Email

Bear Market Continues - Bad News Is Good News. (Cheat Sheet)

| From | Irving <[email protected]> |

| Subject | Bear Market Continues - Bad News Is Good News. (Cheat Sheet) |

| Date | October 10, 2022 2:02 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Good morning,

Thank you for being a subscriber.

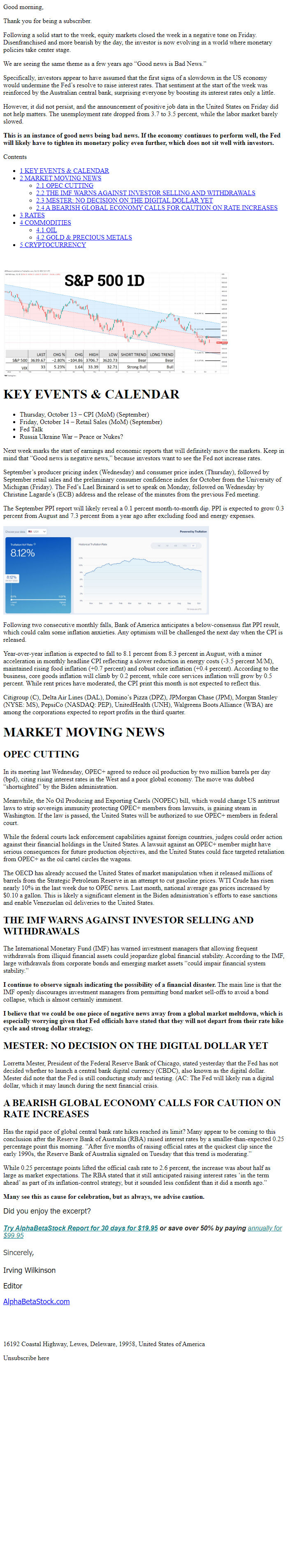

Following a solid start to the week, equity markets closed the week in a negative tone on Friday. Disenfranchised and more bearish by the day, the investor is now evolving in a world where monetary policies take center stage.

We are seeing the same theme as a few years ago “Good news is Bad News.”

Specifically, investors appear to have assumed that the first signs of a slowdown in the US economy would undermine the Fed’s resolve to raise interest rates. That sentiment at the start of the week was reinforced by the Australian central bank, surprising everyone by boosting its interest rates only a little.

However, it did not persist, and the announcement of positive job data in the United States on Friday did not help matters. The unemployment rate dropped from 3.7 to 3.5 percent, while the labor market barely slowed.

This is an instance of good news being bad news. If the economy continues to perform well, the Fed will likely have to tighten its monetary policy even further, which does not sit well with investors.

Contents

1 KEY EVENTS & CALENDAR

2 MARKET MOVING NEWS

2.1 OPEC CUTTING

2.2 THE IMF WARNS AGAINST INVESTOR SELLING AND WITHDRAWALS

2.3 MESTER: NO DECISION ON THE DIGITAL DOLLAR YET

2.4 A BEARISH GLOBAL ECONOMY CALLS FOR CAUTION ON RATE INCREASES

3 RATES

4 COMMODITIES

4.1 OIL

4.2 GOLD & PRECIOUS METALS

5 CRYPTOCURRENCY

KEY EVENTS & CALENDAR

Thursday, October 13 – CPI (MoM) (September)

Friday, October 14 – Retail Sales (MoM) (September)

Fed Talk

Russia Ukraine War – Peace or Nukes?

Next week marks the start of earnings and economic reports that will definitely move the markets. Keep in mind that “Good news is negative news,” because investors want to see the Fed not increase rates.

September’s producer pricing index (Wednesday) and consumer price index (Thursday), followed by September retail sales and the preliminary consumer confidence index for October from the University of Michigan (Friday). The Fed’s Lael Brainard is set to speak on Monday, followed on Wednesday by Christine Lagarde’s (ECB) address and the release of the minutes from the previous Fed meeting.

The September PPI report will likely reveal a 0.1 percent month-to-month dip. PPI is expected to grow 0.3 percent from August and 7.3 percent from a year ago after excluding food and energy expenses.

Following two consecutive monthly falls, Bank of America anticipates a below-consensus flat PPI result, which could calm some inflation anxieties. Any optimism will be challenged the next day when the CPI is released.

Year-over-year inflation is expected to fall to 8.1 percent from 8.3 percent in August, with a minor acceleration in monthly headline CPI reflecting a slower reduction in energy costs (-3.5 percent M/M), maintained rising food inflation (+0.7 percent) and robust core inflation (+0.4 percent). According to the business, core goods inflation will climb by 0.2 percent, while core services inflation will grow by 0.5 percent. While rent prices have moderated, the CPI print this month is not expected to reflect this.

Citigroup (C), Delta Air Lines (DAL), Domino’s Pizza (DPZ), JPMorgan Chase (JPM), Morgan Stanley (NYSE: MS), PepsiCo (NASDAQ: PEP), UnitedHealth (UNH), Walgreens Boots Alliance (WBA) are among the corporations expected to report profits in the third quarter.

MARKET MOVING NEWS

OPEC CUTTING

In its meeting last Wednesday, OPEC+ agreed to reduce oil production by two million barrels per day (bpd), citing rising interest rates in the West and a poor global economy. The move was dubbed “shortsighted” by the Biden administration.

Meanwhile, the No Oil Producing and Exporting Carels (NOPEC) bill, which would change US antitrust laws to strip sovereign immunity protecting OPEC+ members from lawsuits, is gaining steam in Washington. If the law is passed, the United States will be authorized to sue OPEC+ members in federal court.

While the federal courts lack enforcement capabilities against foreign countries, judges could order action against their financial holdings in the United States. A lawsuit against an OPEC+ member might have serious consequences for future production objectives, and the United States could face targeted retaliation from OPEC+ as the oil cartel circles the wagons.

The OECD has already accused the United States of market manipulation when it released millions of barrels from the Strategic Petroleum Reserve in an attempt to cut gasoline prices. WTI Crude has risen nearly 10% in the last week due to OPEC news. Last month, national average gas prices increased by $0.10 a gallon. This is likely a significant element in the Biden administration’s efforts to ease sanctions and enable Venezuelan oil deliveries to the United States.

THE IMF WARNS AGAINST INVESTOR SELLING AND WITHDRAWALS

The International Monetary Fund (IMF) has warned investment managers that allowing frequent withdrawals from illiquid financial assets could jeopardize global financial stability. According to the IMF, large withdrawals from corporate bonds and emerging market assets “could impair financial system stability.”

I continue to observe signals indicating the possibility of a financial disaster. The main line is that the IMF openly discourages investment managers from permitting bond market sell-offs to avoid a bond collapse, which is almost certainly imminent.

I believe that we could be one piece of negative news away from a global market meltdown, which is especially worrying given that Fed officials have stated that they will not depart from their rate hike cycle and strong dollar strategy.

MESTER: NO DECISION ON THE DIGITAL DOLLAR YET

Lorretta Mester, President of the Federal Reserve Bank of Chicago, stated yesterday that the Fed has not decided whether to launch a central bank digital currency (CBDC), also known as the digital dollar. Mester did note that the Fed is still conducting study and testing. (AC: The Fed will likely run a digital dollar, which it may launch during the next financial crisis.

A BEARISH GLOBAL ECONOMY CALLS FOR CAUTION ON RATE INCREASES

Has the rapid pace of global central bank rate hikes reached its limit? Many appear to be coming to this conclusion after the Reserve Bank of Australia (RBA) raised interest rates by a smaller-than-expected 0.25 percentage point this morning. “After five months of raising official rates at the quickest clip since the early 1990s, the Reserve Bank of Australia signaled on Tuesday that this trend is moderating.”

While 0.25 percentage points lifted the official cash rate to 2.6 percent, the increase was about half as large as market expectations. The RBA stated that it still anticipated raising interest rates ‘in the term ahead’ as part of its inflation-control strategy, but it sounded less confident than it did a month ago.”

Many see this as cause for celebration, but as always, we advise caution.

Did you enjoy the excerpt?

Try AlphaBetaStock Report for 30 days for $19.95 or save over 50% by paying annually for $99.95

Sincerely,

Irving Wilkinson

Editor

AlphaBetaStock.com

16192 Coastal Highway, Lewes, Deleware, 19958, United States of America

Unsubscribe here

Thank you for being a subscriber.

Following a solid start to the week, equity markets closed the week in a negative tone on Friday. Disenfranchised and more bearish by the day, the investor is now evolving in a world where monetary policies take center stage.

We are seeing the same theme as a few years ago “Good news is Bad News.”

Specifically, investors appear to have assumed that the first signs of a slowdown in the US economy would undermine the Fed’s resolve to raise interest rates. That sentiment at the start of the week was reinforced by the Australian central bank, surprising everyone by boosting its interest rates only a little.

However, it did not persist, and the announcement of positive job data in the United States on Friday did not help matters. The unemployment rate dropped from 3.7 to 3.5 percent, while the labor market barely slowed.

This is an instance of good news being bad news. If the economy continues to perform well, the Fed will likely have to tighten its monetary policy even further, which does not sit well with investors.

Contents

1 KEY EVENTS & CALENDAR

2 MARKET MOVING NEWS

2.1 OPEC CUTTING

2.2 THE IMF WARNS AGAINST INVESTOR SELLING AND WITHDRAWALS

2.3 MESTER: NO DECISION ON THE DIGITAL DOLLAR YET

2.4 A BEARISH GLOBAL ECONOMY CALLS FOR CAUTION ON RATE INCREASES

3 RATES

4 COMMODITIES

4.1 OIL

4.2 GOLD & PRECIOUS METALS

5 CRYPTOCURRENCY

KEY EVENTS & CALENDAR

Thursday, October 13 – CPI (MoM) (September)

Friday, October 14 – Retail Sales (MoM) (September)

Fed Talk

Russia Ukraine War – Peace or Nukes?

Next week marks the start of earnings and economic reports that will definitely move the markets. Keep in mind that “Good news is negative news,” because investors want to see the Fed not increase rates.

September’s producer pricing index (Wednesday) and consumer price index (Thursday), followed by September retail sales and the preliminary consumer confidence index for October from the University of Michigan (Friday). The Fed’s Lael Brainard is set to speak on Monday, followed on Wednesday by Christine Lagarde’s (ECB) address and the release of the minutes from the previous Fed meeting.

The September PPI report will likely reveal a 0.1 percent month-to-month dip. PPI is expected to grow 0.3 percent from August and 7.3 percent from a year ago after excluding food and energy expenses.

Following two consecutive monthly falls, Bank of America anticipates a below-consensus flat PPI result, which could calm some inflation anxieties. Any optimism will be challenged the next day when the CPI is released.

Year-over-year inflation is expected to fall to 8.1 percent from 8.3 percent in August, with a minor acceleration in monthly headline CPI reflecting a slower reduction in energy costs (-3.5 percent M/M), maintained rising food inflation (+0.7 percent) and robust core inflation (+0.4 percent). According to the business, core goods inflation will climb by 0.2 percent, while core services inflation will grow by 0.5 percent. While rent prices have moderated, the CPI print this month is not expected to reflect this.

Citigroup (C), Delta Air Lines (DAL), Domino’s Pizza (DPZ), JPMorgan Chase (JPM), Morgan Stanley (NYSE: MS), PepsiCo (NASDAQ: PEP), UnitedHealth (UNH), Walgreens Boots Alliance (WBA) are among the corporations expected to report profits in the third quarter.

MARKET MOVING NEWS

OPEC CUTTING

In its meeting last Wednesday, OPEC+ agreed to reduce oil production by two million barrels per day (bpd), citing rising interest rates in the West and a poor global economy. The move was dubbed “shortsighted” by the Biden administration.

Meanwhile, the No Oil Producing and Exporting Carels (NOPEC) bill, which would change US antitrust laws to strip sovereign immunity protecting OPEC+ members from lawsuits, is gaining steam in Washington. If the law is passed, the United States will be authorized to sue OPEC+ members in federal court.

While the federal courts lack enforcement capabilities against foreign countries, judges could order action against their financial holdings in the United States. A lawsuit against an OPEC+ member might have serious consequences for future production objectives, and the United States could face targeted retaliation from OPEC+ as the oil cartel circles the wagons.

The OECD has already accused the United States of market manipulation when it released millions of barrels from the Strategic Petroleum Reserve in an attempt to cut gasoline prices. WTI Crude has risen nearly 10% in the last week due to OPEC news. Last month, national average gas prices increased by $0.10 a gallon. This is likely a significant element in the Biden administration’s efforts to ease sanctions and enable Venezuelan oil deliveries to the United States.

THE IMF WARNS AGAINST INVESTOR SELLING AND WITHDRAWALS

The International Monetary Fund (IMF) has warned investment managers that allowing frequent withdrawals from illiquid financial assets could jeopardize global financial stability. According to the IMF, large withdrawals from corporate bonds and emerging market assets “could impair financial system stability.”

I continue to observe signals indicating the possibility of a financial disaster. The main line is that the IMF openly discourages investment managers from permitting bond market sell-offs to avoid a bond collapse, which is almost certainly imminent.

I believe that we could be one piece of negative news away from a global market meltdown, which is especially worrying given that Fed officials have stated that they will not depart from their rate hike cycle and strong dollar strategy.

MESTER: NO DECISION ON THE DIGITAL DOLLAR YET

Lorretta Mester, President of the Federal Reserve Bank of Chicago, stated yesterday that the Fed has not decided whether to launch a central bank digital currency (CBDC), also known as the digital dollar. Mester did note that the Fed is still conducting study and testing. (AC: The Fed will likely run a digital dollar, which it may launch during the next financial crisis.

A BEARISH GLOBAL ECONOMY CALLS FOR CAUTION ON RATE INCREASES

Has the rapid pace of global central bank rate hikes reached its limit? Many appear to be coming to this conclusion after the Reserve Bank of Australia (RBA) raised interest rates by a smaller-than-expected 0.25 percentage point this morning. “After five months of raising official rates at the quickest clip since the early 1990s, the Reserve Bank of Australia signaled on Tuesday that this trend is moderating.”

While 0.25 percentage points lifted the official cash rate to 2.6 percent, the increase was about half as large as market expectations. The RBA stated that it still anticipated raising interest rates ‘in the term ahead’ as part of its inflation-control strategy, but it sounded less confident than it did a month ago.”

Many see this as cause for celebration, but as always, we advise caution.

Did you enjoy the excerpt?

Try AlphaBetaStock Report for 30 days for $19.95 or save over 50% by paying annually for $99.95

Sincerely,

Irving Wilkinson

Editor

AlphaBetaStock.com

16192 Coastal Highway, Lewes, Deleware, 19958, United States of America

Unsubscribe here

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a