Nov. 3, 2022

Permission to republish original opeds and cartoons granted.

The Fed hikes its core interest rate from 3.75 percent to 4 percent. But is it enough to destroy the $6 trillion printed for Covid and cool inflation?

By Robert Romano

The Federal Reserve hiked its core interest rate for banks up once again another 0.75 percent to 3.75 percent to 4 percent on Nov. 2 as high consumer inflation persists in the U.S. economy, and prepared markets for more rate hikes to come until the inflation gets under control.

According to the Fed’s statement, “The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

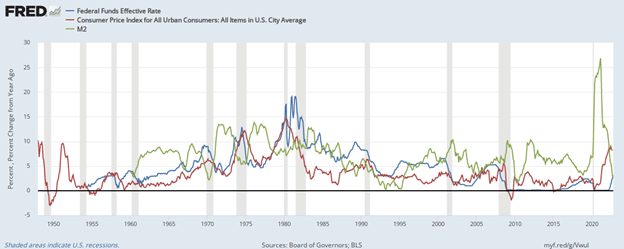

That is lower than it was in 2007 at a time when inflation itself was much lower, but the Fed might still be feeling a bit shell-shocked from the last time they needed to hike interest rates.

Back then, the peak effective Federal Funds Rate was about 5.25 percent in the summer of 2006 after inflation hit 4.7 percent in Sept. 2005.

That was at a time when housing prices particularly were soaring, and had the near term impact of cooling consumer inflation and the growth of the M2 money supply, but the Fed began easing as home values and sales began plummeting in the summer of 2007.

But as the Fed took its foot off the brake to address the housing recession, inflation and the M2 money supply kept accelerating with inflation hitting 5.5 percent July 2008 as oil prices went to the moon.

By then, the credit crunch was already well underway as the U.S. economy was being consumed by a massive recession. Banks had collateralized their mortgage-backed securities holdings, never taking into account how deeply prices would fall.

At the time, there was no backstop for housing. But since the financial crisis, the Fed has recycled mortgage credit by taking on trillions of dollars over time of mortgage-backed securities into its own portfolio, essentially eating the bad debt and making explicit the implicit guarantee that always carried with Government Sponsored Enterprises’ (GSE) paper via Fannie Mae and Freddie Mac, which remain under conservatorship by Congress.

Surely, the Fed wants to address inflation — housing prices are up 10.3 percent year over year as of the third quarter of 2022 according to the U.S. Census and the Department of Housing and Urban Development, and were up 21.8 percent as of Q3 2021 — but it also does not want to spark deflation, either.

Usually, when the Fed is lowering interest rates, the money supply accelerates with inflation, and when it hikes interest rates, the money supply growth slows down and so do price increases, an analysis of Bureau of Labor Statistics and Federal Reserve data shows.

2020 might be the best example of this, as the federal government spent, borrowed and printed about $6 trillion to combat Covid, at the same time the Fed took interest rates down to near-zero percent, a massive torrent of money creation at the same time global production had ground to a halt. Then with all the extra money floating around, demand immediately picked up again, but production had not.

Where do you think all the inflation came from? But how to unwind it is a better question. The extra money has to be destroyed.

But if the money supply contracts too quickly, so will prices, again eating up home equity as in the 2000s. On the other hand, home sales are already contracting and prices slowing down in the near term. Existing home sales have also collapsed 27.4 percent since Jan. 2022 to 4.7 million annualized, according to National Association of Realtors (NAR) data. That mirrors 2007 and 2008 collapses annually of existing home sales of 22 percent and 18 percent, respectively, as home sales fell from their 2005 high of more than 7 million to just 4.1 million by 2008, but without the price decreases.

So, we’re not nearly in the same situation. By backstopping mortgage securities since 2008, the Fed should be more able to address core inflation concerns without worrying it could upset the apple cart, whereas in the 2000s perhaps the infrastructure was not there to deal with the massive feedback this might cause if the credit system were not functioning as it should and defaults were driven by homeowners’ decisions to walk away from their mortgages.

The question does not appear to be whether interest rates need to be hiked at the Federal Funds Rate level — what other mechanism is there to destroy all the extra money we printed? — but by how much, and how quickly. With inflation over 5 percent since June 2021, the Fed has already waited to hike rates past that of the consumer inflation rate.

In the meantime, U.S. consumers are already paying higher interest rates, with 30-year mortgages going for more than 7 percent. It’s the banks’ interest rate that is being kept artificially lower. This will cause U.S. consumers to spend more of their own money to service debt, which eventually the Fed will eat when the banks have to pay their own credit costs via higher interest rates.

What normally happens is a recession intervenes, unemployment goes up, demand drops and prices then cool off, which is what the Fed appears to be waiting for.

But the danger of not conceding the recession now by, say, hiking rates past the inflation rate, as in every other economic cycle since World War II, inflation could again worsen, potentially prolonging the cycle and leading to an even larger recession later, especially as global supply and labor shortages remain ongoing problems, which will keep upward pressure on prices. Either way, with interest rates rising for the foreseeable future, that means we will all be paying off the Covid debt for some time to come.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

J. Peder Zane: Democrats Turn 2022 Into ‘1984’

By J. Peder Zane

It is tempting to ascribe President Biden’s incessant lies to cognitive decline and the ethos of his lifelong profession.

Politicians dissemble without shame – which, ironically, is why they constantly invoke their own honor and allegiance to the truth. Still, Biden’s latest string of whoppers – that gas prices were sky high and the economy was in the tank when he took office, that he convinced the Congress to pass student loan relief, that he’s a deficit hawk who has secured the border, that his son, Beau, died in Iraq – are so obviously false that it’s hard to believe even a politician in his right mind would make such claims.

That he is the president of the United States, leader of the free world, makes this behavior especially troubling. And yet, those relatively small deceptions, so easily fact-checked and debunked, are the least of our problems because they do not simply reveal the partisan instincts of one softening mind. They also reflect the freedom Democrats and their leftist allies now feel to redefine reality itself by advancing their own array of Big Lies which are dividing and inflaming our country.

The most recent example is their framing of the vicious attack on House Speaker Nancy Pelosi’s husband. The best available evidence suggests that Paul Pelosi’s assailant, David DePape, is a mentally ill drug abuser who, his employer told the San Jose Mercury News, suffered delusions and held conversations with a magical fairy. Nevertheless, Biden and his political allies immediately blamed Republicans. These allies apparently include the mainstream media. Two days after the assault, the Associated Press reported that the fact DePape brought zip ties to Pelosi’s San Francisco home was “ the latest parallel to the Capitol riot of Jan. 6, 2021.”

By this strained logic, so too was the fact he was wearing socks.

Instead of demanding that the authorities release security and body-cam footage that could illuminate the events of that night, almost all major news outlets cast DePape – an avowed nudist whose residence, Michael Shellenberger reports, sports “a Black Lives Matter sign in the window and an LGBT rainbow flag, emblazoned with a marijuana symbol, hanging from a tree” – as a dedicated soldier in the GOP’s war on democracy. The New York Times reports that DePape seems to have embraced some far-right conspiracy theories, but an honest account would suggest that his mind was so addled that it is impossible to ascribe any coherent political motivation to his actions.

The left’s rush to tie DePape around the neck of their political opponents is part of their larger effort to portray Republicans as an authoritarian group of white supremacists bent on taking the vote away from African Americans while taking up arms against their fellow citizens.

That there is zero evidence for such ugly smears makes no difference. The left believes this propaganda is useful to their pursuit of power and so they hammer it relentlessly. They did the same thing during Trump’s presidency, pushing the fact-free claim that Donald Trump had conspired with Vladimir Putin to steal the 2016 election.

That they are now trying to make Republican “election denial” the key issue of the 2022 midterms tells you how confident they feel in their ability to spew unfiltered partisan spin through the compliant media. Hillary Clinton, for one, feels so protected that she is engaging in preemptory election denial, releasing a video that declares Republicans “already have a plan” to steal the 2024 presidential election.

And why not? In recent years the left has received little pushback from the legacy media as it has worked to normalize sweeping ideas that seek to redefine reality itself. Through their embrace of transgender ideology, they claim that DNA and the X and Y chromones are meaningless abstractions and that human beings are merely “assigned” a gender at birth.

After pretending that Critical Race Theory was an arcane academic theory taught only in upper-level law school courses, they insisted that we should teach children that racism is embedded in the DNA of Americans and explains every disparity between African Americans and their fellow citizens.

Voices that have risen in opposition have been widely condemned as racist and homophobic while the federal government has suggested they could be subject to arrest. The message: Shut up and submit, or else.

These broad assaults on free speech can make Biden’s misinformation about gas prices and the deficit seem like small beer. But all are part of a perilous pattern in which the left is not simply spinning lies but insisting that it can define reality however it pleases.

George Orwell sounded the alarm about such efforts long ago, one we should urgently heed today as Democrats seek to turn 2022 into “1984.”

To view online: https://www.realclearpolitics.com/articles/2022/11/03/democrats_turn_2022_into_1984_148412.html