| From | Fraser Institute <[email protected]> |

| Subject | Fiscal impact of COVID on Canada |

| Date | October 15, 2022 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

------------------

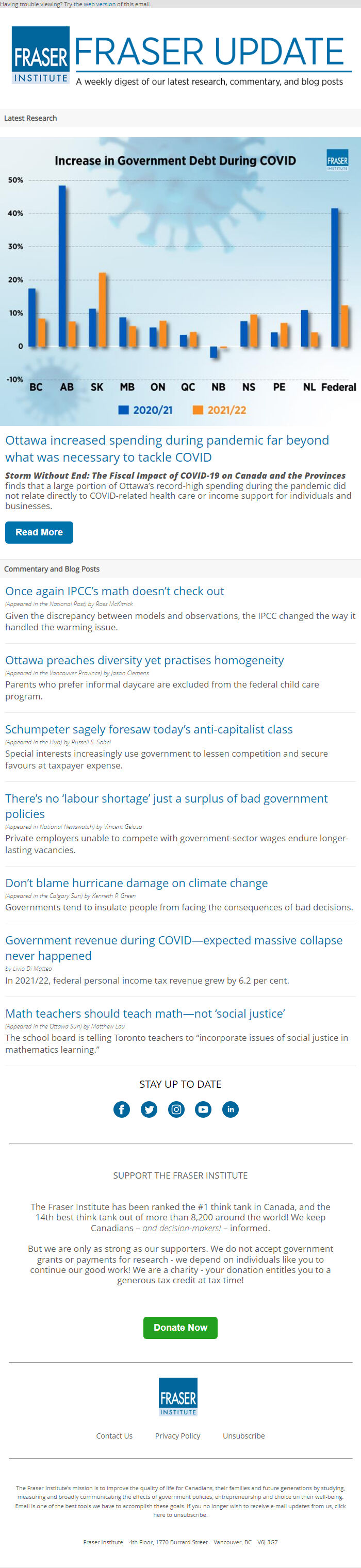

Ottawa increased spending during pandemic far beyond what was necessary to tackle COVID

Storm Without End: The Fiscal Impact of COVID-19 on Canada and the Provinces finds that a large portion of Ottawa’s record-high spending during the pandemic did not relate directly to COVID-related health care or income support for individuals and businesses.

Read More [[link removed]]

Commentary and Blog Posts

------------------

Once again IPCC’s math doesn’t check out [[link removed]]

(Appeared in the National Post) by Ross McKitrick

Given the discrepancy between models and observations, the IPCC changed the way it handled the warming issue.

Ottawa preaches diversity yet practises homogeneity [[link removed]]

(Appeared in the Vancouver Province) by Jason Clemens

Parents who prefer informal daycare are excluded from the federal child care program.

Schumpeter sagely foresaw today’s anti-capitalist class [[link removed]]

(Appeared in the Hub) by Russell S. Sobel

Special interests increasingly use government to lessen competition and secure favours at taxpayer expense.

There’s no ‘labour shortage’ just a surplus of bad government policies [[link removed]]

(Appeared in National Newswatch) by Vincent Geloso

Private employers unable to compete with government-sector wages endure longer-lasting vacancies.

Don’t blame hurricane damage on climate change [[link removed]]

(Appeared in the Calgary Sun) by Kenneth P. Green

Governments tend to insulate people from facing the consequences of bad decisions.

Government revenue during COVID—expected massive collapse never happened [[link removed]]

by Livio Di Matteo

In 2021/22, federal personal income tax revenue grew by 6.2 per cent.

Math teachers should teach math—not ‘social justice’ [[link removed]]

(Appeared in the Ottawa Sun) by Matthew Lau

The school board is telling Toronto teachers to “incorporate issues of social justice in mathematics learning.”

SUPPORT THE FRASER INSTITUTE

------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

------------------

Ottawa increased spending during pandemic far beyond what was necessary to tackle COVID

Storm Without End: The Fiscal Impact of COVID-19 on Canada and the Provinces finds that a large portion of Ottawa’s record-high spending during the pandemic did not relate directly to COVID-related health care or income support for individuals and businesses.

Read More [[link removed]]

Commentary and Blog Posts

------------------

Once again IPCC’s math doesn’t check out [[link removed]]

(Appeared in the National Post) by Ross McKitrick

Given the discrepancy between models and observations, the IPCC changed the way it handled the warming issue.

Ottawa preaches diversity yet practises homogeneity [[link removed]]

(Appeared in the Vancouver Province) by Jason Clemens

Parents who prefer informal daycare are excluded from the federal child care program.

Schumpeter sagely foresaw today’s anti-capitalist class [[link removed]]

(Appeared in the Hub) by Russell S. Sobel

Special interests increasingly use government to lessen competition and secure favours at taxpayer expense.

There’s no ‘labour shortage’ just a surplus of bad government policies [[link removed]]

(Appeared in National Newswatch) by Vincent Geloso

Private employers unable to compete with government-sector wages endure longer-lasting vacancies.

Don’t blame hurricane damage on climate change [[link removed]]

(Appeared in the Calgary Sun) by Kenneth P. Green

Governments tend to insulate people from facing the consequences of bad decisions.

Government revenue during COVID—expected massive collapse never happened [[link removed]]

by Livio Di Matteo

In 2021/22, federal personal income tax revenue grew by 6.2 per cent.

Math teachers should teach math—not ‘social justice’ [[link removed]]

(Appeared in the Ottawa Sun) by Matthew Lau

The school board is telling Toronto teachers to “incorporate issues of social justice in mathematics learning.”

SUPPORT THE FRASER INSTITUTE

------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor