Email

Tax Tip 2022-173: Everyone should know the facts about how the IRS communicates with taxpayers

| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | Tax Tip 2022-173: Everyone should know the facts about how the IRS communicates with taxpayers |

| Date | November 10, 2022 3:07 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

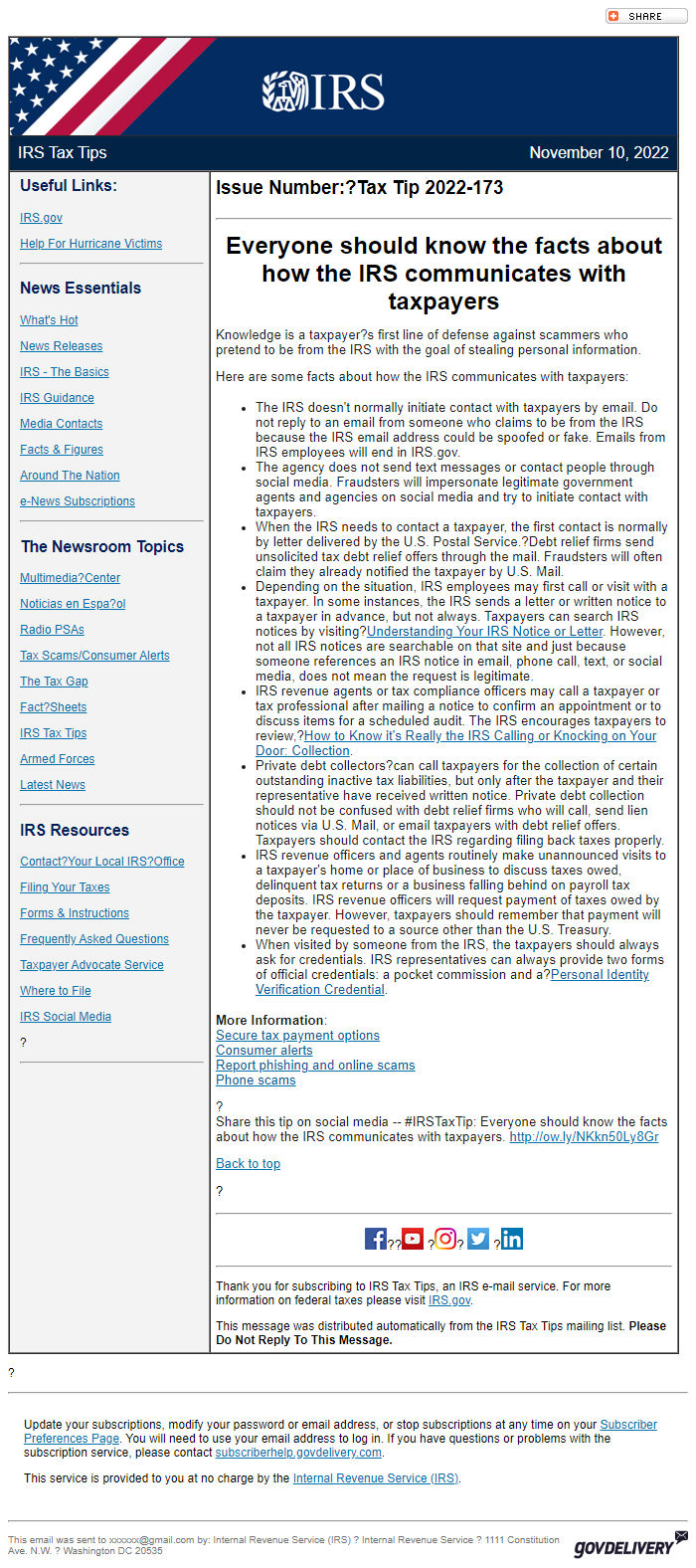

IRS.gov Banner

IRS Tax Tips November 10, 2022

Useful Links:

IRS.gov [ [link removed] ]

Help For Hurricane Victims [ [link removed] ]

________________________________________________________________________

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia?Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams/Consumer Alerts [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact?Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact?Your Local IRS?Office [ [link removed] ]

Filing Your Taxes [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

?

________________________________________________________________________

Issue Number:?Tax Tip 2022-173

________________________________________________________________________

*Everyone should know the facts about how the IRS communicates with taxpayers*

Knowledge is a taxpayer?s first line of defense against scammers who pretend to be from the IRS with the goal of stealing personal information.

Here are some facts about how the IRS communicates with taxpayers:

* The IRS doesn't normally initiate contact with taxpayers by email. Do not reply to an email from someone who claims to be from the IRS because the IRS email address could be spoofed or fake. Emails from IRS employees will end in IRS.gov.

* The agency does not send text messages or contact people through social media. Fraudsters will impersonate legitimate government agents and agencies on social media and try to initiate contact with taxpayers.

* When the IRS needs to contact a taxpayer, the first contact is normally by letter delivered by the U.S. Postal Service.?Debt relief firms send unsolicited tax debt relief offers through the mail. Fraudsters will often claim they already notified the taxpayer by U.S. Mail.

* Depending on the situation, IRS employees may first call or visit with a taxpayer. In some instances, the IRS sends a letter or written notice to a taxpayer in advance, but not always. Taxpayers can search IRS notices by visiting?Understanding Your IRS Notice or Letter [ [link removed] ]. However, not all IRS notices are searchable on that site and just because someone references an IRS notice in email, phone call, text, or social media, does not mean the request is legitimate.

* IRS revenue agents or tax compliance officers may call a taxpayer or tax professional after mailing a notice to confirm an appointment or to discuss items for a scheduled audit. The IRS encourages taxpayers to review,?How to Know it's Really the IRS Calling or Knocking on Your Door: Collection [ [link removed] ].

* Private debt collectors?can call taxpayers for the collection of certain outstanding inactive tax liabilities, but only after the taxpayer and their representative have received written notice. Private debt collection should not be confused with debt relief firms who will call, send lien notices via U.S. Mail, or email taxpayers with debt relief offers. Taxpayers should contact the IRS regarding filing back taxes properly.

* IRS revenue officers and agents routinely make unannounced visits to a taxpayer's home or place of business to discuss taxes owed, delinquent tax returns or a business falling behind on payroll tax deposits. IRS revenue officers will request payment of taxes owed by the taxpayer. However, taxpayers should remember that payment will never be requested to a source other than the U.S. Treasury.

* When visited by someone from the IRS, the taxpayers should always ask for credentials. IRS representatives can always provide two forms of official credentials: a pocket commission and a?Personal Identity Verification Credential [ [link removed] ].

*More Information*:

Secure tax payment options [ [link removed] ]

Consumer alerts [ [link removed] ]

Report phishing and online scams [ [link removed] ]

Phone scams [ [link removed] ]

?

Share this tip on social media -- #IRSTaxTip: Everyone should know the facts about how the IRS communicates with taxpayers. [link removed]

Back to top [ #top ]

?

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to IRS Tax Tips, an IRS e-mail service. For more information on federal taxes please visit IRS.gov [ [link removed] ].

This message was distributed automatically from the IRS Tax Tips mailing list. *Please Do Not Reply To This Message.*

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

IRS Tax Tips November 10, 2022

Useful Links:

IRS.gov [ [link removed] ]

Help For Hurricane Victims [ [link removed] ]

________________________________________________________________________

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia?Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams/Consumer Alerts [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact?Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact?Your Local IRS?Office [ [link removed] ]

Filing Your Taxes [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

?

________________________________________________________________________

Issue Number:?Tax Tip 2022-173

________________________________________________________________________

*Everyone should know the facts about how the IRS communicates with taxpayers*

Knowledge is a taxpayer?s first line of defense against scammers who pretend to be from the IRS with the goal of stealing personal information.

Here are some facts about how the IRS communicates with taxpayers:

* The IRS doesn't normally initiate contact with taxpayers by email. Do not reply to an email from someone who claims to be from the IRS because the IRS email address could be spoofed or fake. Emails from IRS employees will end in IRS.gov.

* The agency does not send text messages or contact people through social media. Fraudsters will impersonate legitimate government agents and agencies on social media and try to initiate contact with taxpayers.

* When the IRS needs to contact a taxpayer, the first contact is normally by letter delivered by the U.S. Postal Service.?Debt relief firms send unsolicited tax debt relief offers through the mail. Fraudsters will often claim they already notified the taxpayer by U.S. Mail.

* Depending on the situation, IRS employees may first call or visit with a taxpayer. In some instances, the IRS sends a letter or written notice to a taxpayer in advance, but not always. Taxpayers can search IRS notices by visiting?Understanding Your IRS Notice or Letter [ [link removed] ]. However, not all IRS notices are searchable on that site and just because someone references an IRS notice in email, phone call, text, or social media, does not mean the request is legitimate.

* IRS revenue agents or tax compliance officers may call a taxpayer or tax professional after mailing a notice to confirm an appointment or to discuss items for a scheduled audit. The IRS encourages taxpayers to review,?How to Know it's Really the IRS Calling or Knocking on Your Door: Collection [ [link removed] ].

* Private debt collectors?can call taxpayers for the collection of certain outstanding inactive tax liabilities, but only after the taxpayer and their representative have received written notice. Private debt collection should not be confused with debt relief firms who will call, send lien notices via U.S. Mail, or email taxpayers with debt relief offers. Taxpayers should contact the IRS regarding filing back taxes properly.

* IRS revenue officers and agents routinely make unannounced visits to a taxpayer's home or place of business to discuss taxes owed, delinquent tax returns or a business falling behind on payroll tax deposits. IRS revenue officers will request payment of taxes owed by the taxpayer. However, taxpayers should remember that payment will never be requested to a source other than the U.S. Treasury.

* When visited by someone from the IRS, the taxpayers should always ask for credentials. IRS representatives can always provide two forms of official credentials: a pocket commission and a?Personal Identity Verification Credential [ [link removed] ].

*More Information*:

Secure tax payment options [ [link removed] ]

Consumer alerts [ [link removed] ]

Report phishing and online scams [ [link removed] ]

Phone scams [ [link removed] ]

?

Share this tip on social media -- #IRSTaxTip: Everyone should know the facts about how the IRS communicates with taxpayers. [link removed]

Back to top [ #top ]

?

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to IRS Tax Tips, an IRS e-mail service. For more information on federal taxes please visit IRS.gov [ [link removed] ].

This message was distributed automatically from the IRS Tax Tips mailing list. *Please Do Not Reply To This Message.*

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery