into Emerging Cyber Crimes and Crypto Tax Compliance* on Nov. 29 at 2 p.m. EST. Earn up to 1 CE credit.

* *Quarterly Update: Program & Policy Updates from SBA, DCEO, IRS, SBAC* on Dec. 15 from 10 ? 11:15 a.m. EST.

* *2023 IRS/CSEA Practitioner Seminars* on Jan. 18-19, 2023. Earn up to 9 hours of IRS qualified CPE (includes 2 hours of federal Ethics). Plus an additional 1 hour of California CE (no IRS credit).

Back to top [ #top ]

________________________________________________________________________

*7.??Technical Guidance*________________________________________________________________________

Rev. Proc. 2022-40 [ [link removed] ] modifies Rev. Proc. 2016-37, 2016-29 IRB 136, which, in part, provides the circumstances under which a plan sponsor may submit a determination letter application to the Internal Revenue Service with respect to a qualified individually designed plan, to permit the submission of determination letter applications for section 403(b) individually designed plans.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Tax Professionals November 10, 2022

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2022-45

Inside This Issue

* IRS Commissioner Charles Rettig?s final message [ #First ]

* IRS announces job openings to hire 700 new employees across the country to help taxpayers in person [ #Second ]

* Annual EA enrollment renewal application period underway [ #Third ]

* Treasury, IRS expand program for approving certain retirement plans [ #Fourth ]

* The IRS?s five-year strategic plan now available in Spanish [ #Fifth ]

* Webinars for tax practitioners [ #Sixth ]

* Technical Guidance [ #Seventh ]

________________________________________________________________________

*1.??IRS Commissioner Charles Rettig?s final message*________________________________________________________________________

IRS Commissioner Chuck Rettig reflects [ [link removed] ] on four years of working alongside IRS employees to serve our country.

Back to top [ #top ]

________________________________________________________________________

*2.??IRS announces job openings to hire 700 new employees across the country to help taxpayers in person*________________________________________________________________________

In addition to the more than 4,000 people recently hired to fill critical customer service representative positions, the IRS is now seeking more than 700 new employees to help taxpayers at taxpayer assistance centers [ [link removed] ] (TACs) across the country. This increase in staffing is part of much wider IRS improvements enabled by the Inflation Reduction Act funding approved in August 2022. This news release is also available in Spanish [ [link removed] ] and Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??Annual EA enrollment renewal application period underway*________________________________________________________________________

For enrolled agents [ [link removed] ] (EAs) with Social Security numbers ending in 4, 5 or 6, renewal season began on Nov. 1, and you must renew by *Jan. 31, 2023*, to ensure you receive your new enrollment cards before current enrollments expire on March 31, 2023. EAs need to renew their credential every three years. EAs can submit their renewal application and payment online through Pay.gov [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*4.??Treasury, IRS expand program for approving certain retirement plans*________________________________________________________________________

The Treasury Department and the IRS recently announced the expansion of one of their programs for approving retirement plans [ [link removed] ]. The IRS will now allow 403(b) retirement plans, which are used by certain public schools, churches and charities, to use the same individually designed retirement plan determination letter program currently used by qualified retirement plans. Visit IRS.gov for more highlights on these changes.

Back to top [ #top ]

________________________________________________________________________

*5.??The IRS?s five-year strategic plan now available in Spanish*________________________________________________________________________

For the first time ever, the IRS?s Strategic Plan for Fiscal Years 2022-2026 [ [link removed] ] is now available in Spanish. This aligns with the IRS's continued effort to expand tax resources in more languages to provide taxpayers with the service they deserve. The Strategic Plan will serve as a roadmap to help guide the agency's programs and operations. This news release is also available in Spanish [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*6.??Webinars for tax practitioners*________________________________________________________________________

Tax pros: Here are some upcoming webinars for the tax practitioner community. For more information or to register, visit IRS.gov [ [link removed] ].

* The IRS Security Summit presents *Deeper Dive into Emerging Cyber Crimes and Crypto Tax Compliance* on Nov. 29 at 2 p.m. EST. Earn up to 1 CE credit.

* *Quarterly Update: Program & Policy Updates from SBA, DCEO, IRS, SBAC* on Dec. 15 from 10 ? 11:15 a.m. EST.

* *2023 IRS/CSEA Practitioner Seminars* on Jan. 18-19, 2023. Earn up to 9 hours of IRS qualified CPE (includes 2 hours of federal Ethics). Plus an additional 1 hour of California CE (no IRS credit).

Back to top [ #top ]

________________________________________________________________________

*7.??Technical Guidance*________________________________________________________________________

Rev. Proc. 2022-40 [ [link removed] ] modifies Rev. Proc. 2016-37, 2016-29 IRB 136, which, in part, provides the circumstances under which a plan sponsor may submit a determination letter application to the Internal Revenue Service with respect to a qualified individually designed plan, to permit the submission of determination letter applications for section 403(b) individually designed plans.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery