Email

Progessivity in Canada's tax system and Public vs. private compensation in Atlantic Canada

| From | Fraser Institute <[email protected]> |

| Subject | Progessivity in Canada's tax system and Public vs. private compensation in Atlantic Canada |

| Date | October 29, 2022 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

===============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

===============

Latest Research

---------------------

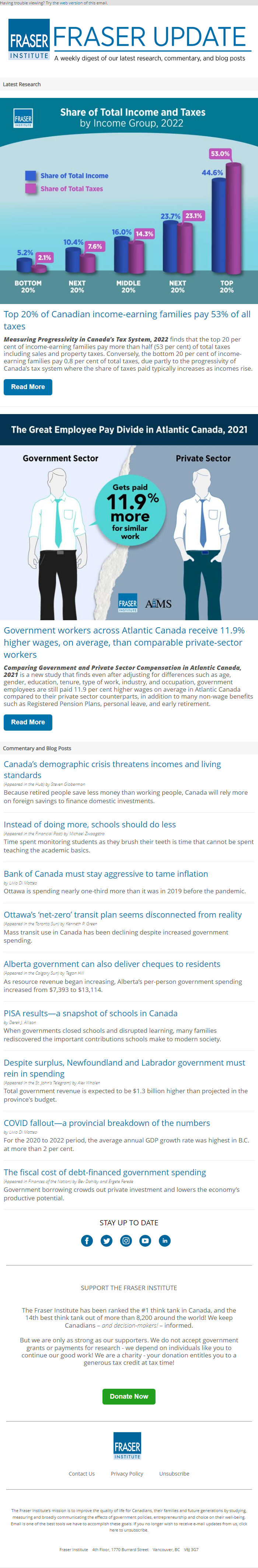

Top 20% of Canadian income-earning families pay 53% of all taxes

Measuring Progressivity in Canada’s Tax System, 2022 finds that the top 20 per cent of income-earning families pay more than half (53 per cent) of total taxes including sales and property taxes. Conversely, the bottom 20 per cent of income-earning families pay 0.8 per cent of total taxes, due partly to the progressivity of Canada’s tax system where the share of taxes paid typically increases as incomes rise.

Read More [[link removed]]

Government workers across Atlantic Canada receive 11.9% higher wages, on average, than comparable private-sector workers

Comparing Government and Private Sector Compensation in Atlantic Canada, 2021 is a new study that finds even after adjusting for differences such as age, gender, education, tenure, type of work, industry, and occupation, government employees are still paid 11.9 per cent higher wages on average in Atlantic Canada compared to their private sector counterparts, in addition to many non-wage benefits such as Registered Pension Plans, personal leave, and early retirement.

Read More [[link removed]]

Commentary and Blog Posts

---------------------

Canada’s demographic crisis threatens incomes and living standards [[link removed]]

(Appeared in the Hub) by Steven Globerman

Because retired people save less money than working people, Canada will rely more on foreign savings to finance domestic investments.

Instead of doing more, schools should do less [[link removed]]

(Appeared in the Financial Post) by Michael Zwaagstra

Time spent monitoring students as they brush their teeth is time that cannot be spent teaching the academic basics.

Bank of Canada must stay aggressive to tame inflation [[link removed]]

by Livio Di Matteo

Ottawa is spending nearly one-third more than it was in 2019 before the pandemic.

Ottawa’s ‘net-zero’ transit plan seems disconnected from reality [[link removed]]

(Appeared in the Toronto Sun) by Kenneth P. Green

Mass transit use in Canada has been declining despite increased government spending.

Alberta government can also deliver cheques to residents [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill

As resource revenue began increasing, Alberta’s per-person government spending increased from $7,393 to $13,114.

PISA results—a snapshot of schools in Canada [[link removed]]

by Derek J. Allison

When governments closed schools and disrupted learning, many families rediscovered the important contributions schools make to modern society.

Despite surplus, Newfoundland and Labrador government must rein in spending [[link removed]]

(Appeared in the St. John's Telegram) by Alex Whalen

Total government revenue is expected to be $1.3 billion higher than projected in the province's budget.

COVID fallout—a provincial breakdown of the numbers [[link removed]]

by Livio Di Matteo

For the 2020 to 2022 period, the average annual GDP growth rate was highest in B.C. at more than 2 per cent.

The fiscal cost of debt-financed government spending [[link removed]]

(Appeared in Finances of the Nation) by Bev Dahlby and Ergete Ferede

Government borrowing crowds out private investment and lowers the economy’s productive potential.

SUPPORT THE FRASER INSTITUTE

---------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

===============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

===============

Latest Research

---------------------

Top 20% of Canadian income-earning families pay 53% of all taxes

Measuring Progressivity in Canada’s Tax System, 2022 finds that the top 20 per cent of income-earning families pay more than half (53 per cent) of total taxes including sales and property taxes. Conversely, the bottom 20 per cent of income-earning families pay 0.8 per cent of total taxes, due partly to the progressivity of Canada’s tax system where the share of taxes paid typically increases as incomes rise.

Read More [[link removed]]

Government workers across Atlantic Canada receive 11.9% higher wages, on average, than comparable private-sector workers

Comparing Government and Private Sector Compensation in Atlantic Canada, 2021 is a new study that finds even after adjusting for differences such as age, gender, education, tenure, type of work, industry, and occupation, government employees are still paid 11.9 per cent higher wages on average in Atlantic Canada compared to their private sector counterparts, in addition to many non-wage benefits such as Registered Pension Plans, personal leave, and early retirement.

Read More [[link removed]]

Commentary and Blog Posts

---------------------

Canada’s demographic crisis threatens incomes and living standards [[link removed]]

(Appeared in the Hub) by Steven Globerman

Because retired people save less money than working people, Canada will rely more on foreign savings to finance domestic investments.

Instead of doing more, schools should do less [[link removed]]

(Appeared in the Financial Post) by Michael Zwaagstra

Time spent monitoring students as they brush their teeth is time that cannot be spent teaching the academic basics.

Bank of Canada must stay aggressive to tame inflation [[link removed]]

by Livio Di Matteo

Ottawa is spending nearly one-third more than it was in 2019 before the pandemic.

Ottawa’s ‘net-zero’ transit plan seems disconnected from reality [[link removed]]

(Appeared in the Toronto Sun) by Kenneth P. Green

Mass transit use in Canada has been declining despite increased government spending.

Alberta government can also deliver cheques to residents [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill

As resource revenue began increasing, Alberta’s per-person government spending increased from $7,393 to $13,114.

PISA results—a snapshot of schools in Canada [[link removed]]

by Derek J. Allison

When governments closed schools and disrupted learning, many families rediscovered the important contributions schools make to modern society.

Despite surplus, Newfoundland and Labrador government must rein in spending [[link removed]]

(Appeared in the St. John's Telegram) by Alex Whalen

Total government revenue is expected to be $1.3 billion higher than projected in the province's budget.

COVID fallout—a provincial breakdown of the numbers [[link removed]]

by Livio Di Matteo

For the 2020 to 2022 period, the average annual GDP growth rate was highest in B.C. at more than 2 per cent.

The fiscal cost of debt-financed government spending [[link removed]]

(Appeared in Finances of the Nation) by Bev Dahlby and Ergete Ferede

Government borrowing crowds out private investment and lowers the economy’s productive potential.

SUPPORT THE FRASER INSTITUTE

---------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor