|

|

Welcome to You’re Probably Getting Screwed, a twice-monthly newsletter and video series from COURIER Newsroom and J.D. Scholten about how and why bad actors are working to put politics and profits over working people.

Last year, Treasury Secretary Janet Yellen warned that climate change could cause major damage to our financial system, and some experts have said that there is even the risk of another 2008-like Wall Street crash.

And the U.S. Military says that one of the biggest threats to the U.S. is climate change.

So what’s holding us back? Well, there are the two entities that are pumping millions, if not billions of dollars, to hold up our investment in combating climate change? Big Banks and Big Oil.

On Nov. 8, there’s a midterm election and there is one race in 28 different states that is important to combating climate change that may not be that obvious. That is the State Treasurer office.

Hear me out:

State treasurers manage their state’s investments, which means they’re making big decisions about how major state budget resources, like public pensions, are handled.

This makes them crucial decision-makers in determining the course of climate finance in the years to come.

In fact, in 2021, 16 state treasurers from all across the country released a letter calling for 1) corporate disclosure of climate risk and 2) getting rid of corporate directors who fail to take appropriately urgent climate action.

So when powerful corporations see state pension funds and treasurers supporting shareholder resolutions to reduce climate risk, pay workers more, or prevent corporations from buying our elections, they see a threat.

That’s why we need to watch out for organizations like the State Financial Officers Foundation (SFOF). They're a dark money group organizing Republican state treasurers to keep Big Oil afloat by forcing state governments to ignore factors like climate change or whether workers are getting paid a living wage.

In the past year, they have been a driving force behind bills that at least five have passed banning state governments from doing business with companies that treasurers say are boycotting fossil fuels. Instead of determining what it is in the best interest of the people who entrusted them with their money, these Republican state treasurers are canceling contracts with companies that they decide are supposedly being too conscious of climate risk.

And it’s screwing over workers. SFOF’s model law forces state treasurers to gamble with workers’ retirement by forcing them to ignore known risks, and guarantee financing to the biggest companies fueling climate risks.

One study found that in the first year that this law was in place in Texas, Texans paid an estimated $532 million in higher interest rate payments. Recently, the Texas law forced a small school district south of Dallas to cancel a bond deal and pursue more costly financing.

Recently, when all the Big Bank CEOs were hauled before Congress, one Member of Congress asked JPMorganChase and Wells Fargo why they are sponsoring SFOF-- given that it is behind this harmful legislation that is leading some states to cancel contracts with….JPMorganChase and Wells Fargo. The bank execs said they’d get back to him.

So do your research. When you vote this fall, don’t just fill out your ballot for governor and Congress. If your state treasurer is up for election vote for the one who is NOT supported by a dark money, Big Oil backed, anti-democratic organization that’s looking to screw you over!

YOU’RE PROBABLY (ALSO) GETTING SCREWED BY:

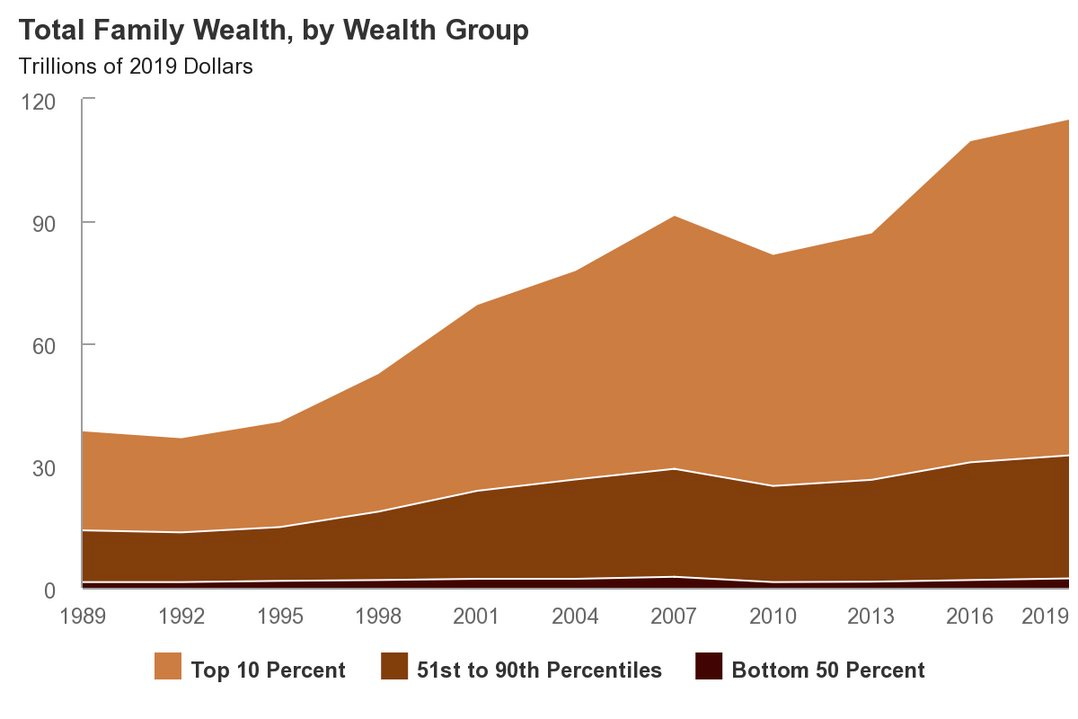

TOP 10%

Jeff Stein (of Washington Post) tweeted out:

Wealth of top 10 percent has grown markedly since 1989

That tiny little line at the bottom of this chart is half the country

IT’S ALMOST LIKE IT WAS INTENDED TO BE THIS WAY!!!

CEOs

Oh, and there’s this…

GOOD NEWS???

A recent study by the University of North Carolina Tax Center used public data to see how the 15% minimum corporate tax that was passed as part of the Inflation Reduction Act would impact corporations based on 2021 taxes. They found a total of $31.8 billion from 78 firms in 2021, led by Berkshire with $8.33 billion, and Amazon follows behind with $2.77 billion.

So the next time someone asks “but how do you pay for it…”

BIG BANKS AND WALL STREET

While most of us are just trying to get by, banks have implemented sneaky fees for daily financial transactions, and manipulate the poorest Americans.

Overdraft fees are on track to come down by $3 billion this year – compared to before the pandemic.

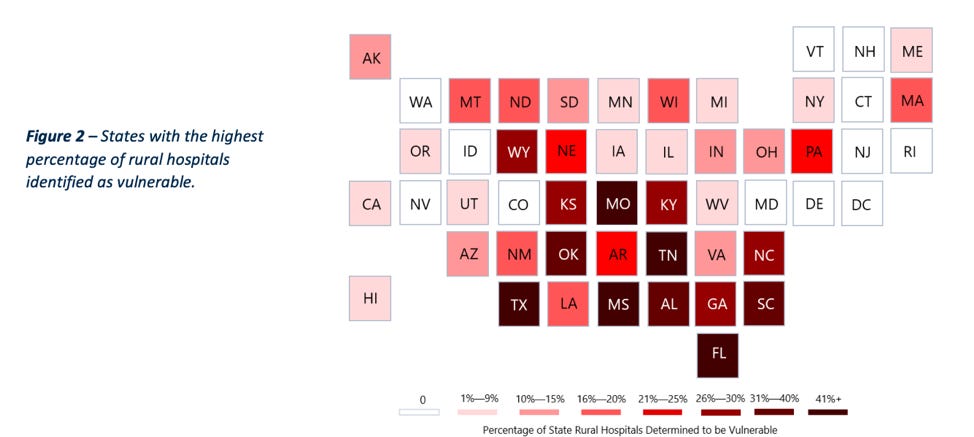

HEALTHCARE IN AMERICA

***If you have a healthcare story or see a healthcare story posted on social media that needs more attention, please comment below and we will reach out.

BEFORE YOU GO

Before you go, I need two things from you: 1) if you like something, please share it on social media or the next time you have coffee with a friend. 2) Ideas, if you have any ideas for future newsletter content please comment below. Thank you.

Standing Tall for All,

J.D. Scholten

If you liked this post from YOU'RE PROBABLY GETTING SCREWED, why not share it?