Email

Middle-income tax rates, Canadian-Australian productivity gap, and BC elementary report card

| From | Fraser Institute <[email protected]> |

| Subject | Middle-income tax rates, Canadian-Australian productivity gap, and BC elementary report card |

| Date | October 1, 2022 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

-------------

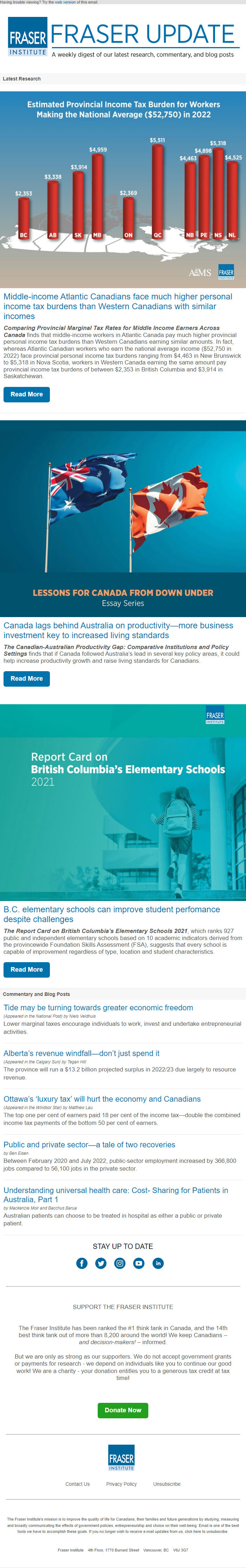

Middle-income Atlantic Canadians face much higher personal income tax burdens than Western Canadians with similar incomes

Comparing Provincial Marginal Tax Rates for Middle Income Earners Across Canada finds that middle-income workers in Atlantic Canada pay much higher provincial personal income tax burdens than Western Canadians earning similar amounts. In fact, whereas Atlantic Canadian workers who earn the national average income ($52,750 in 2022) face provincial personal income tax burdens ranging from $4,463 in New Brunswick to $5,318 in Nova Scotia, workers in Western Canada earning the same amount pay provincial income tax burdens of between $2,353 in British Columbia and $3,914 in Saskatchewan.

Read More [[link removed]]

Canada lags behind Australia on productivity—more business investment key to increased living standards

The Canadian-Australian Productivity Gap: Comparative Institutions and Policy Settings finds that if Canada followed Australia’s lead in several key policy areas, it could help increase productivity growth and raise living standards for Canadians.

Read More [[link removed]]

B.C. elementary schools can improve student perfomance despite challenges

The Report Card on British Columbia’s Elementary Schools 2021, which ranks 927 public and independent elementary schools based on 10 academic indicators derived from the provincewide Foundation Skills Assessment (FSA), suggests that every school is capable of improvement regardless of type, location and student characteristics.

Read More [[link removed]]

Commentary and Blog Posts

-------------

Tide may be turning towards greater economic freedom [[link removed]]

(Appeared in the National Post) by Niels Veldhuis

Lower marginal taxes encourage individuals to work, invest and undertake entrepreneurial activities.

Alberta’s revenue windfall—don’t just spend it [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill

The province will run a $13.2 billion projected surplus in 2022/23 due largely to resource revenue.

Ottawa’s ‘luxury tax’ will hurt the economy and Canadians [[link removed]]

(Appeared in the Windsor Star) by Matthew Lau

The top one per cent of earners paid 18 per cent of the income tax—double the combined income tax payments of the bottom 50 per cent of earners.

Public and private sector—a tale of two recoveries [[link removed]]

by Ben Eisen

Between February 2020 and July 2022, public-sector employment increased by 366,800 jobs compared to 56,100 jobs in the private sector.

Understanding universal health care: Cost- Sharing for Patients in Australia, Part 1 [[link removed]]

by Mackenzie Moir and Bacchus Barua

Australian patients can choose to be treated in hospital as either a public or private patient.

SUPPORT THE FRASER INSTITUTE

-------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

-------------

Middle-income Atlantic Canadians face much higher personal income tax burdens than Western Canadians with similar incomes

Comparing Provincial Marginal Tax Rates for Middle Income Earners Across Canada finds that middle-income workers in Atlantic Canada pay much higher provincial personal income tax burdens than Western Canadians earning similar amounts. In fact, whereas Atlantic Canadian workers who earn the national average income ($52,750 in 2022) face provincial personal income tax burdens ranging from $4,463 in New Brunswick to $5,318 in Nova Scotia, workers in Western Canada earning the same amount pay provincial income tax burdens of between $2,353 in British Columbia and $3,914 in Saskatchewan.

Read More [[link removed]]

Canada lags behind Australia on productivity—more business investment key to increased living standards

The Canadian-Australian Productivity Gap: Comparative Institutions and Policy Settings finds that if Canada followed Australia’s lead in several key policy areas, it could help increase productivity growth and raise living standards for Canadians.

Read More [[link removed]]

B.C. elementary schools can improve student perfomance despite challenges

The Report Card on British Columbia’s Elementary Schools 2021, which ranks 927 public and independent elementary schools based on 10 academic indicators derived from the provincewide Foundation Skills Assessment (FSA), suggests that every school is capable of improvement regardless of type, location and student characteristics.

Read More [[link removed]]

Commentary and Blog Posts

-------------

Tide may be turning towards greater economic freedom [[link removed]]

(Appeared in the National Post) by Niels Veldhuis

Lower marginal taxes encourage individuals to work, invest and undertake entrepreneurial activities.

Alberta’s revenue windfall—don’t just spend it [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill

The province will run a $13.2 billion projected surplus in 2022/23 due largely to resource revenue.

Ottawa’s ‘luxury tax’ will hurt the economy and Canadians [[link removed]]

(Appeared in the Windsor Star) by Matthew Lau

The top one per cent of earners paid 18 per cent of the income tax—double the combined income tax payments of the bottom 50 per cent of earners.

Public and private sector—a tale of two recoveries [[link removed]]

by Ben Eisen

Between February 2020 and July 2022, public-sector employment increased by 366,800 jobs compared to 56,100 jobs in the private sector.

Understanding universal health care: Cost- Sharing for Patients in Australia, Part 1 [[link removed]]

by Mackenzie Moir and Bacchus Barua

Australian patients can choose to be treated in hospital as either a public or private patient.

SUPPORT THE FRASER INSTITUTE

-------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor